Secure The Lowest Personal Loan Interest Rate Today

Table of Contents

Understanding Personal Loan Interest Rates

Before diving into securing a low interest personal loan, it's essential to understand the core concepts. The Annual Percentage Rate (APR) is the total cost of your loan, including interest and any fees, expressed as a yearly percentage. Understanding your APR is critical for comparing loan offers effectively.

- APR Components: The APR includes the interest rate itself, as well as any origination fees, processing fees, or other charges associated with the loan. These fees can significantly impact your overall borrowing cost.

- Fixed vs. Variable Interest Rates: A fixed interest rate remains constant throughout the loan term, providing predictability in your monthly payments. A variable interest rate, on the other hand, fluctuates based on market conditions, potentially leading to fluctuating monthly payments. Choosing between fixed and variable rates depends on your risk tolerance and financial circumstances.

- Loan Terms and Total Interest Paid: The length of your loan term (e.g., 36 months, 60 months) directly affects the total interest you'll pay. While a longer loan term might result in lower monthly payments, it typically leads to a higher overall interest payment because you're paying interest for a longer period. A shorter loan term means higher monthly payments but significantly less interest paid over the life of the loan.

Factors Affecting Your Personal Loan Interest Rate

Several factors influence the personal loan interest rate you'll receive. Lenders carefully assess these factors to determine your creditworthiness and the risk they're taking by lending you money.

- Credit Score: Your credit score is the most significant factor. A higher credit score (generally above 700) demonstrates responsible credit management and significantly improves your chances of securing a low interest personal loan. A lower credit score typically results in a much higher interest rate, or even loan rejection.

- Debt-to-Income Ratio (DTI): Your DTI is the percentage of your monthly income that goes towards paying debts. A lower DTI indicates you have more disposable income to make loan payments, making you a less risky borrower and potentially leading to a better interest rate.

- Loan Amount: Larger loan amounts often carry slightly higher interest rates, as they represent a greater risk for the lender.

