Slow Economic Growth Forecast For Canada: David Dodge's Warning

Table of Contents

David Dodge's Concerns Regarding Canada's Economic Outlook

David Dodge's pessimistic outlook on Canada's economic future stems from a confluence of factors. He points to a persistent and stubborn inflation rate as a major headwind, arguing that the Bank of Canada's aggressive interest rate hikes, while necessary to curb inflation, are simultaneously dampening consumer spending and investment. This creates a delicate balancing act – controlling inflation without triggering a significant economic slowdown or recession. Dodge's concerns extend beyond inflation, encompassing various areas crucial to Canada's economic health.

-

High inflation and its persistent impact: Dodge emphasizes that inflation's lingering effects are eroding purchasing power and impacting consumer confidence. The sustained high cost of living is squeezing household budgets and reducing discretionary spending.

-

The effects of rising interest rates on consumer spending and investment: The Bank of Canada's interest rate increases, while aimed at cooling inflation, are also making borrowing more expensive, thus impacting business investment and consumer spending on big-ticket items like homes and vehicles.

-

Concerns about the housing market and potential for a correction: Dodge expresses concern about the overheated housing market in certain Canadian cities and the potential for a significant correction, which could have cascading effects on the broader economy. This includes reduced consumer wealth and potential banking sector vulnerabilities.

