The Impact Of US Tariffs On Shein's London Stock Market Debut

Table of Contents

Shein's Business Model and US Tariff Vulnerability

Shein's business model, built on a foundation of ultra-fast fashion, relies heavily on efficient, global supply chains. This strategy, which enables the company to offer trendy clothing at incredibly low prices, makes it particularly vulnerable to US tariffs. The majority of Shein's products are manufactured in China, and a significant portion of its sales target the US market. This reliance on Chinese manufacturing creates a direct exposure to the ongoing trade tensions between the US and China.

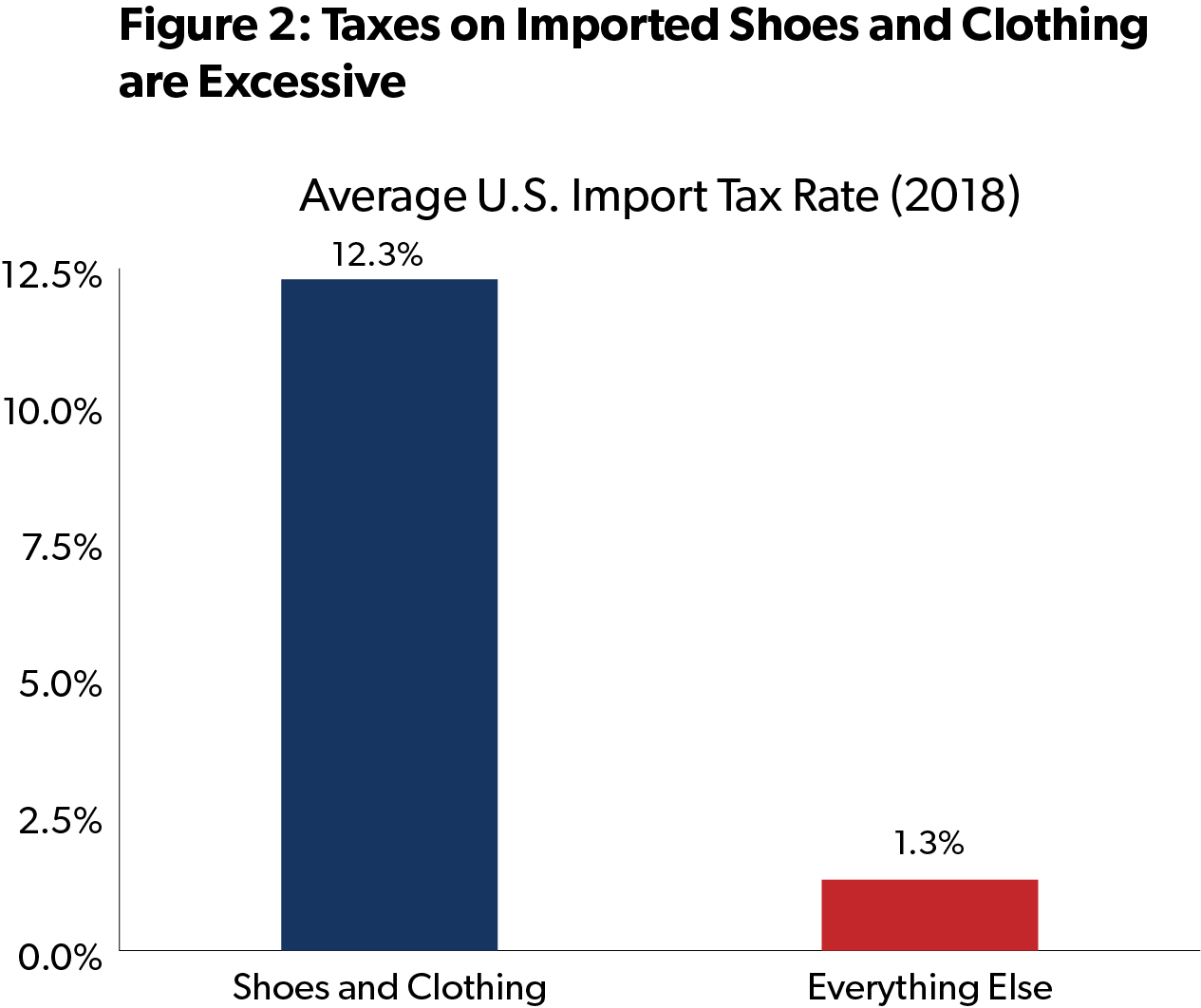

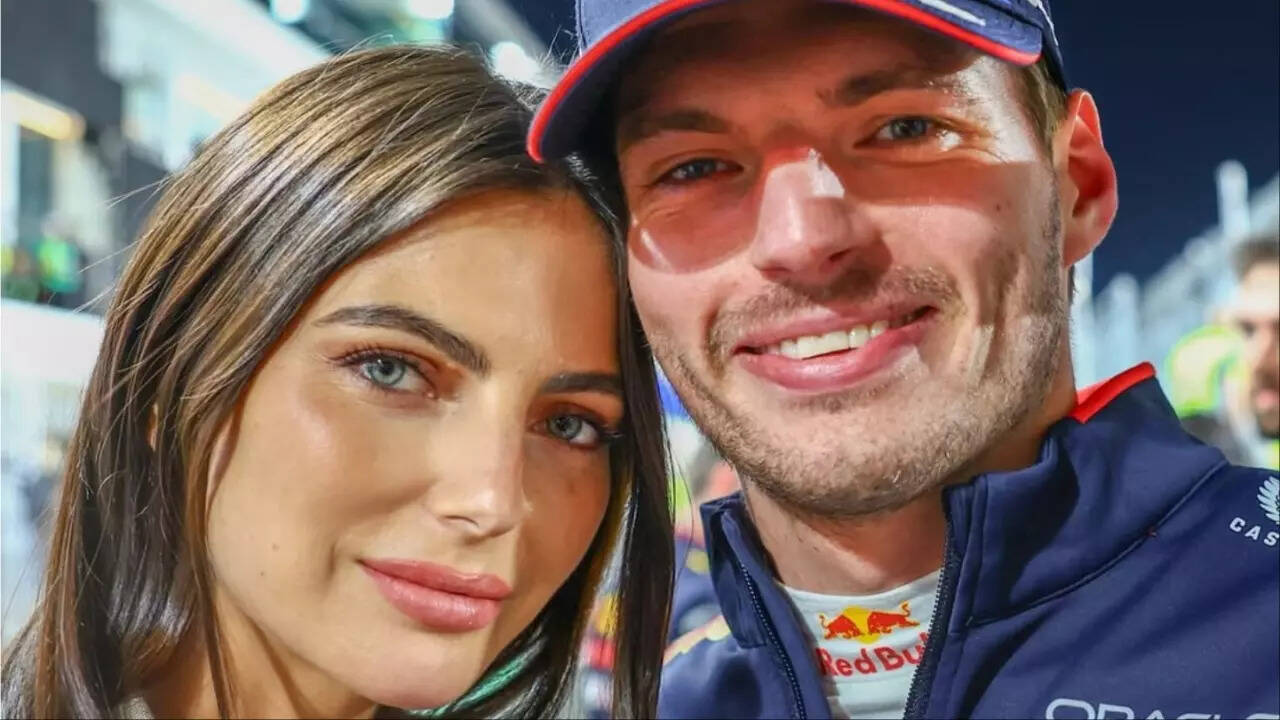

- High volume of clothing and accessories: Shein's vast product catalog, characterized by high volumes of clothing and accessories, makes it highly susceptible to tariff increases.

- Heavy reliance on Chinese manufacturing: The concentration of its manufacturing base in China exposes Shein to potential disruptions and increased costs due to tariffs imposed on goods originating from China.

