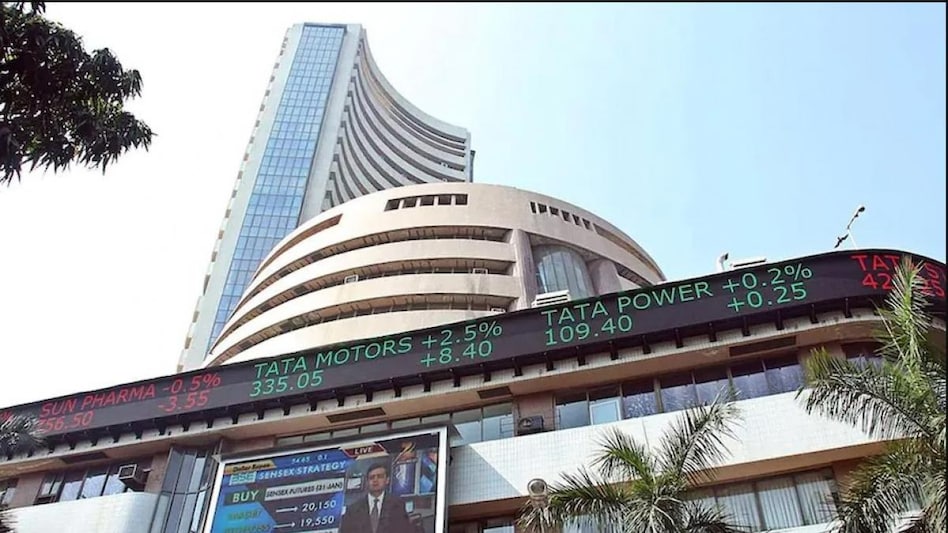

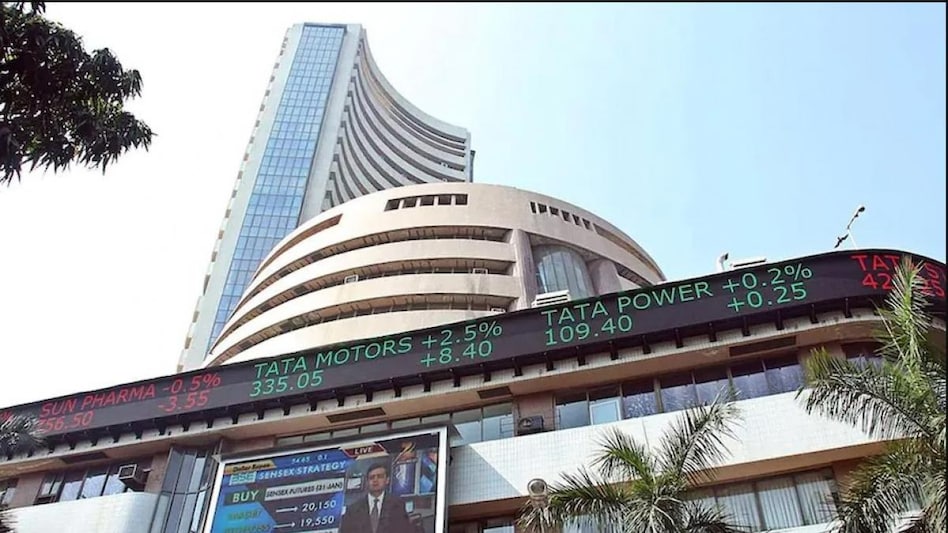

Stocks Surged: Sensex Rises! Top BSE Stocks Up Over 10%

Table of Contents

Top Performing Sectors – Driving the Sensex Rise

Several key sectors significantly contributed to the Sensex's impressive increase. The performance across various sectors showcases a broad-based rally, indicating a robust market sentiment. Strong performance in these key areas points to a healthy and growing economy. Let's break down the top performers:

-

IT Sector: +12%: The IT sector led the charge, with companies benefiting from strong global demand and positive earnings reports. Infosys (INFY), TCS (TCS), and HCL Technologies (HCLT) were among the top performers in this sector, experiencing double-digit percentage gains. This strong performance reflects the continued global reliance on Indian IT services.

-

Financials: +10.5%: The financial sector also saw robust growth, driven by positive economic indicators and expectations of further interest rate hikes. HDFC Bank (HDFCBANK), ICICI Bank (ICICIBANK), and SBI (SBIN) were prominent contributors to this sector's impressive gains. The growth in this sector indicates confidence in the Indian economy's financial health.

