The Unforeseen Long-Term Effects Of 'Liberation Day' Tariffs On Stocks

Table of Contents

H2: Immediate Market Reactions to Liberation Day Tariffs

H3: Initial Volatility and Investor Sentiment: The announcement of the Liberation Day tariffs sent shockwaves through the stock market, causing immediate volatility. Investor sentiment plummeted as uncertainty surrounding the economic fallout began to take hold. The initial reaction varied across sectors, with some experiencing sharp drops while others saw unexpected gains.

- Examples: The technology sector, heavily reliant on global supply chains, saw a significant initial dip (e.g., a 5% drop in the NASDAQ composite index within the first week). Conversely, certain domestic manufacturing stocks experienced a short-term surge, fueled by hopes of increased protectionism.

- Market Indices: The Dow Jones Industrial Average experienced a significant fluctuation, dropping by 2% initially before gradually recovering some ground. The S&P 500 followed a similar pattern, showcasing the widespread uncertainty gripping the market.

H3: Impact on Specific Sectors: The impact of the Liberation Day tariffs wasn't uniform across all sectors. Some industries were disproportionately affected, leading to significant shifts in market dynamics.

- Manufacturing: Domestic manufacturers initially benefited, experiencing increased demand as imported goods became more expensive. However, this was often offset by increased costs for raw materials and components, which are frequently imported.

- Technology: The technology sector was hit particularly hard due to its reliance on global supply chains and international trade. Companies heavily dependent on imported components faced increased production costs and reduced profit margins.

- Agriculture: The agricultural sector witnessed a complex interplay of effects, with some products facing increased export challenges while others experienced temporary boosts in domestic demand.

H2: Long-Term Shifts in Investment Strategies

H3: Changes in Portfolio Diversification: The prolonged impact of the Liberation Day tariffs forced investors to reassess their portfolio diversification strategies. Many investors shifted their focus towards more domestically focused companies and assets to mitigate risks associated with international trade disruptions.

- Shift in Asset Allocation: There was a noticeable shift away from international equities and towards domestic stocks, bonds, and real estate. Investors sought to reduce their exposure to potentially volatile international markets.

- Increased Focus on Domestic Companies: Investments in companies primarily operating within the domestic economy witnessed a surge as investors looked for stability and reduced exposure to tariff-related risks.

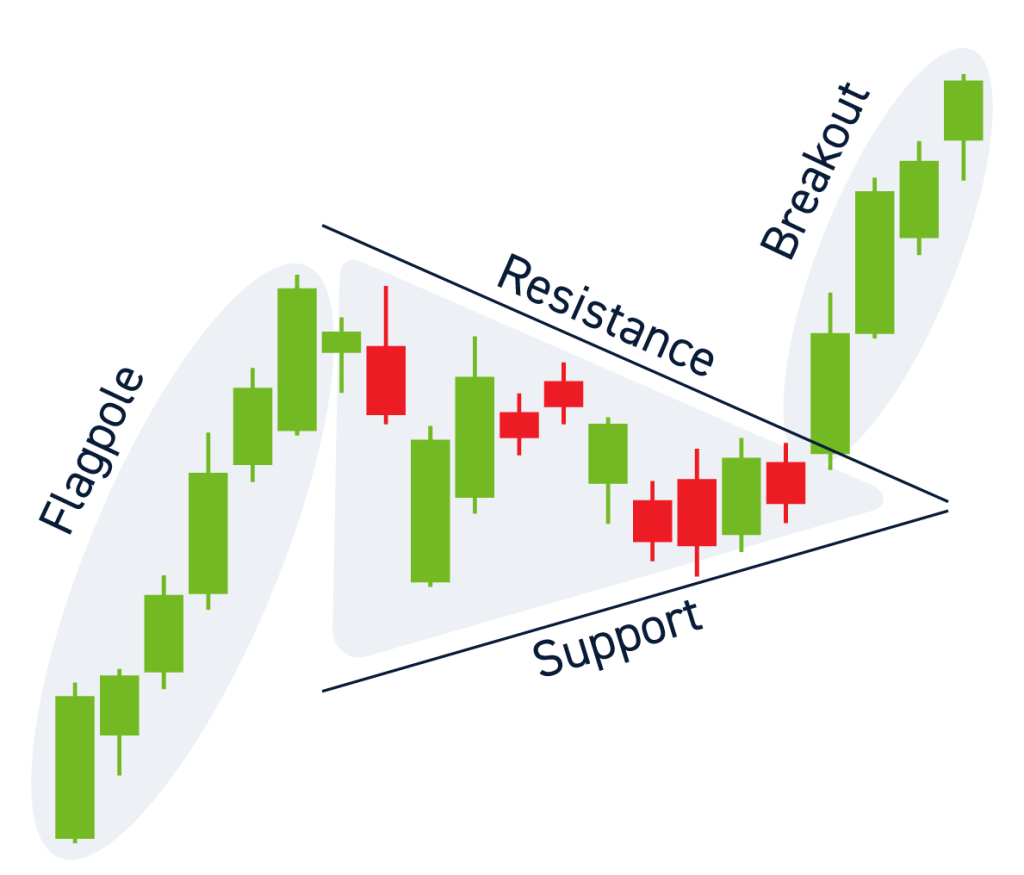

H3: Increased Risk Aversion and Volatility: The enduring uncertainty generated by the Liberation Day tariffs fostered a more risk-averse market environment. Market volatility, as measured by the VIX index (a key indicator of market fear), saw a notable increase in the periods following tariff announcements and retaliatory measures.

