QBTS Earnings Report: Potential Stock Market Reactions

Table of Contents

Analyzing QBTS's Past Performance and Current Financial Health

To predict the market's reaction to the QBTS earnings report, we must first analyze the company's recent financial health and historical performance. This involves examining several key indicators.

Revenue Growth and Trends

Examining past quarters' revenue growth rates reveals important trends and allows for projections of future performance. Analyzing this data helps us understand the company's ability to generate sales and its overall momentum.

- Year-over-year revenue growth: A consistent upward trend suggests robust growth, while a decline raises concerns. (Insert data/chart if available).

- Quarterly revenue comparisons: Analyzing the fluctuations between quarters can reveal seasonality or other underlying patterns affecting QBTS's revenue stream. (Insert data/chart if available).

- Impact of recent market trends on revenue: Have recent economic shifts or industry changes influenced QBTS's revenue? Understanding this context is essential. For example, increased inflation could impact sales figures, impacting QBTS's earnings report and potential stock market reaction.

Profitability and Margins

Profitability is a key indicator of a company's financial health. Analyzing profit margins provides valuable insights into QBTS's efficiency and ability to translate revenue into profit.

- Gross profit margin: This metric shows the profitability of QBTS's core operations. A healthy gross margin suggests efficient cost management. (Insert data/chart if available, compare to industry benchmarks).

- Operating profit margin: This indicates the efficiency of QBTS's operations, excluding interest and taxes. A higher operating profit margin signifies strong operational performance. (Insert data/chart if available, compare to industry benchmarks).

- Net profit margin: This represents the ultimate profitability after all expenses, including taxes and interest, are deducted. This is a crucial indicator of QBTS's overall financial health. (Insert data/chart if available, compare to industry benchmarks).

Key Financial Ratios

Analyzing key financial ratios provides a comprehensive view of QBTS's financial stability and risk profile.

- Debt-to-equity ratio analysis: This ratio indicates QBTS's reliance on debt financing. A high ratio could suggest higher financial risk. (Insert data/chart if available, compare to industry benchmarks).

- Liquidity analysis using current ratio: The current ratio assesses QBTS's ability to meet its short-term obligations. A healthy current ratio indicates strong liquidity. (Insert data/chart if available, compare to industry benchmarks).

- Return on equity (ROE) interpretation: ROE measures QBTS's profitability relative to shareholder equity. A higher ROE generally suggests efficient use of shareholder capital. (Insert data/chart if available, compare to industry benchmarks).

Factors Influencing Market Reaction to the QBTS Earnings Report

Several factors beyond QBTS's financial performance can influence the market's reaction to the earnings report.

Earnings Beat or Miss

The market's response will strongly depend on whether QBTS meets or exceeds analyst expectations.

- Stock price volatility around earnings announcements: Historically, QBTS stock (and most stocks) experience increased volatility in the days surrounding earnings announcements.

- Historical reactions to earnings surprises: Analyze past QBTS earnings reports to understand how the market reacted to positive and negative surprises. This provides valuable insights.

- Impact of market sentiment: The overall market sentiment, whether bullish or bearish, can significantly amplify or dampen the reaction to the QBTS earnings report.

Guidance for Future Performance

Management's outlook on future performance is crucial.

- Importance of forward-looking statements: Pay close attention to management's commentary on future revenue and profitability.

- Impact of positive or negative guidance: Positive guidance usually boosts investor confidence, while negative guidance can lead to sell-offs.

- Investor reactions to revised projections: How have investors reacted to QBTS's past revisions of projected earnings?

Market Sentiment and Overall Economic Conditions

Broader economic conditions and market sentiment play a significant role.

- Impact of inflation: High inflation can negatively impact consumer spending and corporate profits, potentially affecting QBTS.

- Interest rate changes: Interest rate hikes can increase borrowing costs for companies, impacting profitability.

- General market trends: The overall direction of the stock market can influence investor behavior towards individual stocks like QBTS.

- Sector-specific influences: Consider any industry-specific factors that might affect QBTS's performance and market reception.

Potential Investment Strategies Based on the QBTS Earnings Report

The QBTS earnings report will offer opportunities for different investment strategies.

Buy, Sell, or Hold Strategies

The optimal strategy depends on your investment goals and risk tolerance.

- Strategies for long-term investors: Long-term investors may choose to hold their shares regardless of short-term fluctuations.

- Strategies for short-term traders: Short-term traders may look for opportunities to profit from short-term price movements.

- Risk mitigation strategies: Diversification is crucial to mitigate risks associated with individual stock performance.

Analyzing Post-Earnings Stock Movement

Monitoring post-earnings stock movement is crucial for assessing the market's reaction.

- Monitoring volume: Increased trading volume after the earnings release indicates strong market interest.

