Should You Buy Palantir Stock Now? (30% Drop Analysis)

Table of Contents

Palantir Technologies is a prominent player in the big data and analytics space, providing software and services to both government and commercial clients. Its flagship platform, Foundry, is designed to analyze massive datasets, offering valuable insights for diverse applications. However, recent performance has been mixed, leading to the significant price decline and prompting the critical question: Should you buy Palantir stock now?

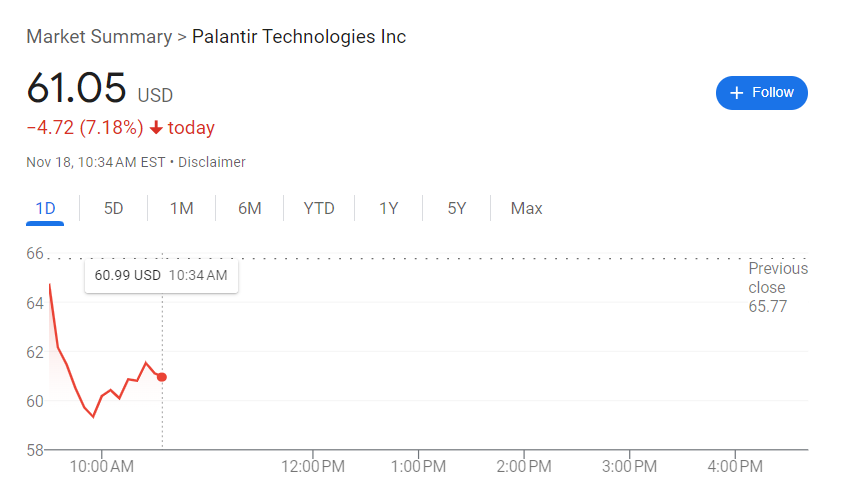

Understanding the 30% Drop in Palantir Stock Price

The 30% plunge in Palantir's stock price wasn't a singular event but rather a confluence of factors. Let's break down the key contributors:

- Market-wide Tech Sell-off: The broader tech sector experienced a significant correction, impacting even strong performers like Palantir. Investor sentiment shifted, leading to widespread selling across the board.

- Concerns about Slowing Revenue Growth: While Palantir continues to grow, some analysts expressed concern about a potential slowdown in revenue expansion, impacting investor confidence. Analyzing recent financial reports is crucial to understanding these concerns.

- Increased Competition in the Data Analytics Market: The data analytics market is becoming increasingly competitive, with established tech giants and new entrants vying for market share. This heightened competition poses a challenge to Palantir's growth trajectory.

- Impact of Geopolitical Factors: Global uncertainty, including the war in Ukraine and broader economic instability, has created a risk-averse environment, impacting investor appetite for riskier assets like Palantir stock.

- Analysis of Palantir's Recent Financial Reports and Earnings Calls: A thorough review of Palantir's recent financial performance, including earnings calls and SEC filings, is essential for understanding the current financial health and future outlook of the company. This includes a careful examination of revenue growth, profitability, and cash flow.

[Insert chart/graph here visually representing Palantir's stock price decline over the relevant period]

Palantir's Strengths and Potential for Future Growth

Despite the recent downturn, Palantir boasts several key strengths that support its long-term growth potential:

- Strong Government Contracts and Relationships: Palantir holds significant contracts with government agencies, providing a stable revenue stream and fostering strong relationships within the sector. This government business forms a crucial part of their revenue base and provides stability.

- Innovative Data Analytics Technology (e.g., Foundry platform): Palantir's Foundry platform represents a significant technological advancement in data analytics, offering powerful capabilities for data integration, analysis, and visualization.

- Growing Commercial Market Adoption: While initially focused on government clients, Palantir is expanding its reach into the commercial sector, opening up new avenues for growth and diversification.

- Potential for Expansion into New Markets: Palantir has the potential to expand into new markets and sectors, leveraging its technology and expertise to address diverse data analytics needs.

- Long-term Growth Prospects in the Big Data and AI Sectors: The big data and artificial intelligence (AI) sectors are experiencing explosive growth, presenting significant opportunities for Palantir to capitalize on its strengths and expand its market share.

Assessing the Risk Factors Associated with Investing in Palantir

Investing in Palantir, like any stock, carries inherent risks:

- High Stock Valuation Compared to Earnings (P/E Ratio): Palantir's stock valuation relative to its earnings might be considered high by some investors, making it susceptible to corrections if earnings don't meet expectations.

- Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts, making it susceptible to changes in government spending and policy.

- Competition from Larger, Established Tech Companies: Palantir faces competition from larger, more established tech companies with substantial resources and market presence.

- Potential for Future Losses or Slower-than-Expected Growth: The data analytics market is dynamic and unpredictable; there's a risk of slower-than-anticipated growth or even potential losses in the future.

- Overall Market Volatility and Its Impact on Palantir's Stock Price: The overall market environment significantly influences Palantir's stock price, making it susceptible to broader market fluctuations.

