Report: 47% Increase In Indian Real Estate Investment In Q1

Table of Contents

Key Drivers Behind the 47% Investment Growth

Several interconnected factors propelled the substantial 47% growth in Indian real estate investment during Q1 2024.

Reduced Interest Rates and Favorable Government Policies

Lower home loan interest rates have significantly boosted investor confidence. The Reserve Bank of India's (RBI) monetary policies, aimed at stimulating economic growth, have resulted in more attractive borrowing costs. This makes property investment more accessible and financially viable for a wider range of buyers. Simultaneously, the government has implemented several pro-real estate initiatives.

- Tax benefits: Specific tax deductions and incentives for homebuyers have further fueled demand.

- Infrastructure development: Massive investments in infrastructure projects across the country, including improved transportation networks and utilities, are increasing property values and attracting investment in related sectors. Keywords: home loan interest rates India, real estate policies India, government incentives real estate.

Increased Demand from Domestic and International Investors

The surge in investment is driven by a significant increase in demand from both domestic and international sources.

- Domestic Buyers: Rising disposable incomes, coupled with a growing preference for homeownership among the burgeoning middle class, has spurred domestic demand. Urbanization continues to drive the need for housing in major cities.

- NRI Investment: Non-Resident Indians (NRIs) are increasingly viewing Indian real estate as a lucrative investment opportunity, contributing to the overall growth. Keywords: NRI investment in Indian real estate, domestic real estate investment, foreign investment in India.

Growth in Specific Real Estate Sectors

The investment growth isn't uniform across all sectors. Certain segments have experienced particularly significant growth:

- Residential Real Estate: The residential sector continues to be a major driver of investment, fueled by the increasing demand for housing.

- Commercial Real Estate: The burgeoning IT sector and the growth of startups have boosted demand for commercial spaces, leading to increased investment in office buildings and commercial complexes.

- Industrial Real Estate: India's growing manufacturing sector is driving investment in industrial parks and warehousing facilities. Keywords: commercial real estate India, residential real estate India, industrial real estate India.

Geographical Distribution of Investment

Investment is not evenly distributed across India. While major metropolitan areas continue to attract significant investment, emerging markets are also seeing growth.

- Major Cities: Mumbai, Delhi, and Bangalore remain hotspots for real estate investment, due to their robust economies and strong infrastructure.

- Tier 2 Cities: Investment in tier 2 cities is also picking up, driven by factors such as improved connectivity and relatively lower property prices. Keywords: Mumbai real estate, Delhi real estate, Bangalore real estate, tier 2 cities real estate.

Future Outlook for Indian Real Estate Investment

The outlook for Indian real estate investment remains positive, although certain challenges need to be considered.

- Continued Growth: The market is expected to witness continued growth in the coming years, driven by sustained economic growth and urbanization.

- Potential Risks: Inflation and potential economic slowdowns pose potential risks. However, the underlying fundamentals of the Indian economy remain strong. Keywords: Indian real estate market forecast, real estate investment trends India, future of Indian real estate.

Investing in the Booming Indian Real Estate Market

The 47% surge in Indian real estate investment in Q1 2024 highlights the sector's dynamism and immense potential. The key drivers – reduced interest rates, supportive government policies, and strong demand – point towards a sustained period of growth. Regional variations exist, with major cities and emerging markets both showing significant investment activity. While risks exist, the long-term outlook for Indian real estate remains positive. Considering the impressive 47% surge in Indian real estate investment in Q1 and the promising future outlook, now is the opportune time to explore investment opportunities. Research the market further and connect with experienced real estate professionals to make informed decisions. Don't miss out on the booming Indian real estate market!

Featured Posts

-

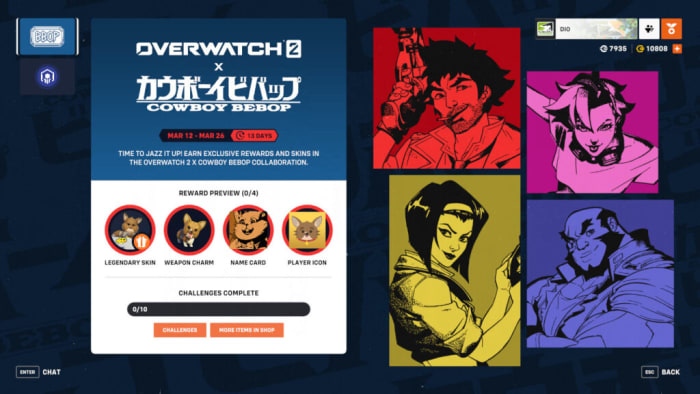

Fortnites Cowboy Bebop Crossover Grab Free Items Now

May 17, 2025

Fortnites Cowboy Bebop Crossover Grab Free Items Now

May 17, 2025 -

Secure Your Free Cowboy Bebop Fortnite Rewards

May 17, 2025

Secure Your Free Cowboy Bebop Fortnite Rewards

May 17, 2025 -

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6th Falsehoods

May 17, 2025

Fox News Faces Defamation Lawsuit From Ray Epps Over Jan 6th Falsehoods

May 17, 2025 -

Florida School Shootings And Lockdown Drills A Generational Perspective

May 17, 2025

Florida School Shootings And Lockdown Drills A Generational Perspective

May 17, 2025 -

Delinquent Student Loans The Governments Aggressive Pursuit And Your Rights

May 17, 2025

Delinquent Student Loans The Governments Aggressive Pursuit And Your Rights

May 17, 2025

Latest Posts

-

No Doctor Who Christmas Special Reasons For Cancellation And Future Implications

May 17, 2025

No Doctor Who Christmas Special Reasons For Cancellation And Future Implications

May 17, 2025 -

Doctor Who To Skip Christmas Special This Year Fan Reaction And Speculation

May 17, 2025

Doctor Who To Skip Christmas Special This Year Fan Reaction And Speculation

May 17, 2025 -

Report No Doctor Who Christmas Special In 2024

May 17, 2025

Report No Doctor Who Christmas Special In 2024

May 17, 2025 -

Renovated Spanish Townhouse For Sale E245 K Celebrity Designer Collaboration

May 17, 2025

Renovated Spanish Townhouse For Sale E245 K Celebrity Designer Collaboration

May 17, 2025 -

Spanish Townhouse Renovation Alan Carr And Amanda Holdens E245 000 Property

May 17, 2025

Spanish Townhouse Renovation Alan Carr And Amanda Holdens E245 000 Property

May 17, 2025