The Looming Bond Market Crisis: What Investors Need To Know

Table of Contents

Rising Interest Rates and Their Impact on Bond Prices

Rising interest rates are the primary driver of concern in the current bond market environment. New bonds issued at higher rates make existing lower-yielding bonds less attractive, triggering a ripple effect throughout the market.

Understanding the Inverse Relationship

The relationship between interest rates and bond prices is inversely proportional. This means that when interest rates rise, bond prices fall, and vice versa. This is because newly issued bonds offer higher yields, making older bonds with lower coupon payments less desirable. Investors seeking higher returns will sell their existing bonds, driving down their prices.

- Increased borrowing costs for governments and corporations: Higher interest rates increase the cost of borrowing for governments and corporations, potentially impacting their ability to service their debt.

- Reduced demand for existing lower-yielding bonds: As new bonds with higher yields become available, the demand for existing lower-yielding bonds decreases.

- Potential for significant capital losses for bondholders: Bondholders who hold bonds to maturity will receive their face value, but those who sell before maturity may experience capital losses if interest rates have risen significantly.

- Strategies for mitigating interest rate risk: Investors can mitigate interest rate risk by diversifying their bond portfolios, focusing on short-term bonds, or investing in floating-rate bonds, whose yields adjust with changes in interest rates. Consider laddering your bonds to manage maturity risk.

Inflation's Erosive Effect on Bond Yields

High inflation erodes the purchasing power of fixed-income investments like bonds. When inflation rises faster than the bond's yield, the real yield (yield adjusted for inflation) becomes negative, making bonds a less attractive investment compared to assets that can keep pace with inflation.

Inflation and Real Returns

Calculating real yield is crucial for evaluating bond investments in an inflationary environment. The formula is: Real Yield = (Nominal Yield - Inflation Rate) / (1 + Inflation Rate). A negative real yield indicates that the investment is losing purchasing power over time.

- Impact of unexpected inflation surges on bond prices: Unexpected surges in inflation can lead to a sharp decline in bond prices as investors demand higher yields to compensate for the erosion of purchasing power.

- Strategies for inflation hedging: Investors can hedge against inflation by investing in inflation-protected securities (TIPS), which adjust their principal value based on inflation. Consider also adding commodities or real estate to your portfolio.

- The importance of monitoring inflation indicators: Closely monitoring inflation indicators such as the Consumer Price Index (CPI) and Producer Price Index (PPI) is crucial for making informed investment decisions.

Geopolitical Uncertainty and its Influence on Bond Markets

Global political instability, conflicts, and economic sanctions create uncertainty in the bond market, impacting investor sentiment and driving capital flows. This uncertainty can lead to significant volatility in bond prices and yields.

Flight to Safety vs. Risk-Off Sentiment

During times of geopolitical uncertainty, investors often exhibit a "flight to safety," moving their investments from riskier assets to safer havens like US Treasury bonds. This increased demand for safe assets can push their prices up and yields down. Conversely, a "risk-off" sentiment can lead to widespread selling of riskier bonds, causing their prices to plummet.

- Impact of geopolitical risks on bond yields and spreads: Geopolitical events can significantly impact bond yields and credit spreads, reflecting the increased risk perceived by investors.

- Diversification strategies to mitigate geopolitical risk: Diversifying investments across different countries and asset classes can help reduce the impact of geopolitical risks.

- Monitoring key geopolitical events and their potential impact: Staying informed about key geopolitical events and their potential impact on the bond market is essential for effective investment management.

