Stock Market Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Assessment of Current Market Conditions

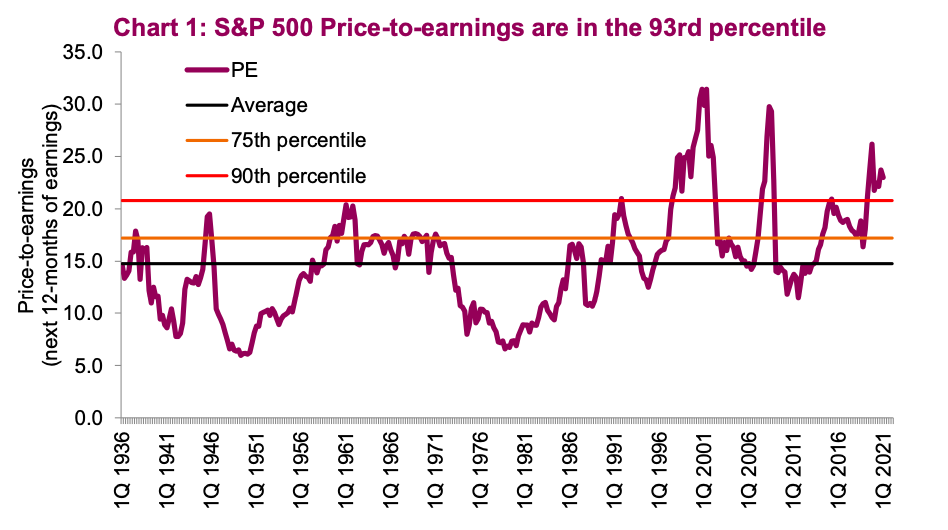

BofA's analysis of current market conditions considers several key factors influencing stock market valuations. Their assessment incorporates a multifaceted view, considering earnings growth, interest rate sensitivity, and inflationary pressures.

Earnings Growth and its Impact on Valuations

BofA's analysis highlights strong earnings growth in several key sectors as a primary support for current valuations. This robust performance suggests a healthy underlying economic foundation.

- Strong earnings growth in specific sectors: BofA's research points to particularly strong earnings growth in technology, healthcare, and certain consumer staples, outweighing weaker performances in other areas.

- Projected future earnings growth: Their analysts project continued, albeit moderated, earnings growth for the coming quarters, indicating sustained corporate profitability. While exact figures vary by sector, the overall trend remains positive.

- Comparison to historical earnings growth rates: When compared to historical averages, current earnings growth is considered robust, albeit not exceeding exceptional peaks seen in previous economic booms. This suggests a sustainable, rather than speculative, level of growth.

While specific data from BofA's internal reports may not be publicly accessible, their public statements consistently highlight this positive earnings trend as a key justification for their relatively optimistic outlook.

Interest Rate Sensitivity and its Influence

The impact of interest rate hikes on stock valuations is a significant concern for many investors. BofA acknowledges this sensitivity but offers a nuanced perspective.

- BofA's predicted interest rate trajectory: While acknowledging further interest rate increases, BofA's projections suggest a slowing pace of hikes in the near future, indicating a potential plateau. This slower pace should lessen the negative impact on stock valuations.

- Impact on bond yields and their correlation to stock market performance: BofA's analysis accounts for the relationship between rising bond yields and stock market performance. While higher yields can compete with stock returns, the projected moderation in rate hikes should limit this impact.

- Sectors most affected by interest rate changes: The report identifies sectors like real estate and utilities as being more sensitive to interest rate fluctuations. However, the overall impact on the broader market is expected to be manageable. BofA suggests diversification and potentially hedging strategies, such as incorporating bonds into a portfolio to mitigate the risks associated with interest rate changes.

Inflationary Pressures and their Effect on Valuations

Inflationary pressures remain a significant concern. BofA's assessment takes this into account, analyzing its impact on corporate profitability and investor sentiment.

- BofA's inflation projections: BofA's projections suggest a gradual decline in inflation over the coming year, although acknowledging potential for unexpected variations.

- How inflation affects corporate profitability and investor sentiment: While inflation erodes purchasing power and can increase costs for businesses, BofA anticipates that many companies can successfully manage these pressures through pricing strategies and efficiency improvements.

- Strategies for mitigating inflation risk: BofA emphasizes the importance of investing in companies with strong pricing power and a demonstrated ability to navigate inflationary environments. They also highlight the potential benefits of inflation-protected securities as a part of a diversified portfolio. Specific sectors, such as energy and materials, are considered potentially more resilient to inflationary pressures, while others might be more vulnerable.

BofA's Long-Term Outlook for Stock Market Growth

Despite acknowledging short-term challenges, BofA maintains a positive long-term outlook for stock market growth. This optimism rests on several key factors.

Factors Supporting Continued Growth

BofA's long-term optimism is driven by several underlying factors:

- Technological advancements and their impact on specific sectors: Innovation across multiple sectors— particularly technology, healthcare, and renewable energy— is expected to fuel long-term growth and create new investment opportunities.

- Growth in emerging markets: Expanding economies in developing nations represent a significant growth engine for global markets, offering opportunities for investors willing to accept higher levels of risk.

