Trump Appointee's Bold Bitcoin Prediction After Market Surge

Table of Contents

The Appointee's Prediction and its Rationale

A former Trump administration official, [insert appointee's name and title here], recently made headlines with a bold Bitcoin price forecast. [He/She] predicted that Bitcoin's price will reach $[insert predicted price] within [insert timeframe, e.g., the next 12 months]. This prediction is based on several factors.

-

Macroeconomic Factors: [He/She] points to the current inflationary environment and the potential for further devaluation of fiat currencies as a key driver for Bitcoin adoption. The argument is that Bitcoin, as a decentralized and limited asset, offers a hedge against inflation.

-

Technological Advancements: The ongoing development of the Bitcoin network, including improvements in scalability and transaction speed, is cited as a positive indicator for future growth. The increasing adoption of the Lightning Network is also mentioned as a factor enhancing Bitcoin's usability.

-

Adoption Rates: [He/She] highlights the increasing adoption of Bitcoin by institutional investors and large corporations as a signal of growing confidence and legitimacy in the cryptocurrency. This institutional interest, according to [the appointee's name], is a strong indicator of future price appreciation.

-

Supporting Data and Analysis: [Insert details about any specific data, reports, or market analysis used to support the prediction. Mention sources if possible.] “[Insert a relevant quote from the appointee supporting their prediction],” stated [the appointee's name] in a recent interview.

Market Reaction to the Bold Bitcoin Prediction

The market reacted swiftly to [the appointee's name]'s prediction. Immediately following the announcement, Bitcoin's price experienced [describe the immediate market reaction: e.g., a significant surge, a slight increase, or a period of consolidation].