-

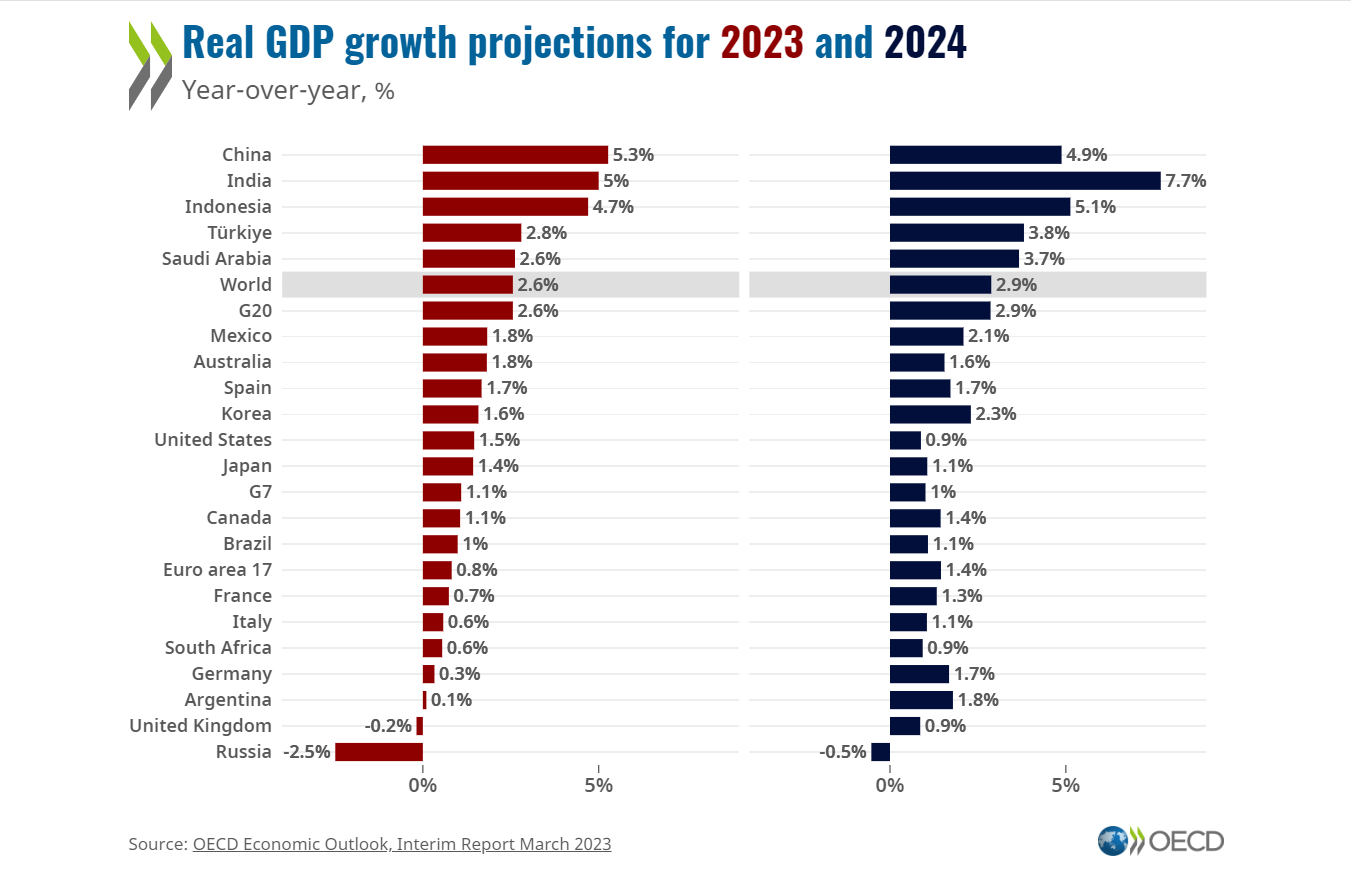

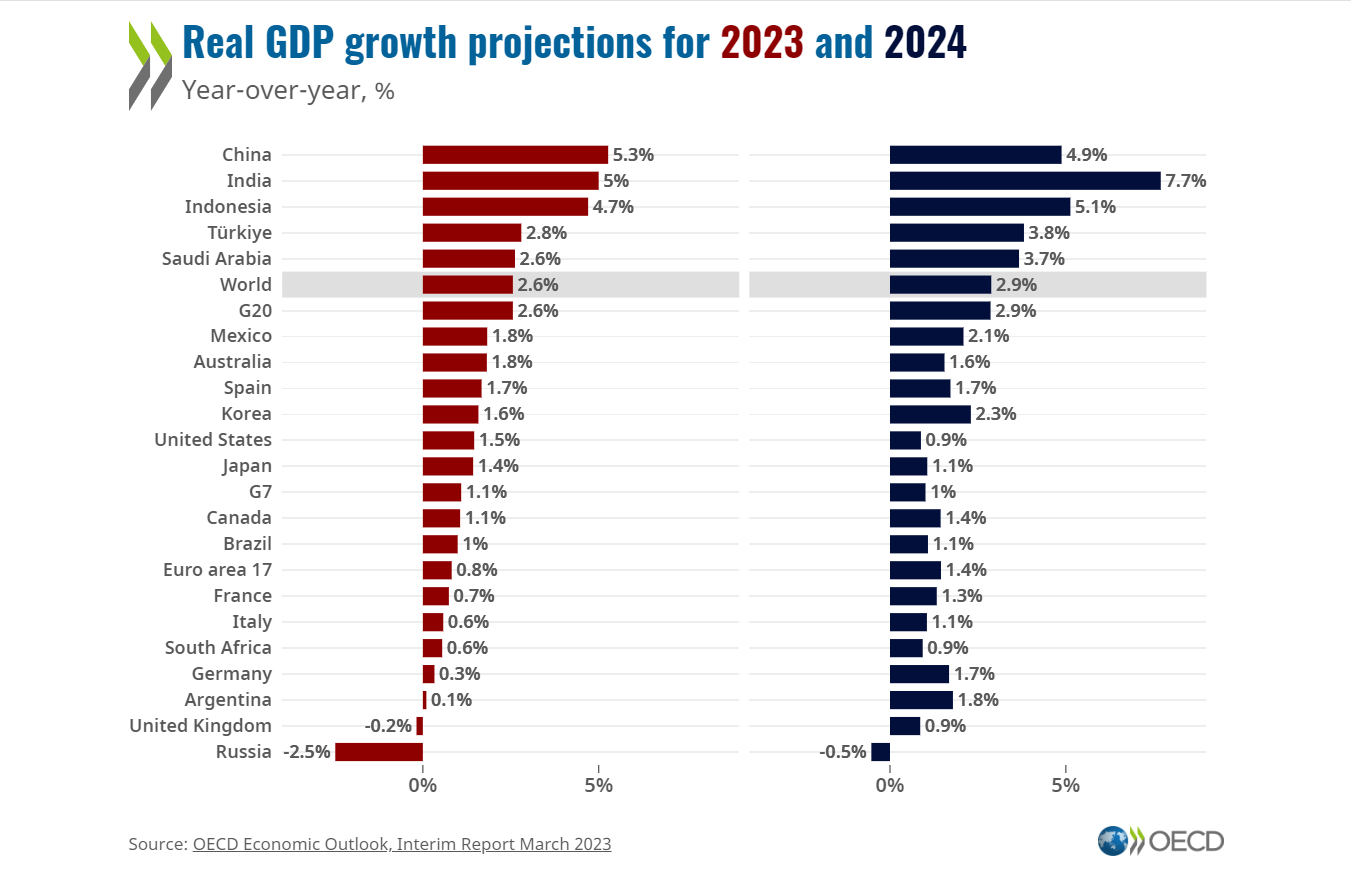

Global economic headwinds impacting Canadian trade: Global economic slowdowns and geopolitical instability are impacting Canadian exports and overall trade performance, further contributing to the weakened outlook.

-

Potential for a recession and its severity: Dodge's assessment suggests a significant risk of a recession, emphasizing the need for proactive measures to mitigate its potential impact and severity.

Analyzing the Current Economic Indicators in Canada

Current economic indicators offer a mixed picture, with some supporting and others contradicting Dodge's forecast. While the most recent GDP growth figures might show modest positive growth, the trajectory is unclear. Inflation, while showing signs of cooling, remains elevated above the Bank of Canada's target.

-

Current GDP growth rate and its trajectory: While recent GDP growth has been positive, it's crucial to monitor the trend to see if it sustains or slows down further. A sustained slowdown would corroborate Dodge's predictions.

-

Latest inflation figures and the Bank of Canada's response: The Bank of Canada's recent decisions regarding interest rates reflect its ongoing efforts to control inflation. However, the effectiveness of these measures in the face of global inflationary pressures remains a key uncertainty.

-

Unemployment rate and its implications for the labor market: The unemployment rate is a key indicator of economic health. Rising unemployment would be a clear sign of an economic slowdown or recession.

-

Current interest rate levels and their projected impact: The current level of interest rates and their projected path will significantly impact borrowing costs for businesses and consumers, shaping investment and spending decisions.

-

Analysis of consumer spending and investment trends: Monitoring consumer confidence and investment trends offers valuable insights into the overall health of the economy and its potential future trajectory.

