Trade War Impact On Crypto: A Single Coin's Path To Success

Table of Contents

Increased Volatility and Crypto's Safe Haven Status

Trade wars inject significant uncertainty into global markets. This uncertainty often drives investors towards perceived "safe haven" assets – traditionally gold, government bonds, and the US dollar. However, the volatile nature of cryptocurrency presents a unique dynamic. While cryptocurrencies themselves are inherently volatile, those with strong fundamentals and established market positions can benefit from a flight to safety, albeit a riskier one.

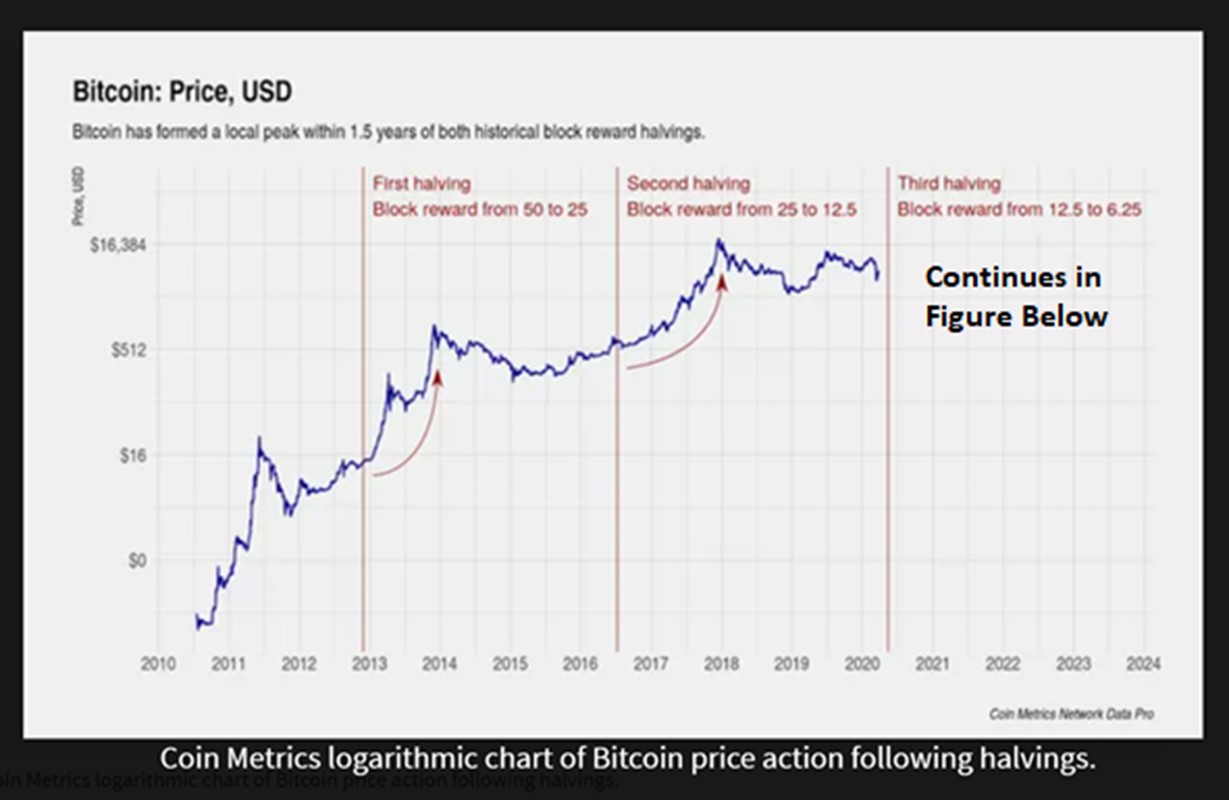

- Increased demand for crypto as a hedge against geopolitical risk: As traditional markets fluctuate during trade disputes, some investors see cryptocurrencies as a potential diversification strategy, hedging against losses in other asset classes. This increased demand can lead to price appreciation.

- Potential for price surges in established and promising altcoins: While Bitcoin often leads the market, altcoins with strong use cases and technological advantages can experience significant price surges during periods of heightened market uncertainty. Investors seek promising projects with potential for long-term growth.

- Impact of regulatory responses to trade tensions on cryptocurrency markets: Government responses to trade wars, including changes in monetary policy or capital controls, can indirectly impact cryptocurrency markets, creating both opportunities and challenges.

For example, during previous periods of heightened trade tensions, we've seen certain cryptocurrencies, like Bitcoin and Ethereum, experience price increases as investors sought alternative investment havens. However, it's crucial to remember that this is not always the case, and volatility remains a significant factor.

Impact of Trade Wars on Cross-Border Transactions

Trade wars often disrupt traditional cross-border financial systems, leading to delays and increased costs. Cryptocurrencies, however, offer a potential solution by facilitating faster and cheaper international transactions, bypassing the traditional banking infrastructure often impacted by trade restrictions.

- Lower transaction fees compared to traditional methods: Crypto transactions often incur significantly lower fees than traditional bank wire transfers, especially for international payments. This is a major advantage during trade wars when traditional banking costs might increase.