-

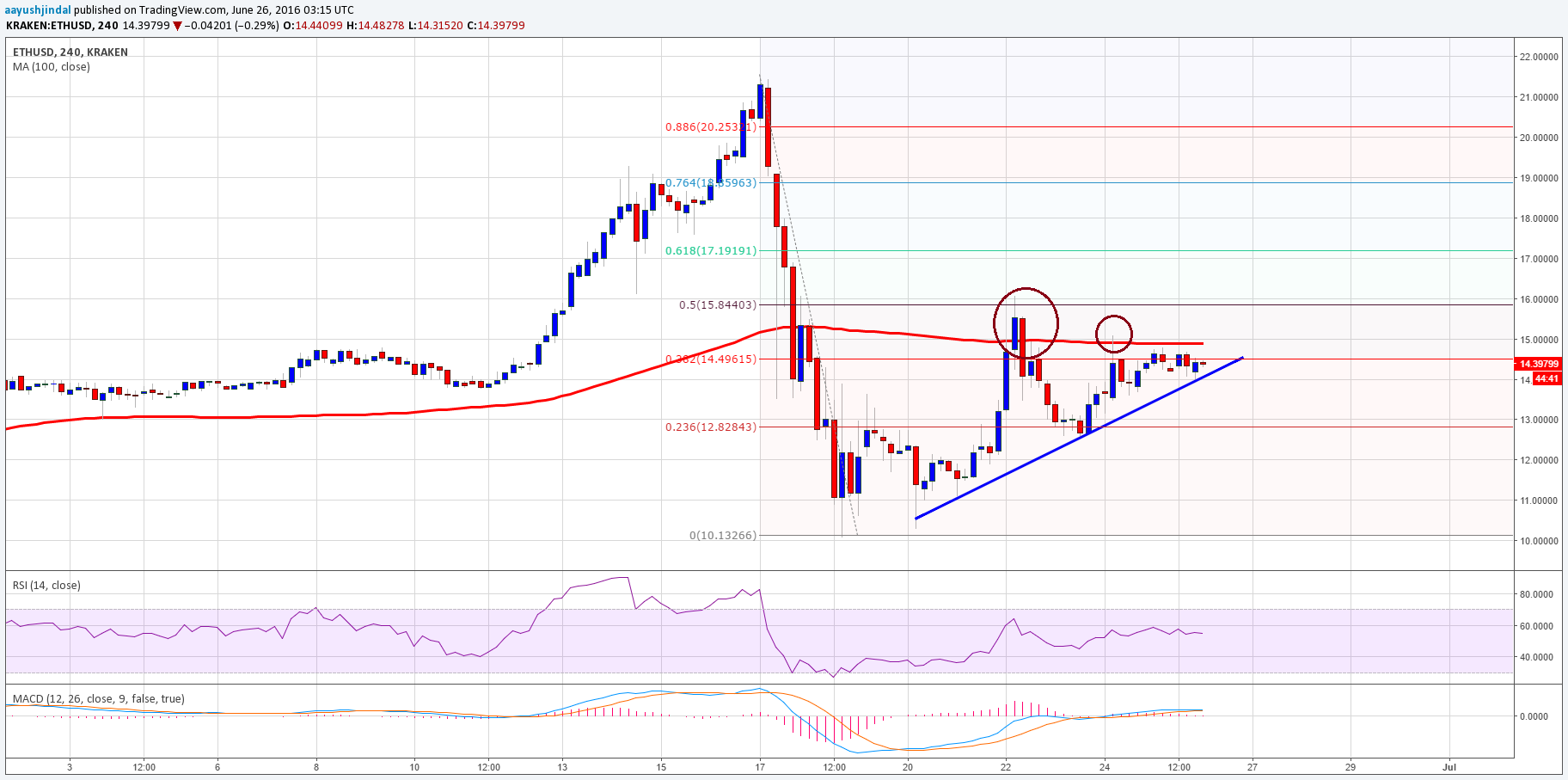

Volatility and Trading Volume: The announcement led to a notable increase in trading volume, demonstrating heightened investor interest and activity. Bitcoin's price volatility also increased temporarily, reflecting the uncertainty surrounding the prediction’s accuracy. [Insert charts and graphs illustrating the price fluctuations and trading volume].

-

Investor Sentiment: Investor sentiment shifted noticeably, with many expressing [describe the prevailing sentiment: e.g., optimism, caution, skepticism]. Social media platforms and crypto news websites were filled with discussions about the prediction and its potential impact. Many analysts weighed in, offering their own perspectives on the feasibility of the forecast.

Implications and Potential Future Scenarios for Bitcoin

[The appointee's name]'s prediction carries significant implications for the future of Bitcoin.

-

Short-Term Implications: The short-term impact could involve continued price volatility as investors react to the prediction and adjust their portfolios accordingly. Increased regulatory scrutiny is also a possibility.

-

Long-Term Implications: The long-term effects depend largely on several factors including wider institutional adoption, regulatory changes, and overall market sentiment. The prediction, regardless of its accuracy, has drawn further attention to Bitcoin and could potentially accelerate adoption.

-

Institutional Adoption: The prediction could further encourage institutional investment in Bitcoin, potentially leading to a more stable and mature market.

-

Future Scenarios: Several future scenarios are possible. A bullish scenario could see Bitcoin exceeding the predicted price, while a bearish scenario might see a price correction and a period of consolidation. The actual outcome will depend on various factors, including regulatory developments and overall macroeconomic conditions.

Regulatory Scrutiny and its Influence on Bitcoin's Trajectory

The regulatory landscape surrounding cryptocurrencies is constantly evolving. [The appointee's name]'s past involvement in [mention relevant past roles and actions related to regulation] could influence future regulatory actions towards Bitcoin.

-

SEC Regulation: The Securities and Exchange Commission's stance on cryptocurrencies will continue to play a significant role in shaping the market. Any significant regulatory changes could significantly impact Bitcoin's price and adoption.

-

Government Oversight: Increased government oversight of cryptocurrencies, potentially driven by concerns about money laundering or market manipulation, could lead to tighter regulations and potentially stifle growth.

-

Compliance and Legal Framework: The lack of a clear, consistent legal framework for cryptocurrencies globally creates uncertainty and risk. This uncertainty can impact investor confidence and influence price fluctuations.

Conclusion

[The appointee's name]'s bold Bitcoin prediction, following a recent market surge, has sparked intense debate within the cryptocurrency community. The prediction’s rationale, incorporating macroeconomic factors, technological advancements, and adoption rates, offers a compelling perspective on Bitcoin's potential future. However, the market's response, characterized by increased volatility and diverse investor sentiment, underlines the inherent uncertainty in the crypto market. Potential future scenarios range from exceeding the predicted price to significant corrections, shaped heavily by regulatory developments and the broader macroeconomic environment. Stay tuned for updates on this developing story and continue to follow the impact of this Trump appointee's bold Bitcoin prediction. Learn more about navigating the volatile Bitcoin market and protecting your crypto investments by [insert links to relevant resources here].

