Stock Market Valuation Concerns? BofA Offers A Calming Perspective

Table of Contents

BofA's Key Arguments Against Excessive Valuation Concerns

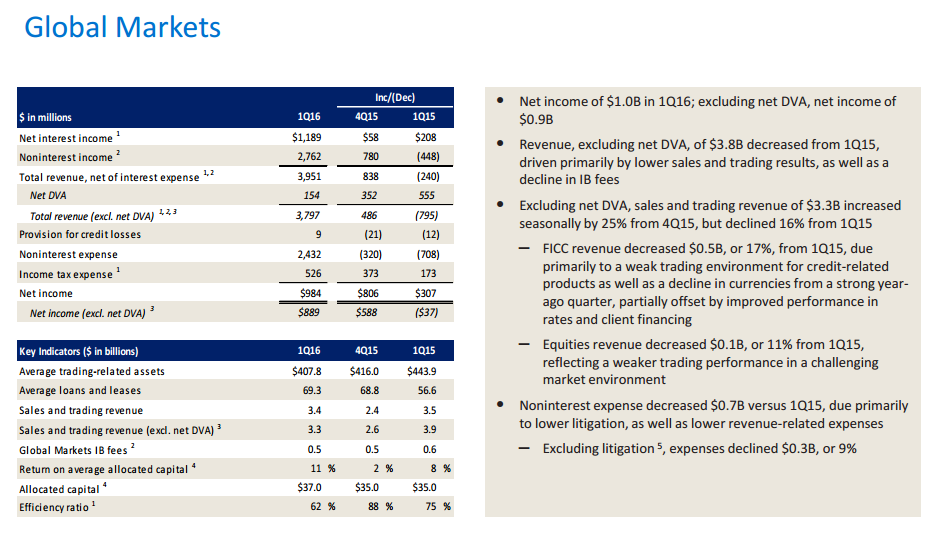

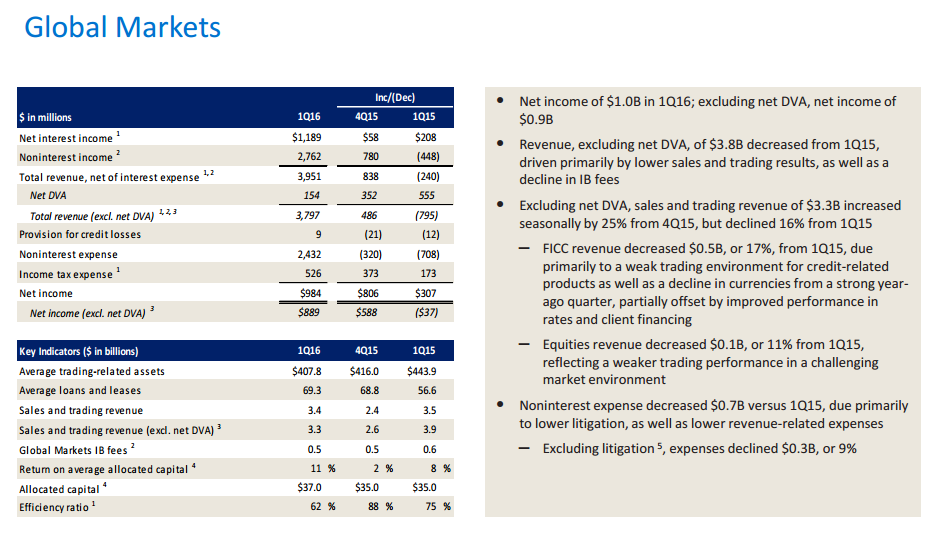

BofA's analysis suggests that while current market conditions present challenges, excessive pessimism regarding stock market valuations may be unwarranted. Their perspective rests on several key pillars.

Long-Term Growth Potential

BofA's assessment highlights significant long-term growth potential across various sectors, underpinning their relatively optimistic outlook on stock valuations. This positive outlook isn't based on short-term gains but rather a longer-term vision of economic expansion.

- Strong Long-Term Growth Sectors: BofA points to sectors like technology (particularly artificial intelligence and cloud computing), renewable energy, and healthcare as possessing robust long-term growth trajectories. Specific companies within these sectors are also highlighted for their potential.

- Supporting Data: BofA's projections include sustained earnings growth across numerous sectors, fueled by technological advancements and increasing consumer demand in key areas. They cite specific data points from their research to support these projections.

- Long-Term Investment Horizon: A crucial element of BofA's argument is the importance of adopting a long-term investment horizon. They emphasize that short-term market fluctuations should not overshadow the potential for substantial long-term returns.

Interest Rate Impact

Rising interest rates undeniably impact stock valuations, increasing borrowing costs for companies and potentially dampening investment. However, BofA's analysis suggests a more nuanced perspective.

- Sophisticated Valuation Models: BofA incorporates the impact of higher interest rates into their complex valuation models, accounting for their influence on discounted cash flows and other key metrics.

