Student Loans And Homeownership: A Realistic Look At Your Options

Table of Contents

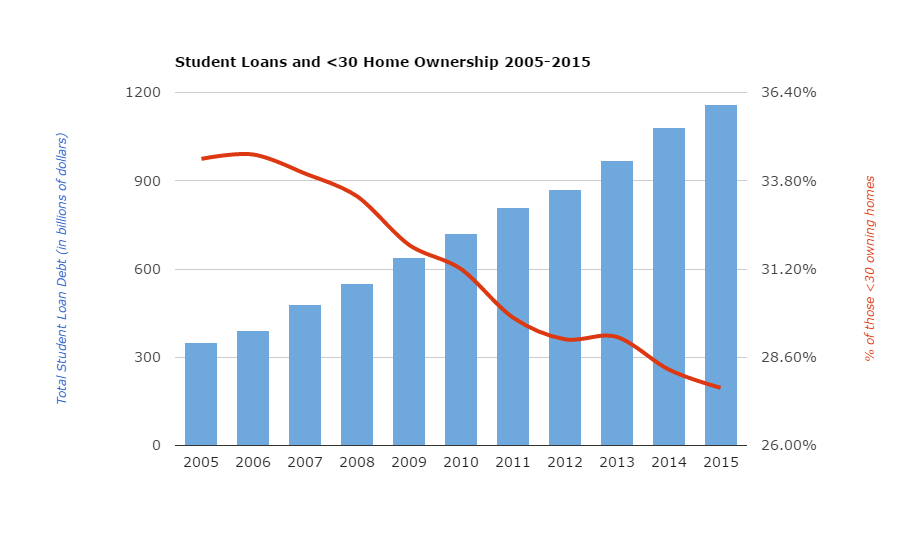

Understanding Your Financial Landscape

Before you even begin dreaming of a mortgage, it's crucial to gain a clear understanding of your current financial situation. This involves assessing both your student loan debt and your homeownership affordability.

Assessing Your Student Loan Debt

Understanding your student loan debt is the first critical step. This means knowing more than just the total amount you owe.

- Types of Student Loans: Identify whether your loans are federal (backed by the government) or private (issued by banks or other lenders). Federal loans often offer more flexible repayment options.

- Interest Rates: Knowing your interest rates is vital for determining your total repayment cost. Higher interest rates mean you'll pay significantly more over the life of your loan.

- Repayment Plans: Familiarize yourself with different repayment plans. Standard plans have fixed payments over a set period, while income-driven repayment plans adjust your monthly payments based on your income.

- Loan Forgiveness Programs: Explore potential loan forgiveness programs, such as those for public service or teachers. These programs can significantly reduce your overall debt burden.

Understanding your total debt amount, monthly payments, and the overall impact on your budget is paramount. Tools like the National Student Loan Data System (NSLDS) at can help you consolidate your information and track your progress.

Calculating Your Homeownership Affordability

Once you have a grasp on your student loan debt, you need to realistically assess your ability to afford a home. Several crucial factors influence your affordability:

- Down Payment: A larger down payment reduces your loan amount and monthly mortgage payments, but saving for a substantial down payment can take time, especially while managing student loans.

- Closing Costs: These upfront costs associated with buying a home can add thousands of dollars to your initial expenses.

- Property Taxes and Insurance: These ongoing costs add to your monthly housing expenses, impacting your overall budget.

- Mortgage Interest Rates: Current interest rates significantly influence your monthly payments and the total cost of your mortgage.

- Debt-to-Income Ratio (DTI): Lenders carefully assess your DTI, which compares your monthly debt payments (including student loans) to your gross monthly income. A high DTI can make it difficult to qualify for a mortgage.

- Credit Score: Your credit score is a crucial factor in determining your eligibility for a mortgage and the interest rate you'll receive. Student loan payments impact both your DTI and credit score.

Using online mortgage calculators can help you estimate your potential monthly payments and determine a realistic budget for homeownership. Remember, your student loan payments directly affect your DTI and credit score, influencing your mortgage approval and interest rates.