- Potential impact on production costs due to tariffs: Increased tariffs directly translate to higher production costs, potentially squeezing Shein's already slim profit margins.

- Increased transportation costs due to altered supply chains: To circumvent tariffs, Shein might need to restructure its supply chain, potentially leading to increased transportation costs and logistical complexities.

Potential Financial Implications of US Tariffs on Shein's IPO

The increased costs resulting from US tariffs could significantly impact Shein's financial performance and consequently, its IPO valuation. Higher production and transportation costs directly translate to reduced profit margins. This decreased profitability could lead to a lower IPO valuation, making it less attractive to potential investors. Furthermore, the uncertainty surrounding future tariff policies introduces significant risk, potentially leading to investor hesitancy.

- Reduced profit margins: Increased costs due to tariffs will inevitably compress Shein's already thin profit margins, impacting its financial health and investor appeal.

- Lower IPO valuation: The risk associated with US tariffs could significantly decrease Shein's perceived value, leading to a lower IPO valuation than initially projected.

- Investor hesitancy due to risk: Uncertainty surrounding future tariff policies creates a significant risk factor that could deter investors from participating in the IPO.

- Potential for price increases to offset tariff costs: To maintain profitability, Shein might be forced to increase its prices, potentially affecting its competitive advantage in the market.

Shein's Strategic Responses to Mitigate Tariff Impacts

To counter the negative effects of US tariffs, Shein needs to adopt proactive strategies to mitigate risk. Diversifying its supply chain by exploring manufacturing locations beyond China is crucial. This would reduce its reliance on a single manufacturing hub and lessen its vulnerability to specific trade policies. Furthermore, negotiating better pricing with existing suppliers and exploring alternative, more cost-effective manufacturing locations are vital steps.

- Restructuring supply chain (diversification): Shein needs to strategically diversify its manufacturing base, potentially shifting production to countries with more favorable trade relations with the US.

- Negotiating with suppliers for better pricing: Shein needs to leverage its significant purchasing power to negotiate more favorable pricing terms with its Chinese suppliers.

- Exploring alternative manufacturing locations: Identifying and establishing manufacturing partnerships in countries outside of China is a crucial step in mitigating tariff risks.

- Adjusting pricing strategies to maintain profitability: While price increases might be necessary, Shein needs to carefully assess the market impact to maintain its competitive edge.

The Broader Geopolitical Context and its Influence on Shein's IPO

The broader geopolitical context between the US and China significantly influences Shein's IPO. Escalating trade tensions and unpredictable policy shifts can undermine investor confidence. Moreover, global economic instability, often linked to geopolitical tensions, can significantly affect investor sentiment towards emerging markets and influence the overall success of the IPO.

- US-China trade relations and their impact: The fluctuating nature of US-China trade relations creates a volatile environment that increases the risk associated with Shein's IPO.

- Global supply chain disruptions: Geopolitical instability can disrupt global supply chains, further exacerbating Shein's vulnerability to increased costs and delays.

- Investor sentiment towards emerging markets: Overall investor sentiment towards emerging markets is influenced by global political and economic stability.

- Overall market volatility and its impact on IPO success: A volatile market environment increases the risk of a less-than-successful IPO.

Conclusion: Navigating the Tariff Landscape: Shein's London IPO and the Future

The impact of US tariffs on Shein's London stock market debut is undeniable and will be a crucial factor determining its success. The company's reliance on Chinese manufacturing and its vulnerability to US trade policies represent significant risks. However, Shein's strategic responses— particularly its ability to diversify its supply chain and manage its pricing strategies— will play a vital role in mitigating these risks. Staying informed about the evolving situation surrounding the impact of US tariffs on Shein's London stock market debut is crucial. Further research into Shein’s supply chain diversification strategies will be critical to understanding the long-term effects of US tariffs on this fast fashion giant.

