Soaring Down Payments: Pricing Canadians Out Of The Housing Market

Table of Contents

The Astronomical Rise of Down Payment Requirements

The need for larger down payments is directly linked to several factors, most significantly the recent increase in interest rates.

Impact of rising interest rates:

Higher interest rates directly translate into higher mortgage payments. To compensate for this increased risk, lenders require larger down payments to ensure borrowers can comfortably manage their monthly mortgage obligations.

- Increased borrowing costs necessitate higher down payments to qualify for a mortgage. A 1% increase in interest rates can significantly increase the monthly payment, often requiring a larger down payment to meet lender qualification criteria.

- Illustrative Example: Consider a $500,000 home. With a 5% interest rate and a 5% down payment ($25,000), the monthly mortgage payment might be manageable. However, with a 7% interest rate, the same down payment might not qualify the buyer, requiring a larger down payment, perhaps 10% or even 20%, to meet the lender’s stress test requirements.

- Data Sources: The Bank of Canada’s website provides valuable data on interest rate trends and their impact on the mortgage market. Statistics Canada also offers relevant data on housing affordability and homeownership rates.

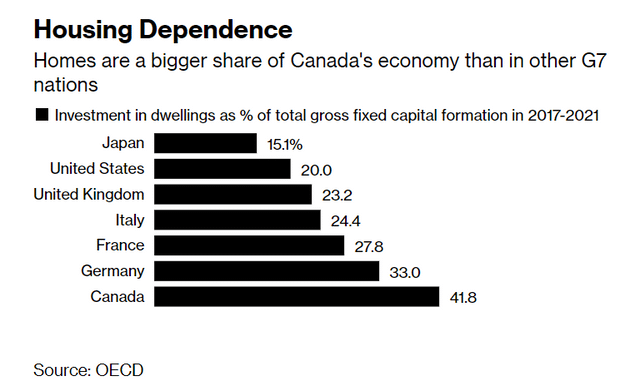

The Shrinking Pool of Affordable Housing:

The impact of rising down payments extends beyond just qualifying for a mortgage; it drastically shrinks the pool of affordable housing options for potential homebuyers.

- High cost of entry pushes buyers into less desirable areas or smaller homes. Facing substantial down payment requirements, many buyers are forced to compromise on location, size, or the overall quality of their homes to remain within their budget.

- Provincial and City Variations: The impact varies greatly across provinces and cities. Areas with already high home prices, like Vancouver and Toronto, see even more pronounced effects, while other regions may experience less extreme pressures. For instance, the average home price in Vancouver might require a significantly larger down payment than a comparable home in a smaller city like Moncton.

- Example Data: Referencing average home prices and required down payments (using a combination of 5% and 20% down payment scenarios for illustration) for various Canadian cities provides concrete evidence of the affordability crisis.

The Disproportionate Impact on Specific Demographics

The impact of soaring down payments is not evenly felt across the population. Certain demographics bear the brunt of these escalating costs.

First-Time Homebuyers:

Young professionals and new families are disproportionately affected. Saving for a substantial down payment while simultaneously managing student loan debt, rent, and other living expenses is an immense challenge.

- Difficulties in saving for a substantial down payment: The high cost of living in many Canadian cities makes it incredibly difficult for young professionals and new families to save the necessary funds for a large down payment.

- Impact on Family Formation: The difficulty in accessing homeownership can delay or even prevent family formation, negatively impacting long-term financial stability and societal well-being.

- Anecdotal Evidence: Including real-life stories from first-time homebuyers facing these challenges can add a human element to the discussion and increase reader engagement.

Low- and Middle-Income Earners:

Income inequality exacerbates the challenge. Those with lower incomes struggle to save even a small percentage of their income, making homeownership nearly impossible.

- Income Inequality and Down Payments: The gap between income and housing costs is widening, making homeownership increasingly out of reach for low- and middle-income earners.

