Tracking The Net Asset Value Of The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

The Amundi Dow Jones Industrial Average UCITS ETF is an exchange-traded fund that tracks the performance of the Dow Jones Industrial Average (DJIA), a widely recognized index of 30 large, publicly-owned companies in the United States. Investing in this ETF provides diversified exposure to a significant portion of the American economy. Understanding its Net Asset Value (NAV) – the net value of the fund's assets minus its liabilities per share – is paramount for informed decision-making. The NAV represents the intrinsic value of each ETF share. Tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV allows investors to gauge the fund's underlying asset performance and make informed buy and sell decisions.

How to Track the Amundi Dow Jones Industrial Average UCITS ETF NAV

Tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV is relatively straightforward using several methods:

- Directly from the Provider: The most reliable source is Amundi's official website. They usually provide daily updates on the ETF's NAV. Look for sections dedicated to fund factsheets or performance data.

- Financial Data Providers: Reputable financial data providers such as Bloomberg Terminal, Refinitiv Eikon, and others offer real-time and historical NAV data for a wide range of ETFs, including the Amundi Dow Jones Industrial Average UCITS ETF. These platforms often provide comprehensive analytical tools as well.

- Brokerage Platforms: Most online brokerage platforms display the NAV of the ETFs held in your portfolio. Check your account statements or the detailed information pages for your ETF holdings.

- Financial News Websites and Apps: Many financial news websites and mobile apps (e.g., Yahoo Finance, Google Finance) provide up-to-date information on ETF NAVs, including the Amundi Dow Jones Industrial Average UCITS ETF NAV.

It's crucial to check the Amundi Dow Jones Industrial Average UCITS ETF NAV at the end of each trading day to get the most accurate reflection of the day's performance. The NAV is typically updated daily, reflecting the closing prices of the underlying assets.

Factors Influencing the Amundi Dow Jones Industrial Average UCITS ETF NAV

Several factors influence the daily fluctuations of the Amundi Dow Jones Industrial Average UCITS ETF NAV:

- Underlying Asset Performance: The 30 components of the Dow Jones Industrial Average are the primary drivers of the ETF's NAV. A positive performance by these companies will generally lead to an increase in the NAV, and vice-versa. Individual stock movements within the index significantly impact the overall NAV.

- Currency Exchange Rates: If you're investing in the Amundi Dow Jones Industrial Average UCITS ETF in a currency other than USD, fluctuations in exchange rates will affect your local currency equivalent of the NAV. A stronger USD relative to your local currency would decrease the NAV in your local currency.

- Management Fees and Expenses: The ETF's management fees and other operational expenses are deducted from the fund's assets, slightly reducing the NAV over time. These fees are usually disclosed in the fund's prospectus.

- Market Sentiment and Conditions: Broad market trends and investor sentiment significantly impact the NAV. During periods of market optimism, the NAV tends to rise, while negative sentiment can lead to declines. Global economic events, geopolitical risks, and interest rate changes can all play a role.

Interpreting the Amundi Dow Jones Industrial Average UCITS ETF NAV and Making Informed Investment Decisions

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV allows for more informed investment choices.

- Arbitrage Opportunities: Compare the NAV to the ETF's market price. Sometimes, discrepancies can arise, offering potential arbitrage opportunities (though these are often short-lived).

- Holistic Analysis: Don't solely rely on the NAV. Consider other factors like trading volume (higher volume suggests more liquidity), the expense ratio (lower is better), and the ETF's historical performance.

- Timing Purchases and Sales: While not a foolproof strategy, analyzing NAV trends in conjunction with market analysis can assist in making more informed decisions about when to buy or sell. A consistently rising NAV may suggest a positive trend.

- Portfolio Management: NAV data is vital for portfolio diversification and risk management. By understanding the NAV and its relationship to market performance, you can better manage your overall portfolio risk.

Potential Pitfalls and Considerations When Tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV

While tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV is beneficial, be aware of these potential issues:

- NAV Reporting Delays: The NAV is usually calculated at the end of the trading day, meaning there's a delay before the official figure is available.

- Bid-Ask Spread: The price you buy or sell the ETF at (the bid and ask price) might differ slightly from the NAV, impacting your actual return.

- Short-Term Fluctuations: Don't overreact to short-term NAV fluctuations. Focus on longer-term trends to make better investment decisions.

- Seek Professional Advice: If you're unsure about interpreting NAV data or making investment decisions based on it, consult a qualified financial advisor.

Mastering Amundi Dow Jones Industrial Average UCITS ETF NAV Tracking

To summarize, effectively tracking the Amundi Dow Jones Industrial Average UCITS ETF NAV involves utilizing various resources (Amundi's website, financial data providers, brokerage platforms, and financial news sources) to obtain accurate and timely data. Understanding the factors influencing the NAV – underlying asset performance, currency exchange rates, management fees, and overall market conditions – is crucial for informed decision-making. By considering the NAV alongside other market indicators and historical performance, you can make more strategic buy and sell decisions. Remember that while the NAV is a key indicator, it shouldn't be the sole determinant of your investment strategy.

