The Trump Tax Cut Bill: What House Republicans Proposed

Table of Contents

Individual Income Tax Rate Reductions

The Trump Tax Cut Bill aimed to significantly reduce individual income tax burdens through several key mechanisms.

Lowering Marginal Tax Rates

The bill proposed substantial reductions in individual income tax rates across all brackets. This aimed to boost disposable income and stimulate economic activity.

- Proposed Rate Changes (Illustrative): While the exact figures varied depending on the specific version of the bill, proposed changes generally involved lowering the highest marginal rates considerably and also reducing rates in lower brackets. For example, a hypothetical scenario might have reduced the top rate from 39.6% to 35%, and lower brackets saw proportionate decreases. Precise figures should be researched from official government documents for accuracy.

- Impact on Taxpayers: Lower income taxpayers generally experienced smaller tax reductions while higher-income taxpayers saw proportionally larger reductions. This aspect fueled debate about the distributional effects of the tax cuts.

- Criticisms: Critics argued that the tax cuts disproportionately benefited high-income earners, exacerbating income inequality. They also questioned the long-term fiscal sustainability of such significant reductions in tax revenue.

Standard Deduction Increases

To simplify the tax system and reduce the number of taxpayers required to itemize deductions, the Trump Tax Cut Bill proposed a significant increase in the standard deduction.

- Standard Deduction Impact: A larger standard deduction meant many taxpayers would owe less in taxes, or even owe nothing at all, as they no longer needed to itemize deductions. This simplified the tax filing process for a large segment of the population.

- Comparison to Previous Years: The proposed increases were substantial compared to previous years' standard deductions, reflecting a clear intent to simplify the tax code and provide broader tax relief.

- Itemizers vs. Standard Deduction: The increase in the standard deduction impacted itemizers (those who itemize deductions) and those taking the standard deduction differently. Many itemizers found the benefit of itemizing diminished, leading them to utilize the standard deduction instead.

Corporate Tax Rate Cuts

A central pillar of the Trump Tax Cut Bill was the dramatic reduction of the corporate tax rate.

Reduction to 20%

The bill proposed slashing the corporate tax rate from 35% to 20%. Proponents argued this would enhance US competitiveness globally and boost investment and job creation.

- Economic Benefits (Claimed): Supporters of the bill asserted that the lower rate would incentivize businesses to invest more, expand operations, and create jobs, leading to higher economic growth. This argument was a cornerstone of the bill's justification.

- Potential Loopholes and Unequal Distribution: Critics argued that the lower rate could lead to increased corporate profits without corresponding job growth or investment, and that loopholes could allow some corporations to benefit disproportionately.

- Impact on Corporate Profits and Competitiveness: The reduction did lead to increased corporate profits, but the extent to which this translated into increased investment and job creation remained a subject of ongoing debate and economic analysis.

International Tax Provisions

The Trump Tax Cut Bill also introduced significant changes to the taxation of multinational corporations' foreign profits.

- Taxation of Foreign Profits: Changes were proposed to encourage repatriation of foreign profits, potentially incentivizing corporations to bring their overseas earnings back to the US.

- Effects on Multinational Corporations: The new rules had significant implications for multinational corporations' tax planning and global competitiveness, leading to both opportunities and challenges for US-based companies operating abroad.

- Anti-Inversion Measures: The bill also sought to address corporate tax inversion strategies, which involved companies relocating their headquarters to lower-tax jurisdictions. The aim was to prevent US companies from avoiding US taxes through such strategies.

Elimination or Modification of Tax Deductions

The Trump Tax Cut Bill also included provisions for the elimination or modification of several popular tax deductions.

State and Local Tax (SALT) Deduction

One of the most controversial aspects of the bill was the limitation on the State and Local Tax (SALT) deduction.

- SALT Deduction Explanation: The SALT deduction allowed taxpayers to deduct their state and local taxes from their federal taxable income. Its limitation disproportionately impacted taxpayers in high-tax states.

