The Impact Of Buffett's Retirement On Berkshire Hathaway's Apple Holdings

Table of Contents

Berkshire Hathaway's Apple Investment Before Buffett's Retirement

The Scale of the Investment

Berkshire Hathaway's Apple investment is monumental. It's not just a significant holding; it's a cornerstone of Berkshire's portfolio. Let's look at some key figures:

- Early Investments: Berkshire Hathaway began acquiring Apple stock in 2016, gradually increasing its position over the years.

- Portfolio Percentage: At its peak, Apple represented a substantial percentage (over 40%) of Berkshire Hathaway's overall equity portfolio.

- Market Value: The sheer market value of Berkshire's Apple holdings has fluctuated with the stock price, reaching tens of billions of dollars at various points. This makes Berkshire Hathaway one of the largest, if not the largest, Apple shareholder. This “Berkshire Hathaway Apple stake” is a testament to Buffett's faith in the company.

This "Warren Buffett Apple investment" wasn't a whim; it was a strategic move reflecting a deep understanding of Apple's business model.

Buffett's Investment Philosophy and Apple's Alignment

Buffett is famously known for his value investing philosophy, focusing on companies with strong fundamentals, consistent profitability, and enduring competitive advantages. Apple, with its robust brand loyalty, innovative products, and massive cash reserves, perfectly aligned with this strategy.

- Strong Fundamentals: Apple consistently delivers impressive earnings and cash flow.

- Consistent Profitability: Apple has maintained strong profitability over many years, demonstrating its resilience.

- Long-Term Holding Strategy: Buffett's approach to investment emphasizes long-term growth rather than short-term gains, making Apple a perfect fit for his “buy and hold” strategy.

The synergy between Buffett's "investment strategy" and Apple's "business model" made this investment a resounding success.

The Succession Plan and its Implications for Apple Holdings

The Role of Greg Abel and Ajit Jain

The succession plan at Berkshire Hathaway rests largely on Greg Abel and Ajit Jain, two long-time executives with diverse experience. Their investment approaches, while informed by Buffett's legacy, might differ subtly.

- Greg Abel: Known for his operational expertise, Abel's investment decisions might lean towards operational efficiency and potential synergies with other Berkshire Hathaway holdings.

- Ajit Jain: With a background in insurance, Jain might bring a more risk-averse approach to investments, potentially impacting the Berkshire Hathaway Apple stake.

- Differences from Buffett: While both individuals respect Buffett's legacy, their individual investment philosophies could lead to variations in investment strategies concerning Apple. The "impact on Apple holdings" remains to be seen.

The "Berkshire Hathaway succession plan" will inevitably shape the future of its Apple holdings.

Potential Scenarios for Apple Stock After the Transition

Several scenarios could unfold after the transition:

- Maintaining the Current Position: Berkshire Hathaway might decide to maintain its current substantial holding in Apple, recognizing its long-term value.

- Partial Divestment: A partial sale of Apple shares could be considered to diversify the portfolio and potentially free up capital for other investments.

- Further Investment: Depending on market conditions and Apple's performance, Berkshire might even increase its Apple holdings.

The “future of Berkshire Hathaway Apple” depends on various factors, including the prevailing economic climate and the leadership's risk appetite.

