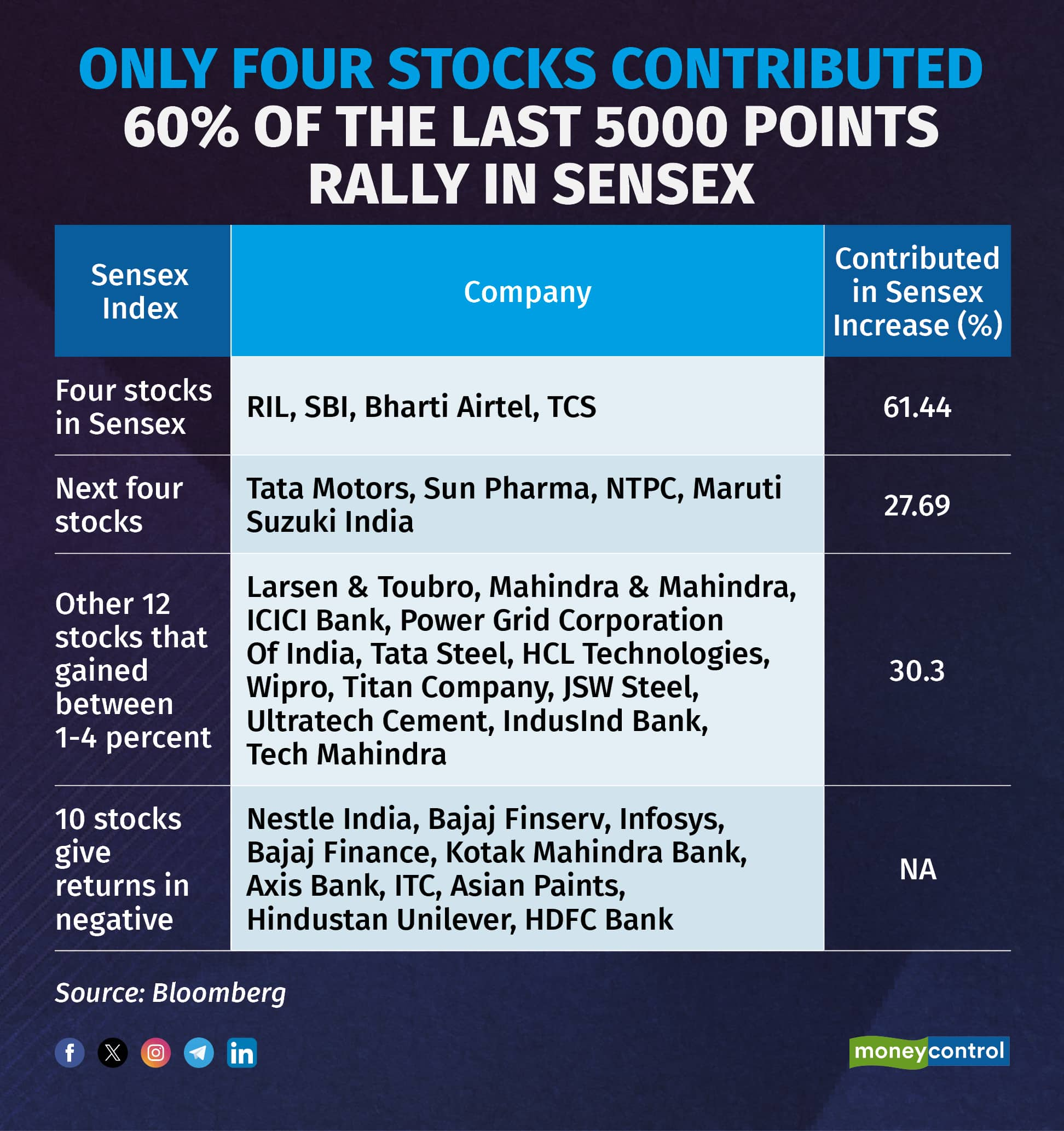

Sensex Rally Fuels Double-Digit Gains For These BSE Stocks

Table of Contents

Top BSE Stocks with Double-Digit Gains

The Sensex rally has seen several BSE stocks experience remarkable growth. Let's examine some of the top performers:

- Reliance Industries (RELIANCE): 20% Gain. This gain is attributed to strong quarterly results exceeding expectations and positive investor sentiment surrounding the company's diversification into new energy sectors.

- HDFC Bank (HDFCBANK): 15% Gain. The impressive growth is a result of sustained profitability, expanding customer base, and a positive outlook for the Indian banking sector.

