This AI Quantum Computing Stock: A Dip Buying Analysis

Table of Contents

Understanding the AI Quantum Computing Market

The AI quantum computing market is poised for explosive growth. Market research firms predict a compound annual growth rate (CAGR) exceeding 30% over the next decade, driven by several key factors.

Market Growth Potential:

- Increased R&D Investment: Major tech companies and governments are pouring billions into quantum computing research, accelerating technological advancements.

- Government Initiatives: National quantum initiatives in countries like the US, China, and the EU are fueling innovation and deployment.

- Algorithmic Advancements: Breakthroughs in quantum algorithms are unlocking new possibilities for solving complex problems previously intractable for classical computers.

- Diverse Industry Applications: Quantum computing has vast potential applications across various sectors, including pharmaceuticals (drug discovery), finance (risk management and portfolio optimization), and materials science (designing new materials). For example, simulations of molecular interactions could revolutionize drug development, while advanced optimization algorithms could transform financial modeling.

According to a report by [Insert Reputable Source and Link Here], the global AI quantum computing market is projected to reach [Insert Projected Market Value] by [Insert Year]. This represents a significant opportunity for early investors.

Competitive Landscape:

QUBT operates within a competitive landscape including established tech giants and emerging startups. While facing competition from companies like [mention key competitors and their strengths], QUBT differentiates itself through [mention QUBT's unique technology, strengths, and IP]. Its strategic partnerships with [mention key partners] also provide a competitive edge. However, maintaining market share and securing future funding remain key challenges.

Analyzing the Stock Dip

QUBT's recent stock price decline can be attributed to a confluence of factors. Understanding these factors is crucial to assessing the dip's significance.

Reasons for the Dip:

- Broad Market Correction: The recent overall market downturn has negatively impacted many growth stocks, including QUBT.

- Sector-Specific Concerns: Concerns about the long-term viability and potential technological hurdles in the quantum computing sector may have contributed to the sell-off.

- [Insert Specific Company News, e.g., Missed Earnings, Delays in Product Development, Regulatory Hurdles]: [Explain the impact of specific news on the stock price. Provide links to reputable news sources.]

Technical Analysis:

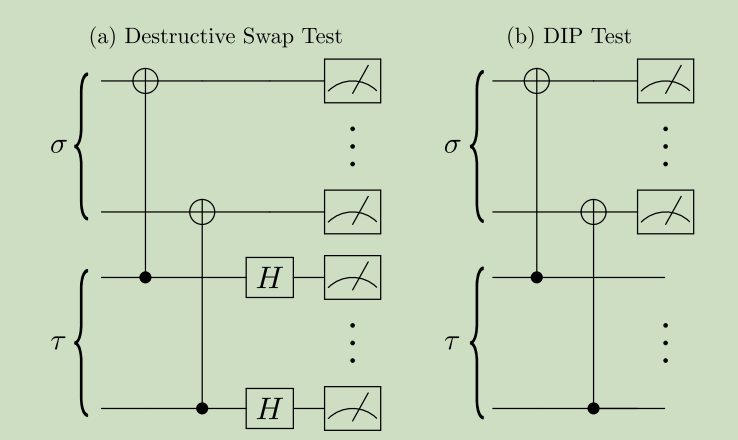

[Insert a brief technical analysis, including charts and graphs if applicable. Discuss support levels, resistance levels, and any potential reversal patterns. This section may require expertise and should be clearly stated as opinion and not financial advice. For example: "Based on a simple moving average analysis, the $X price point appears to be a strong support level. A break below this level could indicate further downside, whereas a bounce off this level could signal a potential reversal."]

Fundamental Analysis:

QUBT's financial health needs careful scrutiny. Examining key metrics like revenue growth, profit margins, debt-to-equity ratio, and cash flow is essential. [Insert relevant financial data and ratios. Source the data appropriately. For example: "QUBT's revenue grew by X% in the last quarter, while its profit margins remain under pressure due to high R&D expenses."]

Dip Buying Strategy

Before considering any investment in QUBT, a thorough risk assessment is necessary.

Risk Assessment:

- Market Volatility: The quantum computing sector is inherently volatile, subject to significant price swings.

- Technological Hurdles: Quantum computing faces significant technological challenges, and success is not guaranteed.

- Intense Competition: The competitive landscape is fierce, and QUBT's market share is not guaranteed.

Investment Recommendation:

[Provide a clear buy, hold, or sell recommendation, justifying your decision based on the analysis conducted. Be clear this is not financial advice. For example: "Based on the analysis above, the current dip in QUBT's stock price may present a limited-risk buying opportunity for long-term investors with a high-risk tolerance. However, this is purely speculative and not financial advice."]

Diversification and Portfolio Management:

Investing in QUBT should be part of a well-diversified investment portfolio. Don't put all your eggs in one basket.

Conclusion

QUBT's recent stock price decline presents a complex scenario. While the AI quantum computing market holds immense potential, risks associated with the sector and QUBT's specific challenges need careful consideration. The potential for growth is significant, but the volatility necessitates a cautious approach. While this analysis suggests a potential dip-buying opportunity in this AI quantum computing stock, always remember to conduct your own due diligence before investing. Learn more about QUBT and the AI quantum computing market to inform your investment strategy. Remember, this analysis is for informational purposes only and not financial advice. Consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

Le Book Club Le Matin Discute Les Grands Fusains De Boulemane De Abdelkebir Rabi

May 21, 2025

Le Book Club Le Matin Discute Les Grands Fusains De Boulemane De Abdelkebir Rabi

May 21, 2025 -

The Goldbergs A Complete Guide To The Beloved Sitcom

May 21, 2025

The Goldbergs A Complete Guide To The Beloved Sitcom

May 21, 2025 -

Maximilian Beiers Brace Leads Dortmund To Victory Against Mainz

May 21, 2025

Maximilian Beiers Brace Leads Dortmund To Victory Against Mainz

May 21, 2025 -

The Viral Reddit Post A Fictional Missing Person Case And The Sydney Sweeney Movie Connection

May 21, 2025

The Viral Reddit Post A Fictional Missing Person Case And The Sydney Sweeney Movie Connection

May 21, 2025 -

Train Hits Family On Railroad Bridge Two Adults Killed Children Injured

May 21, 2025

Train Hits Family On Railroad Bridge Two Adults Killed Children Injured

May 21, 2025

Latest Posts

-

Fastest Ever Man Completes Record Breaking Australian Foot Crossing

May 22, 2025

Fastest Ever Man Completes Record Breaking Australian Foot Crossing

May 22, 2025 -

Australian Crossing New Fastest Time Set On Foot

May 22, 2025

Australian Crossing New Fastest Time Set On Foot

May 22, 2025 -

Bbc Breakfast Presenters On Air Interruption A Guests Unexpected Appearance

May 22, 2025

Bbc Breakfast Presenters On Air Interruption A Guests Unexpected Appearance

May 22, 2025 -

Man Shatters Australias Fastest Foot Crossing Record

May 22, 2025

Man Shatters Australias Fastest Foot Crossing Record

May 22, 2025 -

Australian Foot Race Man Sets New Speed Record

May 22, 2025

Australian Foot Race Man Sets New Speed Record

May 22, 2025