Market Reaction and Investor Sentiment

Analyzing the Market's Response

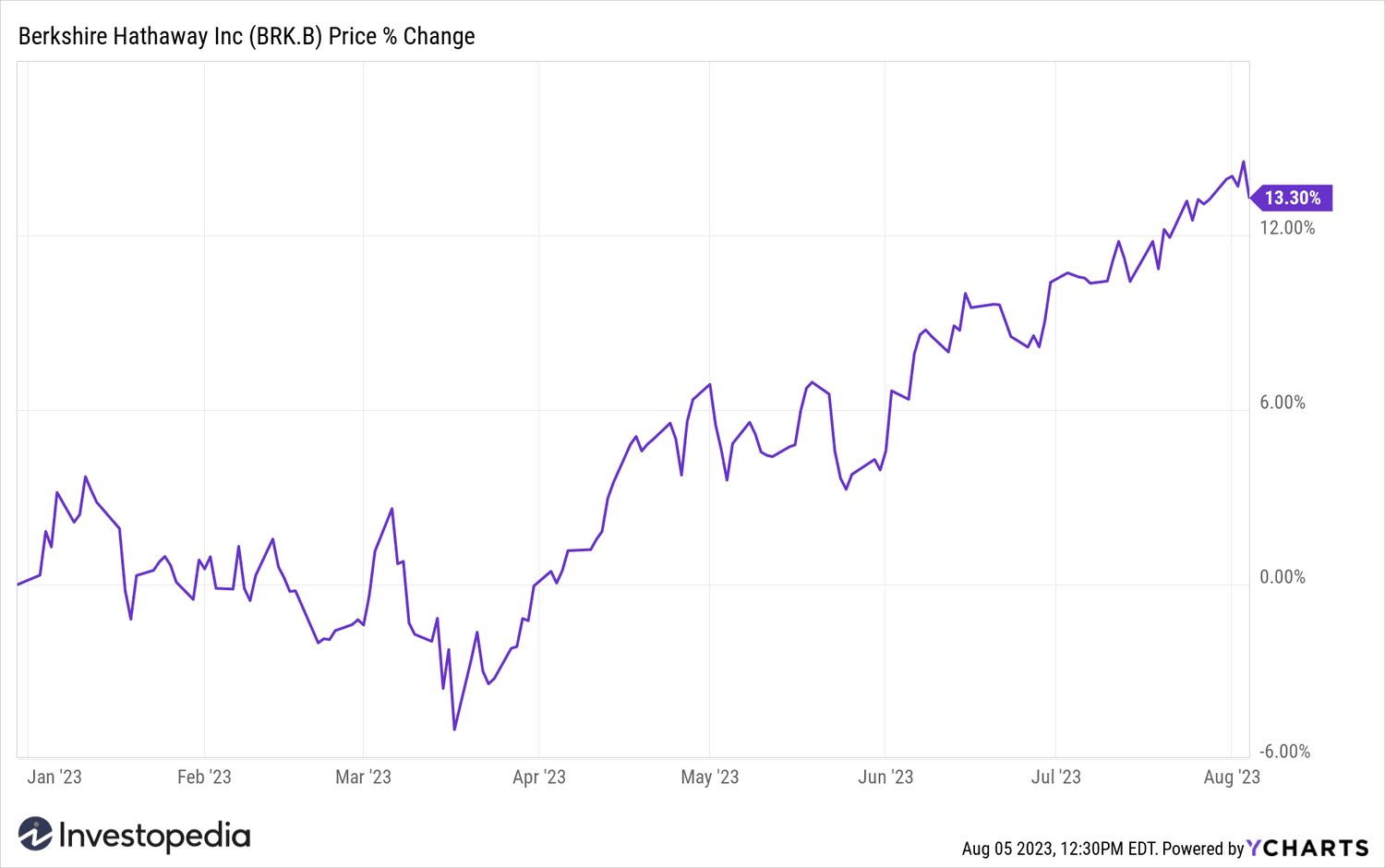

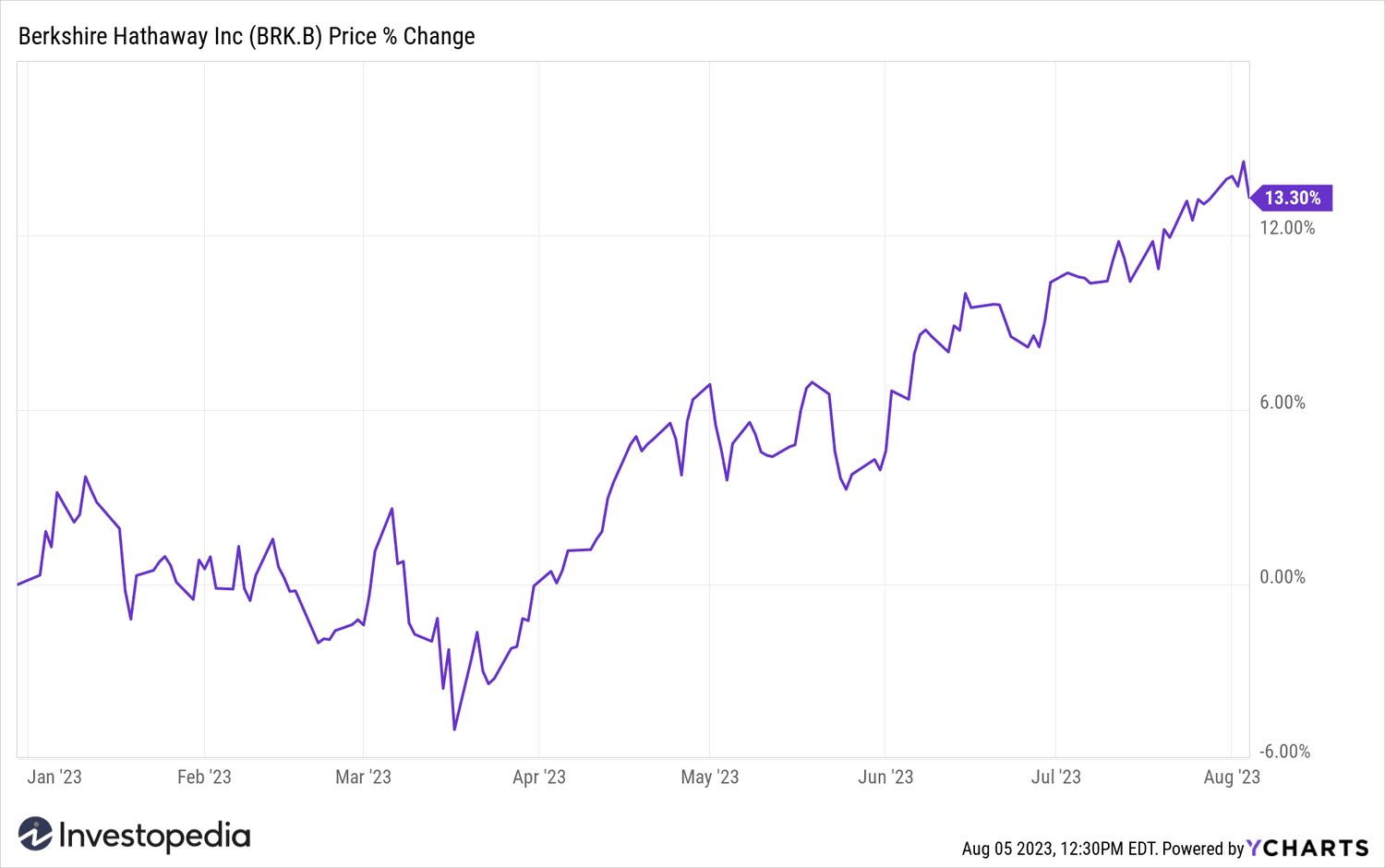

News of Buffett's retirement initially caused some market uncertainty. However, the impact on Apple's stock price has been relatively muted.

- Apple Stock Price: While there have been fluctuations, Apple's stock price has generally remained resilient.

- Investor Commentary: Most analysts believe Apple's long-term prospects remain strong, regardless of changes in Berkshire Hathaway's management.

- Analyst Reports: Many reports suggest that the core fundamentals driving Apple's success remain intact.

The “market reaction to Buffett’s retirement” has been relatively calm, highlighting the confidence in Apple's long-term potential.

Long-Term Outlook for Apple and Berkshire Hathaway

The long-term outlook for both Apple and Berkshire Hathaway remains positive, despite the upcoming leadership transition.

- Apple's Future Growth: Apple continues to innovate and expand into new markets, suggesting sustained growth potential.

- Berkshire Hathaway's Future: Berkshire Hathaway's diverse portfolio and experienced management team ensure its continued success, even with a change in leadership.

- Long-Term Stock Performance: Both companies are expected to maintain strong long-term stock performance, albeit potentially with some adjustments in investment strategy.

The "long-term investment outlook" for both companies is optimistic.

Conclusion: The Future of Berkshire Hathaway's Apple Holdings Post-Buffett