- Increased Reliance on Family Assistance: Many are forced to rely on financial assistance from family members, which can strain relationships and limit long-term financial independence.

- Government Programs and their Limitations: While government programs exist to aid first-time homebuyers, their limitations and often restrictive eligibility criteria make them inaccessible to many.

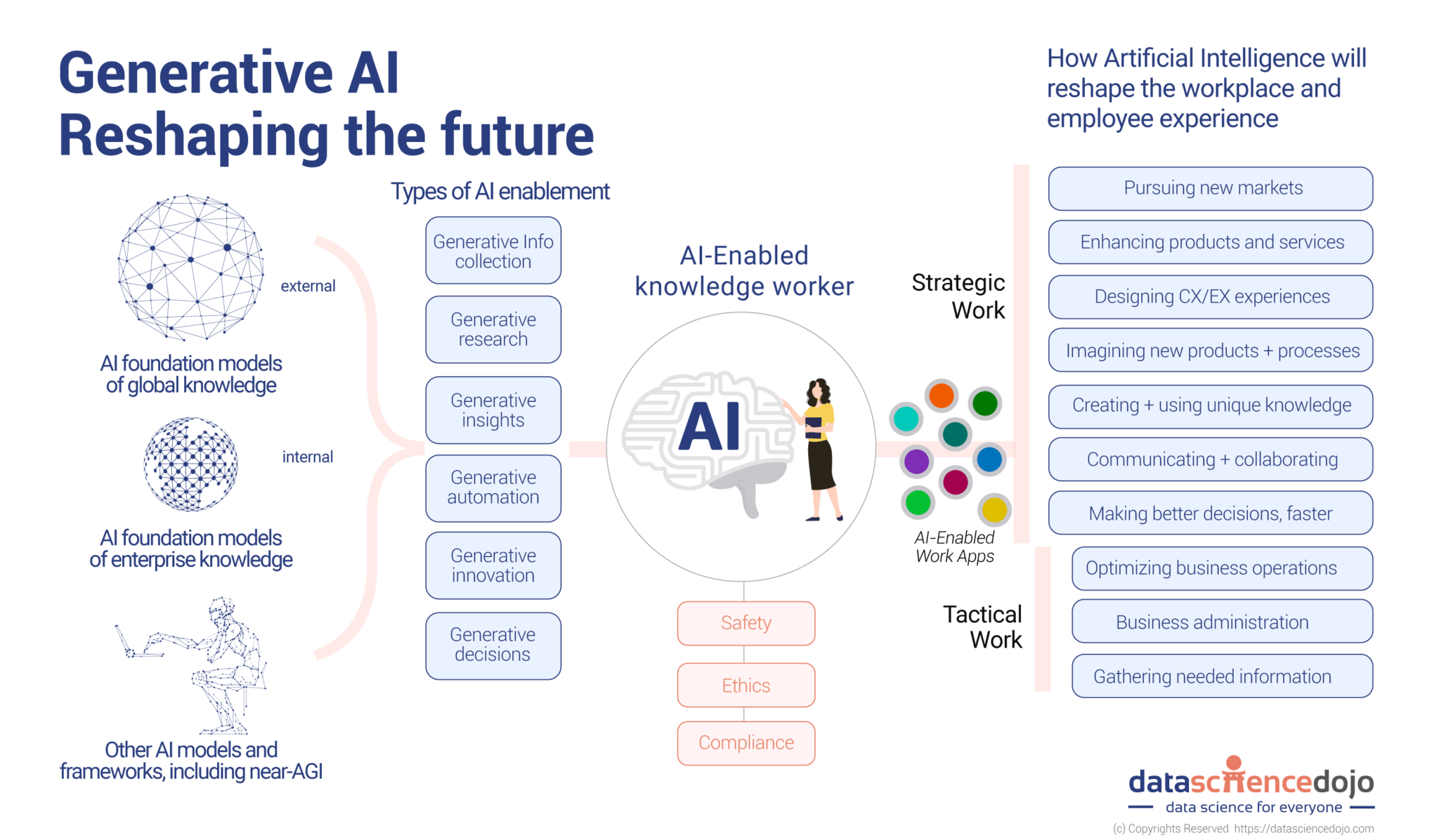

Potential Solutions and Policy Recommendations

Addressing this crisis requires a multi-pronged approach involving government intervention and individual financial planning strategies.

