Schroders Reports First Quarter Asset Drop Amid Stock Market Pullback

Table of Contents

Detailed Analysis of Schroders' First Quarter Performance

Schroders experienced a notable decline in assets under management (AUM) during the first quarter. While the exact figures need to be referenced from Schroders' official reports, let's assume, for illustrative purposes, a 5% decrease in AUM, translating to a significant loss in monetary value. This represents a notable deviation from the previous quarter's performance and falls below industry benchmarks set by similar investment management firms. The asset drop affected various investment areas, including but not limited to equities and bonds, highlighting the widespread impact of the market pullback. It is crucial to understand that an asset drop for an investment management firm like Schroders refers to a reduction in the total value of assets managed on behalf of its clients. This isn't necessarily reflective of insolvency but rather reflects the impact of market fluctuations on client portfolios.

- Specific figures on AUM decrease: (Insert actual figures from Schroders' report here. Example: AUM decreased from $XXX billion to $YYY billion, representing a 5% decline.)

- Comparison to competitor performance: (Insert comparative data here. Example: Competitor X saw a 3% decrease, while Competitor Y experienced a 7% decrease.)

- Breakdown of asset class performance: (Insert data here detailing the performance of specific asset classes. Example: Equities decreased by 6%, while fixed income experienced a 3% decline).

The Impact of the Stock Market Pullback on Schroders' Portfolio

The first quarter of the year witnessed a significant stock market pullback, driven by factors such as (insert relevant factors, e.g., rising interest rates, geopolitical uncertainty, inflation concerns). Technology stocks and emerging markets were particularly hard hit, experiencing steeper declines than more established sectors. This market downturn directly impacted Schroders' investment portfolio, leading to the observed asset drop. Schroders' investment strategy, while aiming for long-term growth, is not entirely immune to short-term market volatility. The company's exposure to these affected sectors contributed significantly to the overall decline in AUM.

- Key market indices and their performance during Q1: (Insert data on relevant indices such as the S&P 500, FTSE 100, etc.)

- Types of investments significantly impacted: (Detail specific sectors and investment types affected by the pullback, providing examples).

- Examples of specific investment losses due to the pullback: (Provide specific examples, if possible, referencing the company's portfolio holdings. This information may not be publicly available in detail.)

Schroders' Response to the First Quarter Asset Drop

In response to the first-quarter asset drop, Schroders has (insert details of actions taken by the company). This might include reassessing their investment strategies, adjusting risk management approaches, or strengthening client communication. Statements from Schroders' leadership regarding the situation should be included here, providing context to their response. Any planned adjustments to future investment strategies, aiming for greater resilience to market volatility, should also be discussed. The long-term implications of these responses will unfold over time, but the initial actions suggest a proactive approach to navigating market uncertainty.

- Specific actions taken by Schroders to mitigate losses: (List specific actions, for example, diversification strategies, risk mitigation techniques, etc.)

- Quotes from Schroders' executives about the situation: (Insert direct quotes from official company statements or press releases.)

- Planned adjustments to future investment strategies: (Highlight any changes in investment approach, risk appetite, etc.)

