The Influence Of Federal Debt On Mortgage Lending Practices

Table of Contents

The Impact of Federal Debt on Interest Rates

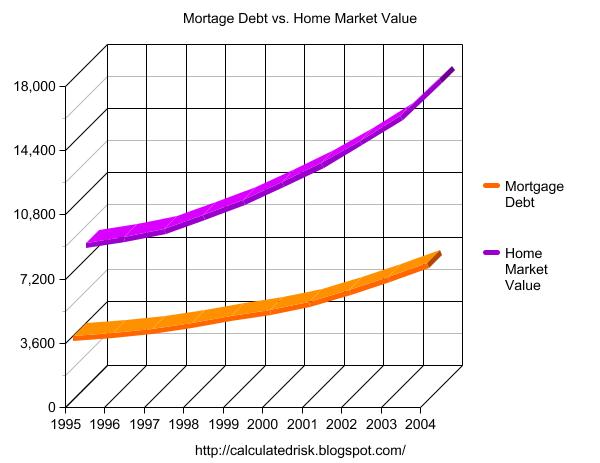

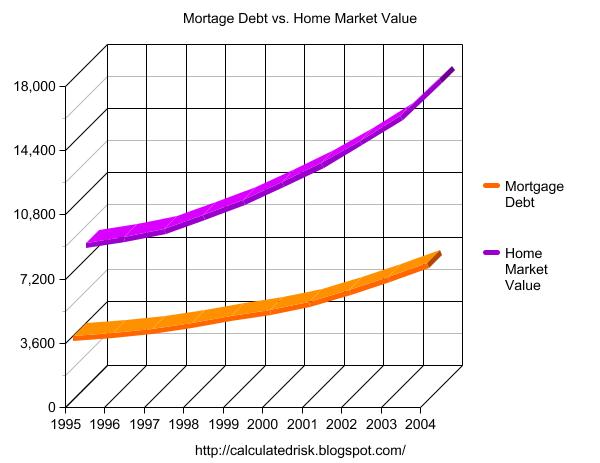

Increasing federal debt significantly influences interest rates, impacting the cost of borrowing for consumers and businesses alike. The connection is multifaceted. When the government borrows heavily to finance its spending, it competes with private sector borrowers for available funds. This increased demand drives up interest rates across the board, including mortgage rates.

- Increased government borrowing competes with private sector borrowing, driving up interest rates. This competition for capital pushes yields higher, making it more expensive for everyone to borrow money.

- Higher bond yields generally lead to higher mortgage rates. Government bond yields act as a benchmark for other interest rates, including those for mortgages. Rising bond yields signal increased borrowing costs, leading lenders to adjust mortgage rates upward.

- The Federal Reserve's response to high federal debt (e.g., interest rate adjustments) directly influences mortgage rates. The Federal Reserve often uses monetary policy tools, such as raising interest rates, to combat inflation fueled by excessive government spending and debt. These actions directly impact mortgage rates.

- Impact of inflation on interest rates and its relation to federal debt. High federal debt can contribute to inflation, prompting the Federal Reserve to raise interest rates to cool down the economy. This further increases borrowing costs for mortgages.

Federal Debt and the Availability of Mortgage Credit

High levels of federal debt can significantly influence the availability of mortgage credit. Lenders, mindful of potential economic instability and increased risk, may react by tightening lending standards or reducing their overall lending activities.

- Lenders may become more cautious during times of high federal debt, tightening lending criteria. This means stricter requirements for credit scores, down payments, and debt-to-income ratios.

- Reduced appetite for risk can lead to decreased availability of mortgages, particularly for borrowers with less-than-perfect credit. Lenders might focus on lower-risk borrowers, potentially excluding those who rely on subprime or alternative lending options.

- Potential for increased scrutiny of borrowers' financial stability. Lenders may conduct more thorough due diligence, increasing the time and effort required to secure a mortgage.

- Impact on subprime and alternative lending options. Increased risk aversion can lead to a contraction in the availability of subprime and alternative mortgages, limiting options for borrowers with less-than-perfect credit histories.