Featured Posts

-

2 1 1 0

May 08, 2025

2 1 1 0

May 08, 2025 -

Us Tariffs And Gms Canadian Workforce A Critical Analysis

May 08, 2025

Us Tariffs And Gms Canadian Workforce A Critical Analysis

May 08, 2025 -

Unexpected Perspective A Rogue One Star On A Popular Character

May 08, 2025

Unexpected Perspective A Rogue One Star On A Popular Character

May 08, 2025 -

Rogue One Stars Unexpected Take On A Fan Favorite Character

May 08, 2025

Rogue One Stars Unexpected Take On A Fan Favorite Character

May 08, 2025 -

Is Arteta Under Threat Collymores Comments On Arsenal

May 08, 2025

Is Arteta Under Threat Collymores Comments On Arsenal

May 08, 2025

Latest Posts

-

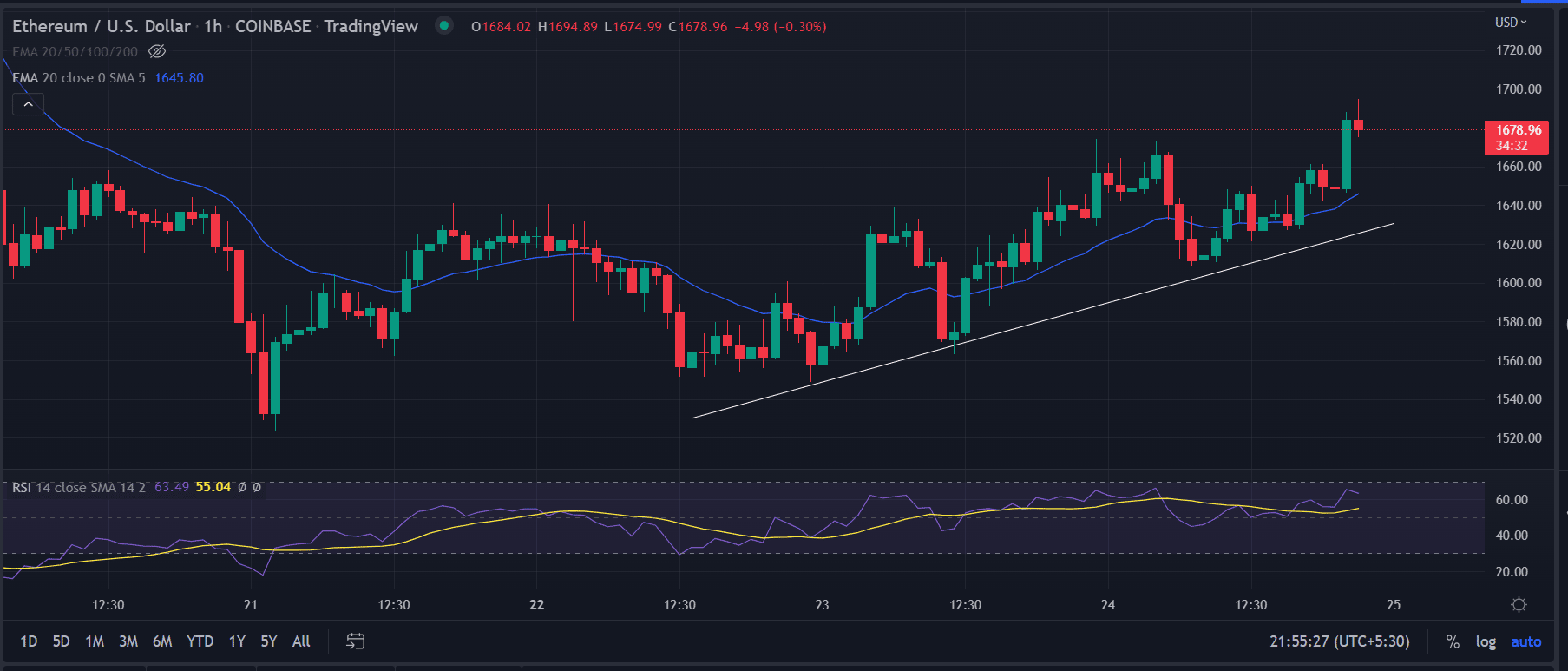

Is A Fall To 1 500 Possible Analyzing Ethereums Price And Support Levels

May 08, 2025

