Securing Your Place In The Sun: Navigating The International Property Market

Table of Contents

Researching Your Ideal Location

Choosing the right location is paramount when investing in overseas property. This involves a multifaceted approach, encompassing market analysis, lifestyle considerations, and a thorough understanding of the legal landscape.

Understanding Market Trends

Analyzing market trends is crucial for making informed decisions in the international property market. This includes examining property prices, rental yields, and future development plans. Factors like tourism, infrastructure development, and overall economic stability significantly impact property values.

- Research property portals: Utilize specialized websites and portals dedicated to international property listings in your target country. These platforms often provide comprehensive data on property prices and market trends.

- Consult local real estate agents: Local agents possess invaluable insight into the nuances of the market, including local regulations, pricing trends, and upcoming developments. Their expertise can be invaluable in your search for foreign property investment.

- Analyze government reports: Studying economic forecasts and government reports provides a macro-level perspective on the stability and future prospects of your target location. This helps mitigate potential risks associated with expat property investments.

- Consider long-term potential: Evaluate the long-term potential for both capital appreciation and rental income. A property with strong rental yields can offer a steady stream of passive income alongside potential capital growth.

Lifestyle Considerations

Your lifestyle preferences should significantly influence your property search. Are you seeking a vibrant city center or a tranquil rural retreat? Consider proximity to amenities, transportation links, and the local culture.

- Climate: Consider the climate and its impact on your lifestyle. Do you prefer warm, sunny weather or a more temperate climate?

- Cultural attractions: Research the cultural attractions, historical sites, and recreational activities available in your chosen location.

- Healthcare access: Investigate the quality and accessibility of healthcare services in the area. This is particularly important for long-term residents or those planning to retire abroad.

- Ease of integration: Evaluate how easy it would be to integrate into the local community. Consider language barriers, cultural differences, and the overall social environment.

Legal and Regulatory Frameworks

Navigating the legal and regulatory frameworks of a foreign country is a crucial aspect of buying property abroad. Understanding the laws governing foreign property ownership, taxation, and residency permits is essential for a smooth transaction.

- Consult a legal professional: Seek advice from a lawyer specializing in international property law. They can guide you through the complexities of local regulations and help prevent potential legal pitfalls in the international property market.

- Property taxes: Research the local property taxes and understand how they are calculated and collected. This is a significant ongoing cost associated with owning foreign property.

- Inheritance laws: Familiarize yourself with inheritance laws in your chosen country. This is crucial for planning the long-term ownership and transfer of your property.

- Permits and visas: Investigate the process for obtaining any necessary permits or visas related to property ownership and residency. This can vary significantly between countries.

Financing Your International Property Purchase

Securing the necessary financing is a key step in buying property abroad. This involves navigating international mortgages, managing currency exchange, and budgeting for additional costs.

Securing a Mortgage

Obtaining a mortgage for international property can be more complex than domestic mortgages. Compare interest rates, loan terms, and eligibility criteria from different lenders specializing in international finance.

- Mortgage broker: Engage a mortgage broker with experience in international finance. They can help you navigate the complexities of securing a loan and find the best options for your circumstances.

- Documentation: Gather all necessary documentation, including proof of income, credit history, and details of your down payment. The required documentation may vary depending on the lender and the country.

- Interest rates: Carefully compare interest rates from different lenders and consider the overall cost of borrowing.

- Loan terms: Understand the terms and conditions of the loan, including repayment schedules and any associated fees.

Managing Currency Exchange

Currency fluctuations can significantly impact the cost of your property purchase. Implementing strategies to mitigate potential losses is crucial.

- Currency exchange service: Utilize a reputable currency exchange service to transfer funds efficiently and minimize exchange rate risks.

- Hedging strategies: Consider hedging strategies, such as forward contracts or options, to protect against adverse exchange rate movements. These strategies can help lock in a favorable exchange rate.

- Timing: Timing your currency exchange strategically can help reduce the impact of fluctuations. Consult with a financial advisor for optimal timing.

Budgeting for Additional Costs

Beyond the property price itself, several additional costs must be factored into your budget. These include closing costs, legal fees, property taxes, insurance, and potential renovation expenses.

- Detailed budget: Develop a detailed budget that accounts for all potential costs associated with buying and maintaining your international property.

- Contingency fund: Include a contingency fund to cover unexpected expenses or unforeseen circumstances that may arise during the purchase or ownership period.

Due Diligence and Property Inspection

Thorough due diligence and a comprehensive property inspection are critical steps to protect your investment in the international property market.

Thorough Property Inspection

Conducting a thorough inspection is vital to identify any potential problems before finalizing the purchase. Engage a qualified surveyor to conduct a professional inspection.

- Structural issues: Check for structural problems, such as cracks in walls or foundations, which can be costly to repair.

