Revolut's 72% Revenue Jump: A Deep Dive Into Fintech's Global Ambitions

Table of Contents

The Driving Forces Behind Revolut's 72% Revenue Growth

Revolut's impressive revenue surge isn't accidental; it's the result of a multi-pronged strategy focused on expansion, diversification, and effective marketing.

Expansion into New Markets

Revolut's aggressive global expansion strategy is a key driver of its success. The company has strategically targeted underserved markets, adapting its offerings to local needs and preferences. This geographic diversification has significantly broadened its customer base.

- Aggressive global expansion strategy: Revolut hasn't been content with dominating its home market; it's actively pursued opportunities worldwide.

- Targeting underserved markets: By focusing on regions with less developed financial technology infrastructure, Revolut has capitalized on unmet demand.

- Localization efforts: Tailoring the app and services to local languages and cultural nuances has been crucial for successful market penetration.

- Strategic partnerships in new regions: Collaborations with local businesses and financial institutions have facilitated smoother entry into new markets, such as Asia and Latin America.

Revolut's international growth is impressive. For instance, its market penetration in certain European countries has exceeded expectations, showcasing the effectiveness of its localized approach. The company’s successful entry into the Indian market, despite its complexities, demonstrates its adaptability and strategic planning. This international success story is a clear indication of the power of strategic global expansion.

Diversification of Product Offerings

Revolut's initial success was built on its core banking services. However, its expansion beyond basic banking into a range of financial products and services has been instrumental in boosting revenue.

- Introduction of new financial products and services: Revolut has successfully expanded its offerings to include premium subscriptions, investment options, crypto trading, and business accounts.

- Expansion beyond basic banking services: This move has transformed Revolut from a simple banking app into a comprehensive financial management platform.

- Development of innovative features: Features like budgeting tools, personalized financial insights, and international money transfers have significantly enhanced user experience and increased engagement.

The introduction of premium subscription tiers, offering enhanced features and benefits, has proven particularly successful in driving revenue growth. The popularity of Revolut's investment and crypto trading features underscores the increasing demand for integrated financial services. This product diversification strategy is a masterclass in leveraging existing user bases to introduce new revenue streams.

Effective Marketing and Customer Acquisition

Revolut's marketing efforts have been instrumental in building brand awareness and acquiring new customers. The company has strategically employed a multi-channel approach.

- Targeted marketing campaigns: Revolut utilizes data-driven marketing strategies to reach specific demographics and tailor messaging for maximum impact.

- Strong social media presence: A vibrant and engaging social media presence fosters brand loyalty and drives organic customer acquisition.

- Referral programs: Incentivizing existing customers to refer new users has proved a cost-effective customer acquisition channel.

- Competitive pricing strategies: Offering competitive fees and transparent pricing models has attracted price-sensitive customers.

- Focus on user experience: A seamless and intuitive user experience is critical for retaining customers and generating positive word-of-mouth referrals.

Revolut's digital marketing expertise is evident in its strong social media engagement, which has helped cultivate a loyal community around the brand. The company’s focus on user experience has resulted in high customer satisfaction scores, reinforcing its positive brand image and driving organic growth.

Challenges and Future Outlook for Revolut

Despite its remarkable success, Revolut faces significant challenges in the increasingly competitive fintech landscape.

Increasing Competition in the Fintech Sector

The fintech sector is becoming increasingly crowded, with both established banks and new fintech companies vying for market share.

- Competition from established banks and other fintech companies: Revolut must constantly innovate to maintain its competitive advantage.

- Challenges in maintaining market share: Sustaining rapid growth in a crowded marketplace requires continuous adaptation and innovation.

- Need for continuous innovation: Revolut needs to consistently develop new features and products to stay ahead of the curve and attract new customers.

Revolut needs to anticipate and respond effectively to competitive threats from both established players and nimble startups. This necessitates a commitment to ongoing innovation and strategic adaptation.

Regulatory Hurdles and Compliance

Navigating the complex regulatory environment in various countries presents another hurdle for Revolut.

- Navigating complex regulatory environments in different countries: Compliance requirements vary significantly across jurisdictions, demanding careful management and proactive adaptation.

- Compliance with financial regulations: Adhering to stringent financial regulations is paramount for maintaining operational integrity and avoiding penalties.

- Potential impact of changing regulations: Future regulatory changes could impact Revolut’s business model and operations, requiring agility and foresight.

Proactive regulatory compliance is crucial for Revolut's long-term sustainability. The company must stay informed about evolving regulations and invest in robust compliance mechanisms.

Maintaining Profitability and Sustainable Growth

Balancing rapid expansion with profitability is a key challenge for Revolut.

- Balancing aggressive expansion with profitability: Achieving sustainable growth requires careful management of operational costs and revenue streams.

- Managing operational costs: Efficient cost management is vital for ensuring long-term profitability.

- Long-term financial sustainability: Revolut needs a robust financial strategy to ensure its long-term viability and continued success.

Sustaining its impressive growth while ensuring profitability requires careful financial planning and efficient resource allocation. Revolut must demonstrate long-term financial sustainability to reassure investors and maintain its market position.

