SEC's XRP Commodity Decision: Ripple Settlement Talks Impact

Table of Contents

The SEC's Case Against Ripple and its Implications

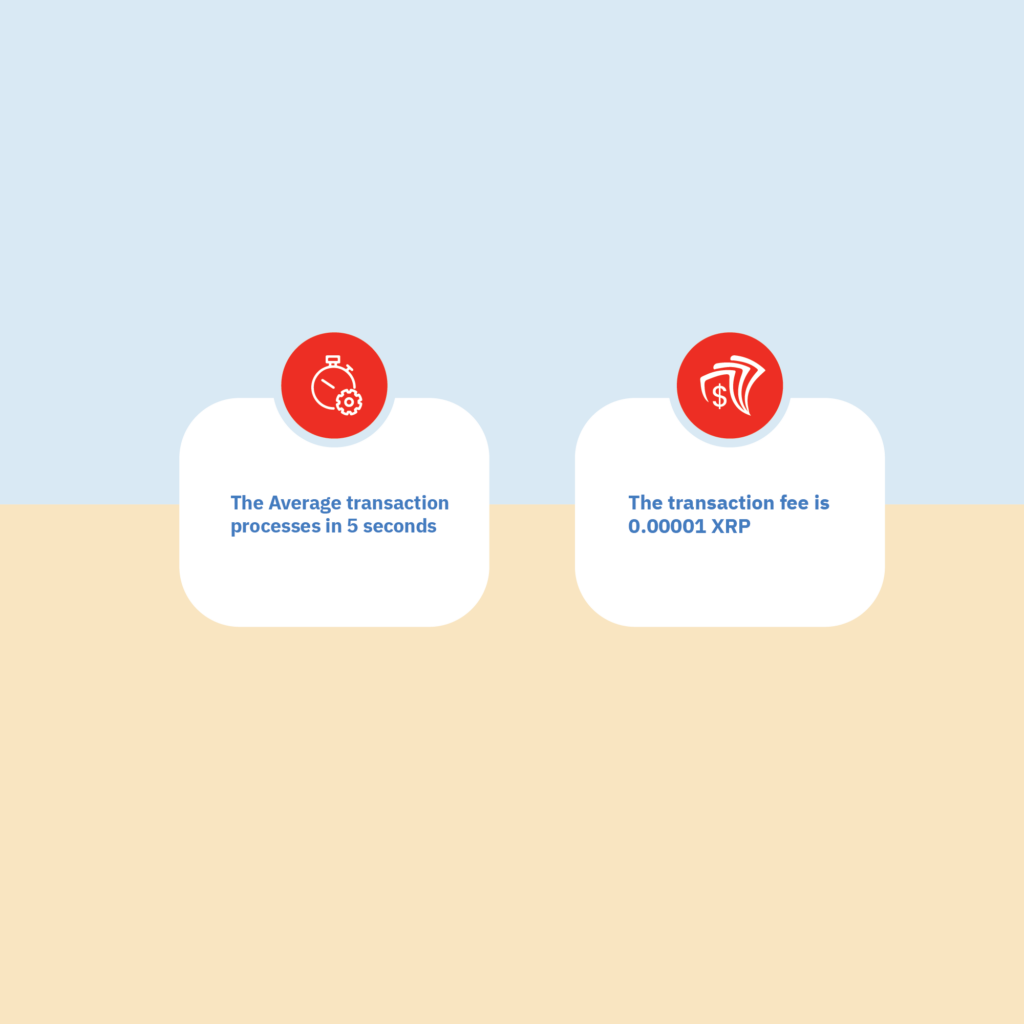

The SEC's lawsuit against Ripple Labs, filed in December 2020, alleged that Ripple conducted unregistered securities offerings of XRP, violating federal securities laws. The SEC argued that XRP sales constituted investment contracts, meaning investors purchased XRP with the expectation of profit based on Ripple's efforts. This argument hinges on the Howey Test, a legal framework used to determine whether an asset qualifies as a security.

The SEC's stance on XRP's classification had far-reaching implications, potentially setting a precedent for how other cryptocurrencies are regulated. This uncertainty created a chilling effect on the market, impacting investor confidence and the development of new crypto projects.

- Summary of the SEC's claims: Ripple's sale of XRP was an unregistered securities offering, violating Section 5 of the Securities Act of 1933.

- Key arguments presented by Ripple's defense: XRP is a decentralized digital asset, not a security, and its sales did not constitute investment contracts. Ripple argued that XRP functioned similarly to other cryptocurrencies like Bitcoin and Ethereum.

- Impact on the broader cryptocurrency market: The case created significant regulatory uncertainty, causing price volatility across numerous cryptocurrencies. Many projects faced increased scrutiny and potential legal challenges.

