Real-Time Sensex And Nifty Updates: Market Trends And Key Movers

Table of Contents

Real-Time Sensex and Nifty Index Data

Current Sensex and Nifty Values

(Note: This section would ideally display live data pulled from a reliable source like the NSE or BSE. For this example, I will use placeholder values.)

- Sensex: 65,000 (Data Source: NSE, as of [Date and Time])

- Nifty: 19,000 (Data Source: NSE, as of [Date and Time])

Percentage Change and Daily High/Low

(Note: This section would ideally display live data pulled from a reliable source like the NSE or BSE. For this example, I will use placeholder values.)

-

Sensex: +0.5% (Percentage Change from Previous Close), High: 65,100, Low: 64,800

-

Nifty: +0.7% (Percentage Change from Previous Close), High: 19,100, Low: 18,900

-

Significance of Percentage Change: The percentage change indicates the direction and magnitude of the market's movement. A positive percentage signifies gains, while a negative percentage shows losses. Monitoring daily percentage changes helps in understanding short-term market sentiment.

-

Importance of Monitoring Intraday Highs and Lows: Tracking intraday highs and lows provides insight into the price volatility and potential trading ranges. These values can be useful for traders employing technical analysis strategies.

-

Technical Indicators: While beyond the scope of this brief overview, technical indicators like moving averages and Relative Strength Index (RSI) can provide further insights into market momentum and potential trend reversals. These tools are valuable for experienced traders.

Analyzing Market Trends

Identifying Major Trends

Identifying trends involves analyzing both short-term and long-term price movements. Short-term trends are typically observed over days or weeks, while long-term trends reflect movements over months or years. Analyzing charts, including candlestick patterns and volume analysis, assists in trend identification.

Impact of Global Markets

The Sensex and Nifty are significantly influenced by global market events. Factors like interest rate changes by the US Federal Reserve, geopolitical instability, and global economic growth directly impact investor sentiment and capital flows, affecting the Indian indices.

- Specific Events: Recent events like rising inflation in the US or geopolitical tensions in a specific region can create significant volatility in the Indian markets.

- Chart Patterns: Recognizing chart patterns like head and shoulders, double tops/bottoms, and triangles can aid in forecasting potential price movements, although these should be used in conjunction with other forms of analysis.

- Correlation between Sensex and Nifty: The Sensex and Nifty are highly correlated, reflecting overall market sentiment. However, individual stock movements within the indices can diverge.

Key Movers and Sectoral Performance

Top Gainers and Losers

(Note: This section would ideally display live data pulled from a reliable source like the NSE or BSE. For this example, I will use placeholder values.)

- Top Gainers (Sensex): Reliance Industries (+2%), HDFC Bank (+1.8%), Infosys (+1.5%)

- Top Losers (Sensex): Tata Motors (-1%), ICICI Bank (-0.8%), SBI (-0.5%) (Similar data for Nifty would be included here)

Sectoral Analysis

Analyzing sectoral performance helps understand the specific drivers of market movement. For example, strong performance in the IT sector might indicate optimism about global tech growth, while weakness in the banking sector might signal concerns about credit quality.

- Reasons Behind Performance: The performance of key movers is often driven by company-specific news (earnings reports, new product launches), industry trends, and overall economic conditions.

- Sector-Specific News: Significant news events within a specific sector, such as regulatory changes or mergers and acquisitions, can significantly impact the performance of related stocks.

- Investment Opportunities and Risks: Sectoral analysis helps identify potential investment opportunities (sectors poised for growth) and risks (sectors facing headwinds).

Understanding Volatility

Factors Affecting Volatility

Market volatility stems from several factors, including:

- Interest Rates: Changes in interest rates influence borrowing costs, impacting corporate profitability and investor sentiment.

- Inflation: High inflation erodes purchasing power and can lead to increased uncertainty, impacting stock valuations.

- Political Events: Political stability and policy decisions significantly impact market sentiment and investment decisions.

- Global Economic News: International events and economic indicators can influence the performance of Indian markets.

Risk Management Strategies

Managing risk is crucial in volatile markets. Strategies include:

- Diversification: Spreading investments across different asset classes and sectors reduces the impact of poor performance in any single area.

- Stop-Loss Orders: These orders automatically sell a security when it reaches a predetermined price, limiting potential losses.

- Long-Term Investment Strategy: A long-term perspective helps navigate short-term market fluctuations. Focus on fundamental analysis and long-term growth prospects.