Conclusion

Revolut's 72% revenue jump is a testament to its successful global expansion strategy and its ability to innovate within the competitive fintech landscape. While challenges remain, the company's continued focus on product diversification, effective marketing, and navigating regulatory hurdles will be crucial for maintaining its impressive growth trajectory. Understanding the factors driving Revolut's success offers valuable insights into the future of global fintech. To stay updated on the latest developments in the fintech industry and Revolut’s continued growth, subscribe to our newsletter and keep an eye out for future articles exploring Revolut’s strategy and the ever-evolving world of financial technology. Learn more about Revolut and its impact on the fintech industry by researching Revolut's global expansion and exploring related news articles on the subject.

Featured Posts

-

Underdog Bochum Defeats Bayern Munich A Comeback For The Ages

Apr 25, 2025

Underdog Bochum Defeats Bayern Munich A Comeback For The Ages

Apr 25, 2025 -

Trump Executive Order Reshaping Higher Education Accreditation

Apr 25, 2025

Trump Executive Order Reshaping Higher Education Accreditation

Apr 25, 2025 -

Sexual Extortion Case Prominent Meteorologist Under Arrest

Apr 25, 2025

Sexual Extortion Case Prominent Meteorologist Under Arrest

Apr 25, 2025 -

Sherwood Ridge School Religious Exemption From Anzac Day Observances

Apr 25, 2025

Sherwood Ridge School Religious Exemption From Anzac Day Observances

Apr 25, 2025 -

Navigate The Private Credit Boom 5 Essential Dos And Don Ts

Apr 25, 2025

Navigate The Private Credit Boom 5 Essential Dos And Don Ts

Apr 25, 2025

Latest Posts

-

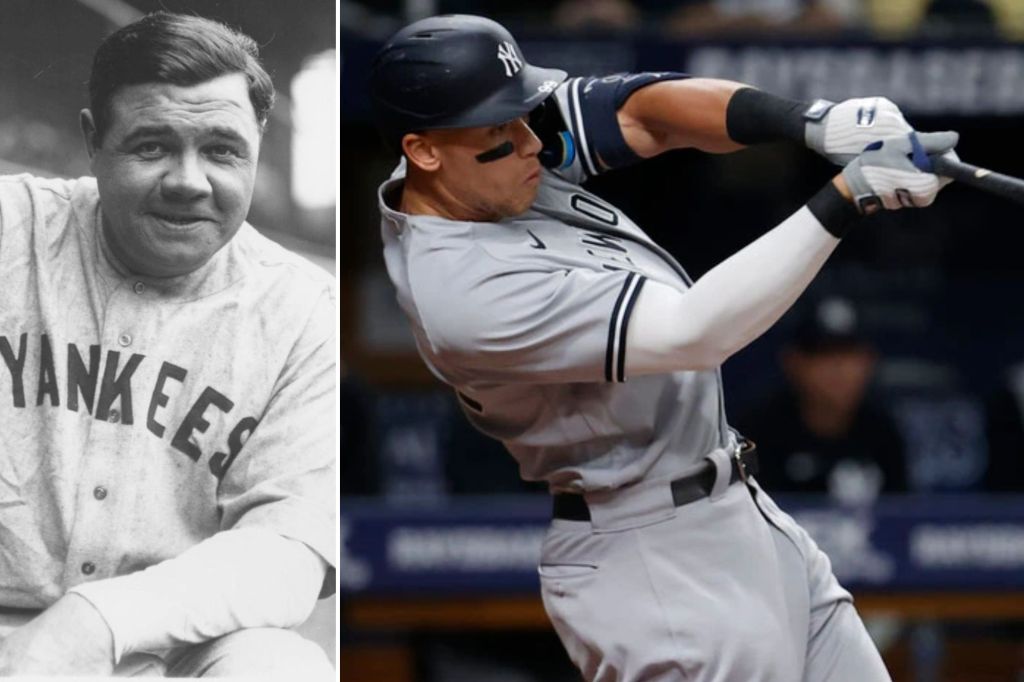

Babe Ruth And Aaron Judge A Yankees Record Tying Feat

Apr 28, 2025

Babe Ruth And Aaron Judge A Yankees Record Tying Feat

Apr 28, 2025 -

Aaron Judges Historic Home Run Matching Babe Ruths Yankees Mark

Apr 28, 2025

Aaron Judges Historic Home Run Matching Babe Ruths Yankees Mark

Apr 28, 2025 -

Yankees Star Aaron Judge Matches Babe Ruths Impressive Record

Apr 28, 2025

Yankees Star Aaron Judge Matches Babe Ruths Impressive Record

Apr 28, 2025 -

Aaron Judge Equals Babe Ruths Legendary Yankees Record

Apr 28, 2025

Aaron Judge Equals Babe Ruths Legendary Yankees Record

Apr 28, 2025 -

Yankees Star Aaron Judge Hints At 2025 With Unique Push Up Celebration

Apr 28, 2025

Yankees Star Aaron Judge Hints At 2025 With Unique Push Up Celebration

Apr 28, 2025