Recent Gold Price Rise: A Result Of Trump's Changing Stance

Table of Contents

Trump's Trade Policies and Their Impact on Gold Prices

Trump's unpredictable trade policies have created significant uncertainty in the global market, a key driver of the recent gold price increase. This uncertainty pushes investors towards safe-haven assets like gold, perceived as a reliable store of value during times of economic turmoil.

Increased Uncertainty

Trump's implementation of tariffs and initiation of trade wars have introduced considerable volatility. This volatility directly impacts investor confidence and fuels demand for gold.

- Example 1: The imposition of tariffs on steel and aluminum imports led to immediate market uncertainty and a spike in gold prices.

- Example 2: The trade dispute with China created prolonged market instability, further boosting gold's appeal as a safe haven.

- Data Point: Studies show a statistically significant correlation between announcements of major trade policy changes and subsequent increases in gold prices. For example, a study by [Insert credible source here] found that gold prices increased by an average of X% within Y days of major tariff announcements.

Weakening Dollar

Trade disputes often weaken the US dollar, making gold, priced in USD, more attractive to international investors. A weaker dollar increases the purchasing power of other currencies, driving up demand for dollar-denominated commodities like gold.

- Bullet Point: The inverse relationship between the US dollar and gold prices is well-established. When the dollar weakens, gold prices typically rise.

- Bullet Point: International investors seeking to hedge against currency risk often turn to gold.

- Data Point: Charts comparing the US Dollar Index (DXY) and gold prices during periods of significant trade disputes clearly illustrate this inverse correlation. [Insert chart or link to relevant data].

Geopolitical Instability and Gold's Safe-Haven Status

Trump's foreign policy decisions and international relations have significantly influenced global stability, boosting gold's appeal as a safe-haven asset. Periods of heightened geopolitical tension often lead to increased demand for gold, driving up its price.

Global Tensions

Trump's actions on the international stage have, at times, created uncertainty and instability, impacting investor sentiment and increasing demand for safe-haven assets.

- Bullet Point: Tensions with Iran and North Korea have, in the past, triggered increases in gold prices.

- Bullet Point: Uncertainties surrounding international alliances have also contributed to increased gold investment.

- Data Point: Analysis reveals a clear correlation between periods of heightened geopolitical risk and upward movements in gold prices. [Insert source/data].

Investor Sentiment and Risk Aversion

Trump's actions and pronouncements frequently impact investor confidence. When uncertainty increases, investors often shift their assets to safer options, like gold, reflecting a flight-to-safety phenomenon.

- Bullet Point: Unexpected policy changes or controversial statements can trigger immediate sell-offs in riskier assets and a surge in gold purchases.

- Bullet Point: This behavior demonstrates gold's role as a hedge against political and economic uncertainty.

- Data Point: Statistical data shows increased investment in gold ETFs and other gold-related instruments during periods of heightened political or economic turmoil linked to Trump's presidency. [Insert source].

Inflationary Pressures and Gold as a Hedge

Certain aspects of Trump's economic policies could lead to inflationary pressures, making gold, a traditional inflation hedge, more appealing. Gold historically performs well during inflationary periods as it retains its value even when fiat currencies lose purchasing power.

Potential for Inflation

Some argue that certain economic policies, such as fiscal stimulus measures, could potentially lead to increased inflation.

- Bullet Point: Increased government spending without corresponding increases in productivity can fuel inflationary pressures.

- Bullet Point: Trade protectionism can also lead to higher prices for imported goods.

- Data Point: Economic indicators like the Consumer Price Index (CPI) and Producer Price Index (PPI) can be analyzed to assess potential inflationary trends during relevant periods.

Monetary Policy and Interest Rates

Federal Reserve decisions on interest rates, potentially influenced by the administration's economic objectives, also play a role in gold price movements.

- Bullet Point: Lower interest rates generally decrease the opportunity cost of holding non-interest-bearing assets like gold, making it more attractive.

- Bullet Point: Conversely, higher interest rates can make other investments more appealing, potentially reducing demand for gold.

- Data Point: Historical data clearly demonstrates the inverse relationship between interest rates and gold prices. [Insert chart/data].

Conclusion

The recent gold price rise is a complex phenomenon influenced by a confluence of factors, and Donald Trump's changing policies play a significant role. His trade policies have created market uncertainty, weakening the dollar and driving investors towards the safe haven of gold. Geopolitical tensions fueled by his foreign policy decisions further increase demand for gold as a hedge against risk. Finally, the potential for inflationary pressures stemming from some of his economic policies enhances gold's appeal as an inflation hedge. Understanding the intricate connection between Trump's policies and the recent gold price rise is crucial for informed investment decisions. Stay updated on market trends and consider incorporating gold into your investment strategy to mitigate risks associated with political and economic uncertainty.

