Should You Invest In MicroStrategy Stock Or Bitcoin In 2025?

Table of Contents

Understanding MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy's Core Business

MicroStrategy is a publicly traded company specializing in business intelligence, analytics, and mobile software. Their core offerings provide enterprise-grade solutions for data analysis and visualization, helping businesses make data-driven decisions. While their financial performance has fluctuated, their established presence in the business analytics market offers a degree of stability, contrasting sharply with the volatile nature of Bitcoin. Keywords such as "business intelligence software," "enterprise analytics," and "data analytics solutions" are key to understanding their core business and market position.

MicroStrategy's Bitcoin Strategy

MicroStrategy's significant Bitcoin holdings have transformed the company into a major player in the cryptocurrency space. Their decision to allocate a substantial portion of their corporate treasury to Bitcoin reflects a belief in Bitcoin's long-term potential as a store of value and a hedge against inflation. This "Bitcoin investment strategy," however, has also increased the company's exposure to the inherent volatility of the cryptocurrency market. This bold move has led to intense scrutiny, examining both the benefits and risks of this novel approach to corporate treasury management. Terms such as "cryptocurrency holdings," "corporate treasury management," and "Bitcoin's long-term value proposition" help define their approach.

- Potential Risks: Exposure to significant price fluctuations in Bitcoin; negative impact on stock price if Bitcoin's value declines substantially.

- Potential Rewards: Substantial gains if Bitcoin's value appreciates; increased investor interest driven by the Bitcoin strategy; positioning as an innovator in corporate finance.

- Correlation: While not perfectly correlated, MicroStrategy's stock price shows a notable sensitivity to Bitcoin's price movements. Significant news concerning Bitcoin often impacts MicroStrategy's share price.

Bitcoin's Market Outlook and Potential in 2025

Bitcoin's Price Volatility and Prediction Challenges

Bitcoin's price is notoriously volatile, making accurate price predictions exceptionally challenging. Factors such as regulatory changes, adoption rates, and macroeconomic conditions all contribute to the unpredictability of Bitcoin's price. Trying to predict the "Bitcoin price prediction" for 2025 is inherently speculative, making risk assessment crucial for any investor. Keywords like "cryptocurrency volatility," "market capitalization," and "price analysis" highlight the challenges involved.

Factors Influencing Bitcoin's Value

Several factors will likely influence Bitcoin's value in 2025:

-

Adoption Rate: Widespread adoption by institutions and individuals will likely drive up demand and price.

-

Regulatory Changes: Favorable regulatory frameworks could increase institutional investment and legitimacy, leading to price appreciation. Conversely, stringent regulations could stifle growth.

-

Technological Advancements: Scalability improvements and the development of new applications built on the blockchain could increase Bitcoin's utility and value.

-

Macroeconomic Conditions: Global economic instability could drive investors towards Bitcoin as a safe haven asset.

-

Bullish Scenarios: Widespread institutional adoption; positive regulatory changes; technological advancements leading to increased efficiency and usability.

-

Bearish Scenarios: Negative regulatory actions; the emergence of superior competing cryptocurrencies; a global economic recovery that reduces the demand for Bitcoin as a safe haven asset.

-

Competing Cryptocurrencies: The emergence of more efficient or feature-rich cryptocurrencies could impact Bitcoin's market dominance.

Comparing Risk and Reward: MicroStrategy Stock vs. Bitcoin

Risk Assessment

Investing in MicroStrategy stock carries risks associated with the company's performance in the business intelligence market and its exposure to Bitcoin's price volatility. Investing directly in Bitcoin exposes investors to even higher volatility and regulatory uncertainty. The "investment risk" associated with both assets differs significantly, requiring investors to assess their "risk tolerance." The concept of "portfolio diversification" is crucial in managing this risk.

Return Potential

The potential return on investment (ROI) for both assets is uncertain. Historical performance is not necessarily indicative of future results. While MicroStrategy's stock price can benefit from its Bitcoin holdings, the volatility of the cryptocurrency market introduces considerable risk. Similarly, Bitcoin's price could experience substantial gains or losses. "Investment strategy" selection is crucial for optimizing returns while mitigating risks.

- Risk/Reward Summary:

| Asset | Risk Level | Potential Return |

|---|---|---|

| MicroStrategy Stock | Moderate to High | Moderate to High |

| Bitcoin | High | High to Extremely High |

- Diversification: A diversified investment portfolio reduces overall risk by spreading investments across various asset classes.

