Securing Stakes In Elon Musk's Private Holdings: A Potential Side Hustle

Table of Contents

Understanding Elon Musk's Diverse Portfolio

Elon Musk's entrepreneurial spirit extends far beyond his publicly traded companies like Tesla and SpaceX. He has a vast and diverse portfolio of private investments, each with its own potential for growth and significant returns. Understanding the scope of his private holdings is the first step towards identifying potential investment avenues. This includes companies that are less visible to the public eye but hold considerable promise.

- The Boring Company: Focused on infrastructure innovation, this company aims to revolutionize transportation with its tunnel-boring technology. Investment in this venture offers exposure to a potentially disruptive technology with long-term growth prospects.

- Neuralink: This neurotechnology company is developing brain-computer interfaces, a field with enormous potential but also significant technological and regulatory hurdles. Investing in Neuralink involves high risk, but also the potential for substantial rewards if the technology proves successful.

- X Corp (formerly Twitter): Musk's acquisition of Twitter, now X Corp, presents a unique investment opportunity, albeit one with significant volatility and ongoing regulatory scrutiny. Analyzing X Corp's future direction and potential for profitability is essential for any potential investor.

- Other Ventures: Musk's entrepreneurial activities extend to other lesser-known ventures, requiring diligent research to identify promising investment opportunities within his broader portfolio.

These examples highlight the diverse nature of Elon Musk investments and the potential for significant returns from strategically targeted private equity opportunities. The key is to identify companies with high-growth potential and strong leadership.

Identifying Potential Investment Avenues

Researching potential investment opportunities linked to Musk's private companies requires a multi-faceted approach. Simply knowing about the companies isn't enough; you need a strategic plan to assess viability and potential entry points.

- News and Industry Analysis: Stay informed about industry trends, news related to Musk's private ventures, and any announcements about funding rounds or strategic partnerships. Publications focused on venture capital and private equity are excellent sources of information.

- Networking: Networking within relevant circles is crucial. Attend industry events, join online communities focused on venture capital and technology, and connect with individuals who have access to private investment opportunities.

- Following Funding Rounds: Actively research upcoming funding rounds for Musk's private companies or companies within their ecosystem. This involves analyzing financial news, investment databases, and industry publications.

- Due Diligence: Thorough due diligence is paramount. Carefully evaluate the company's business model, financial health, competitive landscape, and management team before considering any investment.

Navigating Legal and Regulatory Hurdles

Investing in private companies presents unique legal and regulatory challenges. Understanding these complexities is crucial to avoid legal pitfalls and ensure compliance.

- Securities Laws: Private investments are subject to various securities laws and regulations. It's vital to ensure that any investment strategy complies with applicable federal and state laws.

- Private Placement Memorandums (PPMs): These documents outline the terms and conditions of private investments. Carefully review the PPM before committing any funds.

- Seeking Professional Advice: Consult with experienced legal and financial professionals who specialize in private investments. They can provide valuable guidance on navigating the legal and regulatory landscape. This step is critical to ensure legal compliance and minimize potential risks.

Assessing Risk and Return in Private Holdings

Investing in Elon Musk's private holdings is inherently risky. While the potential for substantial returns is high, it's crucial to understand the associated risks before committing any funds.

- Illiquidity: Private investments are typically illiquid, meaning it can be difficult to sell your stake quickly. Be prepared to hold the investment for an extended period.

- Market Volatility: The value of private investments can fluctuate significantly, especially in the case of high-growth, high-risk ventures.

- Potential for High Returns: If the company performs well, the potential for substantial returns can be considerably higher than traditional investments. However, this also means the potential for significant losses is equally present. Thorough risk assessment is vital.

Building a Network for Access to Private Investments

Access to private investment opportunities often relies on strong networks and relationships. Building a robust network is crucial for securing stakes in Elon Musk's private holdings or similar ventures.

- Industry Events: Attend conferences, workshops, and networking events focused on venture capital, private equity, and the technology industry.

- Online Communities: Engage with relevant online communities and forums to connect with individuals involved in private investments.

- Venture Capitalists and Angel Investors: Develop relationships with venture capitalists and angel investors who may have access to private investment opportunities.

- Strategic Relationships: Building strong relationships with individuals who have a direct connection to Elon Musk’s inner circle or to his private companies can significantly improve your access to such deals.

Conclusion

Securing stakes in Elon Musk's private holdings presents a potentially lucrative side hustle, but it requires careful research, due diligence, and a thorough understanding of the legal and financial implications. This strategy demands a high-risk tolerance, significant financial resources, and a well-developed network within the private investment sphere. While the potential rewards are high, the risks are equally substantial. Remember that investing in Elon Musk's private holdings, or any private investment for that matter, should be a carefully considered decision made only after thorough research and professional advice. Don't jump into investing in Elon Musk's private holdings without thorough research and professional advice. Start your journey towards exploring the world of private investments today and discover more opportunities to diversify your portfolio and potentially profit from high-growth ventures connected to the visionary behind Tesla and SpaceX. Remember to always seek professional advice before making significant investment decisions.