Potential Impacts of Slow Economic Growth on Canadians

A period of slow economic growth or recession would have far-reaching consequences for average Canadians. The potential impacts extend beyond mere inconvenience, impacting livelihoods, financial security, and overall well-being.

-

Increased job losses and unemployment: A slowing economy often leads to reduced hiring and increased layoffs, resulting in higher unemployment rates and increased financial strain on households.

-

Reduced consumer spending and decreased economic activity: Lower consumer confidence and reduced disposable income leads to decreased spending, creating a negative feedback loop that can exacerbate the economic slowdown.

-

Potential decline in home values: A housing market correction, as highlighted by Dodge, could significantly impact homeowner wealth and equity.

-

Impact on government revenues and potential budget cuts: Reduced economic activity leads to lower tax revenues, forcing governments to make difficult choices regarding spending and potentially leading to budget cuts in vital public services.

-

Increased financial strain on households: The combination of job losses, reduced income, and rising costs of living would significantly increase financial strain on Canadian households.

Government Response and Policy Implications

The Canadian government will need to carefully consider its response to a potential economic slowdown. Fiscal policies, such as targeted tax breaks or infrastructure spending, could stimulate the economy. However, the effectiveness of such measures depends on various factors including the severity of the slowdown and the government's fiscal capacity. Monetary policy, primarily controlled by the Bank of Canada, will continue to play a key role in managing inflation while mitigating the risks of a sharp economic contraction. The balance between these policies is crucial for navigating the challenges ahead.

