The ECB On Inflation: The Continuing Role Of Pandemic-Era Fiscal Support

Table of Contents

The Pandemic's Fiscal Response and its Inflationary Pressures

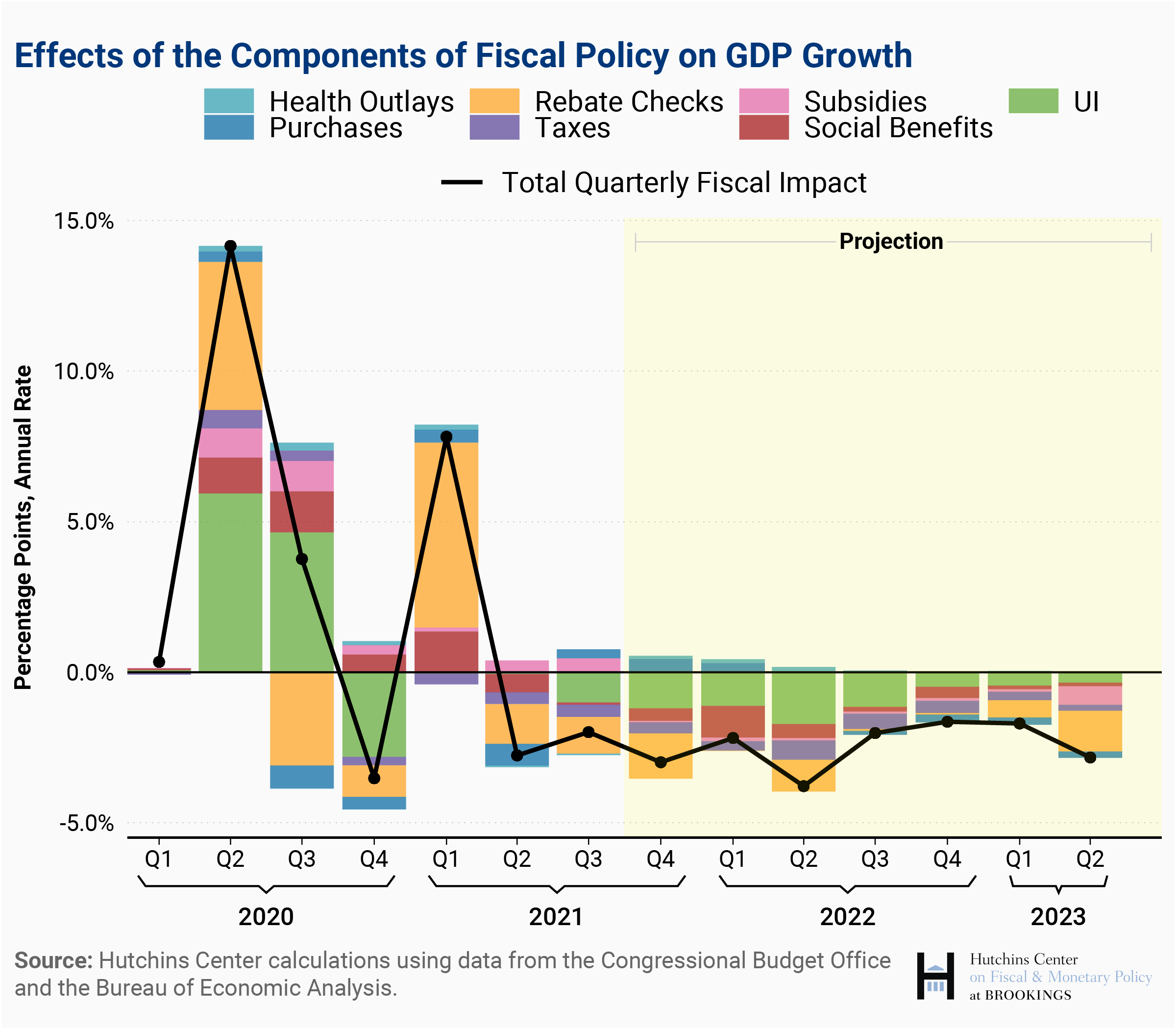

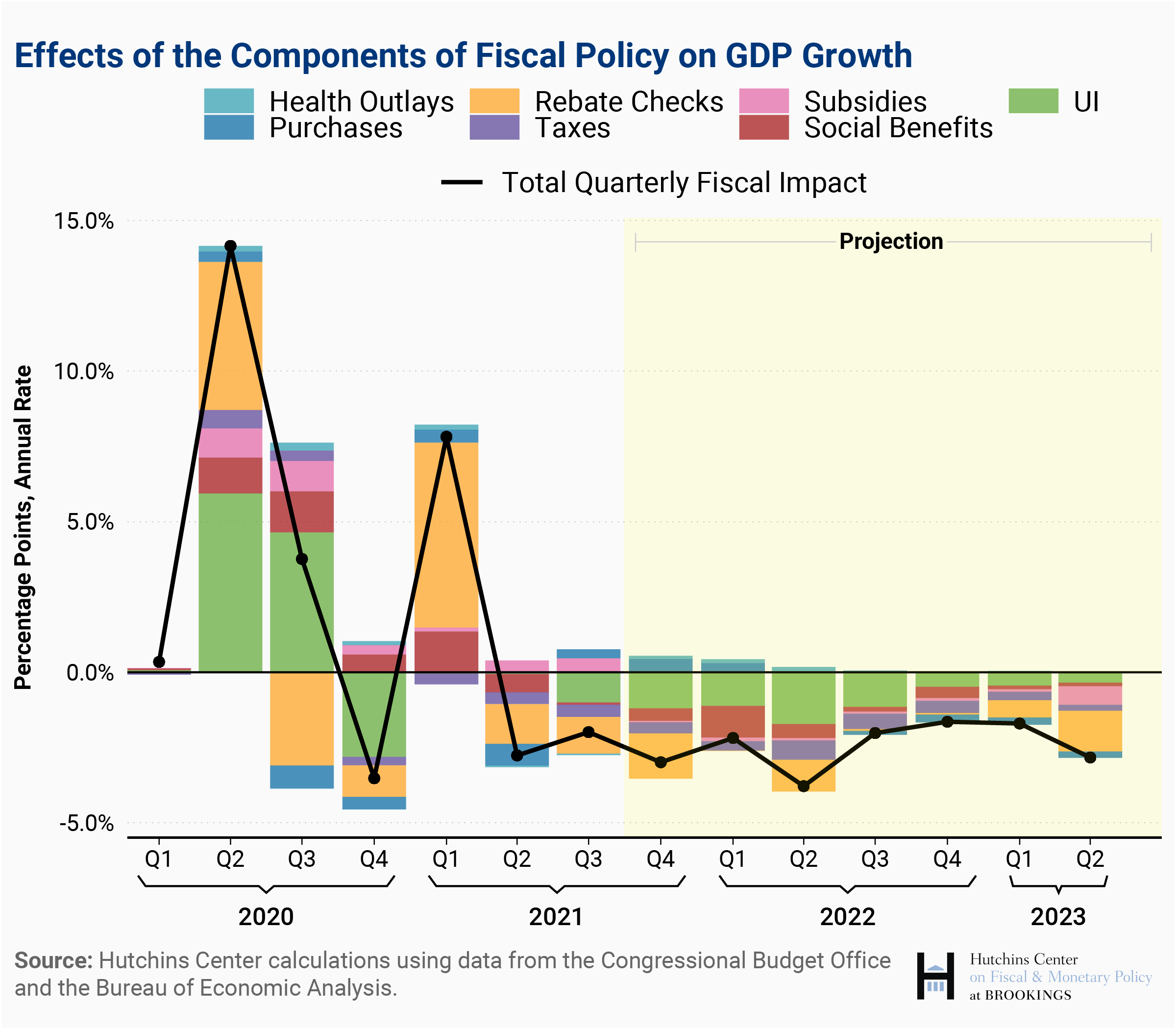

The COVID-19 pandemic triggered an unprecedented fiscal response across the Eurozone. Governments implemented massive stimulus packages aimed at mitigating the economic fallout. These measures, while necessary to prevent a deeper recession, have had significant inflationary consequences.

-

Massive Government Spending Programs: Countries across the Eurozone deployed substantial funds through various channels, including direct cash transfers to citizens, support for businesses (furlough schemes, loan guarantees), and increased healthcare spending. This injection of liquidity into the economy fueled aggregate demand.

-

Increased Money Supply: The scale of government spending led to a significant increase in the money supply. This expansionary monetary policy, while intended to support economic activity, also contributed to inflationary pressures. Direct transfers, in particular, boosted consumer spending.

-

Supply Chain Disruptions: The pandemic severely disrupted global supply chains, leading to shortages of goods and increased production costs. This cost-push inflation added to the already existing demand-pull inflation, creating a double whammy for prices.

-

Surge in Consumer Demand: As lockdowns eased and economies reopened, pent-up consumer demand surged, further fueling demand-pull inflation. Consumers, flush with savings accumulated during lockdowns and supported by government aid, increased spending on goods and services.

Analyzing the relative contributions of demand-side and supply-side factors to inflation remains a complex undertaking for economists. However, it's clear both played a significant role in the Eurozone's inflationary pressures. The interplay between these factors is central to understanding the ECB's response.