- Legal precedents set by the case: The SEC's decision, though specific to XRP, significantly impacts the regulatory landscape for cryptocurrencies, potentially setting precedents for future cases.

Ripple's Settlement Negotiations and Potential Outcomes

Ripple and the SEC have engaged in protracted settlement negotiations. The potential outcomes range from a comprehensive settlement agreement to continued litigation. A full settlement could involve Ripple paying a substantial fine and potentially agreeing to stricter regulatory compliance measures. A partial settlement might address some of the SEC's concerns but leave others unresolved. Continued litigation, however, carries significant financial and reputational risks for both parties.

- Potential terms of a settlement agreement: Financial penalties, regulatory compliance measures, and potentially limitations on future XRP sales are all possibilities.

- Ripple's financial position and willingness to settle: Ripple's strong financial standing might influence its negotiating power, potentially leading to a more favorable settlement or a more aggressive legal defense.

- The SEC's negotiating position and objectives: The SEC's primary objective is likely to set a clear precedent for future cryptocurrency regulation, ensuring compliance with securities laws.

- Potential impact on XRP price volatility: The outcome of the settlement talks will likely significantly impact XRP's price, with a favorable settlement potentially boosting its value and vice versa.

Impact on XRP Price and Market Sentiment

The SEC's decision and the ongoing settlement talks have directly affected XRP's price and the overall market sentiment. XRP experienced significant price fluctuations throughout the legal battle, reflecting investor uncertainty and speculation. Positive news regarding settlement talks generally led to price increases, while negative developments caused declines. This volatility highlights the crucial role investor confidence plays in shaping XRP's market valuation.

- XRP price fluctuations before, during, and after the SEC's decision: XRP's price experienced dramatic swings, highlighting the market's sensitivity to regulatory news.

- Investor sentiment towards XRP: Investor sentiment shifted significantly based on the progress of the case and settlement talks.

- Influence of news and events on XRP trading volume: Major announcements and court developments directly influenced trading volume, indicating heightened market interest.

- Comparison with other cryptocurrencies affected by regulatory uncertainty: The XRP case served as a benchmark for other cryptocurrencies facing regulatory uncertainty, highlighting the interconnectedness of the market.

The Broader Implications for the Cryptocurrency Industry

The SEC's decision on XRP and the Ripple case have far-reaching implications for the broader cryptocurrency industry. The ruling underscores the increased regulatory scrutiny faced by cryptocurrency projects and raises questions about the legal status of other digital assets. This regulatory uncertainty can impact investor confidence, hinder innovation, and potentially reshape the future of decentralized finance (DeFi).

- Increased regulatory scrutiny of cryptocurrencies: The SEC's actions signal a more proactive and assertive approach to regulating the cryptocurrency market.

- Impact on investor confidence and adoption: Regulatory uncertainty can deter investors and hinder the widespread adoption of cryptocurrencies.

- Potential changes in regulatory frameworks: The Ripple case might lead to changes in how cryptocurrencies are classified and regulated.

- The future of decentralized finance (DeFi) in light of the SEC's actions: The regulatory landscape will likely influence the development and growth of decentralized finance.

SEC's XRP Commodity Decision: Ripple Settlement Talks – Key Takeaways and Call to Action

The SEC's decision on XRP, coupled with the ongoing Ripple settlement talks, has created a pivotal moment for the cryptocurrency industry. The outcome will significantly influence the regulatory landscape, investor confidence, and the future trajectory of XRP and other digital assets. The case highlights the need for greater regulatory clarity and a more comprehensive framework for governing the cryptocurrency market.

Stay updated on the evolving situation surrounding the SEC's XRP commodity decision and Ripple's settlement talks by subscribing to our newsletter for regular updates and analysis. Understanding these developments is crucial for anyone involved in or interested in the cryptocurrency market.

Featured Posts

-

Is Christina Aguilera Overdoing The Photoshop Fans React To New Images

May 02, 2025

Is Christina Aguilera Overdoing The Photoshop Fans React To New Images

May 02, 2025 -

Scotland In The Six Nations 2025 Overachievers Or Real Deal

May 02, 2025

Scotland In The Six Nations 2025 Overachievers Or Real Deal

May 02, 2025 -

Sulm Me Arme Te Bardhe Ne Ceki Raportohen Dy Te Vdekur Ne Qender Tregtare

May 02, 2025

Sulm Me Arme Te Bardhe Ne Ceki Raportohen Dy Te Vdekur Ne Qender Tregtare

May 02, 2025 -

Is Xrp A Good Investment Analyzing The Risks And Rewards

May 02, 2025

Is Xrp A Good Investment Analyzing The Risks And Rewards

May 02, 2025 -

The Growing Market Of Disaster Betting Focusing On Los Angeles Wildfires

May 02, 2025

The Growing Market Of Disaster Betting Focusing On Los Angeles Wildfires

May 02, 2025