SSE's £3 Billion Spending Reduction: A Detailed Analysis

Table of Contents

Reasons Behind SSE's £3 Billion Spending Cut

SSE's decision to slash its spending by £3 billion stems from a confluence of factors impacting the energy market's financial landscape. These cost-cutting measures are a response to a challenging regulatory environment, heightened market volatility, and significant economic pressures.

-

Increased Inflationary Pressures and Rising Interest Rates: The current economic climate, characterized by high inflation and rising interest rates, has drastically increased the cost of borrowing and made many previously viable energy projects financially unfeasible. This impacts both the cost of building new infrastructure and the overall profitability of existing assets.

-

Reassessment of the Investment Portfolio: SSE has undertaken a comprehensive review of its investment portfolio, prioritizing projects offering the highest returns and aligning with its revised financial strategy. This strategic reassessment has inevitably led to a reduction in overall capital expenditure.

-

Changes in Government Regulations and Policies: The evolving regulatory landscape for renewable energy projects, including changes in government subsidies and support mechanisms, has impacted the attractiveness of certain investments. This necessitates a careful recalibration of SSE's investment priorities.

-

Strengthening Financial Position: The energy market remains volatile and uncertain. By reducing spending, SSE aims to strengthen its financial position, enhancing its resilience to market fluctuations and ensuring its long-term financial stability. This focus on fiscal prudence is crucial in navigating the current economic headwinds.

-

Focus Shift Towards Profitability and Efficiency: The cost-cutting measures reflect a shift towards more profitable and efficient energy generation and distribution methods. This might involve streamlining operations, optimizing existing infrastructure, and focusing on areas with higher potential returns.

Impact on SSE's Investment in Renewable Energy

SSE's commitment to renewable energy and its ambitious Net Zero targets are directly affected by the £3 billion spending reduction. This investment slowdown raises concerns about the UK's broader green energy transition.

-

Potential Delays and Cancellations: The most immediate impact will likely be delays or even cancellations of planned wind and solar projects. This could impact the timeline for achieving the UK's ambitious renewable energy targets.

-

Impact on the UK's Net-Zero Agenda: The reduction in investment by a major player like SSE could potentially slow down the overall pace of the UK's transition to a low-carbon economy. This raises concerns about the feasibility of achieving Net Zero targets.

-

Alternative Financing Options: SSE may explore alternative financing options, such as partnerships with private investors or government-backed schemes, to secure funding for crucial renewable energy projects. Such collaborations are essential for maintaining momentum in the sector.

-

Strategic Partnerships and Collaborations: To mitigate the impact of the spending cut on renewable energy investments, SSE may seek strategic partnerships and collaborations with other energy companies or investors to share the financial burden and expertise.

-

Prioritization of Existing Projects: SSE is likely to prioritize the completion of existing renewable energy projects while carefully evaluating the viability of new ones based on their projected returns and alignment with revised strategic goals.

Implications for Energy Prices and Consumers

The £3 billion spending reduction by SSE has significant implications for energy prices and the affordability of energy for consumers. The impact is likely to be multifaceted and may unfold over time.

-

Potential Short-Term and Long-Term Effects on Energy Prices: While the immediate impact on energy prices might be limited, long-term consequences could include potential upward pressure on prices, particularly if investment in renewable energy sources is significantly curtailed, leading to increased reliance on fossil fuels.

-

Influence on Market Competition: The spending cut could influence competition within the energy market, potentially leading to less choice for consumers and a reduction in the incentives for innovation and efficiency improvements.

-

Regulatory Response and Price Caps: Regulatory bodies will play a vital role in monitoring the impact on consumer bills and may consider interventions such as adjusting price caps or introducing other measures to ensure affordability.

-

Policy Responses to Address Negative Impacts: Government policy responses will be crucial in mitigating any negative consequences for consumers. This might involve targeted support for vulnerable households or measures to stimulate investment in renewable energy.

-

Increased Reliance on Fossil Fuels: A reduced investment in renewable energy could lead to a greater reliance on fossil fuels in the short to medium term, potentially counteracting efforts to reduce carbon emissions.

Long-Term Strategic Consequences for SSE

SSE's £3 billion spending reduction represents a significant strategic repositioning with lasting consequences for its long-term growth and competitive advantage.

-

Impact on Competitive Position: The cost-cutting measures could affect SSE's competitive position within the energy market, particularly in the rapidly evolving renewable energy sector, where significant investment is crucial.

-

Long-Term Growth Trajectory: The spending reduction may temporarily slow down SSE's long-term growth trajectory, but a more focused and efficient approach could lead to improved profitability and financial stability in the long run.

-

Financial Health and Stability: While the immediate effect might be a temporary reduction in investment activity, the improved financial stability resulting from the cost-cutting measures can create a stronger foundation for future growth.

