Trump Tax Cuts: Key Provisions Unveiled By House GOP

Table of Contents

Individual Income Tax Rate Reductions

The Trump Tax Cuts significantly altered individual income tax rates. This section details the key changes and their implications for taxpayers.

Lowered Brackets

The proposed tax plan substantially lowered individual income tax brackets. Before the cuts, there were seven brackets; the new plan reduced these, resulting in lower tax rates for many Americans.

- Pre-Cut Rates: Ranged from 10% to 39.6%.

- Post-Cut Rates: Lowered rates across the board, although the exact structure varied depending on the specific legislation. Generally, the top rate was reduced, and the lower brackets were also adjusted.

- Impact: Taxpayers across various income levels saw a decrease in their tax liability. Higher-income earners generally experienced more significant tax savings in percentage terms, while lower-income earners saw smaller but still noticeable reductions.

Standard Deduction Increase

The Trump Tax Cuts increased the standard deduction, which is the amount taxpayers can deduct from their gross income before calculating their taxable income. This increase benefited many taxpayers, especially those who previously itemized their deductions.

- Single Filers: The standard deduction increased substantially, allowing for a greater reduction in taxable income.

- Married Filing Jointly: Similar substantial increases applied to married couples filing jointly, resulting in more significant tax savings for many households.

- Impact on Itemizers: The higher standard deduction meant that fewer people needed to itemize their deductions because the standard deduction often exceeded the total amount of their itemized deductions.

Child Tax Credit Expansion

The Child Tax Credit (CTC), a tax break for families with children, was expanded under the Trump Tax Cuts. This expansion provided greater tax relief to families.

- Increased Credit Amount: The maximum credit amount per child was significantly increased.

- Refundability: A portion of the credit became refundable, meaning that even low-income families who didn't owe taxes could receive a tax refund.

- Impact on Families: This significantly benefited families with children, offering substantial tax savings and potentially putting money back into their pockets.

Corporate Tax Rate Cuts

The Trump Tax Cuts also implemented significant reductions in corporate tax rates, aiming to stimulate business investment and economic growth.

Reduced Corporate Tax Rate

A dramatic reduction in the corporate tax rate was a central feature of the Trump Tax Cuts.

- Pre-Cut Rate: The corporate tax rate was significantly higher before the cuts.

- Post-Cut Rate: The rate was slashed to a considerably lower level.

- Impact: This aimed to incentivize businesses to invest more, potentially leading to job creation and economic expansion. However, it also led to concerns about the increased national debt.

Pass-Through Business Deduction

The tax cuts also included provisions affecting pass-through businesses—sole proprietorships, partnerships, and S corporations.

- Deduction Details: A deduction was introduced for pass-through business income, aiming to benefit small business owners.

- Impact: This measure aimed to provide tax relief for small businesses, a significant part of the US economy. However, the specific details and limitations of the deduction were complex and varied.

International Tax Reform

Changes to international taxation were also included in the Trump Tax Cuts.

- Repatriation: Modifications were made to the taxation of foreign profits brought back to the US (repatriation).

- Foreign Tax Credits: Changes to foreign tax credits impacted multinational corporations and their foreign investment strategies.

- Impact: These changes aimed to encourage US companies to bring their profits back to the US and potentially stimulate domestic investment.

Potential Economic Impacts of the Trump Tax Cuts

The Trump Tax Cuts had far-reaching potential consequences for the US economy.