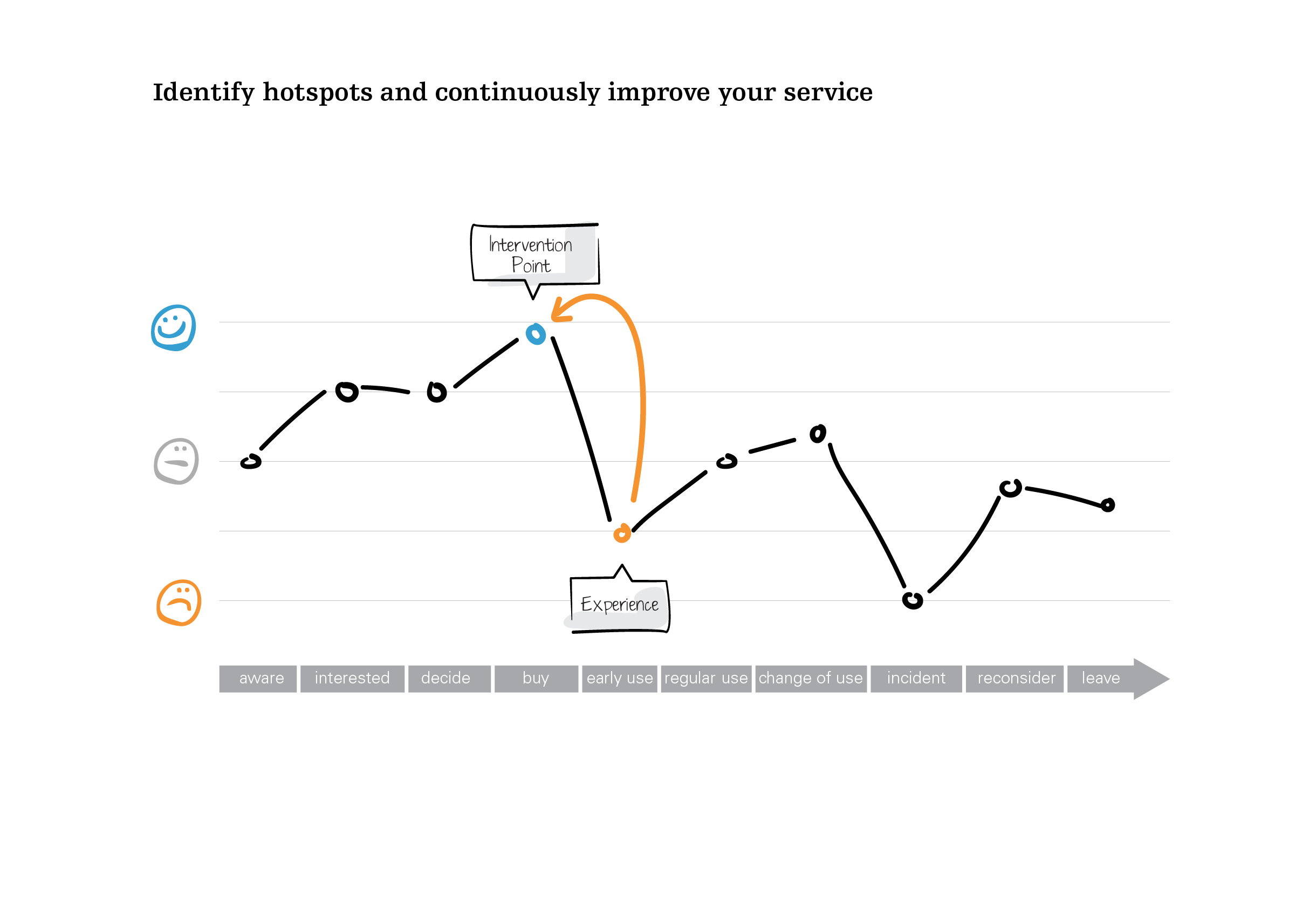

Comparing Palantir to Competitors in the Data Analytics Market

Palantir operates in a competitive landscape. A direct comparison with major competitors like AWS, Microsoft Azure, and Google Cloud is crucial for a comprehensive analysis.

[Insert table/chart here comparing Palantir to competitors – market share, revenue, growth rates, strengths, and weaknesses]

Technical Analysis of Palantir Stock (Optional)

[This section would include a brief discussion of support and resistance levels, chart patterns, and relevant technical indicators like RSI and MACD, with a clear disclaimer that technical analysis is not a guarantee of future performance.]

Conclusion: Should You Buy Palantir Stock Now? A Final Verdict

The 30% drop in Palantir's stock price reflects a combination of market-wide factors, concerns about growth, and increased competition. However, Palantir's strong government relationships, innovative technology, and potential for commercial growth offer counterbalancing strengths.

The decision of whether to buy Palantir stock now is complex and depends on your risk tolerance and investment strategy. While the potential for future growth is significant, the inherent risks associated with the stock should be carefully considered. Conduct thorough due diligence, including analyzing recent financial reports and understanding the competitive landscape before making any investment decisions.

Ultimately, the decision of whether to buy Palantir stock now rests on your individual risk tolerance and investment strategy. Consider your investment goals before making a decision regarding Palantir stock. Should you buy Palantir stock now? Only you can answer that question after careful consideration of the information presented here and further independent research.

Featured Posts

-

La Rental Market Exploits Fire Victims Claims Reality Tv Star

May 09, 2025

La Rental Market Exploits Fire Victims Claims Reality Tv Star

May 09, 2025 -

The Countrys New Business Hotspots Location Growth And Opportunity

May 09, 2025

The Countrys New Business Hotspots Location Growth And Opportunity

May 09, 2025 -

Fox News Internal Dispute Differing Opinions On Trumps Trade Policies

May 09, 2025

Fox News Internal Dispute Differing Opinions On Trumps Trade Policies

May 09, 2025 -

King Na X Gostri Zayavi Pro Politiku Ta Tekhnologiyi

May 09, 2025

King Na X Gostri Zayavi Pro Politiku Ta Tekhnologiyi

May 09, 2025 -

Ferdinand Changes Champions League Final Prediction Psg Vs Arsenal

May 09, 2025

Ferdinand Changes Champions League Final Prediction Psg Vs Arsenal

May 09, 2025