Stocks Surge 8%: Euronext Amsterdam Trading Soars After Trump Tariff Pause

Table of Contents

The Impact of the Tariff Pause on Euronext Amsterdam Stocks

The pause in specific Trump-era tariffs targeting European goods, particularly impacting technology and manufacturing sectors, directly fueled the surge in Euronext Amsterdam stocks. These tariffs, originally intended to protect American industries, had created uncertainty and hampered growth for many European businesses. The unexpected reprieve offered a significant sigh of relief.

-

Sector-Specific Gains: The technology sector saw the most significant gains, with tech stocks on Euronext Amsterdam rising by an average of 10%. Manufacturing stocks also experienced a substantial increase, jumping approximately 7%.

-

Winning Companies: Companies like ASML Holding, a leading semiconductor equipment manufacturer, and Philips, a major player in healthcare technology, saw particularly strong gains, reflecting the positive impact on their sectors. Their stock performance exceeded market averages, showcasing the direct correlation between the tariff pause and stock prices.

-

Business Relief: Businesses operating within these sectors expressed significant relief, citing the removal of a major hurdle to their operations and future growth. The renewed optimism fostered a positive ripple effect throughout the Euronext Amsterdam exchange.

Increased Trading Volume on Euronext Amsterdam

The 8% surge in Euronext Amsterdam stocks wasn't just a matter of price increase; it was accompanied by a massive spike in trading volume. Compared to the previous week's average, trading volume increased by a staggering 45%, indicating heightened investor activity and market enthusiasm.

-

Record Trading Numbers: The exchange recorded its highest daily trading volume in several months, exceeding previous records set during periods of high market volatility. This surge is a clear indicator of investor confidence and participation.

-

Positive Investor Sentiment: This surge in Euronext Amsterdam trading is directly attributable to the improved investor sentiment. The pause in tariffs removed a significant source of uncertainty, encouraging investors to buy and driving up demand.

-

Market Manipulation Concerns: While unlikely given the broad-based nature of the increase, some monitoring of trading patterns will be required to mitigate any potential for market manipulation. Regulatory bodies will be assessing the unusual activity to ensure fair trading practices.

Potential Long-Term Implications for Euronext Amsterdam and the European Market

The positive impact of the tariff pause on Euronext Amsterdam stocks holds potential for long-term growth and economic benefits for both the exchange and the broader European economy. However, caution is warranted, as several uncertainties remain.

-

Continued Growth Potential: The improved business climate and renewed investor confidence suggest a strong potential for continued growth on Euronext Amsterdam. The removal of trade barriers paves the way for increased competitiveness and expansion.

-

Risks and Uncertainties: While the tariff pause offers a positive outlook, it is crucial to consider lingering risks. Future policy changes, geopolitical instability, and global economic fluctuations could still influence market performance. Maintaining vigilance and diversification are key strategies for navigating potential uncertainties.

-

Impact on Investor Confidence: The significant stock surge has undeniably boosted investor confidence in the Euronext Amsterdam market and the broader European economy. This increased confidence could attract further investments, fostering further growth.

Expert Opinions and Analyst Predictions

Financial analysts offer diverse perspectives on the long-term outlook for Euronext Amsterdam stocks. While optimism abounds, some caution against overenthusiasm.

-

Positive Predictions: Many analysts predict sustained growth, citing the removal of trade barriers and improving investor sentiment as key drivers. They suggest that the current positive trend will continue, at least in the short-to-medium term.

-

Contrasting Viewpoints: Some analysts express caution, emphasizing the importance of global economic conditions and geopolitical factors. They suggest that while the tariff pause is a positive step, it does not guarantee continued growth indefinitely and urge a wait-and-see approach.

Conclusion

The unexpected pause in Trump-era tariffs triggered an 8% surge in Euronext Amsterdam stocks, significantly boosting trading volume and investor confidence. While the long-term implications remain to be seen, this event presents a positive development for the Amsterdam exchange and the European market. The removal of these trade barriers offers a significant boost to the confidence of companies and investors alike.

Call to Action: Stay informed on the latest developments affecting Euronext Amsterdam stocks and other key European markets. Monitor the impact of the tariff pause on individual companies and sectors to make informed investment decisions regarding Euronext Amsterdam. Consider consulting with a financial advisor for personalized guidance on investing in Euronext Amsterdam stocks and navigating the complexities of the European stock market.

