Should You Buy Apple Stock At $200? One Analyst's $254 Prediction

Table of Contents

Apple's Current Financial Performance and Future Outlook

Apple's consistent financial success is a major factor influencing its stock price. Understanding its current performance and future outlook is crucial for any investment decision regarding AAPL stock.

Revenue Growth and Profitability

Apple's recent financial reports paint a picture of continued growth across multiple revenue streams. The company’s strength lies in its diversified portfolio, not solely relying on iPhone sales.

- Revenue Growth: Apple has consistently demonstrated strong revenue growth year-over-year, driven by robust sales of iPhones, services, wearables, and Macs. Specific figures will need to be updated to reflect the most current financial reports.

- Profit Margins: Apple maintains impressively high profit margins, indicating efficient operations and strong pricing power. Again, precise figures should be sourced from the latest financial statements.

- Earnings Per Share (EPS): EPS growth reflects the profitability distributed to shareholders. Tracking this metric is essential for evaluating the value of Apple share price.

Future revenue growth hinges on several factors: successful new product launches, maintaining market share in a competitive landscape, and navigating global economic uncertainties.

Strong Brand and Loyal Customer Base

Apple boasts one of the strongest brands globally, translating into exceptional customer loyalty and repeat purchases. This fosters a predictable revenue stream and reduces reliance on constantly acquiring new customers.

- Brand Loyalty: Studies consistently rank Apple among the top brands for customer loyalty, reflecting a strong connection between customers and the Apple ecosystem. Specific statistics should be referenced from reliable market research.

- Customer Satisfaction: High customer satisfaction scores indicate a positive brand image and a willingness to continue purchasing Apple products and services.

- The Apple Ecosystem: The seamless integration of Apple devices and services creates a powerful ecosystem, locking in customers and driving repeat purchases. This is a key factor contributing to Apple's recurring revenue.

Innovation and New Product Pipelines

Apple’s continued investment in research and development fuels its innovation pipeline. New product releases are vital for maintaining growth and driving future stock performance.

- Upcoming Product Releases: Anticipation around new iPhones, AR/VR headsets, and other potential innovations contributes to positive market sentiment and future revenue projections. Specific details should be added as product releases are announced.

- Market Impact of New Products: The successful introduction of new products can significantly boost Apple's revenue and market capitalization. Analyzing past product launches and their market impact is valuable for forecasting future performance.

Analyst Predictions and Market Sentiment

The analyst’s $254 prediction for Apple stock is not an isolated opinion; it's important to analyze the overall market sentiment and other expert predictions.

The $254 Prediction and Its Rationale

The rationale behind the $254 price target likely includes several key factors:

- Expected Revenue Growth: The analyst's prediction is probably based on projections of continued revenue growth across Apple's product categories.

- Market Share Gains: Maintaining or increasing market share in key sectors is essential for justifying this price target.

- Valuation Multiples: The predicted price target often reflects the analyst’s valuation of Apple based on industry-standard metrics.