Is A Fall To 1 500 Possible Analyzing Ethereums Price And Support Levels

May 08, 2025 -

Unforgettable In Three Minutes Nathan Fillions Saving Private Ryan Scene

May 08, 2025

Unforgettable In Three Minutes Nathan Fillions Saving Private Ryan Scene

May 08, 2025 -

Ethereums Price Above Support But Will It Fall To 1 500 Analysis

May 08, 2025

Ethereums Price Above Support But Will It Fall To 1 500 Analysis

May 08, 2025 -

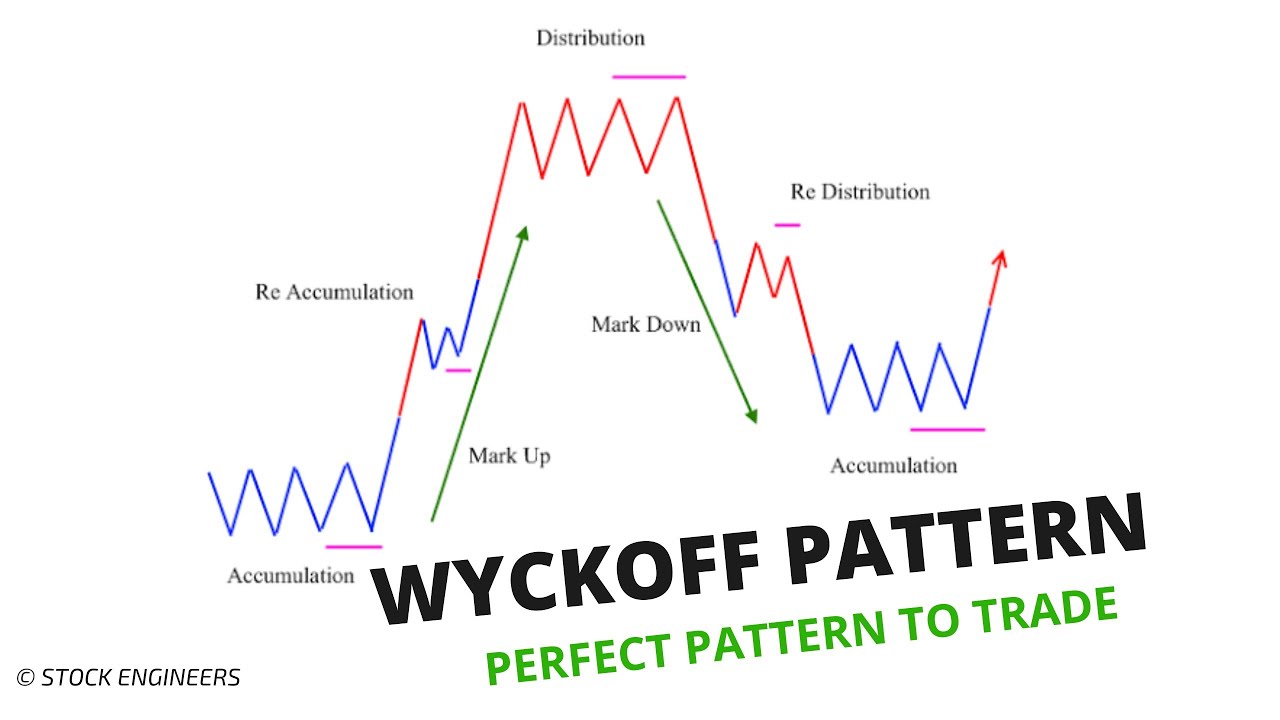

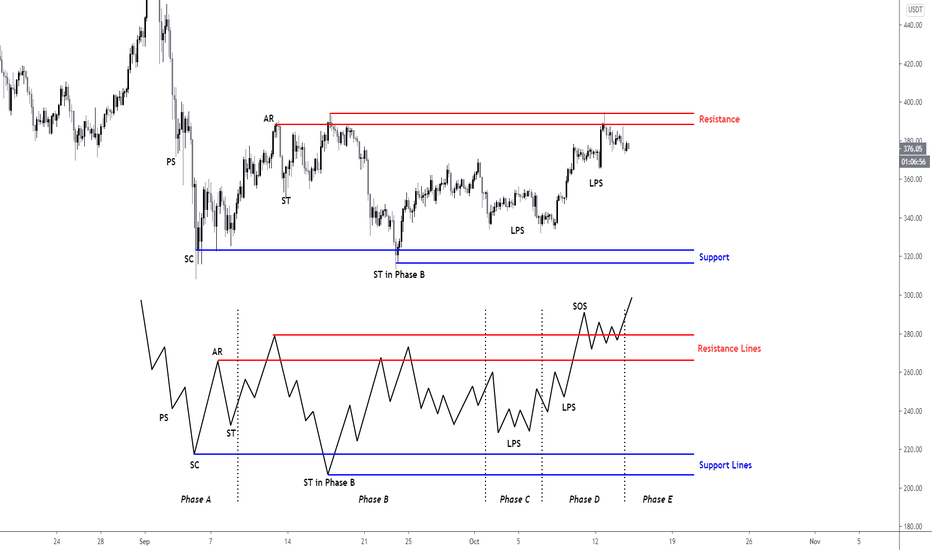

Ethereum Price Analysis Approaching 2 700 Following Wyckoff Accumulation

May 08, 2025

Ethereum Price Analysis Approaching 2 700 Following Wyckoff Accumulation

May 08, 2025 -

Is 2 700 The Next Ethereum Price Target Wyckoff Accumulation Signals

May 08, 2025

Is 2 700 The Next Ethereum Price Target Wyckoff Accumulation Signals

May 08, 2025