Featured Posts

-

The Unraveling Of Elon Musks Robotaxi Plans

Apr 25, 2025

The Unraveling Of Elon Musks Robotaxi Plans

Apr 25, 2025 -

News Roundup Donald Trumps Presidency April 23 2025

Apr 25, 2025

News Roundup Donald Trumps Presidency April 23 2025

Apr 25, 2025 -

Ankara Emniyet Mueduerluegue Nuen Modern Yeni Yerleskesi

Apr 25, 2025

Ankara Emniyet Mueduerluegue Nuen Modern Yeni Yerleskesi

Apr 25, 2025 -

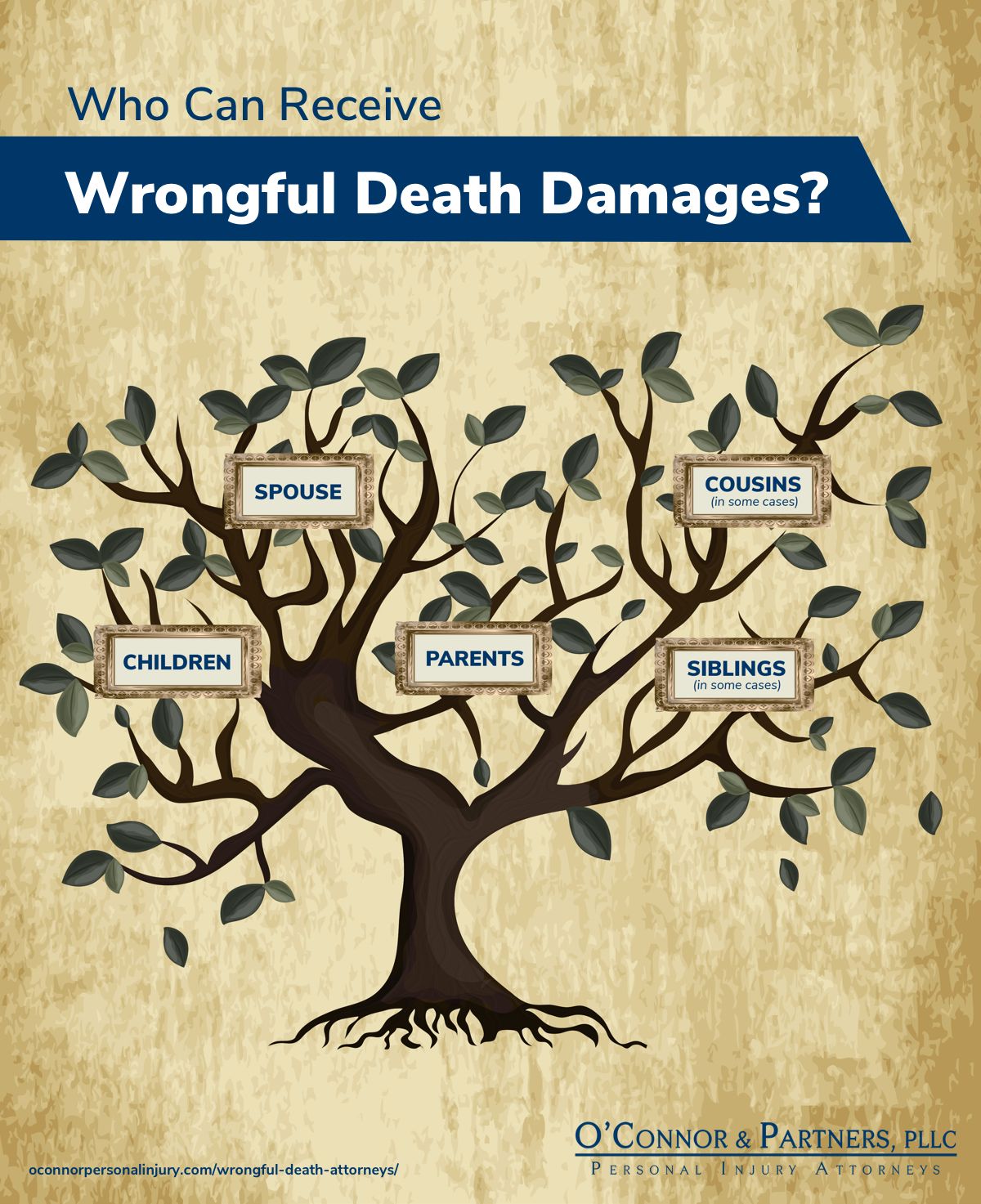

Persistent Misconceptions About Wrongful Death Litigation

Apr 25, 2025

Persistent Misconceptions About Wrongful Death Litigation

Apr 25, 2025 -

St Pauli Vs Bayern Munich Sanes Performance Highlights 5 Goal Encounter

Apr 25, 2025

St Pauli Vs Bayern Munich Sanes Performance Highlights 5 Goal Encounter

Apr 25, 2025

Latest Posts

-

