SSE's £3 Billion Spending Reduction: Reasons And Consequences

Table of Contents

Reasons Behind SSE's Cost-Cutting Measures

Several interconnected factors have driven SSE's decision to slash its spending by £3 billion. Understanding these underlying causes is crucial to grasping the full implications of this move.

Economic Headwinds and Increased Energy Costs

The current economic climate is undeniably challenging. Soaring inflation, coupled with unprecedented volatility in energy prices, has significantly impacted SSE's profitability. Increased operational expenses have squeezed margins, necessitating a drastic response.

- Increased material costs: The price of raw materials used in energy production, from metals to specialized components, has skyrocketed, impacting project budgets.

- Higher labor costs: Wage inflation and competition for skilled labor have added to SSE's operational overhead.

- Regulatory changes impacting energy pricing: Government regulations and policies aimed at controlling energy prices have limited SSE's ability to pass on increased costs to consumers, further compressing profit margins.

The UK inflation rate reached double digits in 2022, while wholesale gas prices experienced record highs. These factors directly contribute to the need for SSE's cost-cutting strategy.

Focus on Renewable Energy Investment

SSE's strategic shift towards renewable energy sources is another key driver of the spending reduction. While the company remains committed to its long-term decarbonization goals, the transition requires a strategic reallocation of capital. Investment in renewable energy projects like onshore and offshore wind farms and solar power plants demands significant upfront investment, necessitating cuts in other areas.

- Examples of specific renewable energy projects: SSE is heavily investing in projects like the Seagreen offshore wind farm and various onshore wind farms across the UK.

- Divestment from fossil fuels: SSE is gradually phasing out its investment in less sustainable energy sources, reallocating resources to renewable energy initiatives.

- Long-term strategic goals for decarbonization: The £3 billion reduction reflects a commitment to long-term sustainability, even if it means short-term pain.

This shift, while crucial for long-term sustainability, requires significant short-term investment and thus impacts overall spending.

Increased Regulatory Scrutiny and Pressure

The energy sector faces increasing regulatory scrutiny and pressure to improve environmental performance. Meeting these stringent standards adds to operational costs and necessitates strategic adjustments to investment plans.

- Examples of new regulations affecting the energy sector: The UK government has implemented several policies aimed at reducing carbon emissions and improving energy efficiency.

- Penalties for non-compliance: Failure to meet regulatory requirements can result in substantial financial penalties, further impacting profitability.

- Pressure to improve environmental performance: Investors and consumers are increasingly demanding that energy companies adopt more sustainable practices, adding pressure to invest in greener technologies.

Compliance with these regulations, while essential for long-term viability, necessitates significant investment and contributes to the overall spending reduction.

Consequences of the £3 Billion Spending Reduction

SSE's £3 billion spending reduction will inevitably have far-reaching consequences, impacting various aspects of the company's operations and the wider energy market.

Impact on SSE's Operations and Projects

The spending cuts could lead to delays or even cancellations of planned projects, impacting both short-term and long-term growth.

- Specific projects potentially affected: Some smaller-scale projects or those deemed less strategically important might be delayed or cancelled to free up resources.

- Job losses or hiring freezes: Cost-cutting measures might involve job losses or a hiring freeze, impacting employee morale and expertise.

- Impact on research and development: Reduced investment in R&D could hinder innovation and the development of new technologies.

- Potential short-term impacts on shareholder value: In the short term, the reduction may negatively affect shareholder value, though long-term strategic benefits are anticipated.

Effects on Energy Prices and Consumers

Reduced investment and operational changes could potentially impact energy prices and consumer bills.

- Potential increases in energy prices: While not a direct consequence, reduced investment may ultimately constrain supply in the longer term, potentially leading to price increases.

- Impact on vulnerable consumers: Increased energy prices disproportionately affect vulnerable consumers, exacerbating existing inequalities.

- Potential for energy security concerns: Delays or cancellations of key energy projects could raise concerns about the UK's energy security.

- Potential mitigations and counterarguments: SSE might explore innovative financing solutions or partnerships to mitigate these potential negative impacts.

Long-Term Strategic Implications

The long-term consequences of the £3 billion spending reduction will significantly shape SSE's competitive position.

- Impact on innovation and future growth: Reduced investment in R&D and new technologies could hinder SSE's ability to remain competitive in the long term.

- Potential loss of market share: Delayed projects and reduced investment could allow competitors to gain a foothold in the market.

- Altered long-term financial projections: The spending reduction will undoubtedly impact SSE's long-term financial projections and growth trajectory.

- Potential risks and opportunities: While the short-term impacts might be negative, the strategic shift towards renewable energy presents significant long-term opportunities for growth and market leadership.

Conclusion

SSE's £3 billion spending reduction reflects a complex interplay of economic pressures, strategic shifts toward renewable energy, and regulatory obligations. While the short-term consequences might include project delays, potential job losses, and potentially higher energy prices, the long-term strategic implications are more nuanced. The focus on renewable energy could solidify SSE's position in a rapidly changing energy landscape. However, the success of this strategy hinges on navigating the challenges of the current economic climate and maintaining a balance between cost-cutting and sustainable growth. Learn more about SSE's response to economic challenges and understand the implications of SSE's £3 billion spending reduction to analyze the future of SSE in light of this cost-cutting strategy.

Featured Posts

-

Help Clean Up Myrtle Beach Volunteer Opportunity

May 25, 2025

Help Clean Up Myrtle Beach Volunteer Opportunity

May 25, 2025 -

F1 Lewis Hamiltons Recent Testing Footage Shows Support For Ex Teammate

May 25, 2025

F1 Lewis Hamiltons Recent Testing Footage Shows Support For Ex Teammate

May 25, 2025 -

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc What You Need To Know

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf Acc What You Need To Know

May 25, 2025 -

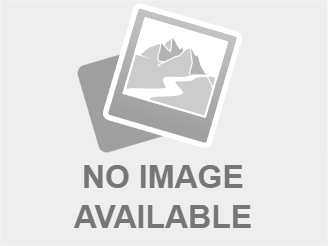

Flash Flood Warning Hampshire And Worcester Counties Thursday Night

May 25, 2025

Flash Flood Warning Hampshire And Worcester Counties Thursday Night

May 25, 2025 -

Sutherland Family Kiefer Honors Donald At Canadian Screen Awards Ceremony

May 25, 2025

Sutherland Family Kiefer Honors Donald At Canadian Screen Awards Ceremony

May 25, 2025