Trade War Intensifies: Amsterdam Stock Market Opens Down 7%

Table of Contents

Impact of the Trade War on the Amsterdam Stock Market

The intensifying trade war is directly impacting the Amsterdam Stock Market through several key channels. Reduced export opportunities are a major concern, as Dutch businesses face increased tariffs and trade barriers in key markets. This is severely impacting investor sentiment, leading to a sell-off in the stock market as confidence wanes. Supply chain disruptions, further exacerbated by geopolitical instability, are adding to the downward pressure.

-

Affected Industries: The impact is widespread, but some sectors are feeling the pinch more acutely than others.

- Agriculture: Dutch agricultural exports, particularly dairy and flowers, are facing significant challenges due to increased tariffs.

- Technology: Dutch tech companies reliant on global supply chains are experiencing disruptions and increased costs.

- Tourism: The uncertainty surrounding the global economy is negatively affecting tourism, impacting related businesses.

-

Specific Stock Drops: Major Dutch companies like [insert example company 1] and [insert example company 2] experienced significant stock price drops, reflecting the broader market anxiety. Precise figures should be included here, citing reputable financial news sources.

Global Market Reactions and Their Ripple Effect on Amsterdam

The escalating trade war isn't just a localized issue; it's triggering a global market reaction with significant repercussions for the Amsterdam Stock Market. The interconnectedness of global financial markets means that negative sentiment in one region quickly spreads to others. Investors are increasingly moving towards safer assets, further impacting the Amsterdam Stock Market's performance.

- Global Stock Market Reactions: Major stock markets around the world are experiencing volatility.

- New York Stock Exchange (NYSE): [Insert data on NYSE performance – cite source]

- London Stock Exchange (LSE): [Insert data on LSE performance – cite source]

- These declines reflect the widespread concern about the global economic impact of the trade war.

Analysis of the 7% Drop and Future Predictions

The 7% drop in the Amsterdam Stock Market is a significant event, indicating a serious erosion of investor confidence. The speed and magnitude of the drop highlight the vulnerability of the Dutch economy to global trade tensions. Sectors heavily reliant on exports and global supply chains were hit particularly hard.

- Expert Opinion: [Quote from a financial analyst on the causes and implications of the drop - cite source]. This section needs a reputable source to back up the analysis.

- Future Predictions: The outlook for the Amsterdam Stock Market depends heavily on the resolution (or escalation) of the trade war. If tensions ease, a recovery is possible. However, continued escalation could lead to further declines and prolonged economic uncertainty. [Include predictions from financial analysts – cite source].

Government Response and Potential Mitigation Strategies

The Dutch government is likely to respond to the stock market drop and the intensifying trade war with a combination of measures. These might include:

- Economic Stimulus: Government spending or tax cuts aimed at boosting economic activity.

- Fiscal Policy: Adjustments to government spending and taxation to manage the economic impact.

- Trade Negotiations: Active engagement in international trade negotiations to find solutions to the trade disputes.

The longer-term consequences will depend on the duration and severity of the trade war. Continued escalation could lead to significant economic damage, job losses, and reduced investor confidence in the Netherlands.

Conclusion: Navigating the Uncertainties of the Amsterdam Stock Market Amidst Trade War

The 7% drop in the Amsterdam Stock Market underscores the severe impact of the intensifying trade war. The interconnected nature of global markets means that events elsewhere have immediate consequences for the Dutch economy. The government's response will be crucial in mitigating the negative effects.

For investors, navigating this uncertainty requires careful consideration of risk management strategies. Diversification of portfolios, thorough due diligence, and a close monitoring of global trade developments are crucial. Stay informed about the Amsterdam Stock Market by consistently following financial news and expert analysis. Further research into the implications of the trade war on specific sectors within the Dutch economy is recommended for a more nuanced understanding. Understanding the complexities of the "Amsterdam Stock Market" within the context of the trade war is essential for making informed investment decisions.