Strategies for Balancing Student Loans and Homeownership

Successfully navigating student loans and homeownership requires a strategic approach. Here are some key strategies to consider:

Prioritizing Debt Reduction

Before diving into homeownership, aggressively tackling your student loan debt can significantly improve your financial position.

- Aggressive Repayment Strategies: Explore the snowball method (paying off smallest debts first) or the avalanche method (paying off highest-interest debts first).

- Refinancing Options: Refinancing your student loans could lower your interest rate, reducing your monthly payments and accelerating debt repayment.

- Loan Forgiveness Programs: If eligible, maximizing loan forgiveness programs can significantly decrease your overall debt.

Reducing your student loan debt before pursuing homeownership will strengthen your financial standing and improve your chances of mortgage approval at a favorable interest rate. A strong financial plan is essential for success.

Exploring Homeownership Options

Even with student loan debt, homeownership is achievable with careful planning. Consider these options:

- Saving for a Larger Down Payment: Though challenging, saving for a larger down payment will significantly reduce your monthly mortgage payments and make homeownership more manageable.

- Government-Backed Loans: FHA and VA loans often require lower down payments and more lenient credit requirements, making them more accessible to borrowers with student loan debt.

- Lower-Cost Housing Options: Consider smaller homes, different locations (areas with lower property prices), or alternative housing types to reduce your overall housing costs.

Carefully weigh the pros and cons of different mortgage types, such as fixed-rate versus adjustable-rate mortgages, to determine the best fit for your financial situation.

Seeking Professional Guidance

Navigating the complexities of student loans and homeownership is often best done with professional support.

- Financial Advisor: A financial advisor can help you create a comprehensive financial plan that addresses both your student loan debt and your homeownership goals.

- Mortgage Lender: A mortgage lender can guide you through the mortgage application process and help you find the most suitable loan for your needs.

- Free Credit Counseling Services: These services can provide valuable guidance on managing your debt and improving your credit score.

Making Homeownership a Reality Despite Student Loans

Understanding your financial situation, developing a strategic plan for debt reduction, and exploring various homeownership options are crucial steps in achieving your homeownership dreams despite student loan debt. Successfully balancing student loans and homeownership requires careful planning, discipline, and potentially, professional guidance. Start planning your path to homeownership today by understanding your student loan situation and exploring the strategies outlined in this article.

Featured Posts

-

Cung Nhanh Ban Ket Miami Open 2025 Djokovic Doi Dau Alcaraz

May 17, 2025

Cung Nhanh Ban Ket Miami Open 2025 Djokovic Doi Dau Alcaraz

May 17, 2025 -

Privatizing Federal Student Loans A Look At Trumps Potential Plan

May 17, 2025

Privatizing Federal Student Loans A Look At Trumps Potential Plan

May 17, 2025 -

Heavy Rare Earths Revolution Lynas Emerges As A Key Global Player

May 17, 2025

Heavy Rare Earths Revolution Lynas Emerges As A Key Global Player

May 17, 2025 -

Josh Cavallo Breaking Barriers After Coming Out

May 17, 2025

Josh Cavallo Breaking Barriers After Coming Out

May 17, 2025 -

Nestle And Shell Reject Musks Boycott Claims Advertisers Respond

May 17, 2025

Nestle And Shell Reject Musks Boycott Claims Advertisers Respond

May 17, 2025

Latest Posts

-

Rockwell Automation Beats Earnings Expectations A Detailed Analysis

May 17, 2025

Rockwell Automation Beats Earnings Expectations A Detailed Analysis

May 17, 2025 -

Stock Market Update Rockwell Automation Leads Positive Earnings Reports

May 17, 2025

Stock Market Update Rockwell Automation Leads Positive Earnings Reports

May 17, 2025 -

Absence Of Brunson Knicks Vulnerability Laid Bare

May 17, 2025

Absence Of Brunson Knicks Vulnerability Laid Bare

May 17, 2025 -

The Jalen Brunson Injury Knicks Face Crucial Roster Decisions

May 17, 2025

The Jalen Brunson Injury Knicks Face Crucial Roster Decisions

May 17, 2025 -

Jalen Brunsons Injury Exposes Knicks Biggest Weakness

May 17, 2025

Jalen Brunsons Injury Exposes Knicks Biggest Weakness

May 17, 2025