Start tracking your Amundi Dow Jones Industrial Average UCITS ETF NAV today to optimize your investment strategy and achieve your financial goals. Regularly review the NAV and stay informed about market trends to make the most of your investment. Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is key to successful investing.

Featured Posts

-

Porsche Investicijos I Elektromobiliu Infrastruktura Europoje

May 24, 2025

Porsche Investicijos I Elektromobiliu Infrastruktura Europoje

May 24, 2025 -

Erlebnisreiche Radtouren Die Geschichte Essens Neu Entdecken

May 24, 2025

Erlebnisreiche Radtouren Die Geschichte Essens Neu Entdecken

May 24, 2025 -

Investigation Launched Into Sexist Abuse Of Female Referee

May 24, 2025

Investigation Launched Into Sexist Abuse Of Female Referee

May 24, 2025 -

2025 Porsche Cayenne Interior And Exterior Design High Resolution Images

May 24, 2025

2025 Porsche Cayenne Interior And Exterior Design High Resolution Images

May 24, 2025 -

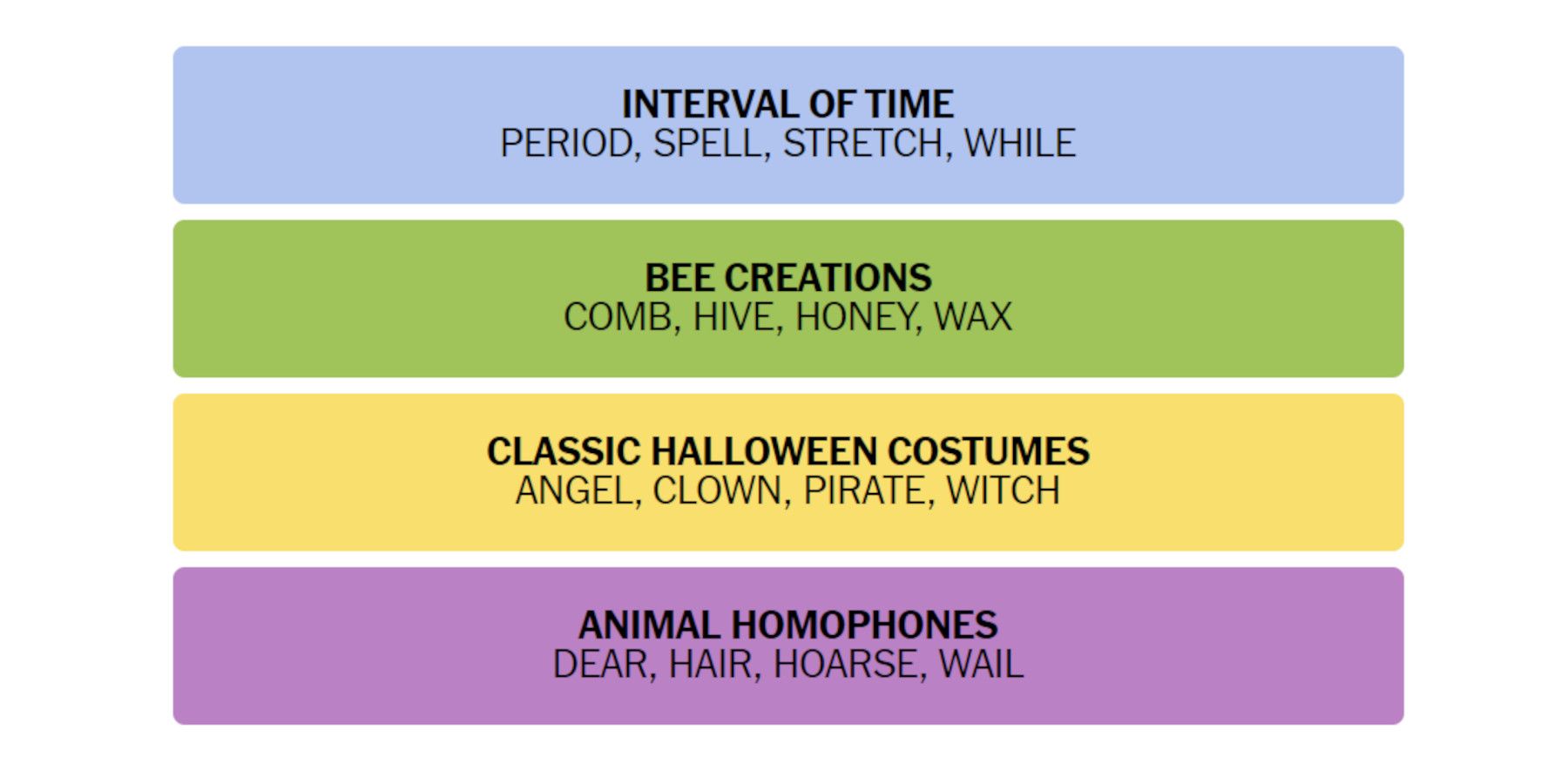

March 18 2025 New York Times Connections Hints And Answers For Puzzle 646

May 24, 2025

March 18 2025 New York Times Connections Hints And Answers For Puzzle 646

May 24, 2025