Conclusion

Staying informed about real-time Sensex and Nifty updates is critical for making well-informed investment decisions. Understanding market trends, identifying key movers, and managing volatility are crucial aspects of successful investing in the Indian stock market. By tracking percentage changes, intraday highs and lows, and sectoral performance, investors can gain valuable insights into market dynamics. Regularly analyzing these factors alongside global market influences and implementing sound risk management strategies will improve investment outcomes. Stay ahead of the curve by regularly checking our site for real-time Sensex and Nifty updates, market trends, and key movers. Make informed investment choices with our comprehensive analysis!

Featured Posts

-

Stephen Kings The Monkey Review A Solid Film But What About His Other Projects

May 10, 2025

Stephen Kings The Monkey Review A Solid Film But What About His Other Projects

May 10, 2025 -

Trumps Transgender Military Ban What It Means And Its Implications

May 10, 2025

Trumps Transgender Military Ban What It Means And Its Implications

May 10, 2025 -

Updated Palantir Stock Predictions Market Rally Impacts Analysis

May 10, 2025

Updated Palantir Stock Predictions Market Rally Impacts Analysis

May 10, 2025 -

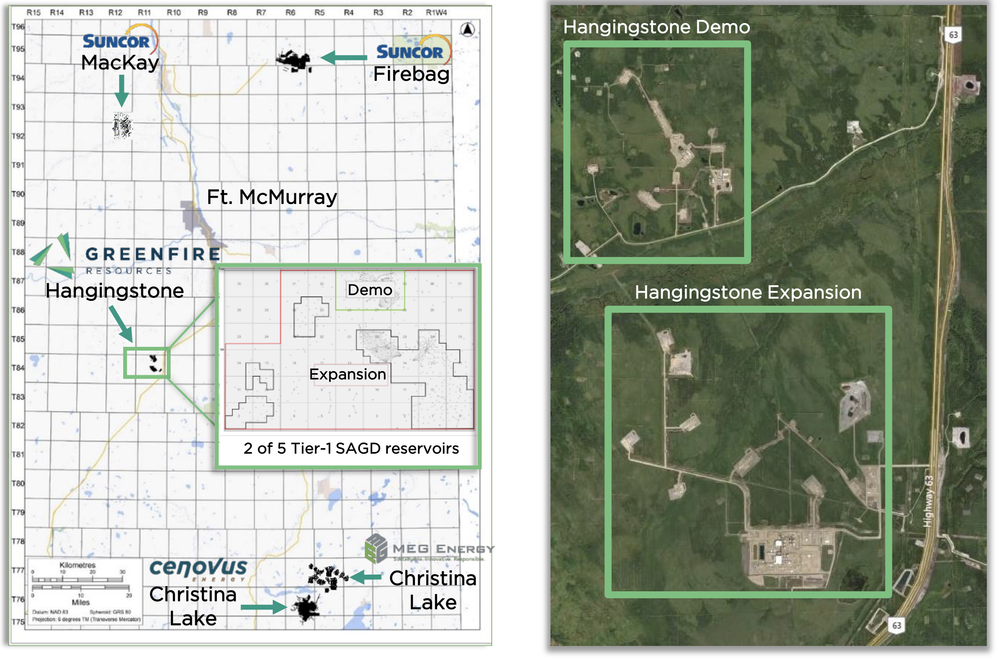

Suncor Production Record High Output Sales Slowdown Explained

May 10, 2025

Suncor Production Record High Output Sales Slowdown Explained

May 10, 2025 -

Letartoztattak Floridaban Egy Transznemu Not A Noi Mosdo Hasznalataert

May 10, 2025

Letartoztattak Floridaban Egy Transznemu Not A Noi Mosdo Hasznalataert

May 10, 2025

Latest Posts

-

Once Rejected Now A Heartbeat The Story Of A Footballers Triumph

May 10, 2025

Once Rejected Now A Heartbeat The Story Of A Footballers Triumph

May 10, 2025 -

Nl Federal Election 2023 Candidate Profiles And Platforms

May 10, 2025

Nl Federal Election 2023 Candidate Profiles And Platforms

May 10, 2025 -

Dangotes Influence On Nnpc Petrol Prices A Thisdaylive Analysis

May 10, 2025

Dangotes Influence On Nnpc Petrol Prices A Thisdaylive Analysis

May 10, 2025 -

10 Unforgettable Film Noir Films A Definitive Guide

May 10, 2025

10 Unforgettable Film Noir Films A Definitive Guide

May 10, 2025 -

Nl Federal Election Getting To Know Your Candidates

May 10, 2025

Nl Federal Election Getting To Know Your Candidates

May 10, 2025