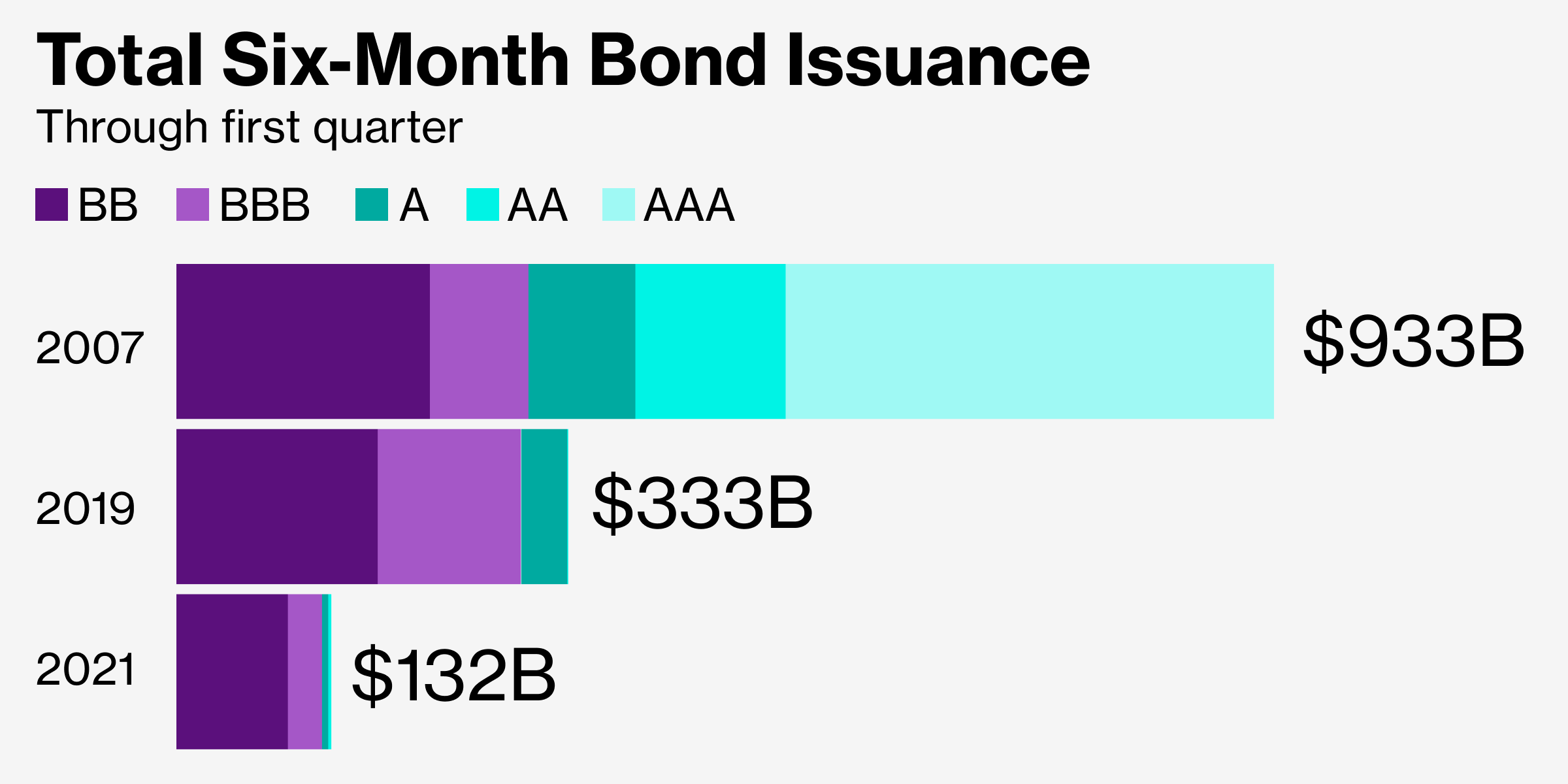

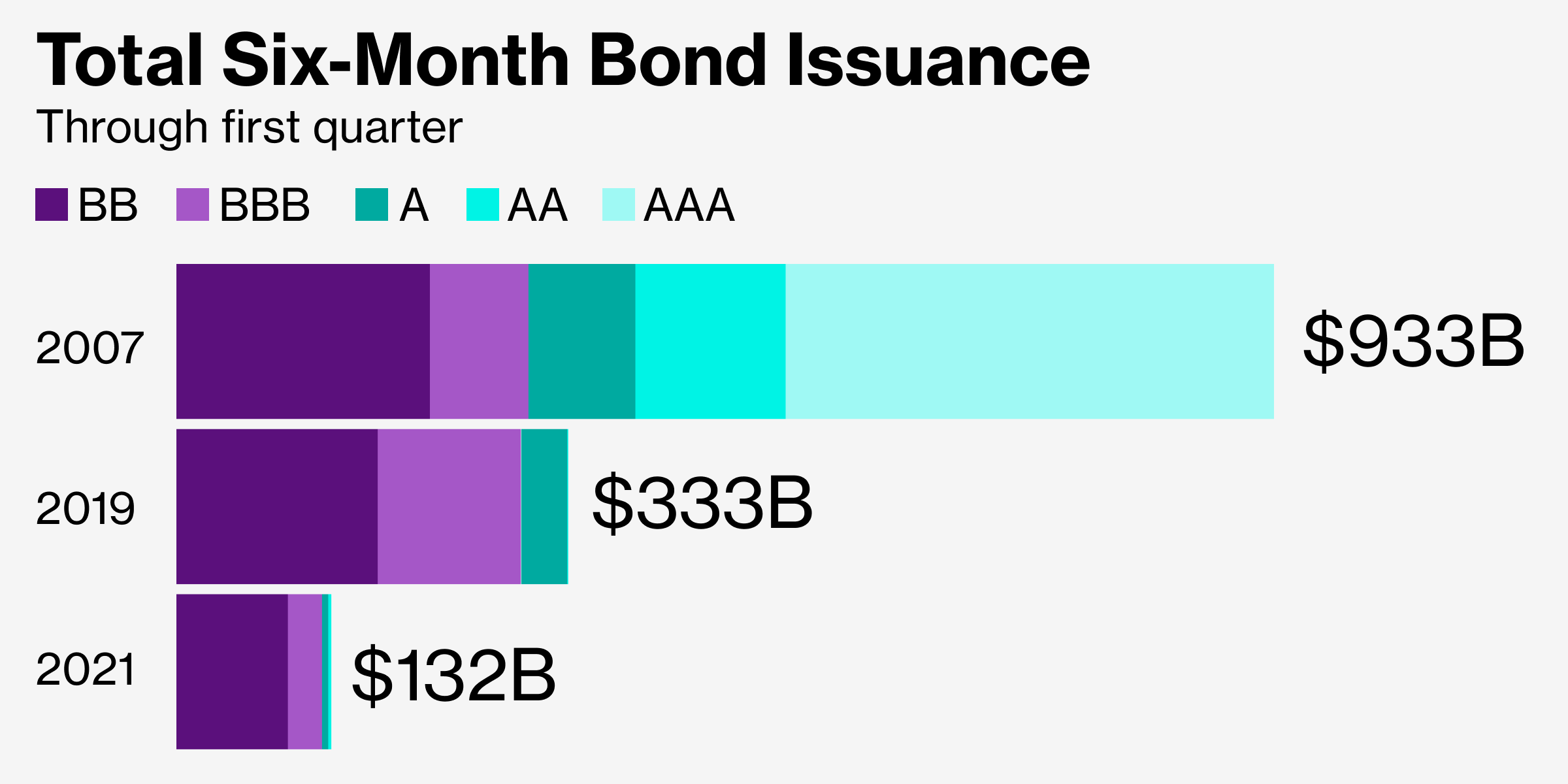

Assessing the Health of the Bond Market

Several key indicators help gauge the health of the bond market and potential vulnerabilities. Monitoring these indicators provides insights into potential risks and opportunities.

Key Metrics to Watch

Several key metrics provide a snapshot of bond market health.

- Understanding credit ratings and their implications: Credit ratings from agencies like Moody's, S&P, and Fitch provide an assessment of the creditworthiness of bond issuers. Lower ratings indicate higher risk and potentially higher yields to compensate for that risk.

- Analyzing the yield curve for signs of recession or economic expansion: The yield curve, which plots the yields of bonds with different maturities, can provide insights into future economic growth. An inverted yield curve (where short-term yields are higher than long-term yields) is often seen as a predictor of a recession.

- Monitoring credit spreads to assess risk premiums: Credit spreads, the difference between the yield of a corporate bond and a comparable government bond, reflect the risk premium investors demand for holding corporate bonds. Widening spreads indicate increasing risk aversion in the market.

Conclusion