- Increased VIX: The VIX index, which often rises during periods of increased uncertainty, reflected the growing risk aversion in the market as investors braced for the unpredictable consequences of the Liberation Day tariffs.

- Investor Behavior: Investor behavior became more cautious. This was evident in reduced trading volumes in some sectors, indicating a preference for holding onto existing assets rather than engaging in potentially risky transactions.

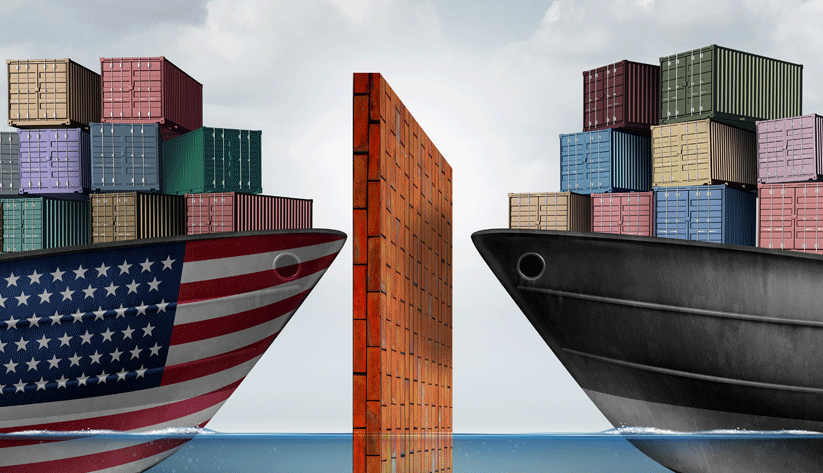

H2: Geopolitical Ramifications and Global Trade Impacts

H3: International Trade Relations: The Liberation Day tariffs significantly strained international trade relations, triggering retaliatory tariffs from affected countries and escalating into trade wars. This had a ripple effect on global stock markets, amplifying uncertainty and volatility.

- Retaliatory Tariffs: Countries targeted by the Liberation Day tariffs retaliated with their own tariffs, creating a cycle of escalating trade tensions that negatively impacted global market confidence.

- Trade Wars: The resulting trade wars significantly impacted global supply chains, leading to disruptions and uncertainties that spread across various sectors and markets.

H3: Supply Chain Disruptions and Inflationary Pressures: The Liberation Day tariffs disrupted global supply chains, leading to shortages of certain goods and increased production costs. This contributed to inflationary pressures in some sectors.

- Supply Chain Bottlenecks: Disruptions in the global supply chain resulted in increased lead times and higher costs for raw materials, impacting manufacturing and consumer goods pricing.

- Inflationary Effects: Increased production costs, combined with reduced supply, resulted in inflationary pressures in various sectors, impacting corporate profitability and investor sentiment.

3. Conclusion:

The Liberation Day tariffs, initially envisioned as a catalyst for economic revitalization, have had complex and largely unforeseen long-term effects on the stock market. While some domestic sectors initially benefited, the overall impact was marked by increased market volatility, shifts in investment strategies, and strained international trade relations. Key takeaways highlight the importance of understanding the interconnectedness of global markets and the significant ripple effects of protectionist policies. Understanding the long-term effects of the 'Liberation Day' tariffs is crucial for informed investment decisions. Continue your research and stay informed about the evolving global economic landscape. Further research into the impact of specific Liberation Day tariffs on individual stocks and sectors will offer deeper insights into their continuing economic effects.

Featured Posts

-

Inters All Time Classic Win Against Barcelona Champions League Qualification

May 08, 2025

Inters All Time Classic Win Against Barcelona Champions League Qualification

May 08, 2025 -

Derrota Del Lyon Contra El Psg En Casa

May 08, 2025

Derrota Del Lyon Contra El Psg En Casa

May 08, 2025 -

Krypto The Super Dog New Superman Footage Shows A Good Boy

May 08, 2025

Krypto The Super Dog New Superman Footage Shows A Good Boy

May 08, 2025 -

Ethereums Bullish Run Price Strength And Future Outlook

May 08, 2025

Ethereums Bullish Run Price Strength And Future Outlook

May 08, 2025 -

India Pakistan Conflict Unprecedented Strikes Across The Border

May 08, 2025

India Pakistan Conflict Unprecedented Strikes Across The Border

May 08, 2025

Latest Posts

-

Xrp Price Prediction 2025 Can Xrp Hit 5

May 08, 2025

Xrp Price Prediction 2025 Can Xrp Hit 5

May 08, 2025 -

Trumps Post On Ripple Sends Xrp Price Higher

May 08, 2025

Trumps Post On Ripple Sends Xrp Price Higher

May 08, 2025 -

Could Xrp Reach 5 In 2025 A Realistic Prediction

May 08, 2025

Could Xrp Reach 5 In 2025 A Realistic Prediction

May 08, 2025 -

Ripple Xrp Rallies After Us Presidents Trump Related Post

May 08, 2025

Ripple Xrp Rallies After Us Presidents Trump Related Post

May 08, 2025 -

Xrp Price Jumps Ripples Response To Trumps Post

May 08, 2025

Xrp Price Jumps Ripples Response To Trumps Post

May 08, 2025