Should You Invest In XRP After A 400% Increase In 3 Months?

Table of Contents

XRP's Recent Price Surge: Understanding the Rally

Factors Contributing to the Price Increase

Several factors have contributed to XRP's remarkable price increase. Understanding these is crucial before considering an XRP investment.

- Increased Adoption by Payment Processors: Several payment processors have integrated XRP into their systems, facilitating faster and cheaper cross-border transactions. This increased demand has pushed the price upward.

- Positive Legal Developments: Recent court cases and regulatory updates have generated positive sentiment around XRP, reducing uncertainty and attracting new investors. While the legal battle is far from over, positive developments have fueled speculation.

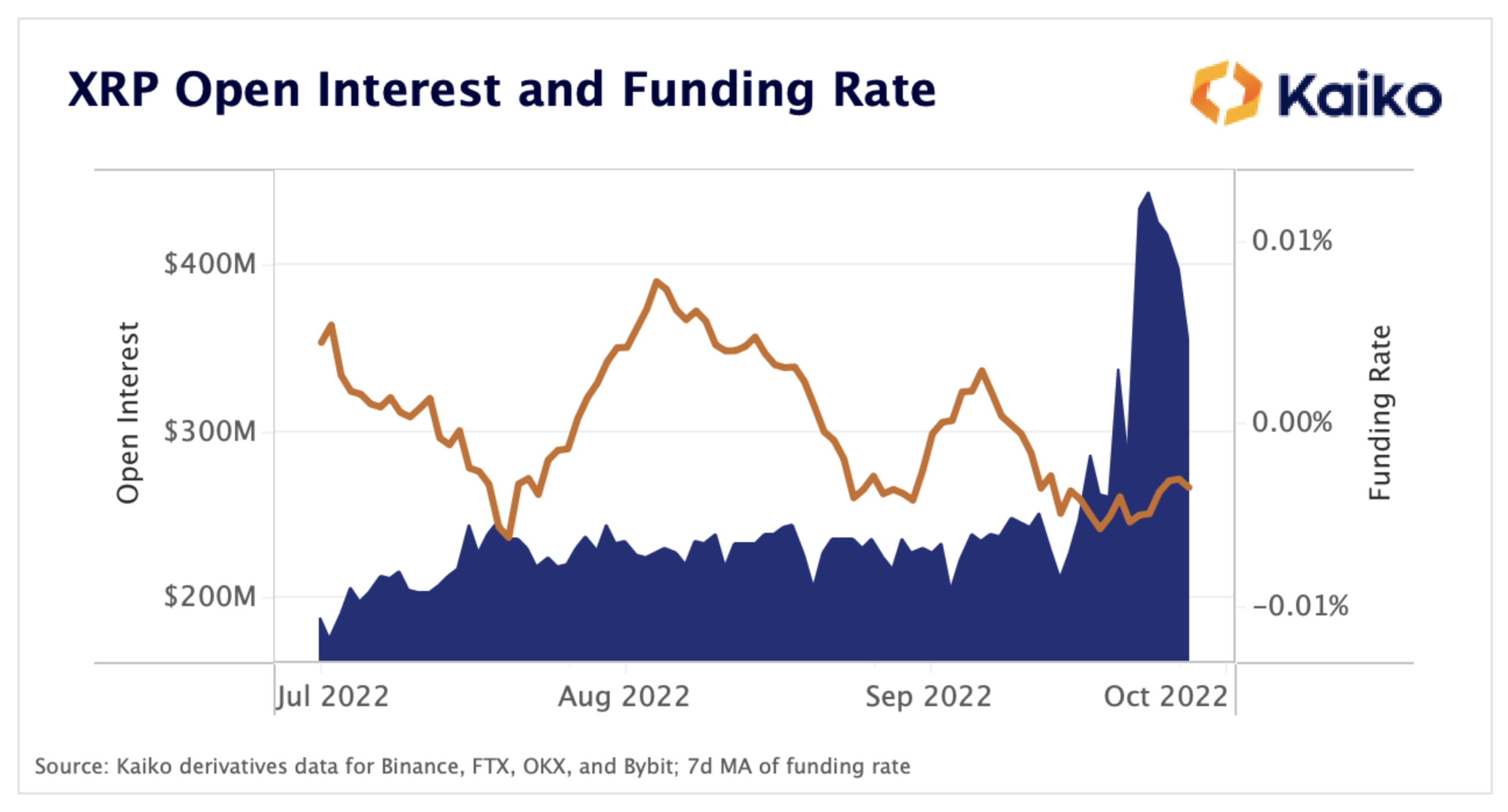

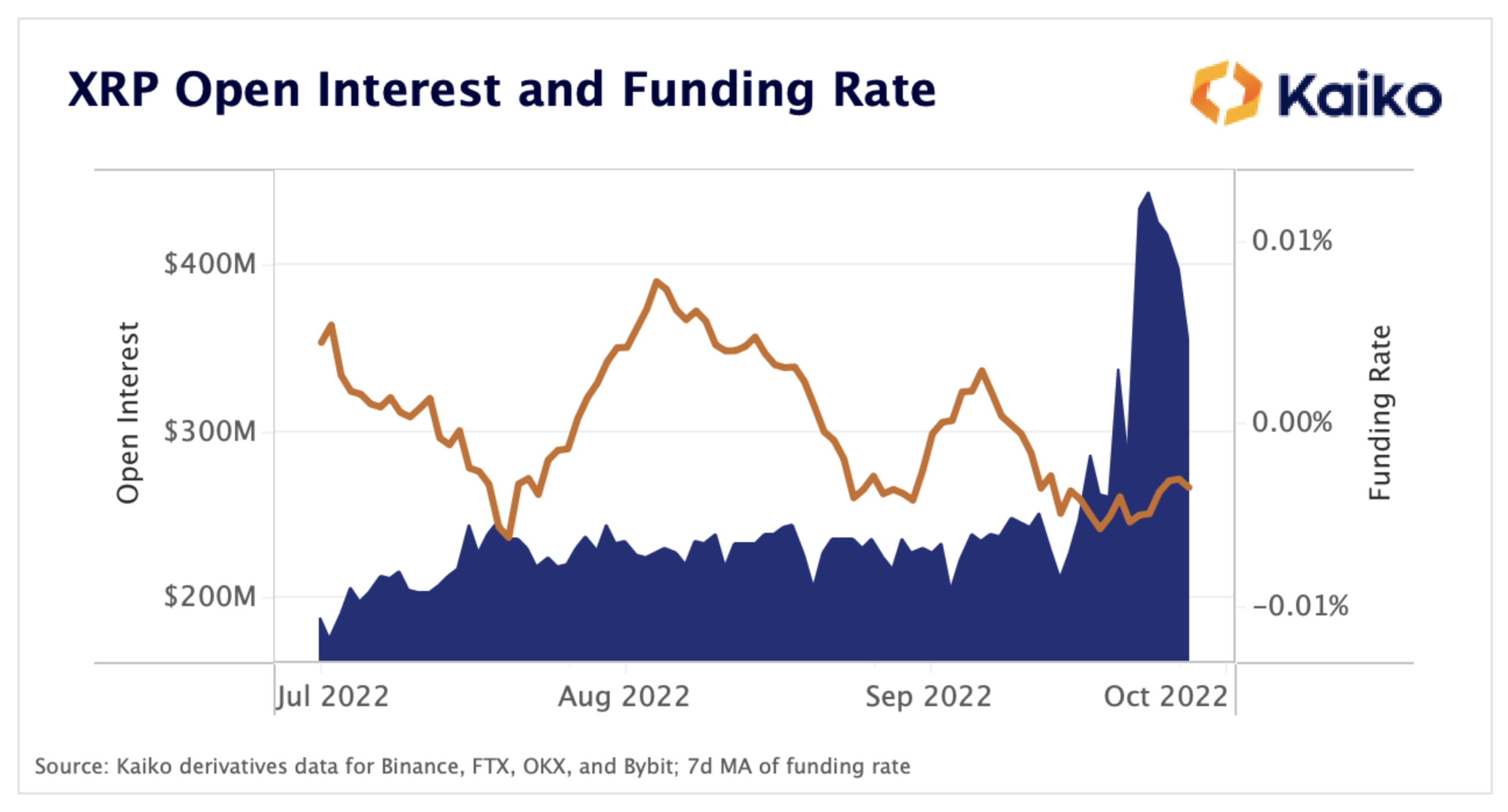

- Increased Trading Volume: A surge in trading volume indicates growing interest and market participation, further contributing to the price increase. High trading volume often signals strong market momentum, though it can also precede a correction.

- Speculation and Market Sentiment: Positive news and speculation about XRP's future potential have created a positive feedback loop, driving up demand and consequently, the price. FOMO (Fear Of Missing Out) can be a powerful driver in cryptocurrency markets.

[Insert chart illustrating XRP's price movement over the past three months here]

Analyzing the Sustainability of the Rally

While the recent surge is impressive, analyzing the sustainability of this rally requires a careful assessment of XRP's fundamentals.

- Technology and Utility: XRP's technology, designed for fast and efficient cross-border payments, offers a clear utility. However, competition in the payments space remains fierce.

- Market Capitalization: XRP's market capitalization, while substantial, needs to be considered in relation to its potential for further growth. A large market cap may limit its percentage growth potential compared to smaller cryptocurrencies.

- Potential Risks and Challenges: Regulatory uncertainty remains a significant risk. Furthermore, competition from other cryptocurrencies and technological advancements could impact XRP's long-term prospects. Analyzing historical price trends and identifying potential resistance levels is crucial before buying XRP.

The Risks of Investing in XRP After a Significant Price Increase

Volatility and Market Corrections

Cryptocurrencies are notoriously volatile. XRP is no exception. The 400% increase makes a correction highly probable.