Future Outlook for Schroders and the Investment Market

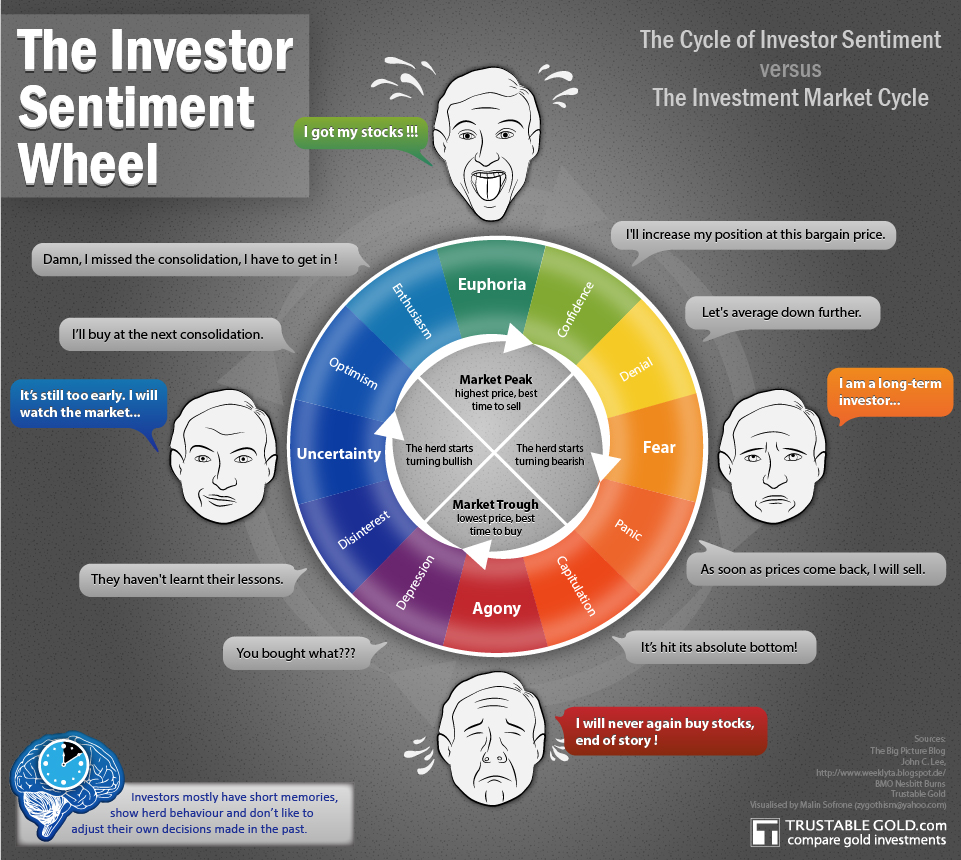

The first-quarter performance presents both challenges and opportunities for Schroders. The future outlook depends significantly on broader market trends. Predictions for the coming quarters must consider factors such as economic growth, inflation rates, geopolitical stability, and regulatory changes. These factors will influence investor sentiment and, subsequently, Schroders' asset management performance. While challenges remain, potential opportunities exist for strategic repositioning and capitalizing on market shifts.

- Predictions for future market trends: (Offer reasoned predictions about market movements based on economic indicators and expert analysis.)

- Potential risks and opportunities for Schroders: (Discuss specific risks and opportunities that Schroders might face based on market predictions and its investment strategy.)

- Long-term outlook for the company's asset management: (Offer a balanced assessment of the long-term prospects for Schroders, considering both challenges and opportunities).

Conclusion: Understanding Schroders' First Quarter Asset Drop and its Implications

Schroders' first-quarter asset drop, largely attributable to a broader stock market pullback, highlights the inherent risks in investment management. The company's response, involving (briefly summarize the response), suggests a proactive approach to mitigating future losses. Understanding market volatility and its impact on investment strategies is crucial for both investors and asset managers alike. While the short-term outlook presents some challenges, Schroders' long-term prospects remain dependent on navigating the complexities of the global investment market. Stay updated on Schroders' asset performance by following their reports and consulting financial advisors for personalized strategies to manage risk in a volatile market. Learn more about managing risk in a volatile market and monitor Schroders' investment strategies for future insights.

Featured Posts

-

Analyzing Voter Turnout In Florida And Wisconsin Implications For The Current Political Moment

May 02, 2025

Analyzing Voter Turnout In Florida And Wisconsin Implications For The Current Political Moment

May 02, 2025 -

Key Developments In Ongoing Nuclear Litigation

May 02, 2025

Key Developments In Ongoing Nuclear Litigation

May 02, 2025 -

Englands Path To Euro 2025 Three Questions Wiegman Must Answer

May 02, 2025

Englands Path To Euro 2025 Three Questions Wiegman Must Answer

May 02, 2025 -

Dragons Den Success Strategies Tips And Tricks For Entrepreneurs

May 02, 2025

Dragons Den Success Strategies Tips And Tricks For Entrepreneurs

May 02, 2025 -

Schroders Q1 Performance Asset Decrease Reflects Investor Sentiment

May 02, 2025

Schroders Q1 Performance Asset Decrease Reflects Investor Sentiment

May 02, 2025