Tariff Troubles? Why Microsoft Stock Offers Stability

Table of Contents

Microsoft's Diversified Revenue Streams Reduce Tariff Risk

One of the key reasons why Microsoft stock offers resilience against tariff troubles is its remarkable revenue diversification. Unlike companies heavily reliant on a single product or sector vulnerable to tariffs, Microsoft boasts a diverse portfolio of offerings. This diversification acts as a powerful buffer against the negative impacts of trade protectionism.

- Cloud computing (Azure): Microsoft's cloud computing platform, Azure, is less susceptible to tariffs than hardware manufacturing. Azure's global infrastructure and service-based model mean it's not as directly impacted by import/export duties as physical goods. This contributes significantly to stable revenue streams.

- Software subscriptions (Office 365, etc.): The recurring revenue model of software subscriptions provides consistent income, insulating Microsoft from the short-term shocks affecting companies reliant on one-time sales. This stable revenue stream is a major factor in Microsoft's overall financial stability.

- Global reach: Microsoft operates globally, diversifying its revenue streams across numerous markets. This geographical diversification minimizes the impact of tariffs imposed by any single country. If one region experiences economic downturn, other regions can compensate.

- Gaming (Xbox): The gaming sector, though subject to some hardware-related tariff considerations, still benefits from a strong digital ecosystem and recurring revenue from subscriptions and in-game purchases. This diversification further strengthens Microsoft’s overall revenue stability.

- Windows and other products: While hardware sales can be affected by tariffs, the sheer scale and long-term adoption of Windows ensure continuing revenue, which is further bolstered by licensing and support agreements.

This diversified approach to revenue generation is a critical component of Microsoft’s tariff mitigation strategy, making it a strong investment choice during periods of economic instability.

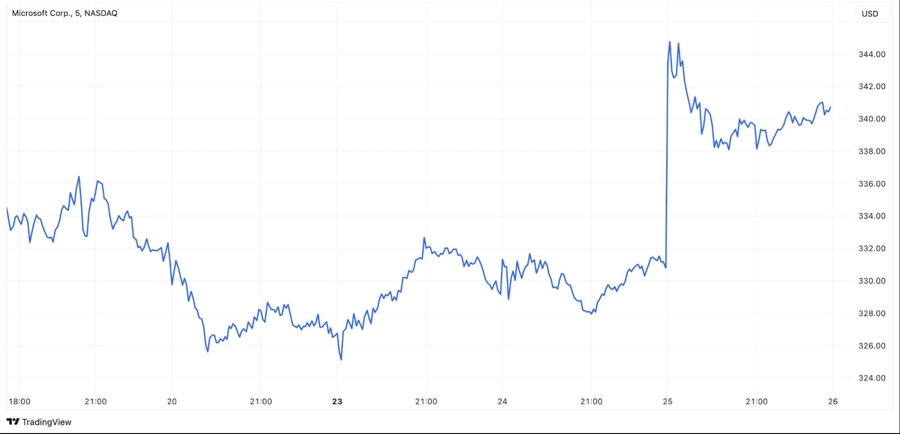

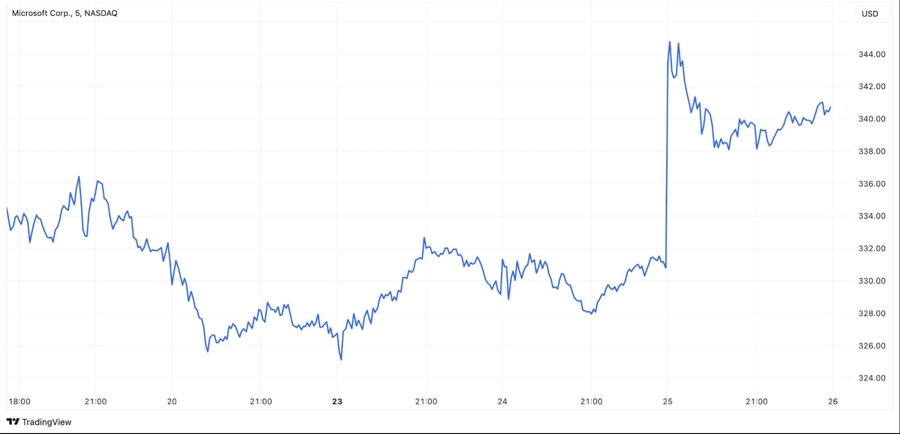

Strong Financial Performance and Consistent Growth Despite Global Headwinds

Microsoft consistently demonstrates strong financial performance and consistent growth, even amidst global economic headwinds. This stability is a testament to its robust business model and ability to adapt to changing market conditions.