The transition at Berkshire Hathaway will undoubtedly influence the company's Apple holdings, yet the core strength of the Apple investment, rooted in strong fundamentals, will likely endure. The potential scenarios – maintaining, divesting, or expanding the holdings – depend on the decisions made by the new leadership, market conditions, and Apple's future performance. The impact of Buffett's retirement on Berkshire Hathaway's Apple investment remains a topic of intense interest. To delve deeper, explore resources on Berkshire Hathaway's investment philosophy, Apple's financial reports, and analyses on the succession plan. Understanding the "future of Berkshire Hathaway's Apple holdings after Buffett" will require continuous monitoring of these factors. Warren Buffett’s legacy will undoubtedly continue to shape the investment landscape for years to come.

Featured Posts

-

Us Dutch Trade Tensions Weigh Heavily On Dutch Stock Performance

May 25, 2025

Us Dutch Trade Tensions Weigh Heavily On Dutch Stock Performance

May 25, 2025 -

Carlos Alcaraz And Aryna Sabalenka Begin Italian Open With Victories

May 25, 2025

Carlos Alcaraz And Aryna Sabalenka Begin Italian Open With Victories

May 25, 2025 -

Jenson Button Back In The 2009 Brawn A Champions Return

May 25, 2025

Jenson Button Back In The 2009 Brawn A Champions Return

May 25, 2025 -

Kharkovschina Svadebniy Rekord Bolee 600 Brakov Za Mesyats

May 25, 2025

Kharkovschina Svadebniy Rekord Bolee 600 Brakov Za Mesyats

May 25, 2025 -

Naomi Campbell Met Gala Ban Truth Behind The Anna Wintour Feud

May 25, 2025

Naomi Campbell Met Gala Ban Truth Behind The Anna Wintour Feud

May 25, 2025