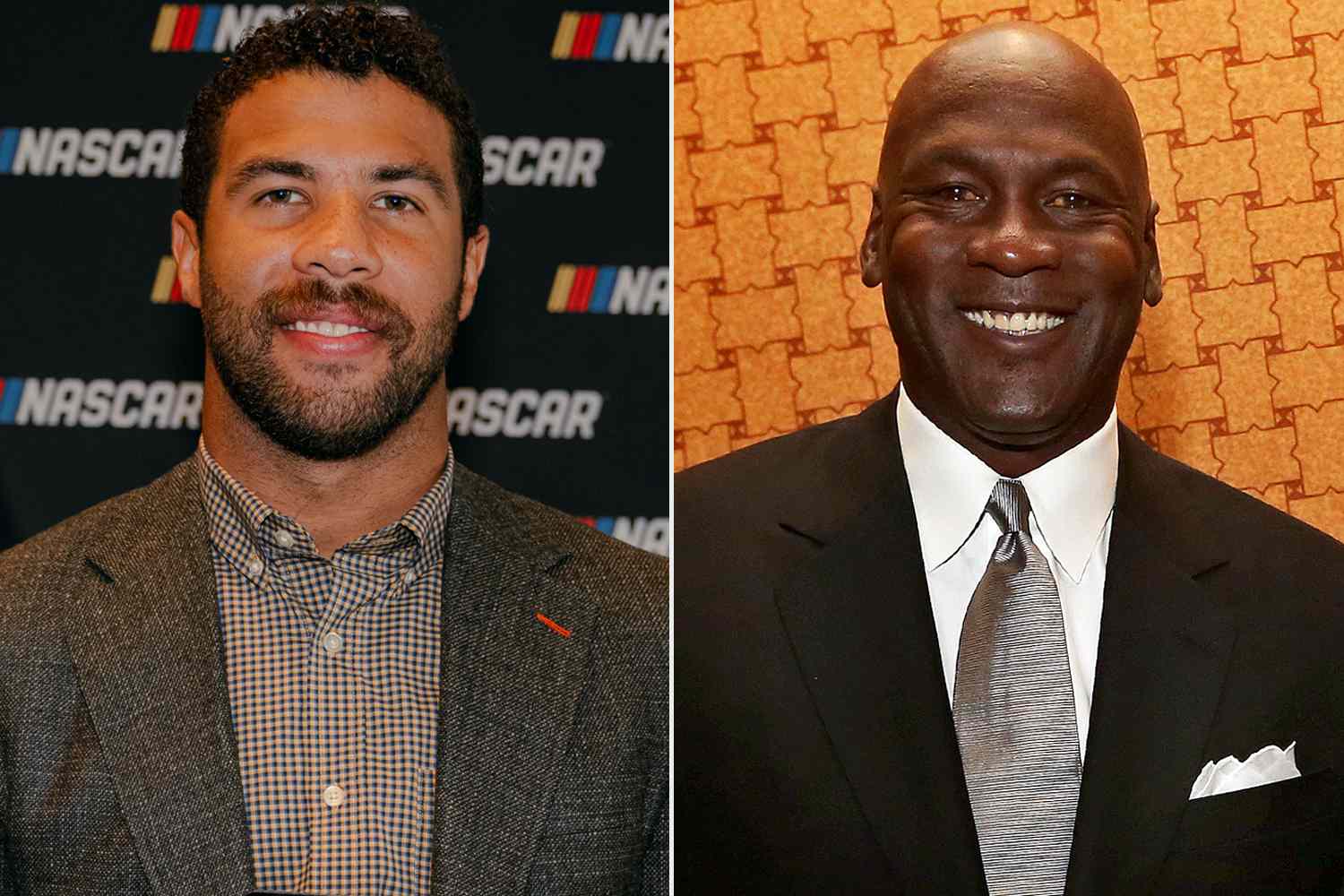

Bubba Wallace On The Encouraging Messages From Michael Jordan

Apr 28, 2025

Bubba Wallace On The Encouraging Messages From Michael Jordan

Apr 28, 2025 -

Two Consistent Texts Bubba Wallace Gets From Michael Jordan

Apr 28, 2025

Two Consistent Texts Bubba Wallace Gets From Michael Jordan

Apr 28, 2025 -

Michael Jordans Encouraging Texts To Bubba Wallace Revealed

Apr 28, 2025

Michael Jordans Encouraging Texts To Bubba Wallace Revealed

Apr 28, 2025 -

Bubba Wallace Shares Two Texts He Always Receives From Michael Jordan

Apr 28, 2025

Bubba Wallace Shares Two Texts He Always Receives From Michael Jordan

Apr 28, 2025 -

How A Final Restart Cost Bubba Wallace At Martinsville

Apr 28, 2025

How A Final Restart Cost Bubba Wallace At Martinsville

Apr 28, 2025