- Market Corrections: Sharp price drops are common in the cryptocurrency market. Investing in XRP after such a significant price jump increases the risk of substantial losses if a correction occurs.

- Risk Tolerance: Only invest an amount you can comfortably afford to lose. Understanding your risk tolerance is paramount before considering any cryptocurrency investment, including XRP.

- Historical Precedents: Numerous examples of cryptocurrency price crashes demonstrate the importance of managing risk effectively.

Regulatory Uncertainty

The regulatory landscape surrounding XRP remains unclear, creating significant uncertainty.

- Legal Battles: Ongoing legal battles regarding XRP's classification as a security pose a substantial risk. An unfavorable ruling could severely impact the price.

- Regulatory Changes: Changes in regulations globally could significantly affect XRP's trading and adoption. Staying informed about regulatory developments is crucial for any XRP investment.

Technical Analysis of XRP

Technical analysis can provide insights into potential future price movements.

- Support and Resistance Levels: Identifying key support and resistance levels on price charts can help assess potential price targets and entry/exit points.

- Moving Averages: Studying moving averages can reveal trends and potential trend reversals.

- Other Indicators: Using other technical indicators (RSI, MACD, etc.) can provide a more comprehensive picture of XRP's market dynamics. [Link to a reputable charting website here]

Should You Invest in XRP? A Balanced Perspective

Diversification and Risk Management

Diversification is crucial in any investment portfolio. Don't put all your eggs in one basket.

- Risk Tolerance: Only invest what you can afford to lose. Assess your risk tolerance carefully before allocating funds to XRP.

- Diversified Portfolio: Spread your investments across different asset classes to mitigate risk.

Long-Term vs. Short-Term Investment Strategy

Your investment strategy significantly impacts your risk and potential returns.

- Long-Term Holding (Hodling): A long-term strategy involves buying and holding XRP for an extended period, hoping for long-term price appreciation. This strategy mitigates short-term volatility.

- Short-Term Trading: Short-term trading involves frequent buying and selling based on short-term price fluctuations. This strategy is riskier but potentially more profitable, demanding more active involvement and expertise.

Alternative Investment Options

Exploring alternative investment options allows for diversification and risk mitigation.

- Other Cryptocurrencies: Consider diversifying your cryptocurrency portfolio by investing in other promising projects.

- Traditional Investments: Balance your cryptocurrency investments with traditional assets like stocks and bonds.

Conclusion

XRP's recent price surge is noteworthy, but it's essential to approach any XRP investment with caution. The potential for high returns comes with significant risks, including volatility, regulatory uncertainty, and competition. Before you decide to invest in XRP, carefully weigh the potential rewards against the inherent risks. Conduct thorough research, understand your risk tolerance, and consider consulting a financial advisor. Remember that making informed decisions is key to successful XRP investment or any investment in the volatile cryptocurrency market.

Featured Posts

-

New Loyle Carner Album Incoming Details And Speculation

May 02, 2025

New Loyle Carner Album Incoming Details And Speculation

May 02, 2025 -

The Negative Impact Of Dividing Keller Isd Progress And Unity At Risk

May 02, 2025

The Negative Impact Of Dividing Keller Isd Progress And Unity At Risk

May 02, 2025 -

Ukraine Receives Renewed Support From Swiss President

May 02, 2025

Ukraine Receives Renewed Support From Swiss President

May 02, 2025 -

Investing In This Country Opportunities And Challenges

May 02, 2025

Investing In This Country Opportunities And Challenges

May 02, 2025 -

Esir Yakinlarinin Israil Meclisi Protestosu Guevenlik Goerevlileriyle Karsilasma

May 02, 2025

Esir Yakinlarinin Israil Meclisi Protestosu Guevenlik Goerevlileriyle Karsilasma

May 02, 2025

Latest Posts

-

Analyzing The 2024 Florida And Wisconsin Voter Turnout Implications For The Political Climate

May 02, 2025

Analyzing The 2024 Florida And Wisconsin Voter Turnout Implications For The Political Climate

May 02, 2025 -

Analyzing Voter Turnout In Florida And Wisconsin Implications For The Current Political Moment

May 02, 2025

Analyzing Voter Turnout In Florida And Wisconsin Implications For The Current Political Moment

May 02, 2025 -

What The Florida And Wisconsin Election Turnout Reveals About The Political Landscape

May 02, 2025

What The Florida And Wisconsin Election Turnout Reveals About The Political Landscape

May 02, 2025 -

Florida And Wisconsin Turnout A Deep Dive Into The Current Political Climate

May 02, 2025

Florida And Wisconsin Turnout A Deep Dive Into The Current Political Climate

May 02, 2025 -

The Bbcs 1bn Funding Crisis Unprecedented Challenges And Future Impact

May 02, 2025

The Bbcs 1bn Funding Crisis Unprecedented Challenges And Future Impact

May 02, 2025