- Year-over-year revenue growth: Microsoft has shown consistent year-over-year revenue growth for several consecutive years, indicating a healthy and expanding business. (Specific data can be inserted here from a reliable financial source).

- Profitability margins: Microsoft maintains impressive profitability margins, showcasing its efficiency and ability to generate substantial profits. (Include relevant data here).

- Strong cash flow: Microsoft's strong cash flow provides a significant buffer against economic downturns, allowing it to invest in R&D, acquisitions, and shareholder returns even during challenging times.

- Positive analyst ratings: Major financial analysts consistently rate Microsoft stock favorably, reflecting confidence in its future growth potential. (Cite analyst reports or ratings here).

This combination of financial stability, consistent growth, and positive market outlook contributes to making Microsoft stock an attractive investment option during times of tariff troubles and overall economic uncertainty.

Microsoft's Position as a Tech Leader Provides a Competitive Advantage

Microsoft’s dominant position in several key technology sectors provides it with a significant competitive advantage, driving sustained market share and long-term growth potential. This leadership position translates directly into enhanced investment stability.

- Market leadership in cloud computing (Azure): Microsoft's Azure platform is a major competitor in the rapidly growing cloud computing market, giving it access to vast revenue streams that are relatively immune to the traditional impact of tariffs on physical goods.

- Strong position in productivity software (Office 365): Microsoft's dominance in productivity software ensures a steady flow of revenue from subscriptions and licenses. This established market leadership is a crucial component of its sustained profitability.

- Continued investments in R&D and innovation: Microsoft's ongoing commitment to research and development positions it to remain at the forefront of technological innovation, creating new revenue streams and maintaining its competitive edge. This continuous innovation further protects its position against competitors.

- Competitive advantages over other tech companies: Microsoft's diversified portfolio, established brand recognition, and strong financial position give it a substantial competitive advantage over many other technology companies, thus lessening its vulnerability to market fluctuations and global events.

This entrenched leadership position within the technology sector is a key factor that enhances investment stability.

Long-Term Investment Strategy: Microsoft Stock as a Safe Haven

Microsoft stock is an excellent choice for long-term investors seeking stability during periods of economic uncertainty. A long-term investment strategy, such as a buy-and-hold approach, can mitigate the impact of short-term market fluctuations.

- Advantages of buy-and-hold strategy: A buy-and-hold approach with Microsoft stock allows investors to benefit from its long-term growth trajectory, minimizing the impact of short-term market volatility.

- Historical performance: Microsoft's historical performance demonstrates sustained long-term growth, indicating its resilience even during previous economic downturns. (Include historical data here to support the claim).

- Risk mitigation strategies: Diversifying your investment portfolio, including Microsoft stock as one component, can significantly mitigate the overall risk associated with tariff uncertainty and other market factors.

- Comparison to other investment options: Compared to other investment options more heavily exposed to tariff risks, Microsoft stock offers a relatively stable and resilient investment opportunity.

By adopting a long-term perspective, investors can potentially harness the growth potential of Microsoft stock while minimizing the negative impacts of short-term economic anxieties.

Conclusion: Navigating Tariff Troubles with Microsoft Stock

In conclusion, Microsoft stock presents a compelling investment opportunity for those seeking stability during periods of tariff troubles and economic uncertainty. Its diversified revenue streams, strong financial performance, and leading position in the technology sector combine to create a resilient investment profile. The long-term growth potential of Microsoft, coupled with its inherent stability, makes it an attractive addition to any diversified investment portfolio. Invest in Microsoft stock today to mitigate tariff risk and secure your portfolio with Microsoft's stability. Consider Microsoft stock as part of your strategy for navigating the complexities of the global economy.

Featured Posts

-

A Potential Kevin Durant Trade To Boston Its Impact On The Nba Landscape

May 15, 2025

A Potential Kevin Durant Trade To Boston Its Impact On The Nba Landscape

May 15, 2025 -

Did Warrens Defense Of Bidens Mental Health Fail

May 15, 2025

Did Warrens Defense Of Bidens Mental Health Fail

May 15, 2025 -

2023 2024 Los Angeles Dodgers Offseason What To Expect

May 15, 2025

2023 2024 Los Angeles Dodgers Offseason What To Expect

May 15, 2025 -

Apa De La Robinet Avertisment Pentru Consumatorii Romani Pericole Si Solutii

May 15, 2025

Apa De La Robinet Avertisment Pentru Consumatorii Romani Pericole Si Solutii

May 15, 2025 -

Jiskefet Ere Zilveren Nipkowschijf Na 20 Jaar

May 15, 2025

Jiskefet Ere Zilveren Nipkowschijf Na 20 Jaar

May 15, 2025