Featured Posts

-

Just In Time Jonathan Groffs Shot At Tony Awards History

May 24, 2025

Just In Time Jonathan Groffs Shot At Tony Awards History

May 24, 2025 -

Nyi Rafdrifnir Porsche Macan Hvad T Harftu Ad Vita

May 24, 2025

Nyi Rafdrifnir Porsche Macan Hvad T Harftu Ad Vita

May 24, 2025 -

Nrw Eis Hit Die Unerwartete Lieblingssorte In Essen

May 24, 2025

Nrw Eis Hit Die Unerwartete Lieblingssorte In Essen

May 24, 2025 -

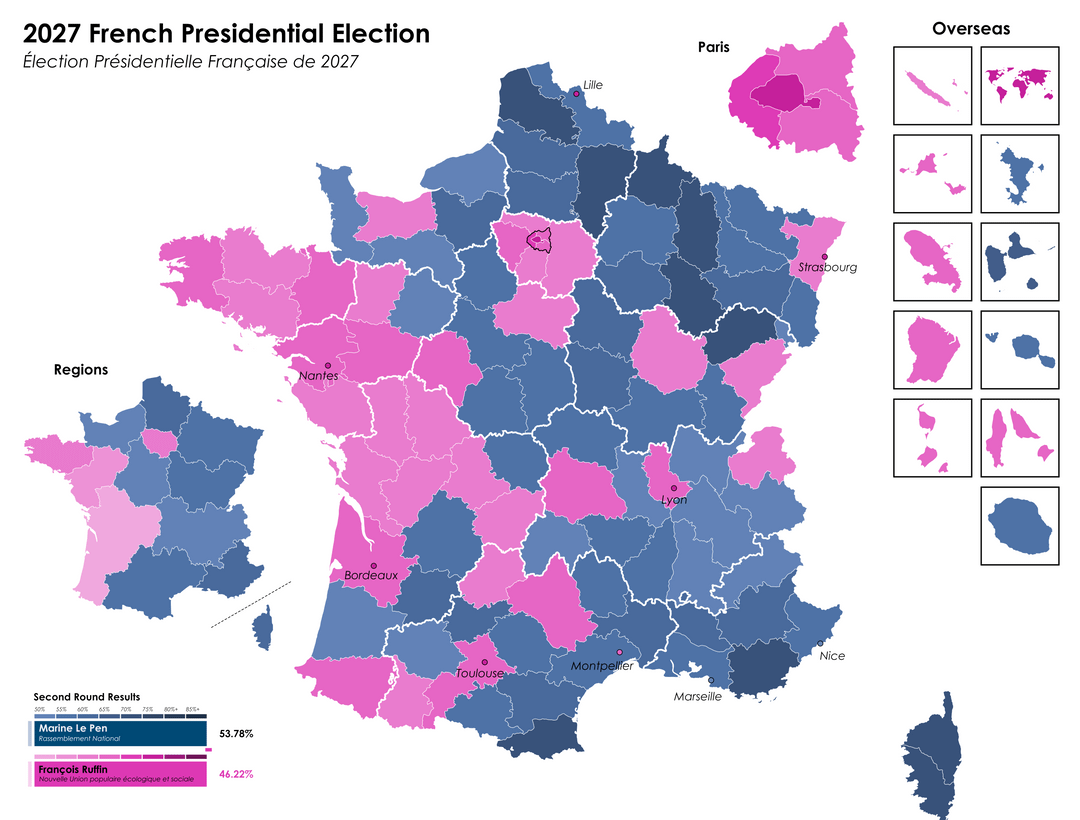

French Presidential Election 2027 Bardellas Path To Power

May 24, 2025

French Presidential Election 2027 Bardellas Path To Power

May 24, 2025 -

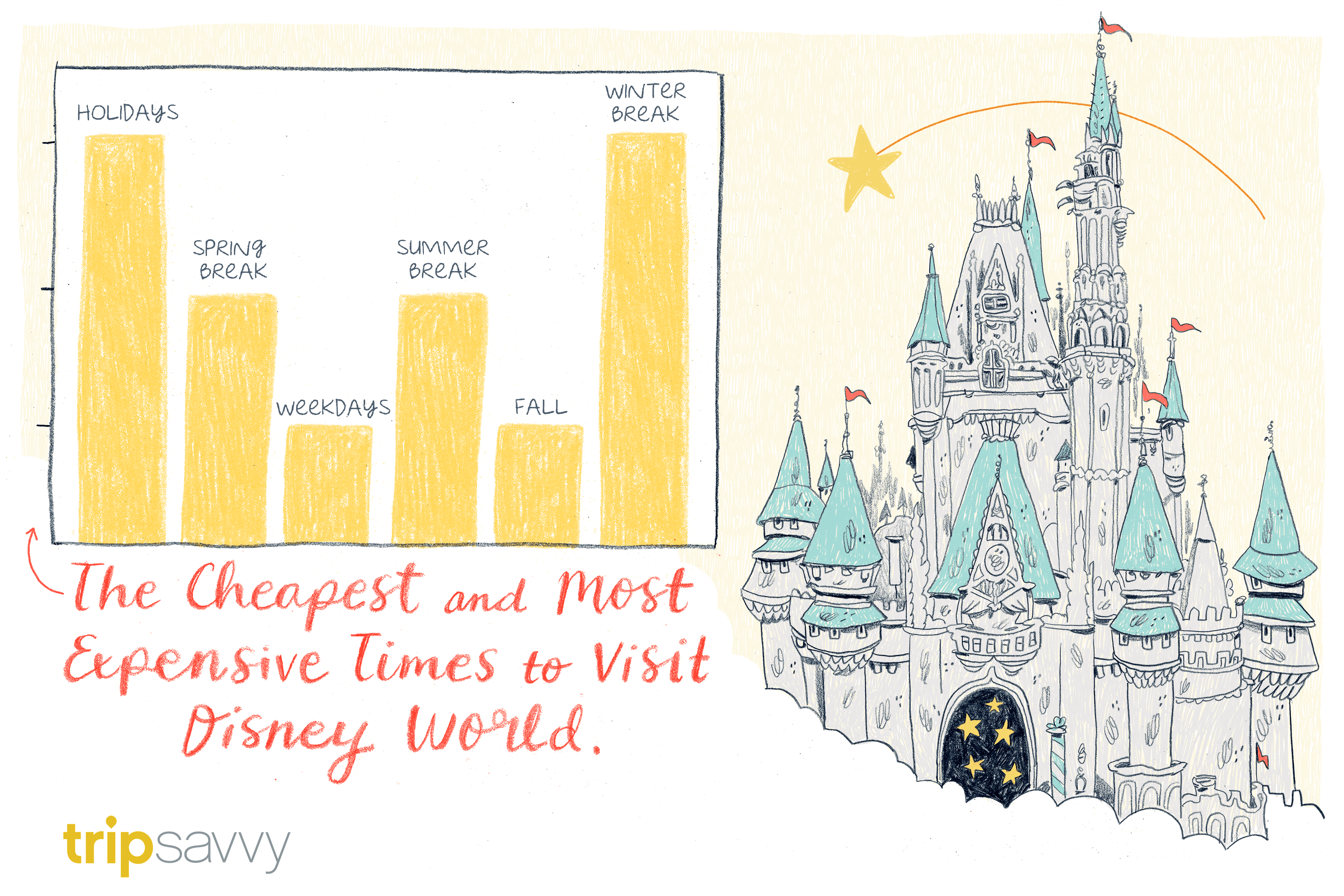

Memorial Day Flights 2025 When To Book For The Cheapest And Least Crowded Flights

May 24, 2025

Memorial Day Flights 2025 When To Book For The Cheapest And Least Crowded Flights

May 24, 2025