Support For Sustainable Growth: Funding Options For SMEs

Table of Contents

What are SMEs and Sustainable Growth?

For the purposes of this article, SMEs are defined as independent businesses with a relatively small number of employees and limited turnover. Sustainable growth, in this context, refers to business expansion that considers the long-term environmental, social, and economic impacts. It means building a profitable business while minimizing negative externalities and contributing positively to society.

1. Government Grants and Subsidies for Sustainable Initiatives

Governments worldwide recognize the crucial role SMEs play in economic growth and environmental sustainability. Many offer grants and subsidies specifically designed to incentivize sustainable practices. These programs aim to support the adoption of green technologies, energy efficiency improvements, and waste reduction strategies.

-

Examples: In the UK, the Green Business Grants Scheme provides funding for energy-efficient upgrades. Similar schemes exist in other countries; for example, the US offers various grants through the Environmental Protection Agency (EPA) and the Department of Energy (DOE). Searching for "[Your Country] Green Business Grants" will yield relevant results.

-

Eligibility Criteria: Eligibility often involves factors such as business size, location, the type of sustainable project, and the projected environmental impact.

-

Application Processes: Applications typically involve a detailed proposal outlining the project's goals, budget, and expected outcomes. Timelines vary depending on the specific grant program.

-

Funded Projects: Typical projects include renewable energy installations (solar panels, wind turbines), energy audits, waste management system improvements, and the adoption of sustainable supply chains.

-

Benefits and Drawbacks: Government funding can provide significant financial assistance, but it's often highly competitive and subject to strict guidelines and reporting requirements.

2. Green Loans and Sustainable Finance from Banks

Traditional business loans aren't always the best fit for sustainable initiatives. Increasingly, banks are offering green loans and other tailored financial products with attractive terms for SMEs focused on sustainability.

-

Examples: Many major banks now offer green loan programs with lower interest rates or other incentives. Look for banks promoting "green financing" or "sustainable business loans" in your area.

-

Financed Projects: These loans often fund projects directly related to environmental sustainability, such as energy efficiency improvements, renewable energy installations, and sustainable waste management systems.

-

Sustainability Strategy: Demonstrating a clear and well-defined sustainability strategy is crucial for securing these loans. Lenders want to see a plan for long-term environmental and social responsibility.

-

Comparison: Green loans often boast lower interest rates and more favorable terms compared to traditional business loans, reflecting the reduced risk associated with environmentally responsible businesses.

3. Impact Investing and Venture Capital for Sustainable SMEs

Impact investors and venture capitalists are increasingly seeking opportunities to fund sustainable and socially responsible businesses. They invest not only for financial returns but also for positive social and environmental impact.

-

Identifying Impact Investors: Research organizations and funds specializing in sustainable investments within your sector (renewable energy, sustainable agriculture, etc.).

-

Due Diligence: The due diligence process is rigorous and often involves assessing the environmental and social impact alongside financial performance.

-

Potential Benefits: Securing impact investment can lead to higher valuations and faster growth, as these investors often provide more than just capital; they offer valuable mentorship and networks.

-

Challenges: Attracting impact investment requires a compelling narrative demonstrating both financial viability and significant positive impact.

4. Crowdfunding Platforms for Sustainable Projects

Crowdfunding offers a unique way for SMEs to access funding by directly engaging with their customers and potential supporters. This approach builds brand loyalty and generates valuable market feedback.

-

Platform Types: Explore platforms offering rewards-based crowdfunding (backers receive products or services in return) or equity-based crowdfunding (backers receive a stake in the company).

-

Successful Campaigns: A successful campaign requires a well-defined project, a compelling narrative, and a strong marketing and outreach strategy.

-

Marketing: Utilizing social media, email marketing, and public relations is vital to reach a broad audience and generate excitement.

-

Limitations: Crowdfunding campaigns can be time-consuming and require significant effort to manage effectively. Success isn't guaranteed.

5. Internal Financing and Bootstrapping Strategies

Before seeking external funding, explore internal financing options through efficient cost management and revenue generation techniques. Strong financial planning is crucial for success.

-

Improving Efficiency: Identify areas to streamline operations, reduce waste, and improve productivity.

-

Revenue Generation: Explore innovative ways to increase revenue streams and improve profitability.

-

Financial Planning: Develop a detailed financial plan outlining projected revenues, expenses, and funding requirements.

-

Challenges: Bootstrapping requires discipline, strong financial management, and a willingness to forgo rapid growth for long-term sustainability.