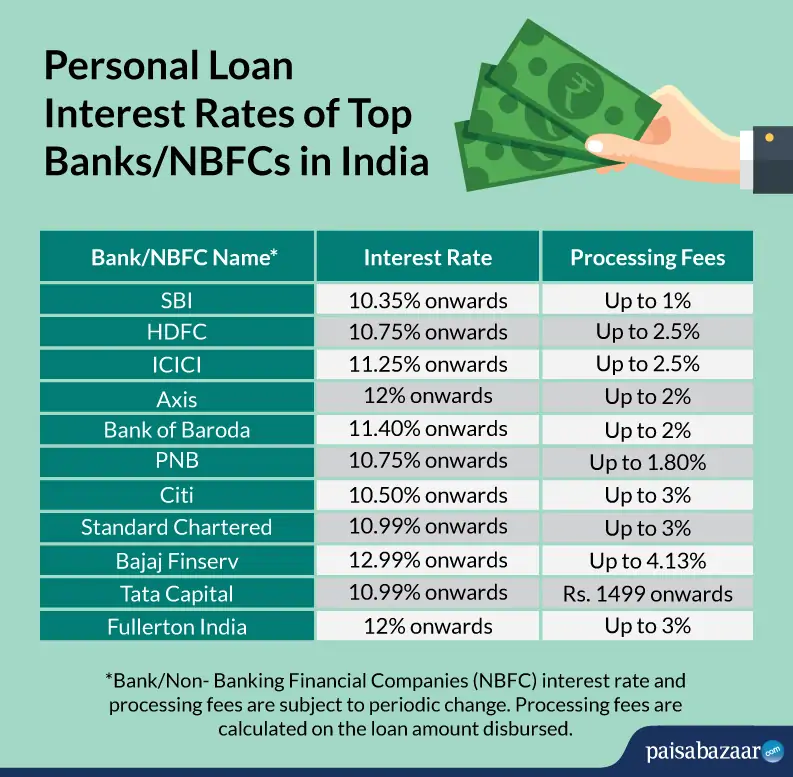

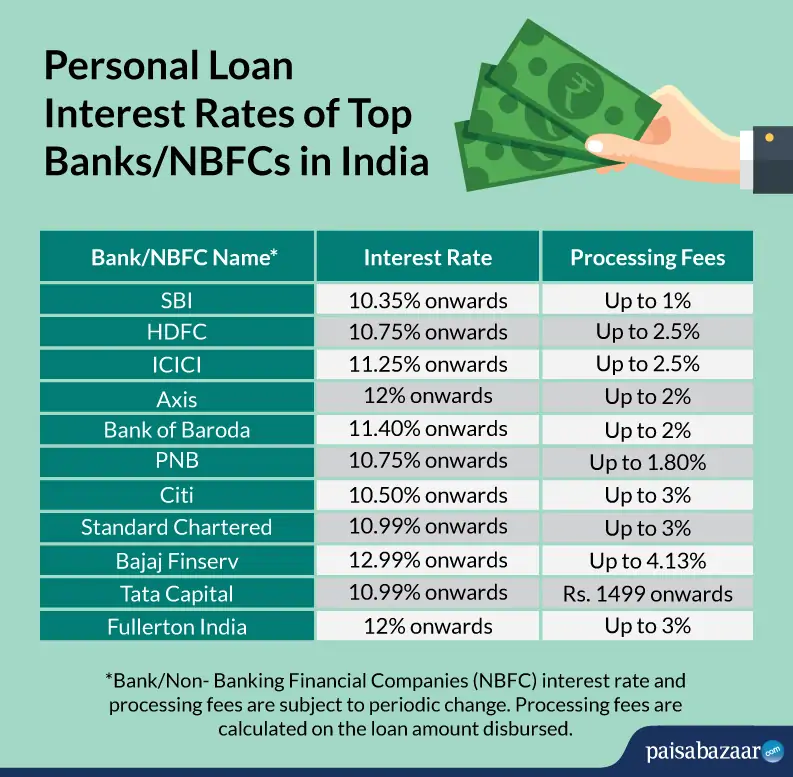

- Lender Type: Different lenders, such as banks, credit unions, and online lenders, have varying interest rate structures. Credit unions often offer more competitive rates for their members, while online lenders can provide greater convenience but may have higher fees.

- Income Verification: Lenders require income verification to ensure you have the capacity to repay the loan. Providing sufficient proof of income increases your chances of approval and potentially a lower interest rate.

Strategies to Secure the Lowest Personal Loan Interest Rate

Finding the best personal loan rates requires proactive effort and strategic planning. Don't settle for the first offer you receive.

- Shop Around and Compare Rates: Use online comparison tools to compare offers from multiple lenders. This allows you to see a range of interest rates and terms before making a decision.

- Pre-qualification: Pre-qualifying for a loan allows you to check your eligibility and see potential interest rates without impacting your credit score. This is a crucial step in the process.

- Improve Your Credit Score: Before applying for a loan, take steps to improve your credit score if it's less than ideal. This could involve paying down existing debt, correcting errors on your credit report, and consistently making on-time payments.

- Negotiate Interest Rates: Once you have a loan offer, don't hesitate to negotiate. If you have a strong credit profile and other attractive attributes, you might be able to negotiate a lower interest rate.

- Gather Documentation: Have all necessary documentation ready, including proof of income, employment history, and identification, to streamline the application process.

Avoiding Personal Loan Scams and Predatory Lending

Be cautious of loan offers that seem too good to be true. Predatory lenders target vulnerable borrowers with high-interest rates and unfair terms.

- Red Flags: Watch out for high upfront fees, hidden charges, aggressive sales tactics, and lenders who don't require credit checks.

- Reputable Lenders: Stick to established banks, credit unions, and reputable online lenders. Check reviews and ratings before applying.

- Read the Fine Print: Carefully review all loan documents before signing. Understand the APR, fees, and repayment terms.

- Seek Financial Advice: If you're unsure about any aspect of the loan process, seek advice from a trusted financial advisor.

Conclusion

Securing the lowest personal loan interest rate involves understanding the factors that influence rates, actively comparing offers, and taking steps to improve your creditworthiness. Remember, a good credit score is your best asset in obtaining favorable loan terms. By following the strategies outlined in this guide, you can significantly reduce the cost of borrowing and make informed decisions about your personal loan. Start comparing rates today to secure the lowest personal loan interest rate for your needs. Don't delay – find the best personal loan for your financial situation! Use our resources to find reputable lenders and learn more about securing a low-interest personal loan.

Featured Posts

-

Revealed The Shop That Sold The Winning Lotto Ticket Prize Unclaimed

May 28, 2025

Revealed The Shop That Sold The Winning Lotto Ticket Prize Unclaimed

May 28, 2025 -

J Lo To Host American Music Awards May Ceremony Details

May 28, 2025

J Lo To Host American Music Awards May Ceremony Details

May 28, 2025 -

Fenerbahce Nin Cristiano Ronaldo Teklifi Sok Etki Ve Olasi Sonuclar

May 28, 2025

Fenerbahce Nin Cristiano Ronaldo Teklifi Sok Etki Ve Olasi Sonuclar

May 28, 2025 -

Unstoppable The Rome Champions Continued Pursuit Of Excellence

May 28, 2025

Unstoppable The Rome Champions Continued Pursuit Of Excellence

May 28, 2025 -

Prakiraan Cuaca Jawa Timur 29 Maret 2024 Waspada Hujan Lebat Dan Petir

May 28, 2025

Prakiraan Cuaca Jawa Timur 29 Maret 2024 Waspada Hujan Lebat Dan Petir

May 28, 2025