Tracking The Net Asset Value (NAV) Of Amundi MSCI World II UCITS ETF USD Hedged Dist

Table of Contents

Accessing Real-time and Historical Amundi MSCI World II UCITS ETF NAV Data

Finding reliable sources for the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is essential. Here are some reputable places to obtain both real-time and historical data:

- Amundi Website: The official Amundi website is the primary source for accurate NAV information. [Insert Link to Amundi's relevant ETF page here]. They typically provide daily NAV updates, often displayed clearly in tables or charts.

- Major Financial News Sources: Many financial news websites (e.g., Bloomberg, Yahoo Finance, Google Finance) provide ETF data, including the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV. However, always verify the data against the official Amundi source.

- Brokerage Platforms: If you hold the Amundi MSCI World ETF through a brokerage account, your platform will usually display the current NAV and historical data. Check your account's information section for this data.

Data Frequency and Formats: The Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is typically updated daily, reflecting the closing price of the underlying assets. You can usually find this data in various formats, including:

- Tables showing historical NAV data.

- Interactive charts visualizing NAV performance over time.

- Downloadable files (e.g., CSV) allowing for easy import into spreadsheets or other financial analysis tools.

Importance of Reliable Sources: Always prioritize reliable sources for NAV information. Inaccurate data can lead to flawed investment decisions. Using the official Amundi website or well-established financial platforms is crucial to ensure accuracy.

Factors Influencing the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Several factors contribute to the daily fluctuations in the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV:

- Underlying Asset Performance: The primary driver of the NAV is the performance of the underlying assets—the MSCI World Index. Positive performance in the index leads to an increase in the ETF's NAV, and vice versa. Tracking the MSCI World Index performance is crucial for understanding NAV movements.

- Currency Fluctuations: The "USD Hedged" aspect is significant. This means the ETF employs strategies to minimize the impact of fluctuations between the Euro (likely the base currency of the UCITS ETF) and the US dollar. This hedging aims to protect investors from currency exchange rate risk, ensuring that changes in the NAV are primarily driven by the underlying asset performance, rather than currency movements. An unhedged version would be significantly more susceptible to exchange rate risk.

- Management Fees and Expenses: The ETF's management fees and other operational expenses are deducted from the assets under management, slightly reducing the NAV over time. These are usually clearly stated in the ETF's fact sheet.

- Dividend Distributions: When the underlying companies in the MSCI World Index pay dividends, these are typically distributed to ETF shareholders. This distribution will result in a decrease in the NAV on the ex-dividend date, reflecting the payout.

Utilizing NAV Data for Investment Decisions

Tracking the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV provides valuable insights for your investment strategy:

- Performance Evaluation: By comparing the current NAV to previous NAVs, you can easily track the ETF's performance over any chosen period. This helps assess whether the ETF is meeting your investment goals.

- Buy/Sell Signals (with caution): While comparing the current NAV to historical trends can offer insights, it's crucial to remember that NAV alone shouldn't drive buy or sell decisions. Consider other factors, including market trends, your risk tolerance, and your overall investment strategy.

- Portfolio Diversification and Rebalancing: Regularly monitoring the NAV allows you to effectively rebalance your portfolio, ensuring it aligns with your asset allocation goals. If one asset class (like the Amundi MSCI World ETF) grows disproportionately, you can sell some shares to maintain your desired balance.

- Calculating Returns: To calculate the return on your investment, simply subtract the initial NAV from the current NAV, divide the result by the initial NAV, and multiply by 100. This gives you the percentage return.

Conclusion: Mastering Amundi MSCI World II UCITS ETF USD Hedged Dist NAV Tracking

Understanding and regularly tracking the Amundi MSCI World II UCITS ETF USD Hedged Dist NAV is crucial for making sound investment decisions. By accessing reliable data from sources like the official Amundi website and reputable financial platforms, you can effectively monitor performance, manage risk, and optimize your portfolio. Remember to consider other market factors alongside NAV data when making buy or sell decisions. Stay informed about your Amundi MSCI World II UCITS ETF USD Hedged Dist investment by regularly monitoring its NAV and making adjustments to your portfolio as needed. [Insert Link to Amundi's relevant ETF page here]

Featured Posts

-

Parasal Sans Nisan Ayinda Zengin Olmaya En Yakin Burclar

May 24, 2025

Parasal Sans Nisan Ayinda Zengin Olmaya En Yakin Burclar

May 24, 2025 -

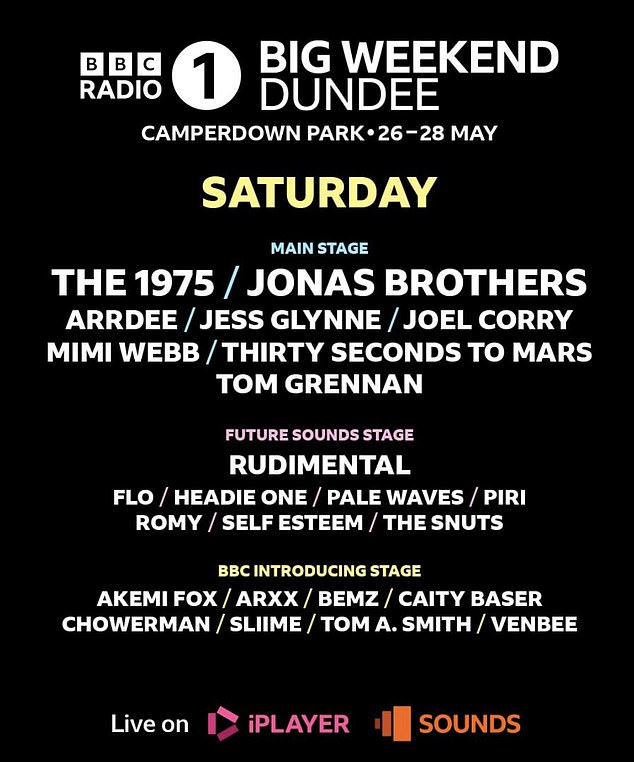

Everything You Need To Know About Bbc Radio 1 Big Weekend Tickets

May 24, 2025

Everything You Need To Know About Bbc Radio 1 Big Weekend Tickets

May 24, 2025 -

3 Burc Icin Mayis Ayinda Askin Ruezgari Esiyor

May 24, 2025

3 Burc Icin Mayis Ayinda Askin Ruezgari Esiyor

May 24, 2025 -

Jonathan Groffs Just In Time Opening Lea Michele Daniel Radcliffe And More Show Support

May 24, 2025

Jonathan Groffs Just In Time Opening Lea Michele Daniel Radcliffe And More Show Support

May 24, 2025 -

Nintendos Action Against Ryujinx Emulator Developers Announcement And Future Implications

May 24, 2025

Nintendos Action Against Ryujinx Emulator Developers Announcement And Future Implications

May 24, 2025