QNB Corp's Investor Presentation: Key Highlights From The March 6th Virtual Conference

Table of Contents

QNB Corp's Financial Performance: A Strong Showing

The QNB Corp investor presentation showcased a strong financial performance, reflecting robust growth and stability across various key metrics.

Revenue and Profitability

QNB Corp reported impressive revenue figures for the period, demonstrating significant year-on-year growth. While precise numbers weren't explicitly stated in the publicly available summary, the presentation highlighted substantial increases driven by several key sectors.

- Significant Revenue Growth: The corporate banking and investment banking divisions were cited as primary contributors to this growth, exceeding expectations.

- Improved Profit Margins: Profit margins showed a healthy increase compared to the previous quarter and the same period last year, indicating improved operational efficiency and strong cost management.

- Controlled Operational Costs: Despite expansion efforts, QNB Corp demonstrated effective cost control measures, contributing to the enhanced profitability.

Asset Quality and Loan Portfolio

The QNB Corp financial results presentation emphasized the bank's healthy asset quality and a well-managed loan portfolio.

- Reduced NPL Ratio: The non-performing loan (NPL) ratio experienced a notable decline, showcasing improved risk management strategies.

- Proactive Credit Risk Management: QNB Corp highlighted its proactive approach to credit risk management, including robust due diligence processes and effective early warning systems.

- Strategic Provisions for Loan Losses: While specific numbers weren't detailed, the presentation mentioned appropriate provisions for loan losses, reflecting a conservative and prudent approach to risk management.

Capital Adequacy and Liquidity

QNB Corp's financial stability was underscored by its strong capital adequacy and liquidity position.

- Robust Capital Adequacy Ratio (CAR): The CAR significantly exceeded regulatory requirements, providing a substantial buffer against potential risks.

- Healthy Liquidity Ratios: Liquidity ratios remained robust, ensuring the bank's ability to meet its short-term obligations.

- Strengthened Capital Base: The presentation mentioned ongoing efforts to further strengthen the bank's capital base through various strategic initiatives.

Strategic Initiatives and Future Outlook

The QNB Corp investor presentation provided a clear roadmap for future growth, outlining key strategic initiatives and a positive outlook.

Key Strategic Goals

QNB Corp's strategic goals for the upcoming year are ambitious and focused on sustained growth and innovation.

- Technological Investments: Significant investments in new technologies and digital transformation initiatives are planned to enhance customer experience and operational efficiency. This includes partnerships with Fintech companies to expand offerings.

- Geographical Expansion: The presentation highlighted plans for geographical expansion into new markets, focusing on regions with high growth potential.

- New Product and Service Launches: QNB Corp aims to launch several new products and services catering to evolving customer needs and market demands.

Management's Guidance and Outlook

Management expressed confidence in the bank's future prospects, providing positive guidance for the coming year.

- Positive Revenue Growth Projections: Management projected continued revenue growth, driven by both organic expansion and strategic initiatives.

- Potential Risks and Uncertainties: While optimistic, management acknowledged potential risks and uncertainties associated with the global economic environment. Mitigation strategies were outlined.

- Confident Outlook: The overall tone of the presentation was one of confidence and optimism, highlighting QNB Corp's ability to navigate challenges and achieve its strategic objectives.

Conclusion: Essential Takeaways from the QNB Corp Investor Presentation

The QNB Corp investor presentation showcased strong financial performance, marked by robust revenue growth, improved profitability, and a healthy asset quality. The presentation also outlined ambitious strategic initiatives focusing on digital transformation and geographical expansion. Management's positive outlook and commitment to sustainable growth underscore QNB Corp's promising future. For more in-depth analysis of the QNB Corp investor presentation and to stay updated on the latest financial news, visit the official QNB Corp website. Stay informed about future QNB Corp investor presentations and financial reports, exploring QNB Corp investment opportunities and understanding QNB Corp strategic plans for continued success.