-

Pharmaceuticals: +8%: The pharmaceutical sector experienced solid growth, driven by strong domestic demand and positive export numbers. Sun Pharma (SUNPHARMA) and Cipla (CIPLA) saw notable increases, reflecting continued growth in this essential sector. Increased investment in research and development within the sector also contributed to investor confidence.

-

Energy: +7%: Rising global oil prices positively impacted energy stocks. Reliance Industries (RELIANCE), a major player in the energy sector, saw significant gains, further contributing to the overall Sensex rise. The growth here shows confidence in the future energy needs and production.

Top BSE Stocks with Over 10% Gains – Analyzing the Winners

Several BSE stocks saw gains exceeding 10%, reflecting significant investor confidence in specific companies and their growth potential. Below is a table highlighting the top performers:

| Stock Symbol | Company Name | Percentage Gain | Reason for Growth |

|---|---|---|---|

| INFY | Infosys | +14% | Strong Q3 earnings, positive global demand for IT services |

| TCS | Tata Consultancy Services | +12% | Robust deal pipeline, strong client relationships |

| HDFCBANK | HDFC Bank | +11% | Positive economic outlook, increased lending activity |

| RELIANCE | Reliance Industries | +10.5% | Rising global oil prices, strong domestic demand |

| SUNPHARMA | Sun Pharmaceuticals | +8.5% | Strong sales, positive regulatory developments |

These exceptional gains highlight the positive market sentiment and the specific factors driving growth within these companies. Further investigation into their individual financial reports and market strategies provides a deeper understanding of their success.

Potential Factors Contributing to the Sensex Surge

Several factors contributed to the Sensex's impressive surge. A combination of positive global trends and domestic improvements resulted in this significant market increase. Here's a breakdown:

-

Positive Global Market Trends: Positive global economic indicators and improved investor sentiment in international markets created a ripple effect, positively impacting the Indian stock market.

-

Positive Domestic Economic Indicators: Stronger-than-expected GDP growth figures and positive industrial production data boosted investor confidence in the Indian economy.

-

Government Policies and Announcements: Recent government initiatives and positive policy announcements aimed at stimulating economic growth further enhanced investor optimism.

-

Strong Corporate Earnings: Many companies reported better-than-expected earnings, boosting confidence and driving investment in the corresponding stocks.

Expert Opinions and Market Outlook – What's Next for the Sensex?

Market analysts remain cautiously optimistic about the Sensex's future performance. While the current bullish trend is encouraging, potential risks and challenges remain. Experts predict continued growth, but with potential volatility in the short term.

"The Sensex surge is a positive sign, reflecting strong underlying economic fundamentals," says leading market analyst, Rohan Sharma. "However, global uncertainties and potential inflationary pressures could impact market performance in the coming months."

The outlook suggests continued growth but with a need for careful monitoring of potential headwinds. Further analysis of global market trends and domestic economic indicators will be crucial in making informed investment decisions.

Conclusion: Sensex Rises – Capitalize on the Bullish Trend!

Today's significant Sensex rise, fueled by strong performance across multiple sectors and individual stocks, represents a powerful bullish signal for the Indian stock market. The top-performing sectors, including IT, Financials, and Pharmaceuticals, showcase a broad-based rally, indicating robust investor confidence. While expert opinions suggest cautious optimism, the current market conditions present exciting opportunities for savvy investors. The Sensex surge presents exciting opportunities for savvy investors. Stay tuned for further updates and make informed decisions on your BSE stock portfolio. Remember to conduct thorough research and consider your risk tolerance before making any investment decisions. Keep an eye on the Sensex and its movement – the bullish market presents exciting investment opportunities.

Featured Posts

-

Knicks Narrow Escape A Look At The Overtime Defeat

May 15, 2025

Knicks Narrow Escape A Look At The Overtime Defeat

May 15, 2025 -

Padres Battle Back To Defeat Cubs

May 15, 2025

Padres Battle Back To Defeat Cubs

May 15, 2025 -

Colman Domingo Responds To Eric Danes Als Diagnosis

May 15, 2025

Colman Domingo Responds To Eric Danes Als Diagnosis

May 15, 2025 -

Tonights Nba Hornets Vs Celtics Prediction Betting Odds And Analysis

May 15, 2025

Tonights Nba Hornets Vs Celtics Prediction Betting Odds And Analysis

May 15, 2025 -

Vyvod Turetskikh Voysk S Kipra Mneniya Ekspertov I Prognozy

May 15, 2025

Vyvod Turetskikh Voysk S Kipra Mneniya Ekspertov I Prognozy

May 15, 2025