Stock Market Valuation Concerns? BofA Offers Reassurance To Investors

Table of Contents

BofA's Analysis of Current Market Valuations

BofA employs a rigorous methodology to assess market valuations, incorporating various key metrics to provide a comprehensive picture. Their analysis goes beyond simple price-to-earnings (P/E) ratios, considering a broader range of indicators including price-to-sales ratios, price-to-book ratios, and dividend yields. These metrics are analyzed across different sectors and compared to historical averages to gauge whether current valuations are justified.

BofA's recent reports suggest a more balanced view than some of the more alarmist predictions circulating in the market. While acknowledging elevated valuations in certain sectors, they haven't declared a broad market overvaluation. Their findings often highlight the importance of focusing on individual company performance rather than reacting solely to overall market indices.

- Key metrics used by BofA: P/E ratios, Price-to-Sales ratios, Price-to-Book ratios, Dividend Yields, Free Cash Flow Yield.

- Specific sectors BofA highlights: BofA's reports frequently highlight specific sectors that appear overvalued (e.g., certain technology sub-sectors) and others that might be undervalued (e.g., energy or financials – this is subject to change based on their most recent reports). Always refer to the latest BofA publications for up-to-date sector assessments.

- Comparison to historical averages: BofA’s analysis usually compares current valuation multiples to long-term historical averages, providing context and helping investors to determine whether current levels represent significant deviations from the norm.

The Impact of Interest Rates on Stock Market Valuations (according to BofA)

Interest rate movements significantly influence stock market valuations. BofA's analysis closely monitors interest rate predictions and their potential impact on stock prices. Rising interest rates typically increase borrowing costs for companies, impacting their profitability and potentially decreasing their valuations. Conversely, lower interest rates can stimulate economic growth and boost corporate earnings, leading to higher valuations.

BofA's interest rate forecasts play a critical role in their valuation models. By anticipating future interest rate changes, they can assess how these changes might affect company earnings and investor sentiment. Higher interest rates generally lead to lower valuation multiples as investors demand higher returns to compensate for the increased risk.

- BofA's interest rate forecast: (This needs to be updated with BofA's current forecast. Check their website for the most recent projections.)

- Impact on company earnings and investor sentiment: Increased interest rates can reduce corporate profits, leading to lower investor confidence and potentially lower stock prices.

- Strategies to mitigate interest rate risk: Diversification, investing in sectors less sensitive to interest rate changes, and utilizing hedging strategies are often recommended.

BofA's Outlook on Earnings Growth and its Influence on Valuation

BofA's predictions for corporate earnings growth are central to their valuation analysis. Strong earnings growth generally supports higher stock valuations, as higher profits justify higher stock prices. Conversely, slowing or declining earnings growth can signal lower valuations. BofA carefully considers various economic factors when forecasting earnings growth.

- BofA's projected earnings growth rates: (Again, consult BofA's latest reports for the most current data on projected earnings growth across different sectors.)

- Factors influencing projections: Economic growth, inflation, consumer spending, geopolitical events, and technological advancements all influence BofA's projections.

- Earnings growth and long-term outlook: Consistent earnings growth is a key driver of long-term stock market valuation increases.

BofA's Recommendations for Investors

Based on their comprehensive valuation analysis, BofA provides recommendations to investors, suggesting appropriate strategies for managing their portfolios. These recommendations often incorporate a balanced approach, acknowledging both potential risks and opportunities within the market.

- Specific investment strategies: BofA might suggest sector rotation (shifting investments from overvalued sectors to undervalued ones), value investing (focusing on companies with lower valuations relative to their fundamentals), or growth investing (focusing on companies expected to have high growth).

- Risk management: Diversification across asset classes and sectors is always emphasized as a key risk management strategy.

- Importance of diversification: Spreading investments across different asset classes and sectors helps to mitigate risk and improve overall portfolio performance.