Securing Your Path to Sustainable Growth: Finding the Right SME Funding

This article has highlighted several key funding options available to SMEs pursuing sustainable growth. The best approach depends on your specific circumstances, the type of project, and your business stage. Remember, a comprehensive sustainability strategy is essential for attracting investors and securing funding. Develop a clear plan demonstrating your commitment to environmental and social responsibility.

Start exploring the diverse funding options for sustainable growth available to SMEs today. Find the right fit for your business and embark on your journey to a sustainable and successful future! Consider exploring options in SME sustainable finance, sustainable SME funding, and green financing for SMEs to find the best solution for your unique needs.

Featured Posts

-

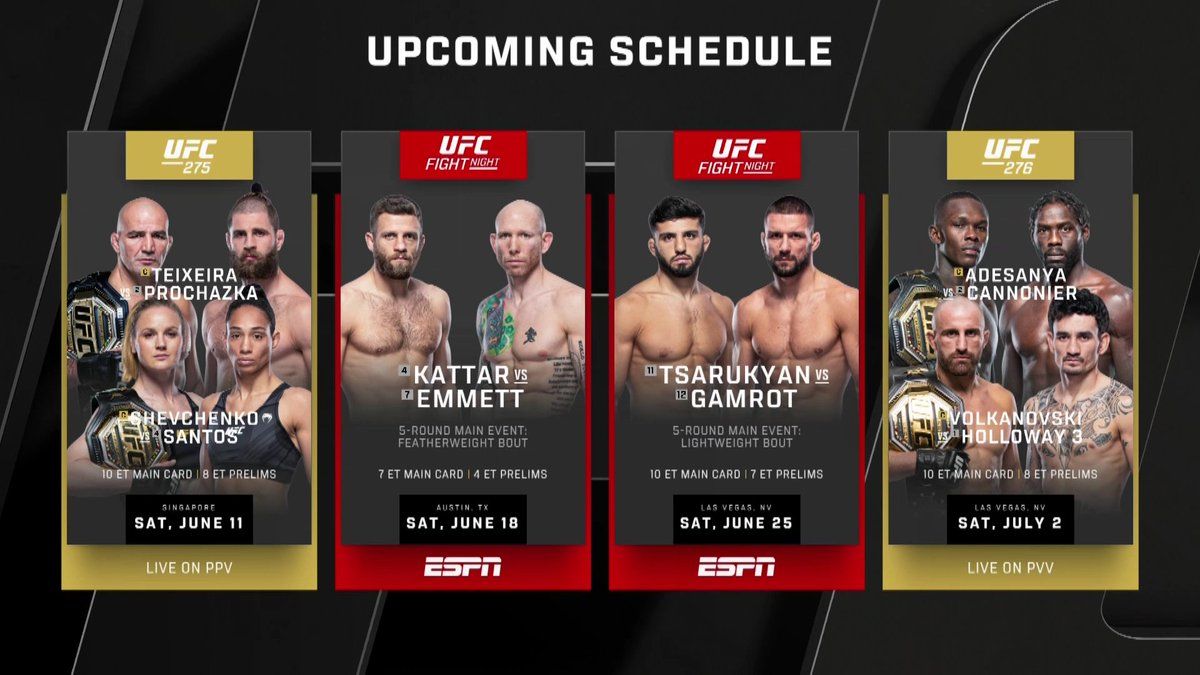

Get The Lowdown Ufc Vegas 106 Fight Card Date Time And Location For Burns Vs Morales

May 19, 2025

Get The Lowdown Ufc Vegas 106 Fight Card Date Time And Location For Burns Vs Morales