Featured Posts

-

Trump Envoy Witkoffs Moscow Arrival Interfax Report Details

Apr 26, 2025

Trump Envoy Witkoffs Moscow Arrival Interfax Report Details

Apr 26, 2025 -

Steun Voor Koningshuis Stijgt Naar 59 Eerste Toename In Jaren

Apr 26, 2025

Steun Voor Koningshuis Stijgt Naar 59 Eerste Toename In Jaren

Apr 26, 2025 -

Technical Glitch Grounds Blue Origin Rocket Launch Cancellation Announced

Apr 26, 2025

Technical Glitch Grounds Blue Origin Rocket Launch Cancellation Announced

Apr 26, 2025 -

Velikonoce 2024 Jak Prezit Zdrazovani Bez Ztraty Radosti

Apr 26, 2025

Velikonoce 2024 Jak Prezit Zdrazovani Bez Ztraty Radosti

Apr 26, 2025 -

Trump Tariff Uncertainty Ceos Warn Of Negative Economic Consequences

Apr 26, 2025

Trump Tariff Uncertainty Ceos Warn Of Negative Economic Consequences

Apr 26, 2025

Latest Posts

-

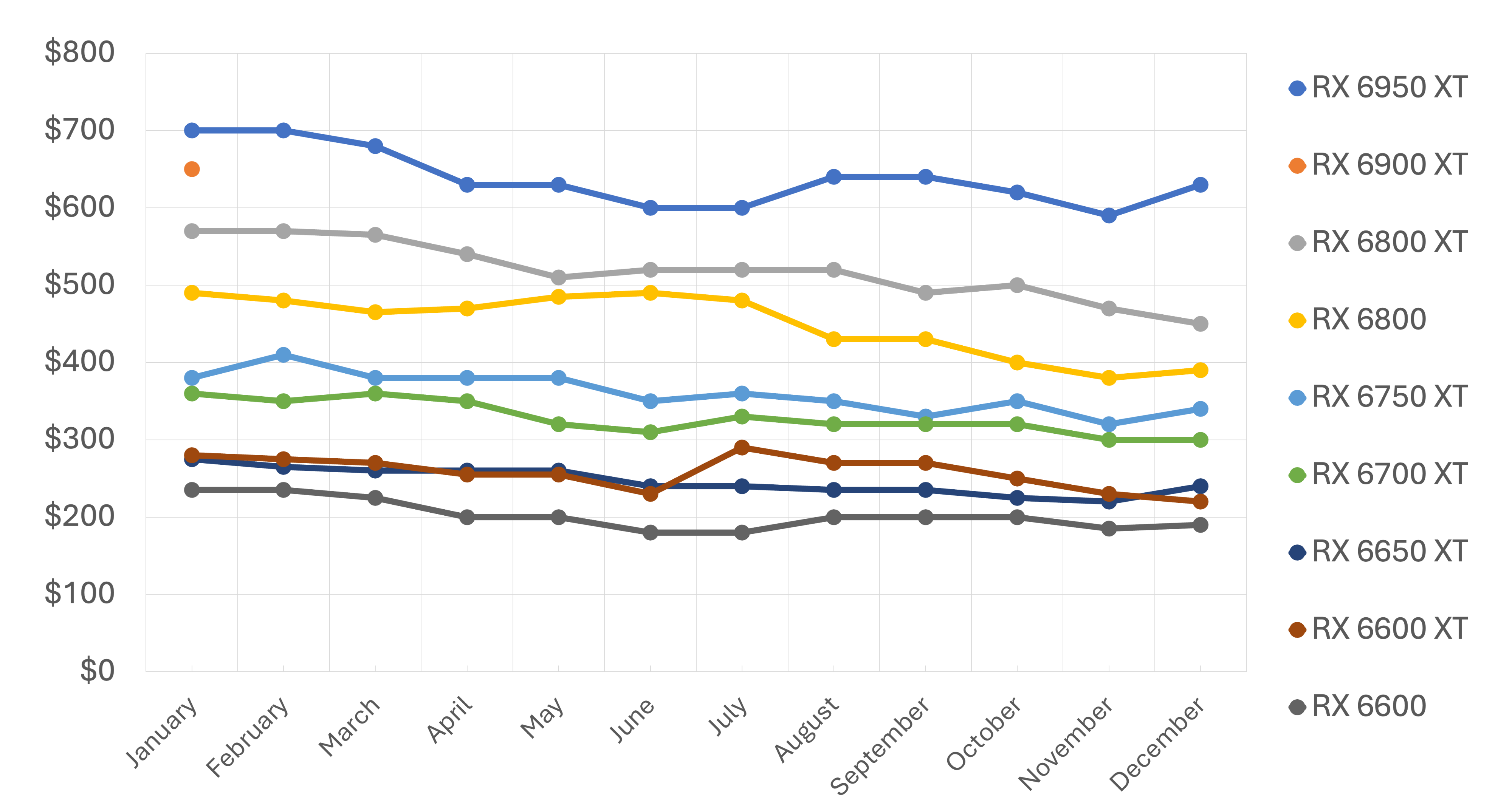

The Current State Of Gpu Pricing A Buyers Guide

Apr 28, 2025

The Current State Of Gpu Pricing A Buyers Guide

Apr 28, 2025 -

Gpu Market Update Prices Remain Elevated

Apr 28, 2025

Gpu Market Update Prices Remain Elevated

Apr 28, 2025 -

Why Are Gpu Prices Out Of Control Again A Deep Dive

Apr 28, 2025

Why Are Gpu Prices Out Of Control Again A Deep Dive

Apr 28, 2025 -

The Resurgence Of High Gpu Prices Causes And Potential Solutions

Apr 28, 2025

The Resurgence Of High Gpu Prices Causes And Potential Solutions

Apr 28, 2025 -

Gpu Price Hikes Understanding The Current Market Situation

Apr 28, 2025

Gpu Price Hikes Understanding The Current Market Situation

Apr 28, 2025