Government Intervention:

Policy changes can significantly impact affordability.

- Increased Grants or Subsidies: Government grants or subsidies targeted at first-time homebuyers could lessen the financial burden of the down payment.

- Changes to Mortgage Rules and Regulations: Adjustments to mortgage rules and stress tests could make it easier for buyers to qualify for mortgages with smaller down payments.

- Increased Supply of Affordable Housing: Government initiatives aimed at increasing the supply of affordable housing are crucial to easing pressure on the market.

Financial Planning Strategies for Homebuyers:

Individuals can also take proactive steps to improve their chances of homeownership.

- Budgeting and Debt Reduction: Creating a detailed budget, tracking expenses, and strategically reducing debt can free up funds for saving.

- Smart Investment Options: Exploring investment options like Registered Retirement Savings Plans (RRSPs) and Tax-Free Savings Accounts (TFSAs) can accelerate savings growth.

- Professional Financial Advice: Seeking professional financial advice can provide personalized guidance on saving and investing for a down payment.

Conclusion

Soaring down payments are significantly hindering the dream of homeownership for many Canadians. The astronomical rise in housing costs, coupled with increasing interest rates, creates a significant barrier to entry for first-time homebuyers and low- to middle-income earners. The disproportionate impact on specific demographics demands attention and action. Understanding the impact of soaring down payments is crucial to finding solutions. Let's work together to address this crisis and make the Canadian dream of homeownership a reality for all. We need effective government policies and proactive individual financial planning to combat the challenges posed by soaring down payments and create a more equitable housing market.