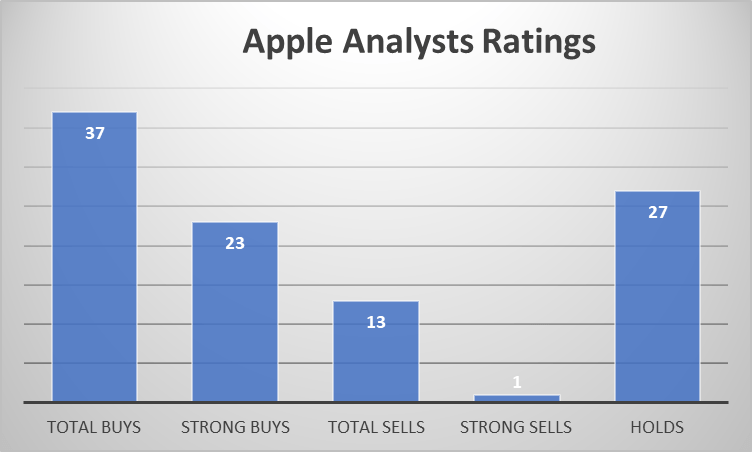

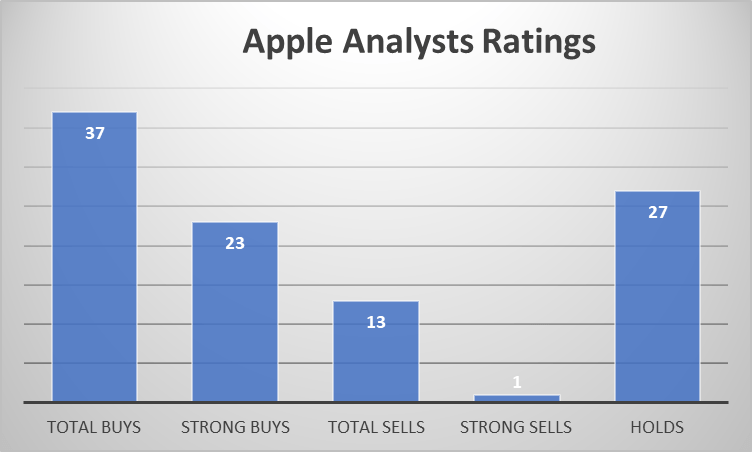

Other Analyst Opinions and Price Targets

While one analyst predicts $254, others may offer different price targets. A range of predictions provides a more comprehensive understanding of market sentiment. Specific predictions from different reputable financial sources should be included here.

Overall Market Sentiment Towards Apple

The general market sentiment toward Apple stock is typically positive, given its history of consistent growth and strong brand reputation. However, factors like investor confidence and broader market trends can influence this sentiment. Any relevant news or events impacting investor sentiment should be discussed.

Risks and Potential Downsides of Investing in Apple Stock at $200

Despite the positive outlook, investing in any stock, including Apple stock, involves risk. Understanding these potential downsides is crucial for informed decision-making.

Economic Uncertainty and Global Market Volatility

Macroeconomic factors can significantly impact Apple's stock price:

- Inflation: High inflation rates can reduce consumer spending and affect Apple's sales.

- Recession: A recessionary environment could lead to reduced consumer demand for Apple products.

- Geopolitical Events: Global political instability can disrupt supply chains and negatively impact investor confidence.

Competition and Market Saturation

Apple faces competition from other technology companies:

- Key Competitors: Samsung, Google, and other tech giants are key competitors in various product categories. Analysis of their strategies and market impact is crucial.

- Market Saturation: Potential market saturation in certain product categories, such as smartphones, could limit future growth opportunities.

Supply Chain Disruptions and Production Challenges

Supply chain disruptions and production challenges can impact Apple's ability to meet demand:

- Vulnerabilities: Apple’s reliance on global supply chains makes it susceptible to disruptions caused by geopolitical events or natural disasters.

- Production Costs: Increased production costs due to supply chain issues can affect profitability and potentially the AAPL stock price.

Conclusion

Should you buy Apple stock at $200? The analyst's $254 prediction highlights the potential upside, driven by Apple's strong financial performance, brand loyalty, and innovation. However, economic uncertainty, competition, and supply chain risks represent potential downsides. Investing in Apple stock requires careful consideration of both the potential gains and losses. Before making any investment decision, it’s critical to conduct thorough due diligence, consider your risk tolerance, and consult with a qualified financial advisor. Should you buy Apple stock at $200? The decision is ultimately yours, but this analysis provides valuable insights to help you decide whether this price point presents a good opportunity to invest in Apple stock.

Featured Posts

-

Understanding The I O And Io Debate Google And Open Ais Competitive Landscape

May 25, 2025

Understanding The I O And Io Debate Google And Open Ais Competitive Landscape

May 25, 2025 -

Paris Welcomes Queen Wen Again

May 25, 2025

Paris Welcomes Queen Wen Again

May 25, 2025 -

Planning Your Memorial Day Trip In 2025 The Smartest Travel Days

May 25, 2025

Planning Your Memorial Day Trip In 2025 The Smartest Travel Days

May 25, 2025 -

Met Gala 2025 The Naomi Campbell And Anna Wintour Feud And Its Potential Consequences

May 25, 2025

Met Gala 2025 The Naomi Campbell And Anna Wintour Feud And Its Potential Consequences

May 25, 2025 -

Complete Guide To Nyt Mini Crossword March 16 2025

May 25, 2025

Complete Guide To Nyt Mini Crossword March 16 2025

May 25, 2025