The Bond Market Crisis: What Investors Should Be Watching

Table of Contents

Rising Interest Rates and Their Impact on Bond Yields

The inverse relationship between interest rates and bond prices is a fundamental principle of finance. When interest rates rise, the yields on newly issued bonds increase, making existing bonds with lower yields less attractive. This leads to a decline in the price of existing bonds to match the higher yields available in the market. The Federal Reserve's (Fed) monetary policy plays a crucial role in this dynamic. The Fed's recent aggressive interest rate hikes, aimed at combating inflation, have significantly impacted bond yields across the board.

This impact varies across different bond types. Government bonds, generally considered safer investments, have experienced price declines, although the extent varies depending on the maturity of the bond. Corporate bonds, which carry higher credit risk, are even more vulnerable to rising interest rates, as investors demand higher yields to compensate for increased risk.

- Higher interest rates lead to lower bond prices. This is a direct consequence of the inverse relationship.

- Increased risk of capital losses for bondholders. Holding bonds during periods of rising interest rates can result in substantial capital losses.

- Potential for higher yields on newly issued bonds. While existing bond prices fall, new bonds offer higher yields reflecting current interest rate levels.

- Impact on bond duration and interest rate risk. Longer-duration bonds are more sensitive to interest rate changes, experiencing greater price fluctuations than shorter-duration bonds.

Inflation's Role in the Bond Market Crisis

High inflation significantly erodes the purchasing power of fixed-income investments like bonds. When inflation rises, the real return on a bond – the return after accounting for inflation – diminishes. This leads investors to demand higher yields to compensate for the loss of purchasing power. Inflation expectations also directly influence bond yields; higher inflation expectations translate into higher bond yields. The impact of inflation extends to real interest rates, which represent the nominal interest rate minus the inflation rate. Negative real interest rates indicate that the return on bonds is less than the rate of inflation.

- Inflation reduces the real return on bonds. High inflation diminishes the value of future bond payments.

- Central banks' responses to inflation influence bond market performance. Aggressive monetary policy tightening to combat inflation can trigger a bond market crisis.

- Impact of inflation on different bond maturities. Longer-maturity bonds are generally more sensitive to inflation expectations.

- The importance of inflation-protected securities (TIPS). TIPS are designed to protect investors from inflation, offering a hedge against rising prices.

Geopolitical Risks and Their Influence on Bond Markets

Global events, such as wars, political instability, and trade disputes, significantly impact investor sentiment and bond prices. During times of uncertainty, investors often seek the safety of government bonds, leading to a "flight-to-safety" phenomenon. This increased demand for safe-haven assets pushes down the yields on government bonds, while yields on riskier assets like corporate bonds tend to rise. Credit risk in corporate bonds increases during geopolitical uncertainty, as the ability of companies to meet their debt obligations becomes more uncertain.

- Increased uncertainty leads to higher demand for safe-haven assets (e.g., U.S. Treasury bonds). This drives down yields on these assets.

- Potential for increased volatility in emerging market bonds. Emerging markets are particularly vulnerable to geopolitical shocks.

- Impact on global bond market correlations. Geopolitical events can increase correlations between different bond markets globally.

- The role of diversification in mitigating geopolitical risk. Diversifying across different bond markets and asset classes can reduce exposure to geopolitical risks.

Assessing Credit Risk and Default Probabilities

Credit ratings play a crucial role in determining the yield and risk associated with bonds. Higher credit ratings indicate lower default risk, leading to lower yields. However, in the current economic climate, several factors contribute to increased credit risk. Rising interest rates, high inflation, and geopolitical uncertainty can strain the finances of corporations, increasing the likelihood of defaults.

- Importance of due diligence in assessing creditworthiness. Thorough research is vital before investing in any bond.

- Strategies for managing credit risk in a bond portfolio. Diversification, shorter-maturity bonds, and credit default swaps are some strategies.

- The role of credit default swaps (CDS) in hedging credit risk. CDS can help mitigate losses in the event of a bond default.

- Impact of corporate governance and financial health on bond ratings. Strong corporate governance and robust financial health are crucial for maintaining high credit ratings.

Conclusion: Navigating the Bond Market Crisis

The current bond market crisis is a complex issue driven by a confluence of factors: rising interest rates, persistent inflation, escalating geopolitical risks, and increased credit risk. Monitoring these factors closely is paramount for investors. To navigate this challenging environment, diversification across different bond types and asset classes is essential. Careful due diligence in assessing creditworthiness is also crucial. Investors may need to adjust their bond portfolio strategies based on their risk tolerance and investment objectives. Understanding the complexities of the bond market crisis is crucial for investors. Stay informed and adapt your strategies to navigate this challenging environment. Consult with a financial professional for personalized advice on managing your bond investments during this period of uncertainty.