The Influence of Government Policy on Mortgage Lending

Government intervention plays a significant role in shaping the mortgage lending landscape, particularly when grappling with the effects of high federal debt. Fiscal and monetary policies are often implemented to address challenges in the housing market.

- Government intervention might include measures to stimulate the housing market or manage interest rates. This can involve direct subsidies, tax incentives, or interest rate manipulation by the Federal Reserve.

- Analysis of the effectiveness of different government policies in mitigating the negative effects of high federal debt. The success of these interventions varies, depending on the specific circumstances and the design of the policy.

- Discussion on mortgage subsidies and their impact on the market. Mortgage subsidies, such as those offered by government-sponsored enterprises (GSEs), can make homeownership more accessible but can also introduce risks and complexities into the market.

- Potential unintended consequences of government intervention. Government actions, while intended to stabilize the market, can sometimes have unintended consequences, creating new challenges or exacerbating existing ones.

Long-Term Effects of High Federal Debt on Housing Market Stability

Persistently high federal debt can have profound and long-lasting consequences on the housing market. The implications extend far beyond short-term fluctuations in interest rates and credit availability.

- Persistent high interest rates can hinder homeownership. High mortgage rates make homeownership less affordable, potentially reducing the number of people who can buy homes.

- Impact on housing prices and market volatility. Interest rate changes can significantly influence housing prices, potentially leading to market instability or volatility.

- Effect on long-term economic growth and its influence on the housing market. Slow economic growth due to high federal debt can negatively impact the housing market, potentially leading to a prolonged period of low activity or even a decline in prices.

- Potential for increased housing affordability challenges. High federal debt can exacerbate existing affordability challenges, making homeownership even more difficult for many people.

Conclusion

The influence of federal debt on mortgage lending practices is multifaceted and profound. From its direct impact on interest rates and credit availability to its indirect effects through government policy, high federal debt creates significant challenges for the housing market. Understanding this intricate relationship is critical for both borrowers and lenders. To make informed financial decisions, particularly concerning mortgages, staying informed about federal debt levels and their potential consequences is crucial. Further research into the nuances of this complex interplay will empower you to navigate the housing market effectively. Therefore, remain vigilant and continue exploring the influence of federal debt on mortgage lending practices.

Featured Posts

-

New Final Destination Bloodline Footage From Cinema Con A Potential Franchise Best

May 19, 2025

New Final Destination Bloodline Footage From Cinema Con A Potential Franchise Best

May 19, 2025 -

Dr John Delony Mastering Difficult Conversations In Podcasting

May 19, 2025

Dr John Delony Mastering Difficult Conversations In Podcasting

May 19, 2025 -

April 17 Nyt Connections 676 Complete Answers And Hints

May 19, 2025

April 17 Nyt Connections 676 Complete Answers And Hints

May 19, 2025 -

Slow Tariff Relief For U S Allies After China Trade Agreement

May 19, 2025

Slow Tariff Relief For U S Allies After China Trade Agreement

May 19, 2025 -

New Uber Pet Service Convenient Pet Transport In Delhi And Mumbai

May 19, 2025

New Uber Pet Service Convenient Pet Transport In Delhi And Mumbai

May 19, 2025

Latest Posts

-

St Louis Cardinals Afternoon News And Notes Wednesday

May 19, 2025

St Louis Cardinals Afternoon News And Notes Wednesday

May 19, 2025 -

Jennifer Lawrence Welcomes Second Child With Cooke Maroney

May 19, 2025

Jennifer Lawrence Welcomes Second Child With Cooke Maroney

May 19, 2025 -

Jennifer Lawrence Shows Off Growing Baby Bump In New York City

May 19, 2025

Jennifer Lawrence Shows Off Growing Baby Bump In New York City

May 19, 2025 -

Wednesdays Cardinal Report Key News And Notes From The Afternoon

May 19, 2025

Wednesdays Cardinal Report Key News And Notes From The Afternoon

May 19, 2025 -

Jennifer Lawrences Baby Bump A Nyc Sighting

May 19, 2025

Jennifer Lawrences Baby Bump A Nyc Sighting

May 19, 2025