Rupiah Weakness Triggers Significant Drop In Indonesia's Foreign Exchange Reserves

Table of Contents

Understanding the Rupiah's Recent Weakness

The weakening Rupiah is a result of a confluence of global and domestic economic pressures.

Global Economic Factors

Global economic uncertainties have significantly impacted emerging market currencies, including the Rupiah.

- Rising US Interest Rates: The Federal Reserve's aggressive interest rate hikes to combat inflation attract capital flows away from emerging markets like Indonesia, weakening the Rupiah against the US dollar. This is because higher US yields make dollar-denominated assets more attractive to investors.

- Global Inflation and Recessionary Fears: High global inflation and fears of a global recession are causing investors to seek safer havens, leading to capital flight from riskier emerging markets and further pressure on the Rupiah.

- US Dollar Strength: The strengthening US dollar, a safe haven currency during times of global uncertainty, directly impacts the value of the Rupiah, making Indonesian exports more expensive and imports cheaper, contributing to a widening trade deficit.

Domestic Economic Factors

Internal economic pressures are further exacerbating the Rupiah's decline.

- Current Account Deficit: A persistent current account deficit, where imports exceed exports, puts downward pressure on the Rupiah as Indonesia needs to rely on foreign capital inflows to finance this gap. A wider deficit increases demand for foreign currency, weakening the IDR.

- Inflation and Interest Rate Policies: While Bank Indonesia (BI) has raised interest rates to combat inflation, the impact on the Rupiah has been limited, highlighting the strength of global headwinds. High inflation erodes purchasing power and can negatively affect investor confidence.

- Government Spending and Policy Changes: Government spending policies and any significant changes in economic regulations can influence investor sentiment and affect the Rupiah's exchange rate. Uncertainty surrounding government policies can lead to capital flight.

The Impact on Indonesia's Foreign Exchange Reserves

The weakening Rupiah has directly resulted in a substantial decline in Indonesia's foreign exchange reserves.

The Scale of the Decline

The drop in reserves is significant, representing a [insert specific percentage]% decrease compared to [insert previous period].

- Reserves Level in USD: As of [insert date], Indonesia's forex reserves stood at approximately [insert official figure in USD] according to data from Bank Indonesia. This is [insert comparison to previous periods, e.g., lower than the level seen in Q2 2023].

- Implications of Falling Below a Certain Threshold: Falling below a critical reserve threshold could limit Indonesia's ability to intervene in the forex market to stabilize the Rupiah, potentially leading to further currency depreciation.

Central Bank Interventions

Bank Indonesia (BI) has taken several measures to mitigate the Rupiah's decline.

- Interest Rate Hikes: BI has implemented interest rate hikes to attract foreign investment and support the Rupiah. However, the effectiveness of these measures has been limited given the strength of global headwinds.

- Forex Market Interventions: BI has utilized its foreign exchange reserves to intervene in the forex market, attempting to manage the Rupiah's volatility. However, continued intervention depletes reserves.

Implications for Import Costs and Inflation

The weakening Rupiah significantly increases the cost of imported goods.

- Impact on Consumer Prices: Higher import costs contribute to inflation, impacting consumer purchasing power and potentially leading to social unrest. Essential goods, like fuel and food, are particularly vulnerable to price increases.

- Import-Dependent Sectors: Industries reliant on imported raw materials or components will experience increased production costs, potentially affecting competitiveness and profitability.

Investment Implications and Future Outlook

The Rupiah's weakness has significant implications for investment and the Indonesian economy's future.

Investor Sentiment

The declining Rupiah has negatively impacted investor sentiment.

- Potential Capital Flight: Concerns about the Rupiah's future may lead to capital flight, further weakening the currency and depleting reserves.

- Impact on Foreign Direct Investment (FDI): The weakening Rupiah could deter foreign direct investment, hindering economic growth.

Government Response and Policy Recommendations

The Indonesian government needs to implement effective strategies to address the situation.

- Economic Reforms to Improve the Trade Balance: Boosting exports and reducing reliance on imports are crucial. This may involve promoting domestic industries, diversifying export markets, and implementing trade policies that favour exports.

- Fiscal Policy for Economic Stabilization: Well-targeted fiscal policies, including managing government spending and investing in infrastructure, can help boost economic growth and confidence, supporting the Rupiah.

Potential Recovery Scenarios

The future trajectory of the Rupiah and Indonesia's forex reserves depends on various factors. Optimistic scenarios involve a stabilization of global markets, successful government interventions, and increased foreign investment. However, pessimistic scenarios include continued global uncertainty, further capital flight, and prolonged inflationary pressures.

Conclusion

The significant drop in Indonesia's foreign exchange reserves is primarily due to Rupiah weakness, driven by a combination of global economic uncertainties and domestic economic challenges. The consequences are far-reaching, affecting inflation, import costs, investor sentiment, and the overall economic stability of Indonesia. The weakening Rupiah necessitates continuous monitoring of economic indicators and government policy responses. Stay informed about the latest developments regarding Rupiah weakness and its impact through reputable financial news sources and economic reports to make informed decisions. Further research into Indonesia's economic policies and global market trends is crucial for understanding the ongoing challenges and potential recovery scenarios.

Featured Posts

-

Why Invest In Middle Management A Strategic Approach To Business Success

May 09, 2025

Why Invest In Middle Management A Strategic Approach To Business Success

May 09, 2025 -

Polaca Detida No Reino Unido Alega Ser Maddie Mc Cann

May 09, 2025

Polaca Detida No Reino Unido Alega Ser Maddie Mc Cann

May 09, 2025 -

Adin Hills 27 Saves Shutout Columbus Golden Knights Win 4 0

May 09, 2025

Adin Hills 27 Saves Shutout Columbus Golden Knights Win 4 0

May 09, 2025 -

Madhyamik Exam 2025 How To Check Your Result And Merit List

May 09, 2025

Madhyamik Exam 2025 How To Check Your Result And Merit List

May 09, 2025 -

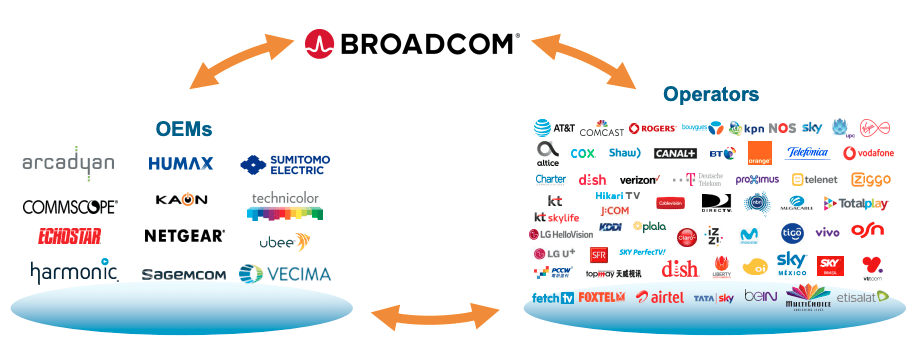

1 050 V Mware Price Increase At And Ts Concerns Over Broadcoms Acquisition

May 09, 2025

1 050 V Mware Price Increase At And Ts Concerns Over Broadcoms Acquisition

May 09, 2025