Featured Posts

-

Cuaca Bandung 22 April Perkiraan Hujan Siang Dan Kondisi Cuaca

May 29, 2025

Cuaca Bandung 22 April Perkiraan Hujan Siang Dan Kondisi Cuaca

May 29, 2025 -

League Of Legends Lore Changes After Arcane Analyzing The 2 Xko Impact

May 29, 2025

League Of Legends Lore Changes After Arcane Analyzing The 2 Xko Impact

May 29, 2025 -

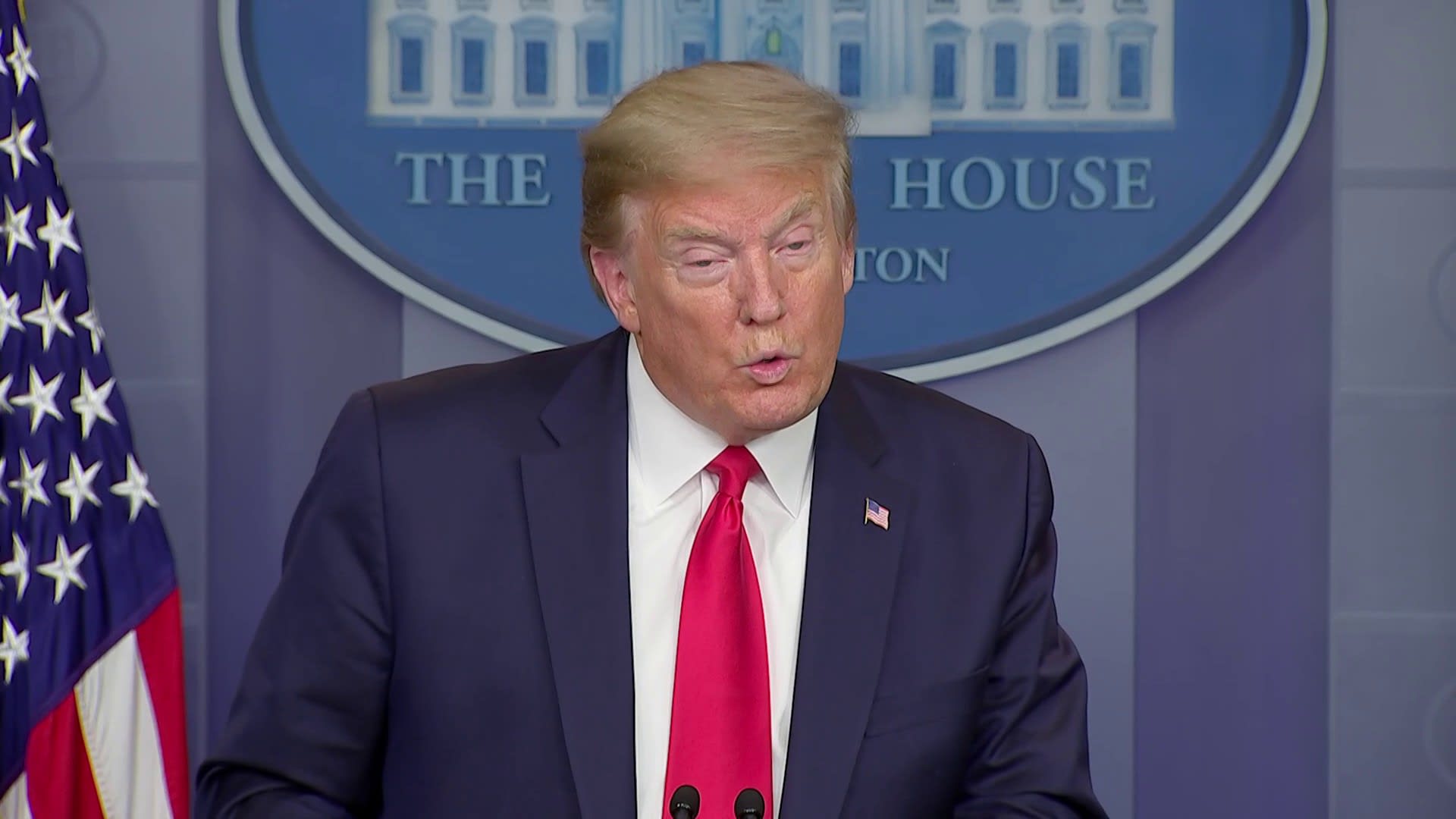

The Trump Administrations Plan To Eliminate Harvards Federal Contracts

May 29, 2025

The Trump Administrations Plan To Eliminate Harvards Federal Contracts

May 29, 2025 -

Anfield Charity Match Full Liverpool Legends Squad Revealed

May 29, 2025

Anfield Charity Match Full Liverpool Legends Squad Revealed

May 29, 2025 -

Anfield Bound Real Madrid Starlet Nears Liverpool Transfer

May 29, 2025

Anfield Bound Real Madrid Starlet Nears Liverpool Transfer

May 29, 2025