The potential for a bond market crisis is a significant concern for investors. Rising interest rates, persistent inflation, and geopolitical uncertainty are creating a challenging environment for fixed-income investments. By understanding these risks and employing appropriate strategies like diversification, inflation hedging, and careful monitoring of key market indicators, investors can better navigate the complexities of the bond market and protect their portfolios. Staying informed about the evolving situation and proactively managing your bond holdings is crucial to mitigate the risks associated with this looming bond market crisis. Don't underestimate the importance of staying up-to-date on bond market news and seeking professional financial advice to help you manage your investments effectively during these uncertain times.

Featured Posts

-

Aftenposten Karer Arets Redaktor En Fortjent Pris

May 29, 2025

Aftenposten Karer Arets Redaktor En Fortjent Pris

May 29, 2025 -

Hujan Di Bandung 22 April Detail Prakiraan Cuaca Jawa Barat

May 29, 2025

Hujan Di Bandung 22 April Detail Prakiraan Cuaca Jawa Barat

May 29, 2025 -

Altesb Aldmny Walensryt Fy Alryadt Asbabha Watharha

May 29, 2025

Altesb Aldmny Walensryt Fy Alryadt Asbabha Watharha

May 29, 2025 -

Sfqt Naryt Bayrn Mywnkh Wbrshlwnt Ytnafsan

May 29, 2025

Sfqt Naryt Bayrn Mywnkh Wbrshlwnt Ytnafsan

May 29, 2025 -

Rtl Sale To Dpg Media Regulatory Approval Expected Soon

May 29, 2025

Rtl Sale To Dpg Media Regulatory Approval Expected Soon

May 29, 2025