- Government policies promoting economic growth: Supportive government policies in various countries, including infrastructure investments and tax incentives, could stimulate further economic expansion and stock market growth. These positive factors, according to BofA, contribute to a sustained, albeit potentially volatile, growth trajectory.

Potential Risks and Mitigation Strategies

While BofA's outlook is positive, they acknowledge significant potential risks:

- Geopolitical risks: Geopolitical instability, including conflicts and trade tensions, could negatively impact global markets.

- Supply chain disruptions: Ongoing supply chain challenges can continue to disrupt businesses and affect profitability.

- Potential economic slowdowns: The possibility of a global or regional economic slowdown remains a significant risk factor. BofA advises investors to diversify their portfolios, monitor geopolitical developments carefully, and remain flexible in their investment strategies to navigate these potential risks.

Maintaining Calm Amidst Stock Market Valuations

BofA's analysis provides a framework for maintaining a calm perspective on current stock market valuations. Their assessment highlights strong earnings growth in several key sectors, projects a moderation in interest rate hikes, and anticipates a gradual decline in inflation. While acknowledging potential risks like geopolitical instability and supply chain disruptions, BofA emphasizes the importance of long-term growth prospects fueled by technological advancements and emerging market expansion. By understanding BofA's rationale and conducting thorough due diligence, investors can navigate the complexities of stock market valuations and make informed decisions to achieve their financial goals. Consult BofA's reports for more in-depth analysis and to develop a well-informed investment strategy based on their assessment of stock market valuations.

Featured Posts

-

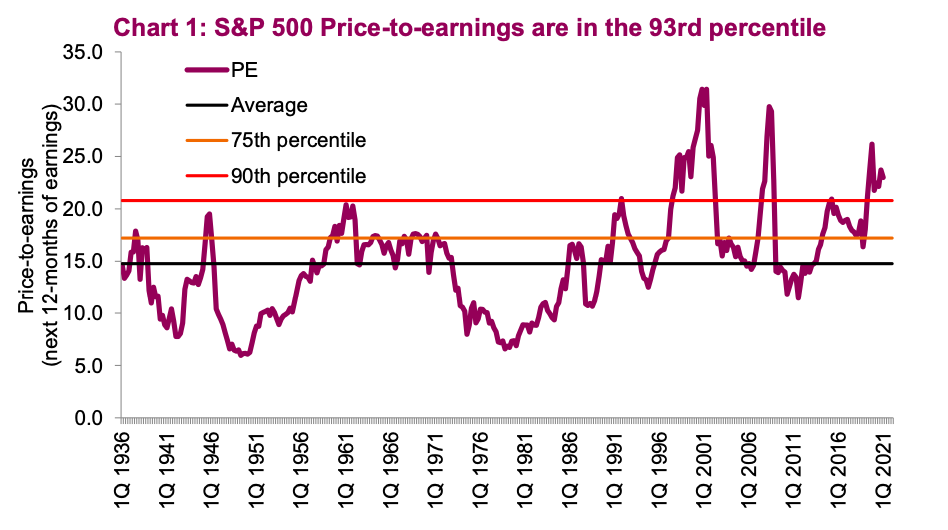

Massive Reddit Outage Thousands Of Users Affected Globally

May 18, 2025

Massive Reddit Outage Thousands Of Users Affected Globally

May 18, 2025 -

Alka Yagnk Asamh Bn Ladn Ky Fhrst Myn Phla Nam

May 18, 2025

Alka Yagnk Asamh Bn Ladn Ky Fhrst Myn Phla Nam

May 18, 2025 -

Dutch Public Opinion Opposition To Eu Retaliation Against Trump Tariffs

May 18, 2025

Dutch Public Opinion Opposition To Eu Retaliation Against Trump Tariffs

May 18, 2025 -

Wildfire Betting A Concerning Sign Of The Times In Los Angeles

May 18, 2025

Wildfire Betting A Concerning Sign Of The Times In Los Angeles

May 18, 2025 -

Trumps Middle East Visit A Shift In Regional Power Dynamics

May 18, 2025

Trumps Middle East Visit A Shift In Regional Power Dynamics

May 18, 2025

Latest Posts

-

Amanda Bynes Comeback A New Showbiz Project After 15 Years

May 18, 2025

Amanda Bynes Comeback A New Showbiz Project After 15 Years

May 18, 2025 -

Dodgers Defeat Mariners 6 4 Confortos Debut Home Run

May 18, 2025

Dodgers Defeat Mariners 6 4 Confortos Debut Home Run

May 18, 2025 -

Confortos First Dodgers Homer 6 4 Win Over Mariners

May 18, 2025

Confortos First Dodgers Homer 6 4 Win Over Mariners

May 18, 2025 -

Amanda Bynes Returns To The Public Eye With 50 Only Fans Subscription

May 18, 2025

Amanda Bynes Returns To The Public Eye With 50 Only Fans Subscription

May 18, 2025 -

Classmate Shares Account Of Amanda Bynes Past

May 18, 2025

Classmate Shares Account Of Amanda Bynes Past

May 18, 2025