Featured Posts

-

Ufc 314 Card Altered Highly Anticipated Knockout Match Removed

May 05, 2025

Ufc 314 Card Altered Highly Anticipated Knockout Match Removed

May 05, 2025 -

Vegas Golden Knights Stanley Cup Contenders

May 05, 2025

Vegas Golden Knights Stanley Cup Contenders

May 05, 2025 -

Long Prison Sentence For Hate Crime Targeting Palestinian American Family

May 05, 2025

Long Prison Sentence For Hate Crime Targeting Palestinian American Family

May 05, 2025 -

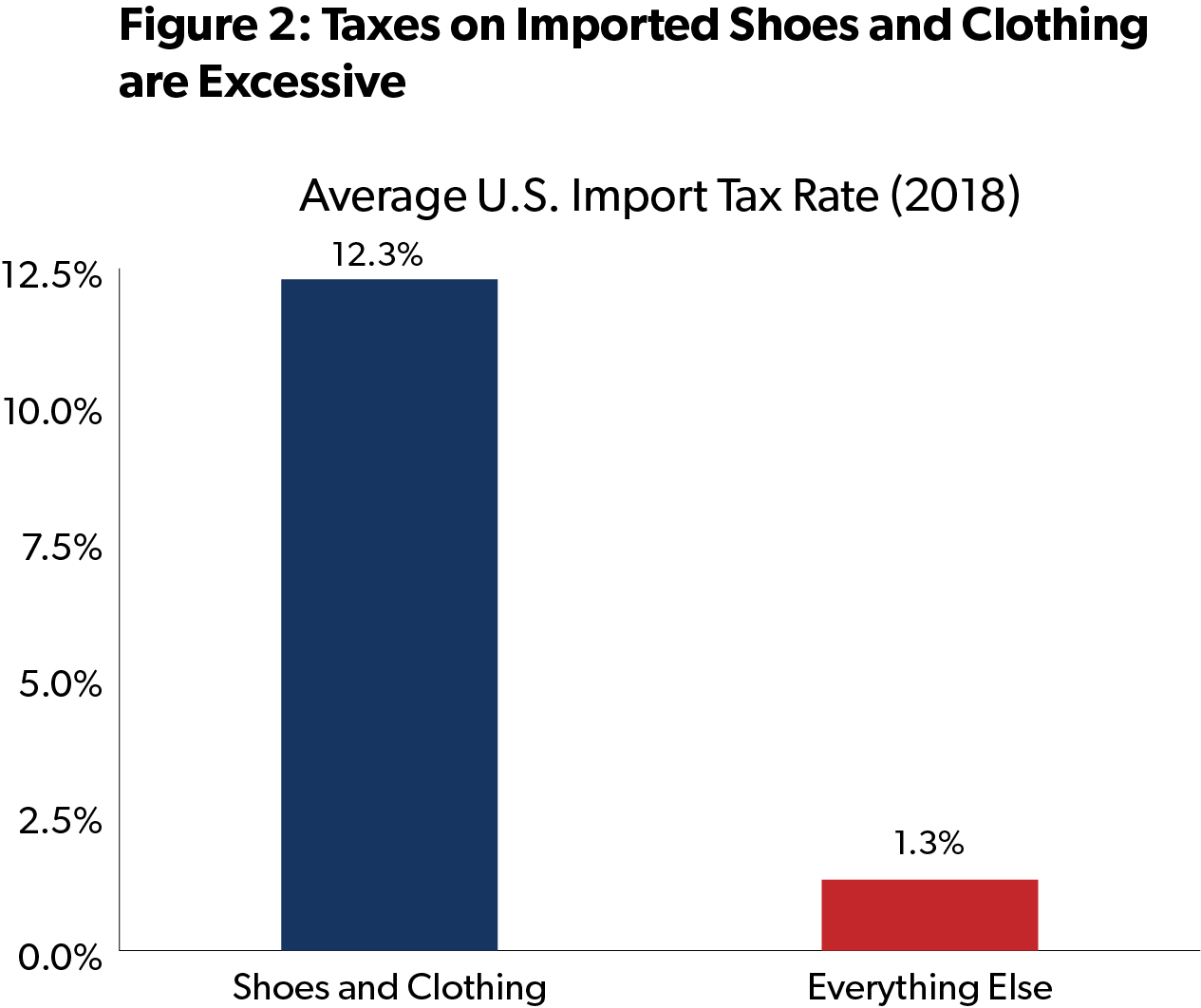

Ruling Partys Grip On Power Tested In Upcoming Singapore Election

May 05, 2025

Ruling Partys Grip On Power Tested In Upcoming Singapore Election

May 05, 2025 -

Formula 1 News Verstappen And Piquet Become Parents To Baby Girl Lily

May 05, 2025

Formula 1 News Verstappen And Piquet Become Parents To Baby Girl Lily