- Infosys (INFY): 12% Gain. Strong revenue growth fueled by increased demand for IT services globally and successful project executions contributed to Infosys' double-digit gain.

- Tata Consultancy Services (TCS): 11% Gain. Similar to Infosys, TCS benefited from the robust global demand for IT services, resulting in consistent revenue growth.

- Hindustan Unilever Limited (HINDUNILVR): 10% Gain. This FMCG giant benefited from consistent consumer demand and a strong brand portfolio, weathering economic uncertainties relatively well.

Further Analysis: These top performers represent a diverse range of sectors, including IT (Infosys and TCS), Financials (HDFC Bank), and FMCG (Hindustan Unilever). However, the IT sector showed disproportionately high gains, reflecting the continued global demand for technology services. The strong performance of Reliance Industries also highlights the growing interest in renewable energy and diversification strategies.

Factors Driving the Sensex Rally and Stock Gains

Several interconnected factors contributed to the recent Sensex rally and the subsequent double-digit gains experienced by many BSE stocks.

Positive Economic Indicators

Several positive macroeconomic factors underpinned the market's upward trajectory:

- Improved GDP growth forecasts: Positive projections for India's GDP growth instilled confidence among investors.

- Falling inflation rates: A decrease in inflation eased concerns about rising prices and boosted investor sentiment.

- Increased foreign investment: Significant foreign institutional investor (FII) inflows provided substantial liquidity to the market.

- Government policy initiatives supporting growth: Government policies aimed at boosting economic growth and infrastructure development played a role in improving market confidence.

Sector-Specific Growth Drivers

Beyond macroeconomic factors, specific industry trends fueled the growth of certain sectors:

- Technological innovation in the IT sector: Continued advancements in technology and rising global demand for IT services propelled the IT sector's growth.

- Strong demand in the pharmaceutical industry: Robust demand for pharmaceuticals, both domestically and internationally, supported the performance of companies in this sector.

- Positive regulatory changes in the financial sector: Favorable regulatory changes and supportive government policies boosted the financial sector's performance.

Risk Assessment and Investment Strategies

While the Sensex rally presents exciting opportunities, it's crucial to acknowledge inherent market risks:

- Market volatility: Stock markets are inherently volatile, and even during a rally, price fluctuations can occur.

- Sector-specific risks: Individual sectors can experience downturns even during a broader market upswing.

- Geopolitical uncertainties: Global events can significantly impact market sentiment and stock prices.

Therefore, diversification is key. Don't put all your eggs in one basket. Thorough research before investing in any BSE stock is essential.

Long-Term vs. Short-Term Investment

The Sensex rally presents opportunities for both long-term and short-term investors. Long-term investors can benefit from the potential for sustained growth, while short-term investors might aim to capitalize on short-term price fluctuations. However, both strategies carry different levels of risk.

Conclusion

The Sensex rally has resulted in significant double-digit gains for several BSE stocks, notably in the IT and Financial sectors. Positive economic indicators, sector-specific growth drivers, and increased investor confidence have contributed to this upward trend. However, investors must remember the inherent risks associated with stock market investments. By understanding the driving forces behind the Sensex rally and conducting thorough research, you can make more informed investment decisions.

Call to Action: Stay informed about the latest developments in the BSE Sensex and identify more potential double-digit gainers by regularly reviewing market analyses and conducting your own research. Understanding the factors driving the Sensex rally and the performance of individual BSE stocks can help you make informed investment decisions and potentially capitalize on future opportunities in the dynamic BSE stock market.

Featured Posts

-

Profession De Gardien Salaires Formations Et Perspectives D Emploi

May 15, 2025

Profession De Gardien Salaires Formations Et Perspectives D Emploi

May 15, 2025 -

Nba Playoffs Charles Barkleys Take On The Warriors Timberwolves Matchup

May 15, 2025

Nba Playoffs Charles Barkleys Take On The Warriors Timberwolves Matchup

May 15, 2025 -

Tonights Nhl Playoffs Senators Vs Maple Leafs Game 2 Predictions And Betting Picks

May 15, 2025

Tonights Nhl Playoffs Senators Vs Maple Leafs Game 2 Predictions And Betting Picks

May 15, 2025 -

Kibris Sorunu Ve Direkt Ucuslar Tatar In Son Aciklamalarinin Analizi

May 15, 2025

Kibris Sorunu Ve Direkt Ucuslar Tatar In Son Aciklamalarinin Analizi

May 15, 2025 -

Predicting The Giants Vs Padres Game Padres Win Or One Run Difference

May 15, 2025

Predicting The Giants Vs Padres Game Padres Win Or One Run Difference

May 15, 2025