- Plumbing and electrical: Inspect plumbing and electrical systems for faults or deficiencies.

- Pest infestation: Look for signs of pest infestation, which can cause significant damage to the property.

- Review documentation: Carefully review all relevant documentation, including title deeds and building permits, to ensure legal compliance.

Working with Local Professionals

Engage the services of reputable local professionals, including a real estate agent, lawyer, and surveyor. Their expertise in the local market is invaluable.

- Proven track record: Choose professionals with a proven track record of successful transactions and positive client testimonials.

- Clear communication: Ensure clear communication and contractual agreements are in place to avoid misunderstandings or disputes.

Protecting Your Investment

Protecting your investment in international property requires careful planning and proactive measures.

Property Insurance

Secure comprehensive property insurance to safeguard against unforeseen events, such as damage, theft, or liability.

- Adequate coverage: Choose a policy that offers adequate coverage for the building and its contents.

- Specific risks: Ensure the policy covers risks specific to your property and location.

Long-Term Planning

Develop a long-term plan for managing your international property, including maintenance, rental management, and potential resale.

- Property management: Decide on a strategy for managing your property – self-management, hiring a property management company, or appointing a local representative.

- Taxation: Consider the tax implications of owning and eventually selling your property.

Conclusion

Securing your place in the sun through international property investment can be a rewarding experience. By carefully researching your options, planning your finances, and engaging the services of qualified professionals, you can significantly increase your chances of a successful outcome. Remember to always conduct thorough due diligence and understand the local legal and regulatory frameworks. Don’t delay your dream of owning international property; start your search today and secure your place in the sun!