- Consequences for High-Tax States: The limitation had significant consequences for taxpayers in states with high property taxes and income taxes, leading to considerable political backlash.

- Political Ramifications: The limitation on the SALT deduction became a major political issue, highlighting regional disparities and the differing impacts of tax policy across the United States.

Other Deduction Changes

Other deductions were also affected, leading to further debate and analysis of the bill's overall impact.

- Affected Deductions: Deductions for mortgage interest, charitable contributions, and other items were modified or eliminated in varying degrees, depending on the specific version of the bill.

- Rationale for Changes: The rationale behind these changes varied, but often involved concerns about budget neutrality, simplification of the tax code, and the desire to make the tax system more efficient.

- Impact on Specific Taxpayer Groups: These changes disproportionately affected specific groups of taxpayers depending on their income levels, geographic location, and their reliance on these deductions.

Conclusion

The Trump Tax Cut Bill, as proposed by House Republicans, represented a sweeping overhaul of the US tax code. The proposed reductions in individual and corporate tax rates, coupled with changes to deductions, aimed to stimulate economic growth and simplify the tax system. However, the bill also sparked considerable debate regarding its impact on income inequality, its long-term fiscal implications, and the fairness of the proposed changes. Understanding the intricacies of the Trump Tax Cut Bill and its various components is crucial for navigating the complexities of the American tax system. Further research into specific aspects of the bill, particularly its impact on your own financial situation, is strongly recommended. To delve deeper into the specifics and potential effects of this significant legislation, thoroughly research the details of the Trump Tax Cut Bill and consult with a tax professional for personalized advice.