May 05, 2025

Latest Posts

-

Major Blow To Ufc 314 Neal Vs Prates Fight Off

May 05, 2025

Major Blow To Ufc 314 Neal Vs Prates Fight Off

May 05, 2025 -

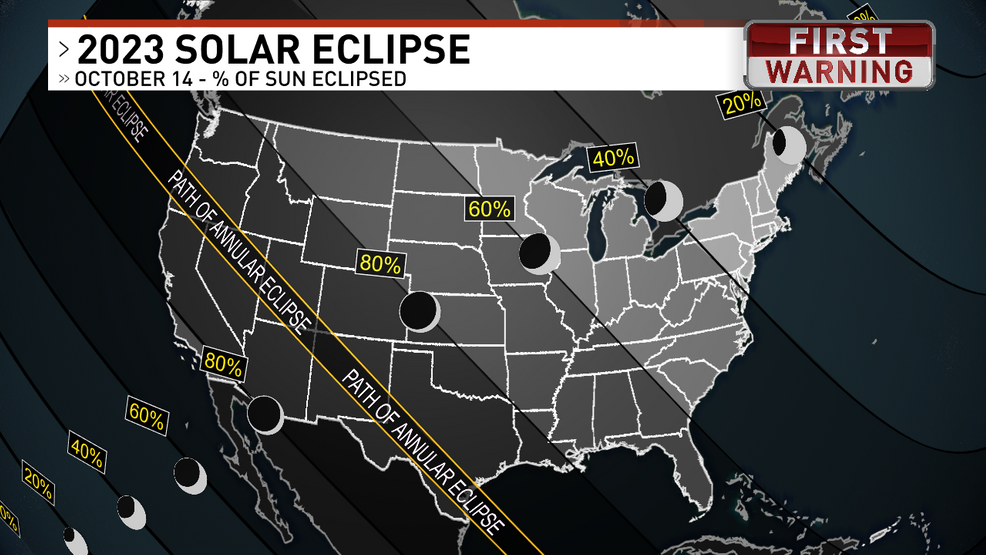

Partial Solar Eclipse Saturday In Nyc Time And Viewing Guide

May 05, 2025

Partial Solar Eclipse Saturday In Nyc Time And Viewing Guide

May 05, 2025 -

Star Studded Ufc 314 Lineup Imperiled By Neal Prates Cancellation

May 05, 2025

Star Studded Ufc 314 Lineup Imperiled By Neal Prates Cancellation

May 05, 2025 -

Ufc 314 Card Suffers Blow Neal Prates Bout Cancelled

May 05, 2025

Ufc 314 Card Suffers Blow Neal Prates Bout Cancelled

May 05, 2025 -

Ufc 314 Mitchell Silva Press Conference Marked By Accusation Of Verbal Abuse

May 05, 2025

Ufc 314 Mitchell Silva Press Conference Marked By Accusation Of Verbal Abuse

May 05, 2025