- Faster transaction speeds, reducing delays caused by trade disputes: Crypto transactions can be processed much faster than traditional bank transfers, reducing delays often associated with trade disputes and sanctions.

- Increased privacy compared to traditional banking systems: The pseudonymous nature of many cryptocurrency transactions can offer a degree of privacy that might be appealing to businesses and individuals seeking to avoid scrutiny during periods of heightened trade tensions.

Stablecoins, pegged to fiat currencies like the US dollar, play a critical role in mitigating the volatility inherent in crypto transactions. They provide a more stable medium of exchange for international trade, reducing the risk associated with fluctuating cryptocurrency prices.

Regulatory Responses and Their Influence on Crypto Success

The impact of trade wars extends to the regulatory landscape. Different countries respond to trade tensions in various ways, and these responses significantly influence the cryptocurrency market. Favorable regulatory environments can foster innovation and attract investment, while restrictive policies can stifle growth.

- Impact of stricter regulations on market liquidity and adoption: Increased regulatory scrutiny can limit market liquidity and hinder the adoption of cryptocurrencies, especially in jurisdictions with more stringent rules.

- Opportunities for innovation in jurisdictions with supportive regulations: Conversely, countries with forward-thinking regulatory approaches can become hubs for cryptocurrency innovation, attracting both developers and investors.

- The role of decentralized finance (DeFi) in circumventing regulatory hurdles: DeFi projects, operating on decentralized networks, often seek to operate outside traditional regulatory frameworks, creating both opportunities and risks.

The contrasting regulatory approaches of countries like Singapore (relatively crypto-friendly) and China (highly restrictive) illustrate how differing regulatory landscapes impact the success of various crypto projects. A single coin’s path to success is heavily influenced by its ability to navigate this complex regulatory maze.

The Role of Blockchain Technology in a Globalized Economy

Underlying all cryptocurrencies is blockchain technology. Its inherent transparency and immutability offer significant advantages in a globalized economy, especially during periods of economic uncertainty caused by trade wars.

- Enhanced traceability and accountability in international trade: Blockchain's transparent ledger allows for better tracking of goods and payments throughout the supply chain, increasing accountability and reducing the risk of fraud.

- Reduced risk of fraud and counterfeiting: The immutability of blockchain makes it difficult to alter transaction records, reducing the risk of fraud and counterfeiting, which are significant concerns in international trade.

- Improved cross-border payments and settlements: Blockchain technology can streamline cross-border payments and settlements, improving efficiency and reducing delays caused by trade disputes.

Conclusion

Trade wars create both challenges and opportunities for the cryptocurrency market. A single coin's path to success hinges on its ability to leverage blockchain technology's inherent advantages, navigate the increased volatility, and adapt to the evolving regulatory landscape. By understanding these factors, investors can identify promising cryptocurrencies poised for growth even amidst global trade tensions.

Understanding the complex interplay between trade wars and the cryptocurrency market is crucial for successful investment. Learn more about navigating the volatile world of crypto and identifying promising single coins poised for success, even amidst global trade tensions. Research thoroughly and invest wisely in the right cryptocurrencies to capitalize on this dynamic landscape.

Featured Posts

-

Sec Review Of Grayscale Etf Could Send Xrp Price To Record Highs

May 08, 2025

Sec Review Of Grayscale Etf Could Send Xrp Price To Record Highs

May 08, 2025 -

Health Concerns And The Future Of Fettermans Senate Seat

May 08, 2025

Health Concerns And The Future Of Fettermans Senate Seat

May 08, 2025 -

Simsek In Kripto Varliklar Hakkindaki Aciklamalari Ve Yatirimcilar Icin Tavsiyeler

May 08, 2025

Simsek In Kripto Varliklar Hakkindaki Aciklamalari Ve Yatirimcilar Icin Tavsiyeler

May 08, 2025 -

Saving Private Ryans 10 Most Memorable Characters

May 08, 2025

Saving Private Ryans 10 Most Memorable Characters

May 08, 2025 -

2025 Bitcoin Conference In Seoul A Focus On Asian Markets

May 08, 2025

2025 Bitcoin Conference In Seoul A Focus On Asian Markets

May 08, 2025

Latest Posts

-

Ubers Antitrust Lawsuit Against Door Dash Examining The Claims

May 08, 2025

Ubers Antitrust Lawsuit Against Door Dash Examining The Claims

May 08, 2025 -

Kalanicks Admission Ubers Topic Abandonment Was A Strategic Error

May 08, 2025

Kalanicks Admission Ubers Topic Abandonment Was A Strategic Error

May 08, 2025 -

Zherson I Zenit Kontrakt Na E500 000

May 08, 2025

Zherson I Zenit Kontrakt Na E500 000

May 08, 2025 -

Food Delivery War Heats Up Uber Files Suit Against Door Dash

May 08, 2025

Food Delivery War Heats Up Uber Files Suit Against Door Dash

May 08, 2025 -

Travis Kalanick Regretting The Decision To Drop Topic At Uber

May 08, 2025

Travis Kalanick Regretting The Decision To Drop Topic At Uber

May 08, 2025