- Identifying support and resistance levels: These levels can help predict future price movements.

- Evaluating the sustainability of price movements: Determine if the initial post-earnings price reaction is likely to persist.

Conclusion

The QBTS earnings report is a critical event with the potential to significantly impact the stock market. By carefully analyzing past performance, key financial indicators, market sentiment, and the company's guidance, investors can better position themselves to navigate the potential volatility surrounding the QBTS earnings report. Remember to consider the overall economic climate when formulating your investment strategy. Understanding these factors allows for more informed decisions regarding your QBTS investments. Stay informed and monitor the QBTS earnings report closely. Consider diversifying your portfolio to manage the risk associated with individual stock movements around major announcements like the QBTS earnings report. Always conduct thorough research before making any investment decisions.

Featured Posts

-

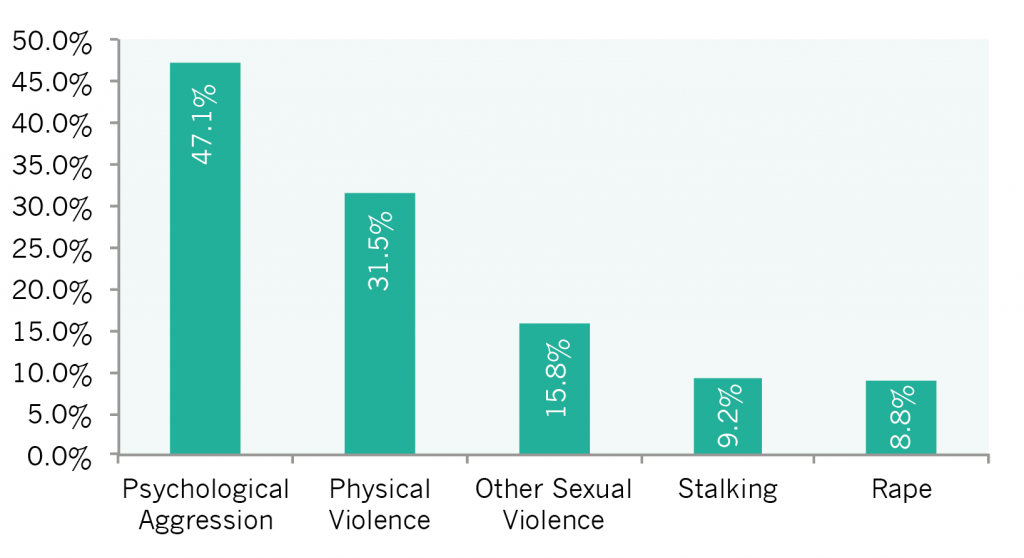

Femicide A Deep Dive Into The Causes And Statistics Of Violence Against Women

May 21, 2025

Femicide A Deep Dive Into The Causes And Statistics Of Violence Against Women

May 21, 2025 -

Mission Patrimoine 2025 Deux Sites Bretons A Restaurer Plouzane Et Clisson Selectionnes

May 21, 2025

Mission Patrimoine 2025 Deux Sites Bretons A Restaurer Plouzane Et Clisson Selectionnes

May 21, 2025 -

The Costco Campaign Insights From A Saskatchewan Political Panel

May 21, 2025

The Costco Campaign Insights From A Saskatchewan Political Panel

May 21, 2025 -

Endiaferon Apo Mls I Los Antzeles Psaxnei Ton Giakoymaki

May 21, 2025

Endiaferon Apo Mls I Los Antzeles Psaxnei Ton Giakoymaki

May 21, 2025 -

Freepoint Eco Systems Secures Project Finance Facility From Ing

May 21, 2025

Freepoint Eco Systems Secures Project Finance Facility From Ing

May 21, 2025

Latest Posts

-

Brooklyn Roars Vybz Kartels Sold Out Show Success

May 22, 2025

Brooklyn Roars Vybz Kartels Sold Out Show Success

May 22, 2025 -

Vybz Kartels Brooklyn Concerts A Review Of The Sold Out Events

May 22, 2025

Vybz Kartels Brooklyn Concerts A Review Of The Sold Out Events

May 22, 2025 -

Understanding Rum Culture Through The Lens Of Kartel Stabroek News

May 22, 2025

Understanding Rum Culture Through The Lens Of Kartel Stabroek News

May 22, 2025 -

Kartels Influence On Rum Culture A Stabroek News Perspective

May 22, 2025

Kartels Influence On Rum Culture A Stabroek News Perspective

May 22, 2025 -

Minister Limits Vybz Kartels Activities In Trinidad And Tobago

May 22, 2025

Minister Limits Vybz Kartels Activities In Trinidad And Tobago

May 22, 2025