Conclusion

David Dodge's warning about slow economic growth in Canada highlights the significant challenges facing the Canadian economy. Factors such as persistent inflation, rising interest rates, and global economic headwinds contribute to a concerning outlook. Monitoring key economic indicators such as GDP growth, inflation, and unemployment is essential to understanding the evolving situation. It is crucial for Canadians to stay informed about Canada's slow economic growth and understand the forecast for slow economic growth in Canada to effectively prepare for potential slow economic growth in Canada and make informed decisions regarding their personal finances. Staying informed and proactive is vital for navigating this period of economic uncertainty.

Featured Posts

-

Winter Storm Warning Four Or More Inches Of Snow Extreme Cold Tuesday

May 03, 2025

Winter Storm Warning Four Or More Inches Of Snow Extreme Cold Tuesday

May 03, 2025 -

Deciphering Ap Decision Notes The Minnesota Special House Election Explained

May 03, 2025

Deciphering Ap Decision Notes The Minnesota Special House Election Explained

May 03, 2025 -

Conflit Macron Sardou Les Mots Forts Echanges En Prive

May 03, 2025

Conflit Macron Sardou Les Mots Forts Echanges En Prive

May 03, 2025 -

Fortnite Servers Down Chapter 6 Season 2 Lawless Update Maintenance

May 03, 2025

Fortnite Servers Down Chapter 6 Season 2 Lawless Update Maintenance

May 03, 2025 -

Celebrity Traitors On Bbc Chaos Ensues As Famous Siblings Pull Out

May 03, 2025

Celebrity Traitors On Bbc Chaos Ensues As Famous Siblings Pull Out

May 03, 2025

Latest Posts

-

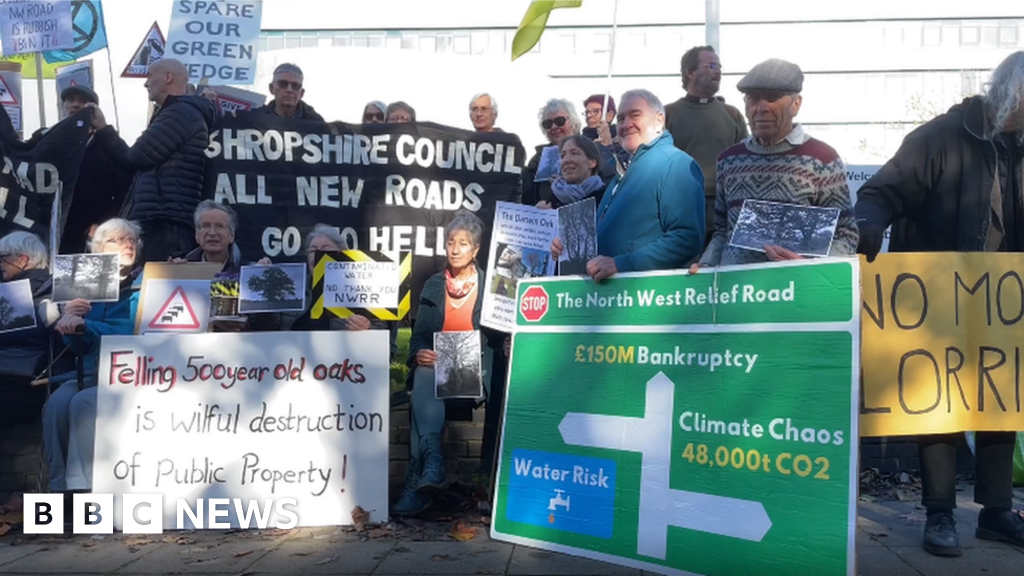

Shrewsbury Visit Farage Attacks Conservatives Over Relief Road Plans

May 04, 2025

Shrewsbury Visit Farage Attacks Conservatives Over Relief Road Plans

May 04, 2025 -

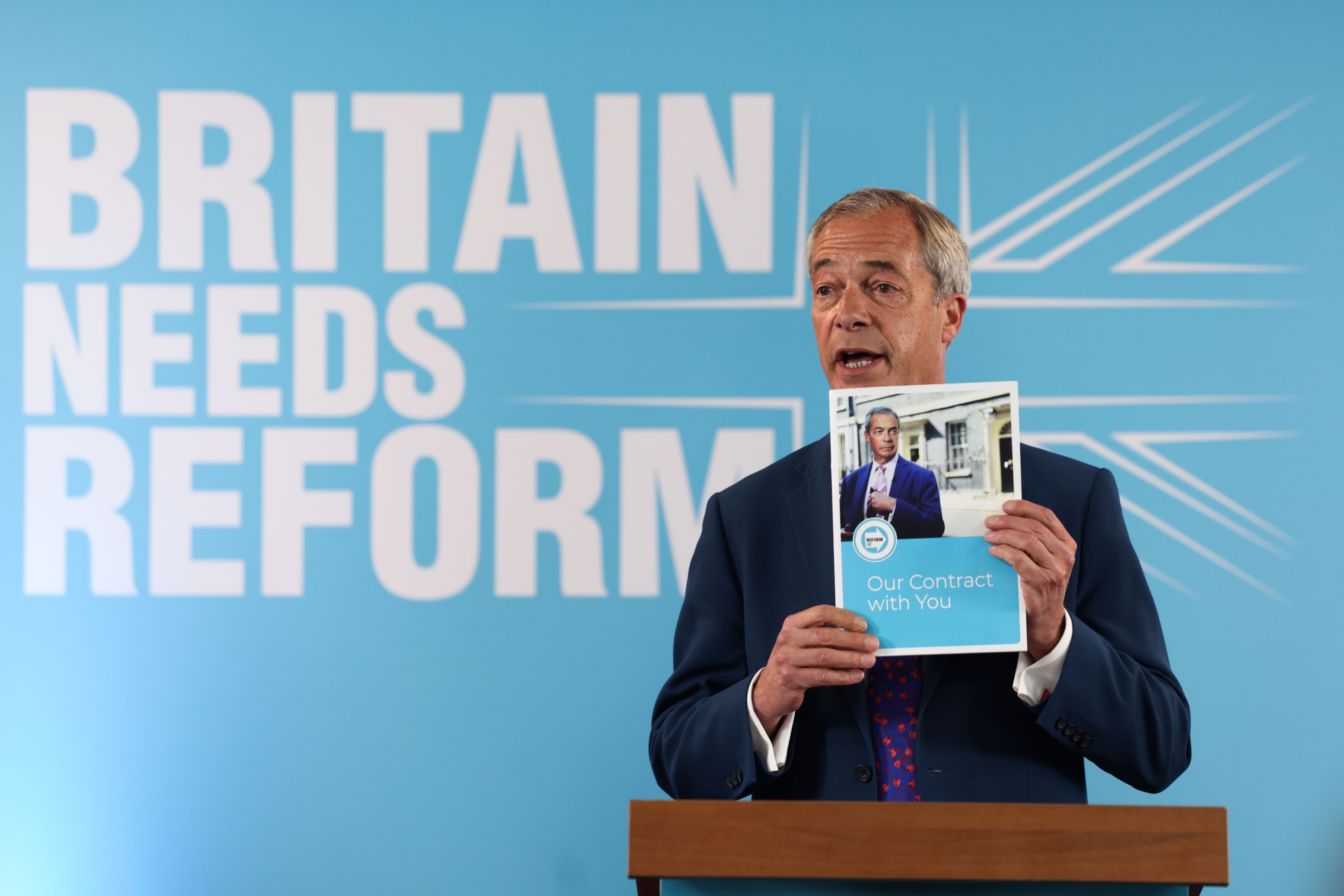

Reform Uks New Slogan A Controversial Farage Move

May 04, 2025

Reform Uks New Slogan A Controversial Farage Move

May 04, 2025 -

Rupert Lowe To Sue Nigel Farage For Defamation False Allegations At The Heart Of The Lawsuit

May 04, 2025

Rupert Lowe To Sue Nigel Farage For Defamation False Allegations At The Heart Of The Lawsuit

May 04, 2025 -

Nigel Farages Shrewsbury Visit Flat Cap G And T And Conservative Criticism

May 04, 2025

Nigel Farages Shrewsbury Visit Flat Cap G And T And Conservative Criticism

May 04, 2025 -

Controversy Erupts Nigel Farage And A Jimmy Savile Slogan

May 04, 2025

Controversy Erupts Nigel Farage And A Jimmy Savile Slogan

May 04, 2025