The ECB's Monetary Policy Response to Inflation

The ECB's primary mandate is to maintain price stability in the Eurozone. In response to rising inflation, the ECB has shifted from an extremely accommodative monetary policy to a more restrictive stance.

-

ECB's Mandate and Inflation Targets: The ECB aims to keep inflation at 2% over the medium term. The sharp rise in inflation above this target necessitated a change in policy.

-

Gradual Monetary Tightening: The ECB has gradually increased interest rates to curb inflation. These rate hikes aim to reduce borrowing costs and cool down the economy, thereby reducing demand-pull inflationary pressures.

-

Quantitative Easing (QE) Reduction: The ECB has also significantly reduced or ceased its asset purchase programs (quantitative easing), a key component of its accommodative monetary policy during the pandemic. This reduction aims to decrease the money supply.

-

Balancing Inflation Control and Economic Growth: The ECB faces the challenge of balancing inflation control with the need to avoid triggering a sharp economic slowdown. Finding the optimal path requires careful consideration of the potential trade-offs.

The Interaction Between Fiscal and Monetary Policy

The relationship between fiscal and monetary policy is crucial in managing inflation. In the Eurozone, this relationship has become particularly complex due to the legacy of pandemic-era fiscal support.

-

Coordination Challenges: Coordinating fiscal and monetary policies presents significant challenges, particularly when governments pursue expansionary fiscal policies while the central bank aims to control inflation.

-

Potential for Policy Conflict: The ECB's inflation targets might conflict with governments' fiscal goals of stimulating economic growth. This can lead to tension and necessitate careful policy coordination.

-

High Government Debt Levels: High levels of government debt, accumulated during the pandemic, constrain the ECB's policy options. High debt levels can increase government borrowing costs, further complicating the situation.

-

Risk of Fiscal Dominance: There's a risk of fiscal dominance, where fiscal policy overrides monetary policy objectives. This scenario can undermine the ECB's ability to maintain price stability.

Achieving both price stability and sustainable economic growth requires a careful balance between fiscal consolidation and maintaining adequate economic stimulus.

The Outlook for Inflation and the ECB's Future Actions

Predicting the future path of inflation and the ECB's actions remains uncertain, but several factors are key:

-

ECB Inflation Projections: The ECB regularly publishes inflation projections, providing insights into its assessment of future inflationary pressures.

-

Persistence of Inflationary Pressures: The persistence of supply chain disruptions and the strength of consumer demand will heavily influence future inflation.

-

Future Interest Rate Adjustments: The ECB's future interest rate decisions will depend on its assessment of inflation and economic growth.

-

Economic Growth and Geopolitical Risks: Uncertainties surrounding economic growth, geopolitical risks, and energy prices add to the complexity of the situation.

The ECB remains committed to maintaining price stability, but the path ahead involves significant challenges. The legacy of pandemic-era fiscal support continues to shape the ECB's response to inflation.

Conclusion

The ECB's response to inflation, heavily influenced by the legacy of pandemic-era fiscal support, represents a delicate balancing act. Understanding the lingering impacts of these fiscal measures is crucial for grasping the ECB's current monetary policy decisions and anticipating future actions. While the ECB is committed to maintaining price stability, navigating the complex interactions between fiscal and monetary policies presents a considerable challenge. Staying informed about the ECB's ongoing assessment of inflation and its implications for the Eurozone economy is vital. Continue to follow updates on the ECB's stance on inflation and the impact of pandemic-era fiscal support to make informed decisions related to investment and economic forecasting. Understanding the ECB's actions on inflation is key to navigating the current economic climate.

Featured Posts

-

Papal Conclave Debate Over Convicted Cardinals Vote

Apr 29, 2025

Papal Conclave Debate Over Convicted Cardinals Vote

Apr 29, 2025 -

Willie Nelsons Outlaw Music Festival Bob Dylan And Billy Strings In Portland

Apr 29, 2025

Willie Nelsons Outlaw Music Festival Bob Dylan And Billy Strings In Portland

Apr 29, 2025 -

Major Market Withdrawal Pw C Leaves 12 Countries Following Scrutiny

Apr 29, 2025

Major Market Withdrawal Pw C Leaves 12 Countries Following Scrutiny

Apr 29, 2025 -

British Paralympian Missing Las Vegas Police Seek Publics Help

Apr 29, 2025

British Paralympian Missing Las Vegas Police Seek Publics Help

Apr 29, 2025 -

Trump To Pardon Pete Rose Examining The Implications For Baseball And Sports Betting

Apr 29, 2025

Trump To Pardon Pete Rose Examining The Implications For Baseball And Sports Betting

Apr 29, 2025