Featured Posts

-

Leaked Texts Expose Fresh Clash Between Nigel Farage And Rupert Lowe

May 03, 2025

Leaked Texts Expose Fresh Clash Between Nigel Farage And Rupert Lowe

May 03, 2025 -

Dispute Erupts Between Farage And Teaching Union Over Far Right Claim

May 03, 2025

Dispute Erupts Between Farage And Teaching Union Over Far Right Claim

May 03, 2025 -

Analyzing Us Sales Data Ps 5 Dominates Or Xbox Catches Up

May 03, 2025

Analyzing Us Sales Data Ps 5 Dominates Or Xbox Catches Up

May 03, 2025 -

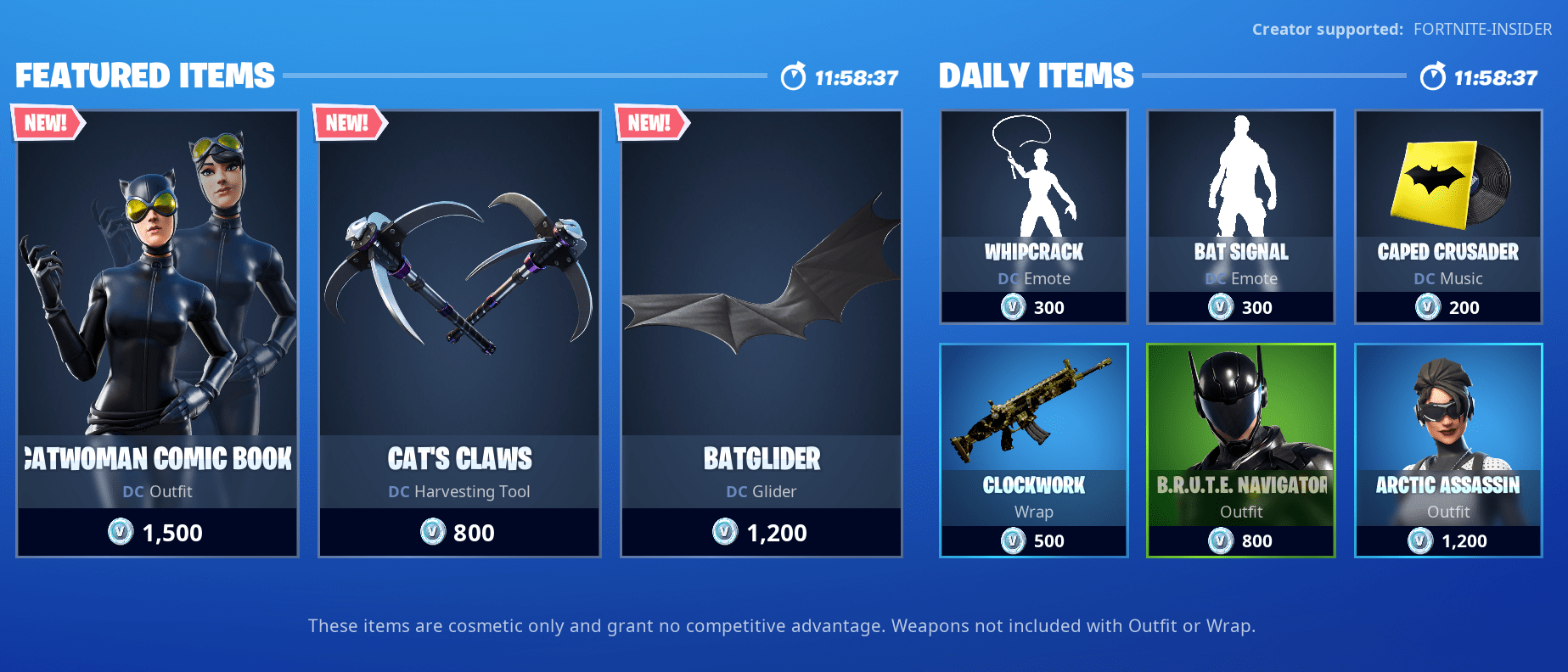

Free Captain America Cosmetics Available In The Fortnite Item Shop

May 03, 2025

Free Captain America Cosmetics Available In The Fortnite Item Shop

May 03, 2025 -

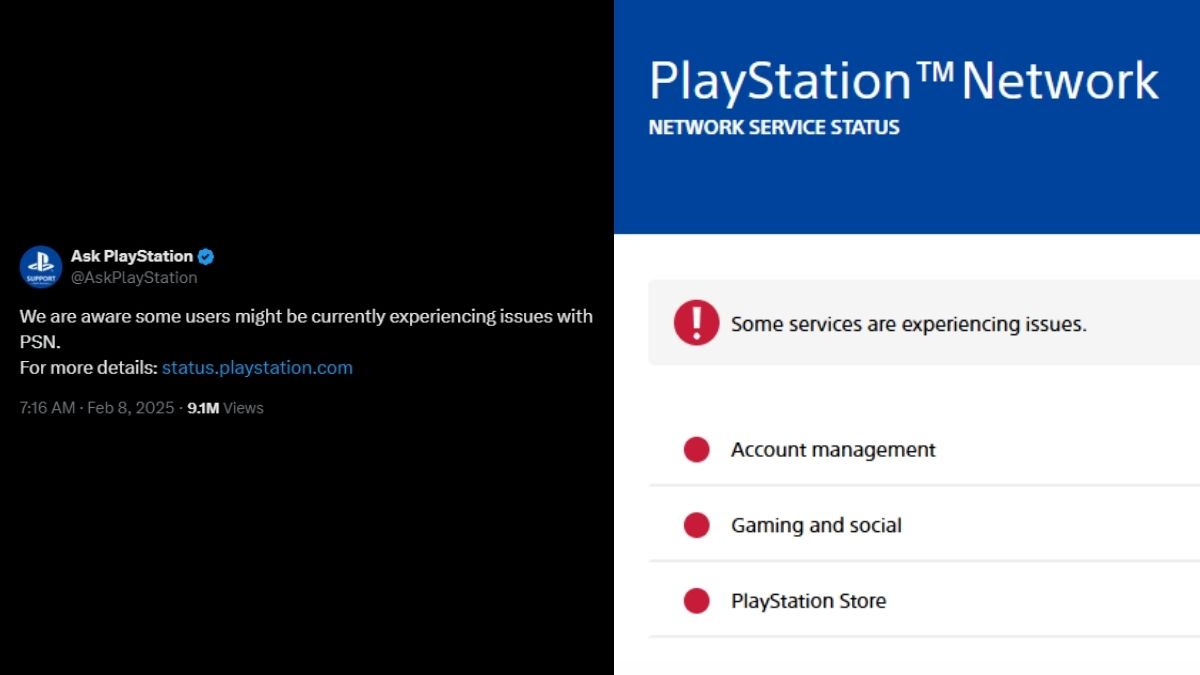

Play Station Network Outage Christmas Voucher Glitch And Credit Compensation

May 03, 2025

Play Station Network Outage Christmas Voucher Glitch And Credit Compensation

May 03, 2025

Latest Posts

-

Open Ai Unveils Streamlined Voice Assistant Creation Tools

May 04, 2025

Open Ai Unveils Streamlined Voice Assistant Creation Tools

May 04, 2025 -

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcement

May 04, 2025

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcement

May 04, 2025 -

Unlocking Insights How Ai Creates A Poop Podcast From Tedious Scatological Data

May 04, 2025

Unlocking Insights How Ai Creates A Poop Podcast From Tedious Scatological Data

May 04, 2025 -

Ai Driven Podcast Creation Turning Repetitive Documents Into A Poop Podcast Hit

May 04, 2025

Ai Driven Podcast Creation Turning Repetitive Documents Into A Poop Podcast Hit

May 04, 2025 -

Trumps Tariffs Nicolai Tangens Response And Its Global Implications

May 04, 2025

Trumps Tariffs Nicolai Tangens Response And Its Global Implications

May 04, 2025