-

Strategic Priorities and Business Model Adjustments: The company might adjust its strategic priorities, potentially refocusing on core competencies and divesting from less profitable areas. This could lead to a reshaped business model better suited to the prevailing economic and regulatory landscape.

-

Innovative Solutions and New Investment Opportunities: The strategic repositioning may also create opportunities for SSE to explore innovative solutions and identify new investment opportunities that offer greater returns and align with evolving market demands.

Conclusion:

SSE's £3 billion spending reduction is a momentous decision with wide-ranging implications for the company, the UK energy sector, and consumers. This analysis has explored the underlying reasons, the impact on renewable energy investment, the potential effects on energy prices, and the long-term strategic consequences. Understanding this complex situation is essential for anyone involved in or affected by the UK energy market. To stay updated on further developments concerning SSE's £3 billion spending reduction and its impact on the energy sector, continue to follow our analyses and in-depth reports.

Featured Posts

-

Visages Du Brest Urban Trail L Importance Des Benevoles Artistes Et Partenaires

May 24, 2025

Visages Du Brest Urban Trail L Importance Des Benevoles Artistes Et Partenaires

May 24, 2025 -

Us To Eliminate Penny Production What This Means For Consumers By 2026

May 24, 2025

Us To Eliminate Penny Production What This Means For Consumers By 2026

May 24, 2025 -

Gelungener Auftakt Radtouren Zu Essener Persoenlichkeiten

May 24, 2025

Gelungener Auftakt Radtouren Zu Essener Persoenlichkeiten

May 24, 2025 -

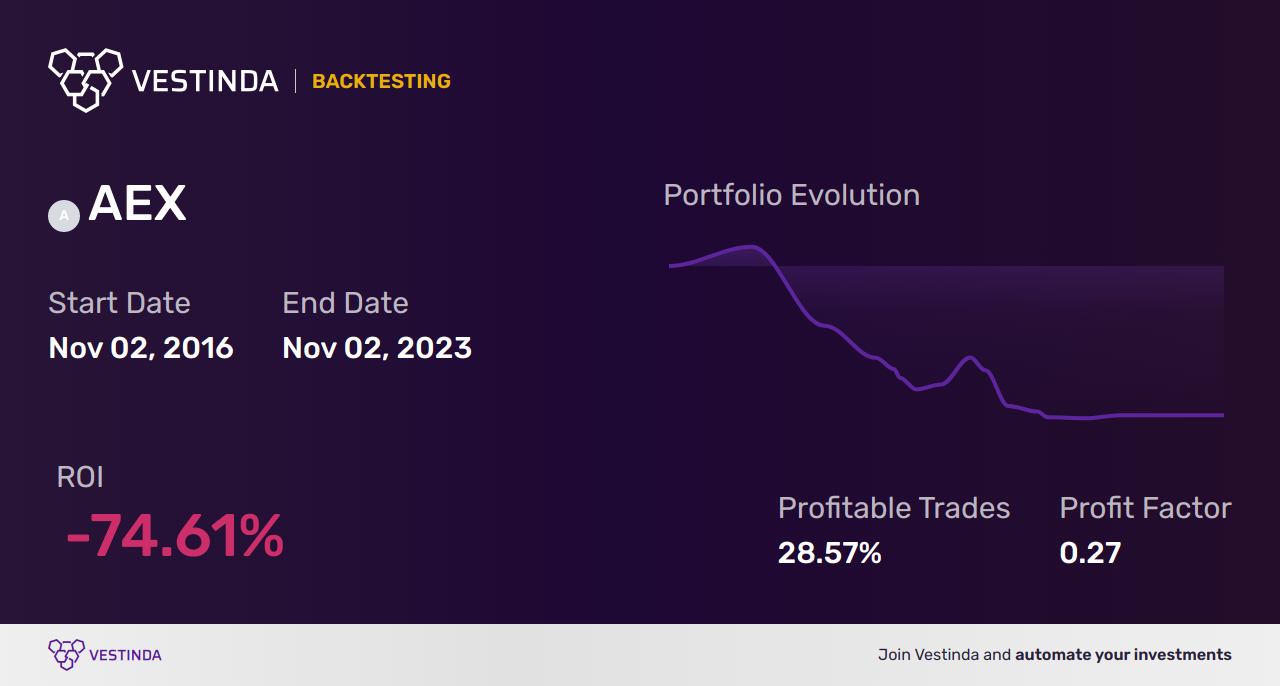

Aex Index Amsterdams Stock Market Experiences Heavy Losses

May 24, 2025

Aex Index Amsterdams Stock Market Experiences Heavy Losses

May 24, 2025 -

Traffic Congestion On M6 Southbound 60 Minute Delays

May 24, 2025

Traffic Congestion On M6 Southbound 60 Minute Delays

May 24, 2025