- Investor Sentiment: Positive market sentiment can drive up prices for both assets, while negative sentiment can cause significant drops.

Practical Considerations for Investors

Due Diligence

Before investing in either MicroStrategy stock or Bitcoin, thorough "investment research" is essential. Understand each asset's risk profile, potential rewards, and market dynamics. Conducting "due diligence" involves analyzing financial statements, market trends, and regulatory landscapes.

Investment Strategies

Several investment strategies can help manage risk and potentially improve returns:

-

Dollar-Cost Averaging: Investing a fixed amount at regular intervals reduces the impact of price fluctuations.

-

Diversification: Spreading investments across different asset classes helps mitigate risk.

-

Reputable Resources: Consult financial news websites, reputable analysts, and government regulatory bodies for up-to-date information.

-

Professional Advice: Seek advice from a qualified financial advisor before making significant investment decisions.

-

Risk Tolerance: Understand your own risk tolerance and investment goals before committing funds.

Conclusion: Making Informed Investment Decisions about MicroStrategy Stock and Bitcoin

This analysis highlights the distinct risk and reward profiles of investing in MicroStrategy stock and Bitcoin in 2025. MicroStrategy offers a blend of established business operations and exposure to the volatile Bitcoin market. Direct investment in Bitcoin presents potentially higher returns but also carries significantly higher risk. The key difference lies in your risk tolerance and investment goals. Remember, both "MicroStrategy stock" and "Bitcoin" are volatile assets, requiring careful consideration before committing your funds. Conduct thorough research, seek professional advice if needed, and make informed decisions based on your risk tolerance and financial objectives. Further exploration of both investment options is crucial before committing to a strategy.

Featured Posts

-

Inter Milans Shock Loan Bid For Matthijs De Ligt A Man Utd Transfer Update

May 09, 2025

Inter Milans Shock Loan Bid For Matthijs De Ligt A Man Utd Transfer Update

May 09, 2025 -

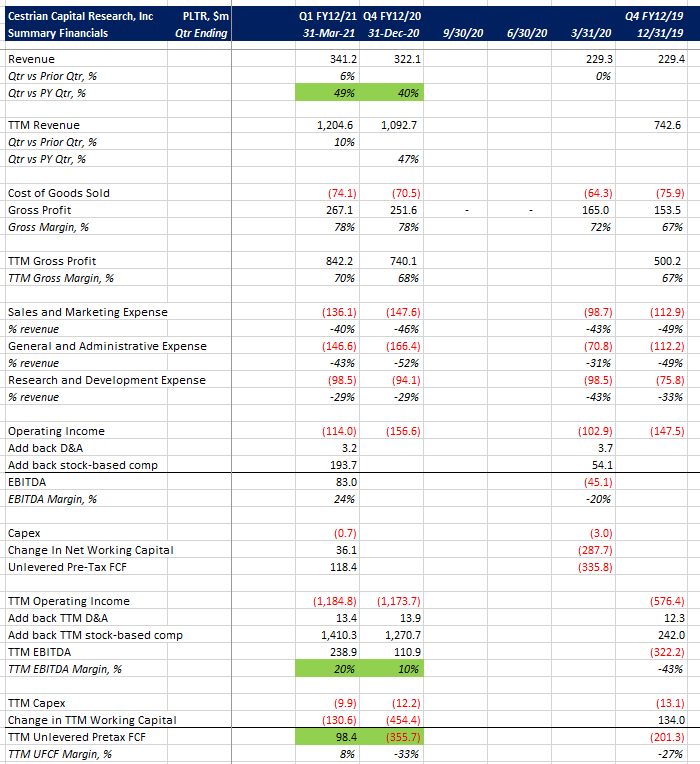

Should You Buy Palantir Stock Before May 5 A Prudent Investors Guide

May 09, 2025

Should You Buy Palantir Stock Before May 5 A Prudent Investors Guide

May 09, 2025 -

Palantir Stock To Buy Or Not To Buy Before May 5th Earnings

May 09, 2025

Palantir Stock To Buy Or Not To Buy Before May 5th Earnings

May 09, 2025 -

Concarneau S Impose A Dijon 0 1 En National 2 Saison 2024 2025

May 09, 2025

Concarneau S Impose A Dijon 0 1 En National 2 Saison 2024 2025

May 09, 2025 -

Figmas Ai Update A Game Changer Against Adobe Word Press And Canva

May 09, 2025

Figmas Ai Update A Game Changer Against Adobe Word Press And Canva

May 09, 2025