Featured Posts

-

Kraujingos Dakota Johnson Nuotraukos Tiesa Apie Incidenta

May 10, 2025

Kraujingos Dakota Johnson Nuotraukos Tiesa Apie Incidenta

May 10, 2025 -

Singer Summer Walker Shares Story Of Almost Dying In Childbirth

May 10, 2025

Singer Summer Walker Shares Story Of Almost Dying In Childbirth

May 10, 2025 -

Trump Appoints Casey Means Maha Movement Figure As Surgeon General

May 10, 2025

Trump Appoints Casey Means Maha Movement Figure As Surgeon General

May 10, 2025 -

The Future Of Apple Ais Role In Innovation

May 10, 2025

The Future Of Apple Ais Role In Innovation

May 10, 2025 -

Top 5 Stephen King Books A Fans Checklist

May 10, 2025

Top 5 Stephen King Books A Fans Checklist

May 10, 2025

Latest Posts

-

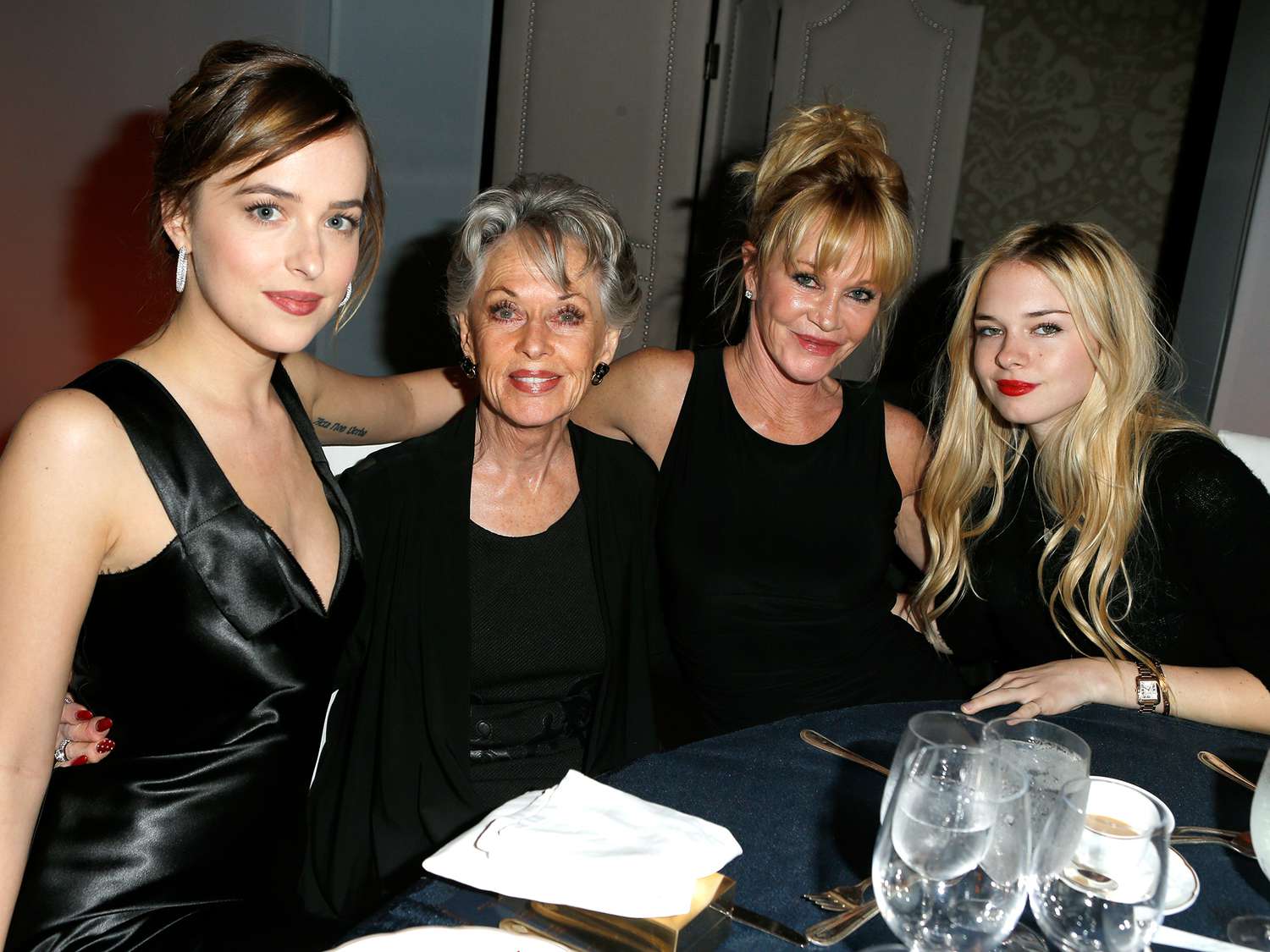

Melanie Griffith And Dakota Johnson At Materialist Los Angeles Premiere

May 10, 2025

Melanie Griffith And Dakota Johnson At Materialist Los Angeles Premiere

May 10, 2025 -

Kraujingos Dakota Johnson Nuotraukos Tiesa Apie Incidenta

May 10, 2025

Kraujingos Dakota Johnson Nuotraukos Tiesa Apie Incidenta

May 10, 2025 -

Dakota Johnson With Family At Materialist Premiere Photos

May 10, 2025

Dakota Johnson With Family At Materialist Premiere Photos

May 10, 2025 -

Dakota Johnson Traumos Naujos Detales Apie Kraujingas Nuotraukas

May 10, 2025

Dakota Johnson Traumos Naujos Detales Apie Kraujingas Nuotraukas

May 10, 2025 -

Dakota Johnson Supported By Family At Materialist La Screening

May 10, 2025

Dakota Johnson Supported By Family At Materialist La Screening

May 10, 2025