Recent Gains In D-Wave Quantum (QBTS) Stock: A Detailed Look

Table of Contents

Recent QBTS Stock Performance and Market Trends

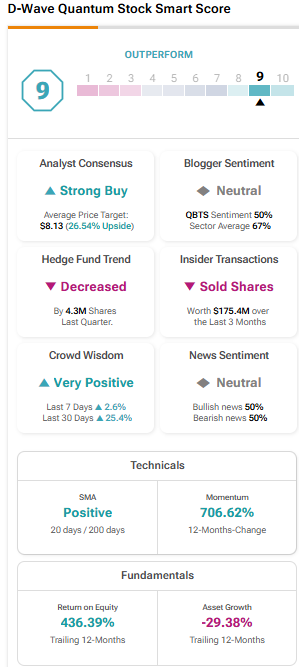

Understanding the recent performance of QBTS stock is crucial for any potential investor. Analyzing the stock price movements, alongside broader market trends, provides valuable context.

- QBTS Stock Price Movements: [Insert a chart or graph illustrating recent QBTS stock price performance here]. As you can see from the chart, the stock price has shown [Describe the nature of the price movement - e.g., a steady increase, periods of volatility followed by growth, etc.]. This increase can be attributed to several factors discussed below.

- Comparison to Market Benchmarks: Compared to other technology stocks and broader market indices like the Nasdaq Composite, QBTS's performance has [Describe relative performance - e.g., outperformed, underperformed, mirrored trends]. This comparison helps contextualize the gains within the larger economic landscape.

- Trading Volume Analysis: Increased trading volume often signals heightened investor interest. The recent trading volume for QBTS has [Describe the trading volume trend - e.g., increased significantly, remained relatively stable, shown periods of high and low activity]. High volume alongside price increases can be a bullish indicator, suggesting strong demand.

Analyzing these key metrics – stock price, market benchmarks, and trading volume – paints a clearer picture of QBTS's recent performance and potential future trajectory.

Factors Driving the Increase in D-Wave Quantum's Stock Value

Several factors have contributed to the rise in D-Wave Quantum's stock value. These include advancements in its core technology, strategic partnerships, and growing market acceptance of quantum computing solutions.

- Advancements in Quantum Annealing Technology (QPU): D-Wave's continued development and improvement of its Quantum Processing Unit (QPU) is a primary driver of investor confidence. Recent announcements regarding [mention specific advancements, e.g., increased qubit count, improved coherence times, enhanced performance on specific algorithms] have showcased the company's commitment to innovation in the field of quantum annealing.

- Strategic Partnerships and Collaborations: Collaborations with major corporations provide validation and potential for revenue generation. Partnerships with [mention key partners and the nature of their collaborations] demonstrate the real-world applications of D-Wave's technology and its increasing acceptance within the industry.

- Growing Market Interest and Adoption: The overall growth of the quantum computing market is a significant tailwind for D-Wave. Increasing interest from various sectors, such as [mention sectors like finance, pharmaceuticals, materials science, etc.], signals growing adoption and the potential for future revenue streams.

- Revenue Growth and Positive Financial Reports: [Mention any recent positive financial news, e.g., increased revenue, secured funding, successful product launches]. Strong financial performance strengthens investor confidence and fuels further price increases.

- Competitive Landscape: While competition exists in the quantum computing space, D-Wave maintains a strong position through its focus on quantum annealing. The company's [mention specific competitive advantages, e.g., established infrastructure, large-scale QPUs, extensive customer base] help to differentiate it from other players.

Analyzing Risks and Potential Future Growth of QBTS Stock

While the recent gains are encouraging, investors must carefully consider the inherent risks associated with investing in QBTS stock.

- Investment Risk and Market Volatility: The stock market is inherently volatile, and QBTS, as a relatively young company in a nascent technology sector, is particularly susceptible to fluctuations. Significant price swings should be anticipated.

- Technological Risk and Competition: The quantum computing field is rapidly evolving, and the technology is still relatively immature. Competition from other companies developing different quantum computing approaches poses a risk. D-Wave's success depends on its ability to maintain its technological edge and adapt to the rapidly changing landscape.

- Future Projections and Financial Outlook: While the long-term prospects for quantum computing are bright, predicting the future performance of QBTS requires careful consideration of the many factors discussed above. [mention any available forecasts and analyses of future market growth and company revenue].

- Potential Future Revenue Streams and Strategic Plans: D-Wave's future growth hinges on its ability to translate its technological advancements into commercial success. [Mention any planned strategic initiatives and new revenue generating opportunities.]

Expert Opinions and Market Analysis on D-Wave Quantum

Several analysts have commented on D-Wave Quantum and its stock performance. [Insert summaries of analyst ratings and predictions, citing sources]. The overall sentiment among experts appears to be [Summarize the overall consensus, mentioning any significant divergence in opinions]. It's crucial to consult multiple sources and conduct independent research before making any investment decisions.

Conclusion

The recent gains in D-Wave Quantum (QBTS) stock are driven by a confluence of factors, including advancements in quantum annealing technology, strategic partnerships, and increased market interest in quantum computing solutions. However, investors should carefully weigh the potential for substantial growth against the inherent risks associated with investing in this emerging technology. The company's future success depends on its ability to continue innovating, securing strategic partnerships, and navigating a highly competitive landscape.

While investing in D-Wave Quantum (QBTS) presents both opportunities and challenges, understanding the factors driving its recent stock gains is crucial for any potential investor. Conduct thorough research, consult with a financial advisor, and stay updated on the latest developments in the quantum computing market before making any investment decisions related to D-Wave Quantum (QBTS) stock. Remember to diversify your portfolio and only invest what you can afford to lose in this high-growth, high-risk sector.

Featured Posts

-

Analysis Sasol Sol And The Investor Questions Following Its Strategy Update

May 21, 2025

Analysis Sasol Sol And The Investor Questions Following Its Strategy Update

May 21, 2025 -

Indias Record 19 Paddlers At Wtt Star Contender Chennai

May 21, 2025

Indias Record 19 Paddlers At Wtt Star Contender Chennai

May 21, 2025 -

Travel Bookings Drop Following Japanese Mangas Disaster Claim

May 21, 2025

Travel Bookings Drop Following Japanese Mangas Disaster Claim

May 21, 2025 -

Fa Cup Rashfords Brace Leads Aston Villa To Easy Win Over Preston

May 21, 2025

Fa Cup Rashfords Brace Leads Aston Villa To Easy Win Over Preston

May 21, 2025 -

Could This Runner Topple The Trans Australia Run Record

May 21, 2025

Could This Runner Topple The Trans Australia Run Record

May 21, 2025

Latest Posts

-

Former Man United Manager Erik Ten Hag A Potential Move To Rb Leipzig

May 23, 2025

Former Man United Manager Erik Ten Hag A Potential Move To Rb Leipzig

May 23, 2025 -

Maguires Reaction Losing The Manchester United Captaincy

May 23, 2025

Maguires Reaction Losing The Manchester United Captaincy

May 23, 2025 -

Is Erik Ten Hag Leipzigs Next Manager Exploring The Transfer Speculation

May 23, 2025

Is Erik Ten Hag Leipzigs Next Manager Exploring The Transfer Speculation

May 23, 2025 -

Man United News Tagliaficos Criticism Of Players Following Ten Hags Setbacks

May 23, 2025

Man United News Tagliaficos Criticism Of Players Following Ten Hags Setbacks

May 23, 2025 -

Ten Hags Man United Problems Tagliafico Points The Finger At Players

May 23, 2025

Ten Hags Man United Problems Tagliafico Points The Finger At Players

May 23, 2025