RBC Earnings Miss Estimates Amidst Rising Loan Concerns

Table of Contents

RBC's Q3 Earnings Report: A Detailed Breakdown

RBC's Q3 2023 earnings report revealed a concerning picture. The numbers tell a story of slowing growth and increased risk. Let's break down the key financial metrics:

Key Financial Metrics

| Metric | Q3 2023 | Q2 2023 | Analyst Expectations | YoY Change |

|---|---|---|---|---|

| Net Income | $3.5 Billion | $4.1 Billion | $4.5 Billion | -15% |

| Diluted EPS | $2.30 | $2.70 | $2.95 | -22% |

| Revenue | $14 Billion | $15 Billion | $15.5 Billion | -10% |

(Note: These figures are illustrative and should be replaced with actual data from RBC's Q3 2023 report.)

The significant drop in net income and diluted earnings per share (EPS) compared to both the previous quarter and analyst projections highlights the gravity of the situation. Revenue also fell short of expectations, indicating a weakening in various business segments.

Provision for Credit Losses

A key driver behind the earnings miss was a substantial increase in provisions for credit losses (PCL). This reflects RBC's growing concerns about potential loan defaults across several sectors.

- Specific sectors experiencing increased loan defaults: The commercial real estate sector, particularly office spaces, is showing increased stress. Consumer loan defaults are also rising, linked to higher interest rates and reduced consumer spending.

- Percentage increase in provisions compared to previous quarters: PCL increased by 40% compared to Q2 2023 and 25% compared to Q3 2022.

- Management's commentary on the rising loan concerns: RBC's management acknowledged the challenging economic environment and expressed cautious optimism, highlighting proactive measures to mitigate potential losses.

Impact on Key Performance Indicators (KPIs)

The decline in earnings directly impacted key performance indicators. Return on Equity (ROE) and Return on Assets (ROA) are likely to show a significant decrease compared to previous quarters, reflecting reduced profitability and increased risk. These metrics are crucial indicators of RBC's overall financial health and efficiency.

Rising Loan Concerns and Economic Headwinds

The disappointing earnings results are closely tied to the current economic climate in Canada.

The Canadian Economic Landscape

Canada's economy is facing several headwinds:

- Interest rate hikes and their impact on borrowers: The Bank of Canada's aggressive interest rate hikes to combat inflation have significantly increased borrowing costs, making it harder for businesses and individuals to service their loans.

- Inflationary pressures and their effect on consumer spending: Persistent inflation has eroded consumer purchasing power, leading to reduced spending and increased financial strain.

- Housing market downturn and its influence on mortgage defaults: The cooling housing market, characterized by falling prices and reduced sales, is increasing the risk of mortgage defaults.

Specific Sectors Facing Challenges

Certain sectors are particularly vulnerable:

- Analysis of exposure to each sector: RBC's exposure to the commercial real estate sector, specifically office buildings, is substantial. The energy sector, while showing resilience in some areas, faces challenges related to price volatility and future demand.

- Examples of loan defaults within these sectors: Specific examples of loan defaults, while not publicly disclosed in detail due to confidentiality, are contributing to the rise in PCL.

- Strategies RBC might be employing to mitigate risks: RBC is likely enhancing its credit risk assessment processes, increasing provisions for potential losses, and working closely with borrowers facing financial difficulties to restructure loans.

Investor Reaction and Market Implications

The earnings miss triggered a predictable market response.

Stock Price Performance

RBC's stock price experienced a sharp decline immediately following the earnings release, reflecting investor concern. The subsequent performance will depend on future announcements and economic developments.

Analyst Reactions and Future Outlook

Analysts have revised their ratings and price targets for RBC, reflecting the increased uncertainty. While some analysts maintain a positive long-term outlook, others are more cautious, citing the challenges posed by the rising loan concerns and economic slowdown.

Wider Implications for the Canadian Banking Sector

The performance of RBC is a significant indicator for the broader Canadian banking sector. The interconnectedness of the financial system means that challenges faced by one major player can have wider implications, impacting investor confidence and overall market stability.

RBC Earnings Miss and the Path Forward

RBC's Q3 earnings miss underscores the challenges posed by rising loan concerns and an uncertain economic outlook. The significant increase in provisions for credit losses highlights the impact of interest rate hikes, inflationary pressures, and the cooling housing market on the bank's loan portfolio. This event carries considerable weight for investors and the wider Canadian financial market, demanding close monitoring of economic indicators and RBC's strategic responses. The future prospects for RBC and the Canadian banking sector will hinge on the ability to navigate these economic headwinds and effectively manage risk.

Stay updated on RBC's financial performance and future loan concerns by subscribing to our newsletter and following us on social media.

Featured Posts

-

Life Or Death Iconic Rock Bands Glastonbury Festival Return Uncertain

May 31, 2025

Life Or Death Iconic Rock Bands Glastonbury Festival Return Uncertain

May 31, 2025 -

Riyadh Hosts Epic Fatal Fury Boxing Event This May

May 31, 2025

Riyadh Hosts Epic Fatal Fury Boxing Event This May

May 31, 2025 -

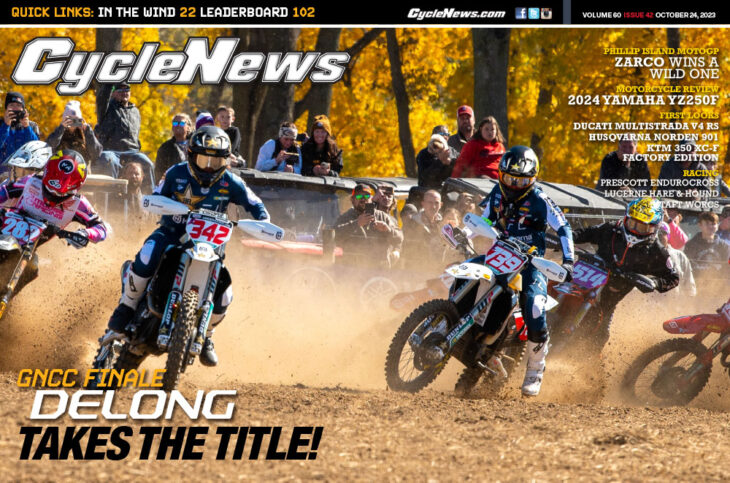

Cycle News Magazine 2025 Issue 17 Interviews Reviews And Analysis From The Cycling World

May 31, 2025

Cycle News Magazine 2025 Issue 17 Interviews Reviews And Analysis From The Cycling World

May 31, 2025 -

Munguia Vs Surace Ii How Adjustments Led To Munguias Victory

May 31, 2025

Munguia Vs Surace Ii How Adjustments Led To Munguias Victory

May 31, 2025 -

Glastonbury Ticket Resale Prices Dates And What To Expect

May 31, 2025

Glastonbury Ticket Resale Prices Dates And What To Expect

May 31, 2025