May 19, 2025 -

Preserving A Tradition The Jersey Battle Of Flowers

May 19, 2025

Preserving A Tradition The Jersey Battle Of Flowers

May 19, 2025 -

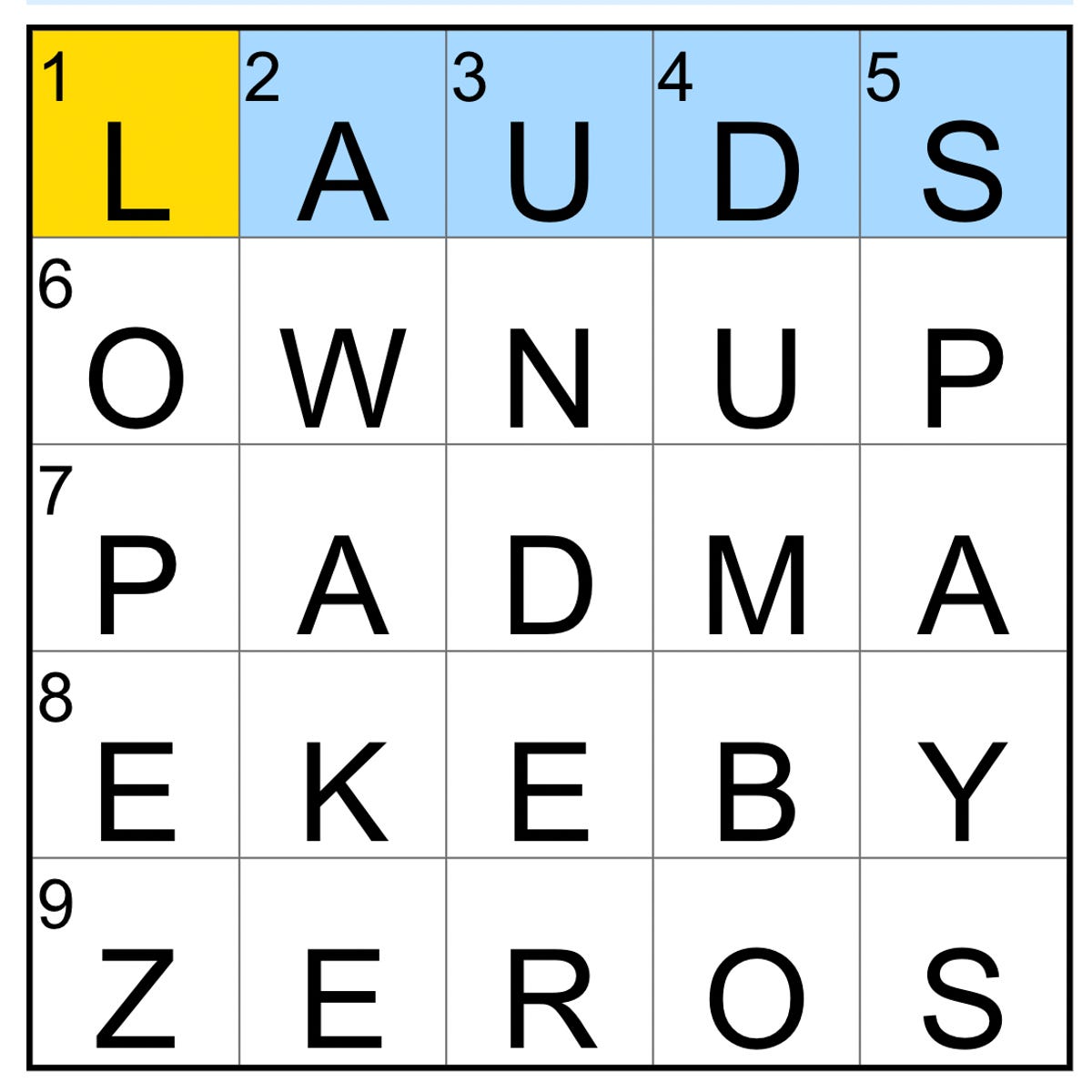

Nyt Mini Crossword Solutions For March 26 2025

May 19, 2025

Nyt Mini Crossword Solutions For March 26 2025

May 19, 2025 -

Ana Paola Hall Defiende La Independencia Y Colegiado Del Cne

May 19, 2025

Ana Paola Hall Defiende La Independencia Y Colegiado Del Cne

May 19, 2025 -

The Far Right Challenge Comparing Macrons And Merzs Approaches

May 19, 2025

The Far Right Challenge Comparing Macrons And Merzs Approaches

May 19, 2025

Latest Posts

-

Chinas Impact On Luxury Car Brands Bmw Porsche And Beyond

May 19, 2025

Chinas Impact On Luxury Car Brands Bmw Porsche And Beyond

May 19, 2025 -

Bmw And Porsches China Challenges A Growing Trend

May 19, 2025

Bmw And Porsches China Challenges A Growing Trend

May 19, 2025 -

Canada Defends Tariff Stance Against Oxford Report Criticism

May 19, 2025

Canada Defends Tariff Stance Against Oxford Report Criticism

May 19, 2025 -

Indias Defense Concerns Over Chinas Satellite Support To Pakistan

May 19, 2025

Indias Defense Concerns Over Chinas Satellite Support To Pakistan

May 19, 2025 -

Los Angeles Wildfires Exploring The Ethics Of Disaster Based Gambling

May 19, 2025

Los Angeles Wildfires Exploring The Ethics Of Disaster Based Gambling

May 19, 2025