Conclusion: Navigating Stock Market Valuation Concerns with BofA's Guidance

BofA's analysis provides a valuable framework for understanding current stock market valuations. While acknowledging the challenges posed by interest rate changes and potential economic headwinds, their assessments offer a balanced perspective, avoiding overly optimistic or pessimistic predictions. Their recommendations highlight the importance of thorough research, diversification, and adapting investment strategies to evolving market conditions. Stay informed about stock market valuations by regularly reviewing BofA's market analysis and adjust your investment strategy accordingly. Don't let stock market valuation concerns paralyze you. Use BofA's insights to make informed investment decisions. Remember to conduct your own research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

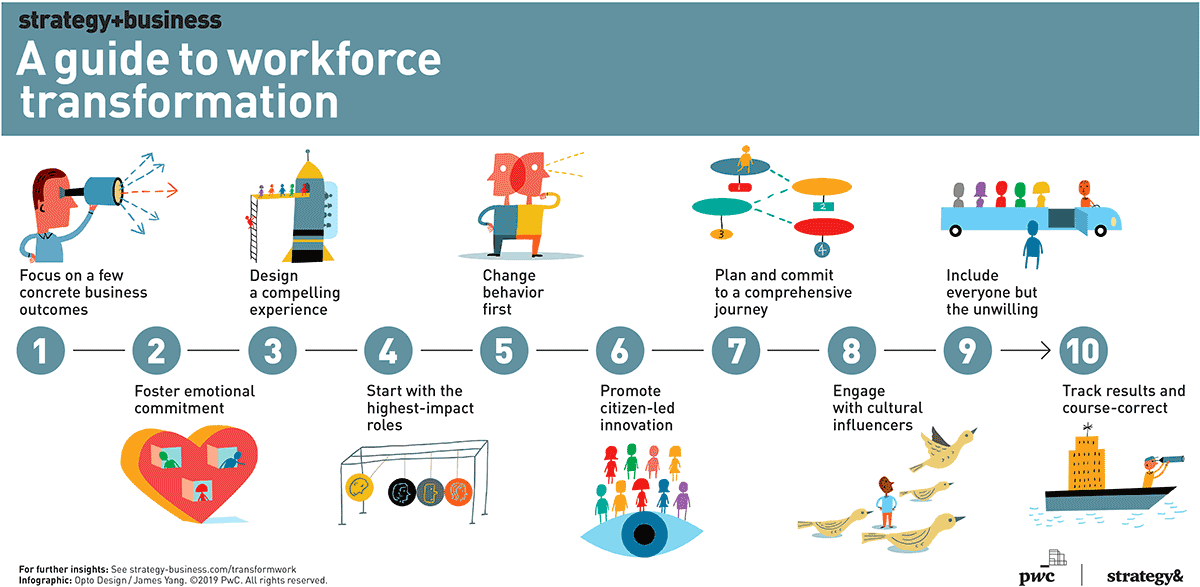

Africas Workforce Transformation Climate Change Impacts And Green Jobs

Apr 26, 2025

Africas Workforce Transformation Climate Change Impacts And Green Jobs

Apr 26, 2025 -

Colgate Cl Stock Slumps 200 Million Tariff Impact On Profits

Apr 26, 2025

Colgate Cl Stock Slumps 200 Million Tariff Impact On Profits

Apr 26, 2025 -

Vestas Investment Warning Uk Wind Auction Reform Implications

Apr 26, 2025

Vestas Investment Warning Uk Wind Auction Reform Implications

Apr 26, 2025 -

Vingegaards Tour De France Focus After Concussion Recovery

Apr 26, 2025

Vingegaards Tour De France Focus After Concussion Recovery

Apr 26, 2025 -

Gavin Newsom Criticizes Toxic And Judgmental Democrats

Apr 26, 2025

Gavin Newsom Criticizes Toxic And Judgmental Democrats

Apr 26, 2025

Latest Posts

-

Los Angeles Wildfires And The Gambling Industry A Concerning Development

Apr 26, 2025

Los Angeles Wildfires And The Gambling Industry A Concerning Development

Apr 26, 2025 -

Wildfire Gambling Exploring The Ethics Of Betting On The La Fires

Apr 26, 2025

Wildfire Gambling Exploring The Ethics Of Betting On The La Fires

Apr 26, 2025 -

The Troubling Trend Of Betting On The Los Angeles Wildfires

Apr 26, 2025

The Troubling Trend Of Betting On The Los Angeles Wildfires

Apr 26, 2025 -

Is Betting On Natural Disasters Like The La Wildfires A Sign Of The Times

Apr 26, 2025

Is Betting On Natural Disasters Like The La Wildfires A Sign Of The Times

Apr 26, 2025 -

The China Factor How Market Dynamics Affect Luxury Car Brands Like Bmw And Porsche

Apr 26, 2025

The China Factor How Market Dynamics Affect Luxury Car Brands Like Bmw And Porsche

Apr 26, 2025