Featured Posts

-

Byd Targets 50 International Car Sales By 2030

May 13, 2025

Byd Targets 50 International Car Sales By 2030

May 13, 2025 -

5 Minute Ev Charging A Real World Test Of Byds Technology

May 13, 2025

5 Minute Ev Charging A Real World Test Of Byds Technology

May 13, 2025 -

How Byd Is Expanding Its Global Ev Lead Using Brazil As A Foothold

May 13, 2025

How Byd Is Expanding Its Global Ev Lead Using Brazil As A Foothold

May 13, 2025 -

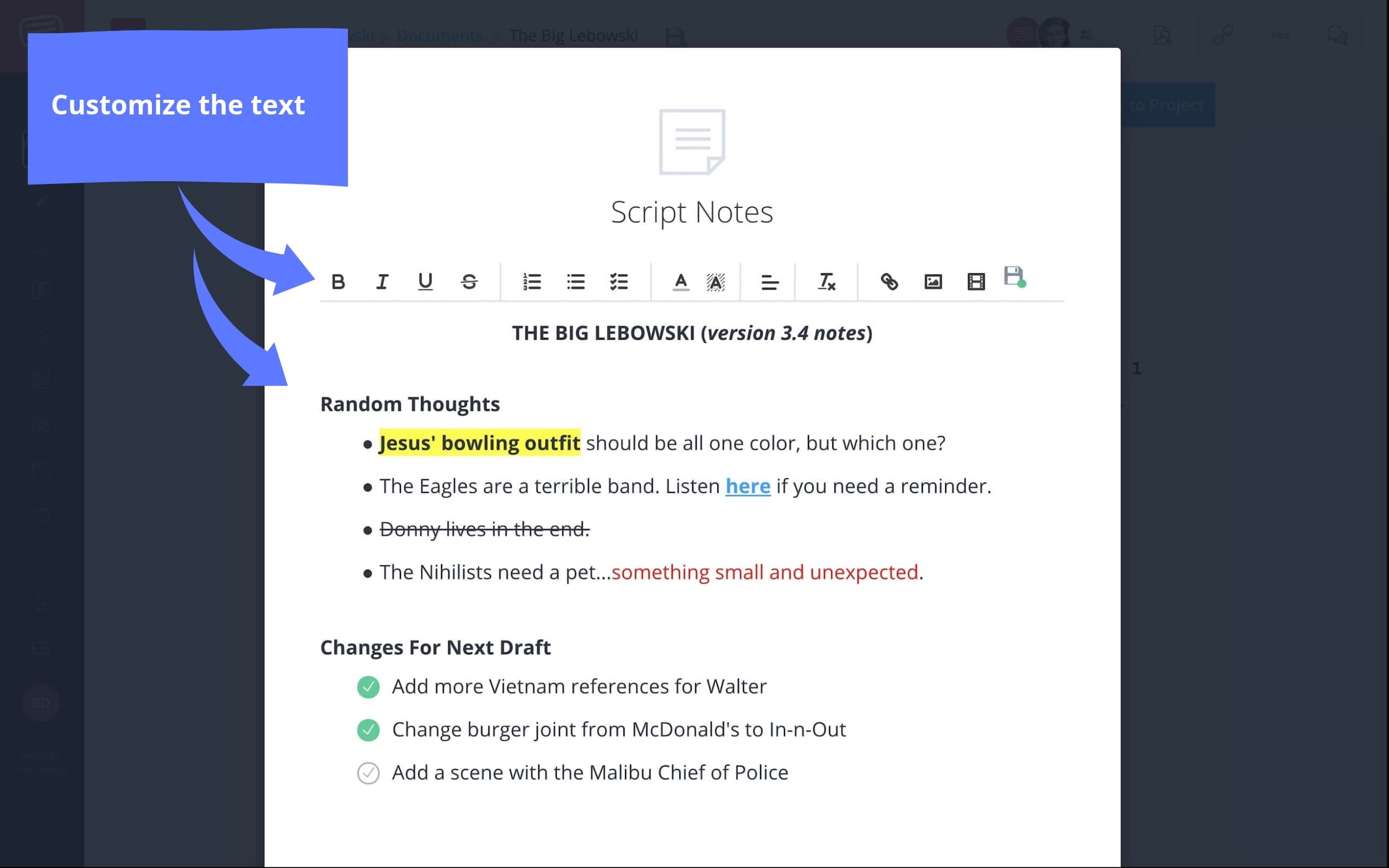

Beyonces Rigorous Script Approval The Five Revisions A Producer Underwent

May 13, 2025

Beyonces Rigorous Script Approval The Five Revisions A Producer Underwent

May 13, 2025 -

Sequel To Hit Heist Film Starring Iconic Scot Arrives On Amazon Prime This Month

May 13, 2025

Sequel To Hit Heist Film Starring Iconic Scot Arrives On Amazon Prime This Month

May 13, 2025

Latest Posts

-

Situation Des Demandeurs D Asile A Bourg En Bresse Des Avancees Notables

May 14, 2025

Situation Des Demandeurs D Asile A Bourg En Bresse Des Avancees Notables

May 14, 2025 -

Incident A Cannes Un Migrant Menace Une Famille Avec Un Cutter

May 14, 2025

Incident A Cannes Un Migrant Menace Une Famille Avec Un Cutter

May 14, 2025 -

Oqtf Et Violences Sexuelles L Udr Appelle L Etat A Reparer Les Prejudices Subis

May 14, 2025

Oqtf Et Violences Sexuelles L Udr Appelle L Etat A Reparer Les Prejudices Subis

May 14, 2025 -

Oqtf A Cannes Attaque Au Cutter Dans Un Bus Une Mere Et Son Fils Menaces

May 14, 2025

Oqtf A Cannes Attaque Au Cutter Dans Un Bus Une Mere Et Son Fils Menaces

May 14, 2025 -

Demandeurs D Asile A Bourg En Bresse Progres En Matiere D Aide Et De Solidarite

May 14, 2025

Demandeurs D Asile A Bourg En Bresse Progres En Matiere D Aide Et De Solidarite

May 14, 2025