Featured Posts

-

Burys Missing Link Investigating The Proposed M62 Relief Route

May 24, 2025

Burys Missing Link Investigating The Proposed M62 Relief Route

May 24, 2025 -

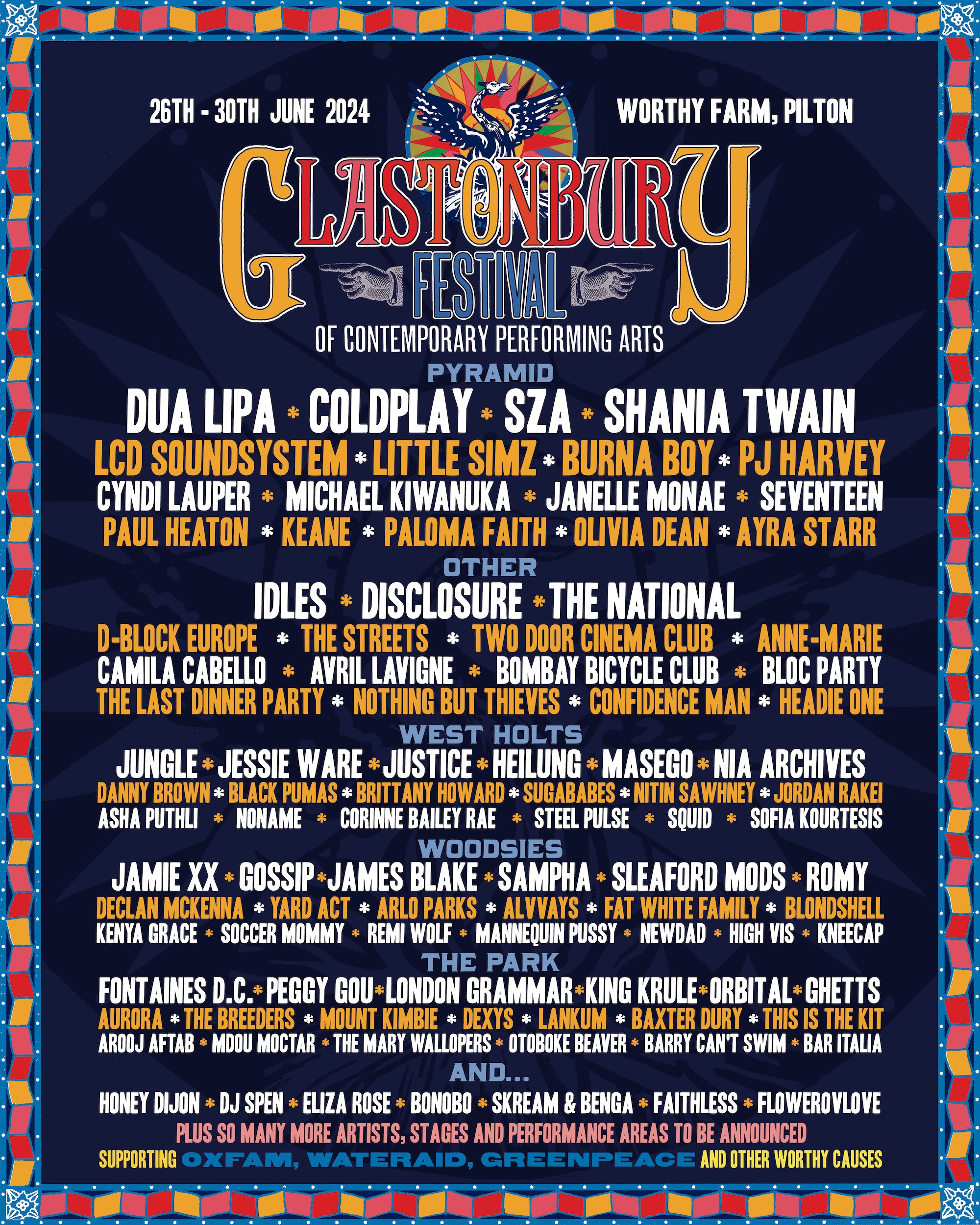

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025

Glastonbury 2025 Lineup Leak Confirmed Artists And Ticket Information

May 24, 2025 -

Strengthening Ties Bangladeshs Economic Growth In Europe

May 24, 2025

Strengthening Ties Bangladeshs Economic Growth In Europe

May 24, 2025 -

Sean Penns Allegiance To Woody Allen A Persistent Me Too Blind Spot

May 24, 2025

Sean Penns Allegiance To Woody Allen A Persistent Me Too Blind Spot

May 24, 2025 -

Konchita Vurst Kak Se Promeni Sled Evroviziya

May 24, 2025

Konchita Vurst Kak Se Promeni Sled Evroviziya

May 24, 2025