- Mitigating Factors: BofA notes potential mitigating factors such as the possibility of future interest rate cuts if inflation cools significantly, as well as the strong corporate earnings reported by many companies, which can offset the negative impacts of higher rates.

- Balanced Perspective: While acknowledging the negative influence of higher interest rates, BofA emphasizes that their impact is not uniformly negative and can be offset by other factors such as strong earnings and the long-term growth potential of many companies.

Market Corrections vs. Bear Markets

BofA carefully distinguishes between temporary market corrections and a sustained bear market, emphasizing the importance of this distinction for investors.

- Criteria for Differentiation: BofA uses a range of criteria to differentiate, including the duration and depth of the downturn, the breadth of market declines, and the underlying economic fundamentals.

- Data-Driven Assessment: They cite specific data points, such as the performance of leading economic indicators and market sentiment indices, to support their classification of the current market situation.

- Implications for Investors: Based on their assessment, BofA provides different investment advice depending on whether they consider the market to be undergoing a correction or a more significant bear market.

BofA's Suggested Investment Strategies

Based on their analysis, BofA offers several key investment strategies to help navigate the current market landscape.

Sector-Specific Recommendations

BofA's sector-specific recommendations are aligned with their assessment of long-term growth potential.

- Undervalued Sectors: They suggest focusing on sectors they consider undervalued, emphasizing opportunities for growth and potential outperformance in the longer term.

- Growth-Oriented Allocation: The recommendations lean towards a growth-oriented portfolio allocation, reflecting their belief in the strength of the long-term growth outlook. They provide specific rationale for each recommendation.

Risk Management Strategies

BofA emphasizes the importance of robust risk management strategies, particularly during periods of market uncertainty.

- Diversification: They advocate for diversification across different asset classes and sectors to mitigate portfolio risk, emphasizing the benefits of a well-balanced portfolio.

- Risk Tolerance: BofA stresses the importance of aligning investment strategies with individual risk tolerance, advising investors to carefully consider their personal circumstances and investment goals.

Addressing Stock Market Valuation Concerns – BofA's Reassuring View

In summary, BofA's analysis provides a relatively optimistic perspective on stock market valuations, despite acknowledging the challenges presented by inflation and rising interest rates. Their key arguments emphasize the importance of long-term growth potential, the nuanced impact of interest rates, and the ability to differentiate between market corrections and more severe downturns. While acknowledging market risks, BofA's perspective encourages a more balanced approach, highlighting the potential for long-term returns despite current market volatility. Consider BofA's perspective when making your own investment decisions, but remember to tailor your investment strategy to your individual circumstances and risk tolerance. Learn more about BofA's insights on stock market valuation and navigate current market uncertainty with a well-informed approach.

Featured Posts

-

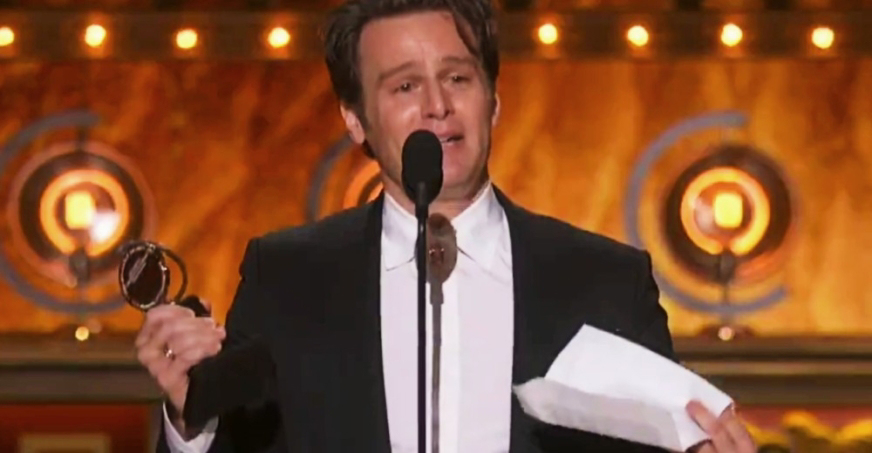

Jonathan Groffs Broadway Opening Lea Michele And Friends Show Support

May 23, 2025

Jonathan Groffs Broadway Opening Lea Michele And Friends Show Support

May 23, 2025 -

The Whos Drummer A Statement Following Recent Dismissal

May 23, 2025

The Whos Drummer A Statement Following Recent Dismissal

May 23, 2025 -

2025 Commencement Address Kermit The Frog At University Of Maryland

May 23, 2025

2025 Commencement Address Kermit The Frog At University Of Maryland

May 23, 2025 -

Da Li Je Vanja Mijatovic Promenila Ime

May 23, 2025

Da Li Je Vanja Mijatovic Promenila Ime

May 23, 2025 -

Could Jonathan Groff Make Tony Awards History With Just In Time

May 23, 2025

Could Jonathan Groff Make Tony Awards History With Just In Time

May 23, 2025