Featured Posts

-

Pokhorony Papy Rimskogo Tramp Ne Isklyuchaet Vstrechi S Zelenskim

Apr 30, 2025

Pokhorony Papy Rimskogo Tramp Ne Isklyuchaet Vstrechi S Zelenskim

Apr 30, 2025 -

House Fire And Explosion In Yate Live Updates From The Scene

Apr 30, 2025

House Fire And Explosion In Yate Live Updates From The Scene

Apr 30, 2025 -

2025 Summer Slides Top Models And Brands

Apr 30, 2025

2025 Summer Slides Top Models And Brands

Apr 30, 2025 -

New Jersey Prisons Receive Laptops From Princeton A Focus On Digital Literacy And Higher Education

Apr 30, 2025

New Jersey Prisons Receive Laptops From Princeton A Focus On Digital Literacy And Higher Education

Apr 30, 2025 -

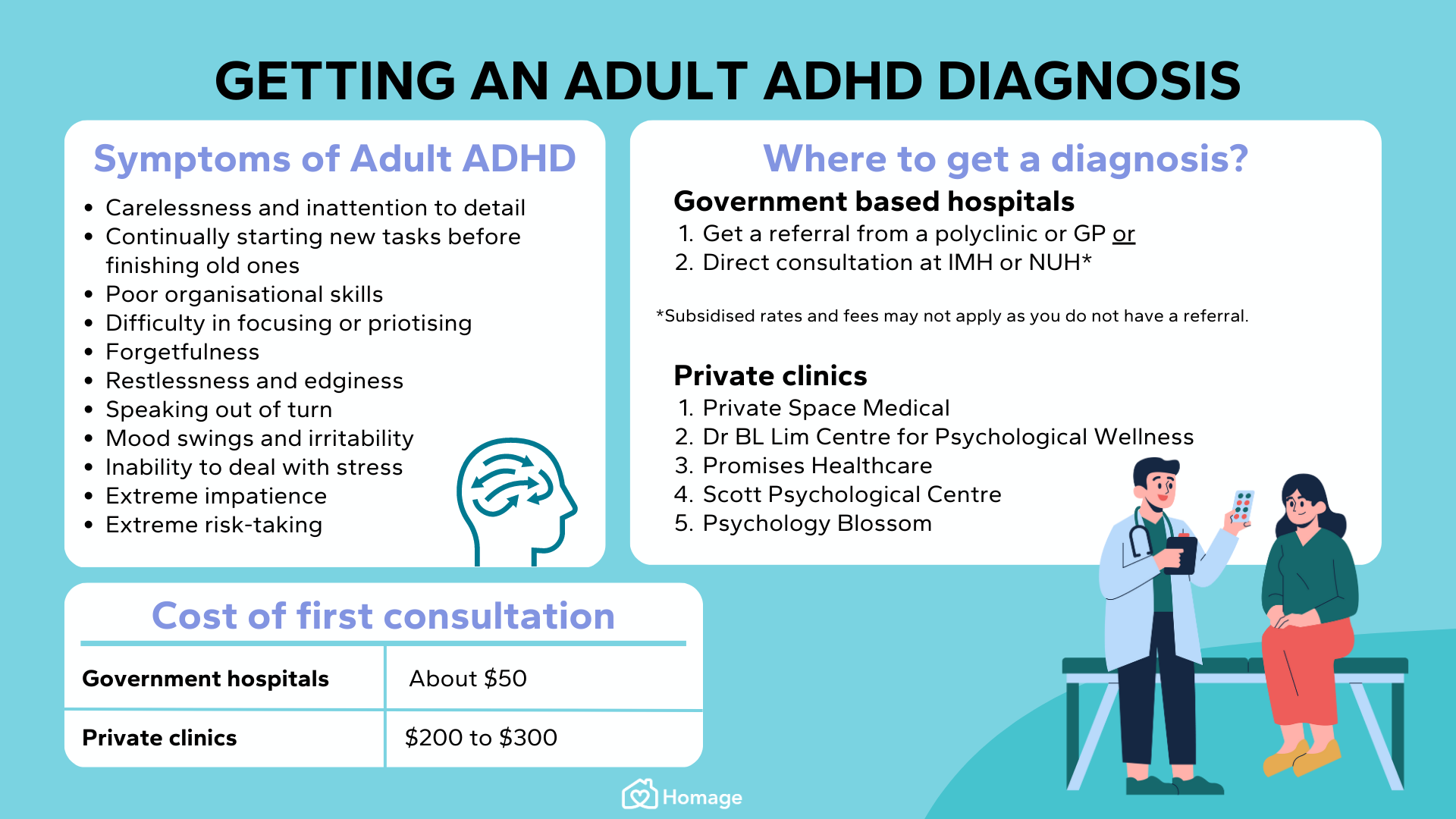

Adult Adhd Diagnosis Next Steps And Support

Apr 30, 2025

Adult Adhd Diagnosis Next Steps And Support

Apr 30, 2025

Latest Posts

-

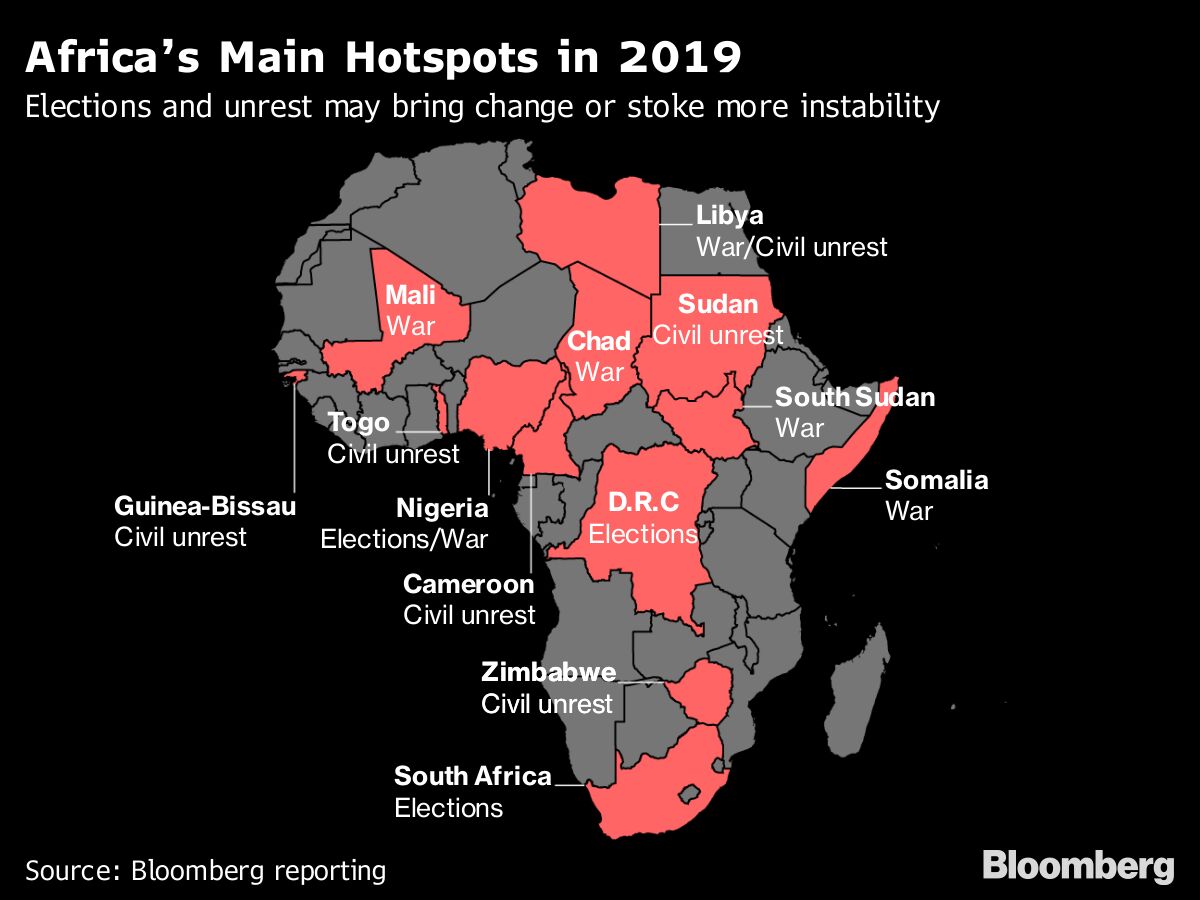

Understanding The Countrys New Business Hotspots Location Growth And Potential

Apr 30, 2025

Understanding The Countrys New Business Hotspots Location Growth And Potential

Apr 30, 2025 -

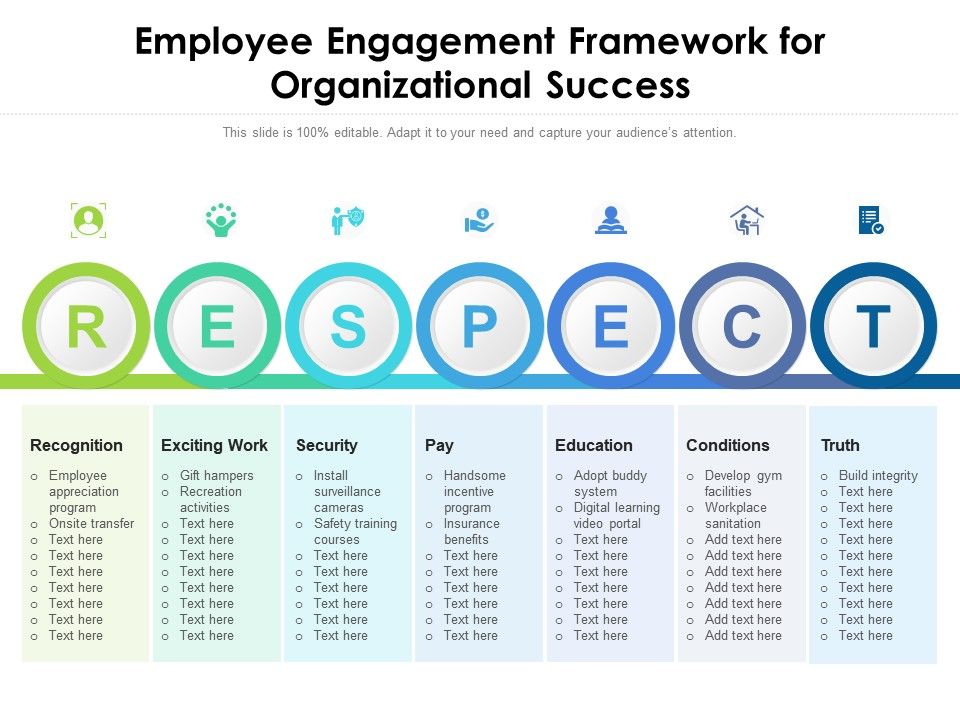

Middle Managers Key Players In Organizational Success And Employee Engagement

Apr 30, 2025

Middle Managers Key Players In Organizational Success And Employee Engagement

Apr 30, 2025 -

Exploring New Business Opportunities A Map Of The Countrys Hottest Areas

Apr 30, 2025

Exploring New Business Opportunities A Map Of The Countrys Hottest Areas

Apr 30, 2025 -

The Countrys Business Landscape Emerging Hotspots And Growth Opportunities

Apr 30, 2025

The Countrys Business Landscape Emerging Hotspots And Growth Opportunities

Apr 30, 2025 -

Rethinking Middle Management Their Contribution To Modern Organizations

Apr 30, 2025

Rethinking Middle Management Their Contribution To Modern Organizations

Apr 30, 2025