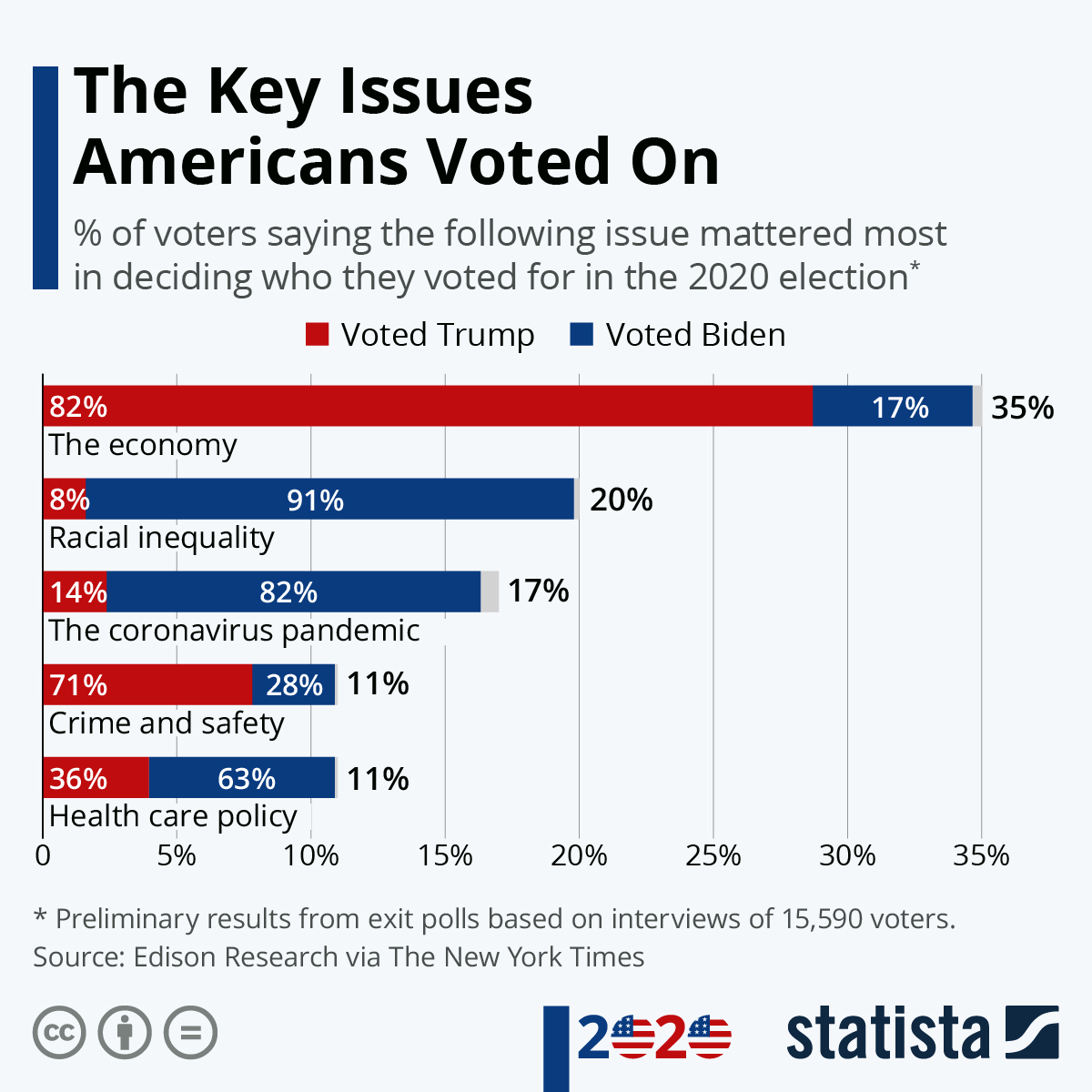

GDP Growth Projections

Economists offered various projections regarding the impact of the tax cuts on GDP growth.

- Varying Forecasts: Some predicted robust GDP growth, while others expressed more cautious optimism or even concern about potential negative effects.

- Increased Investment: Proponents argued that the tax cuts would stimulate business investment, fueling economic expansion.

- Inflationary Concerns: Critics worried about the potential for increased inflation due to higher consumer demand.

National Debt Implications

A major concern surrounding the Trump Tax Cuts was their impact on the national debt.

- Increased Deficit Spending: The tax cuts were predicted to significantly increase the federal budget deficit and the national debt.

- Long-Term Consequences: The long-term consequences of a growing national debt raised concerns about future economic stability.

- Arguments For and Against: Debates ensued regarding the trade-off between short-term economic stimulus and the long-term burden of increased debt.

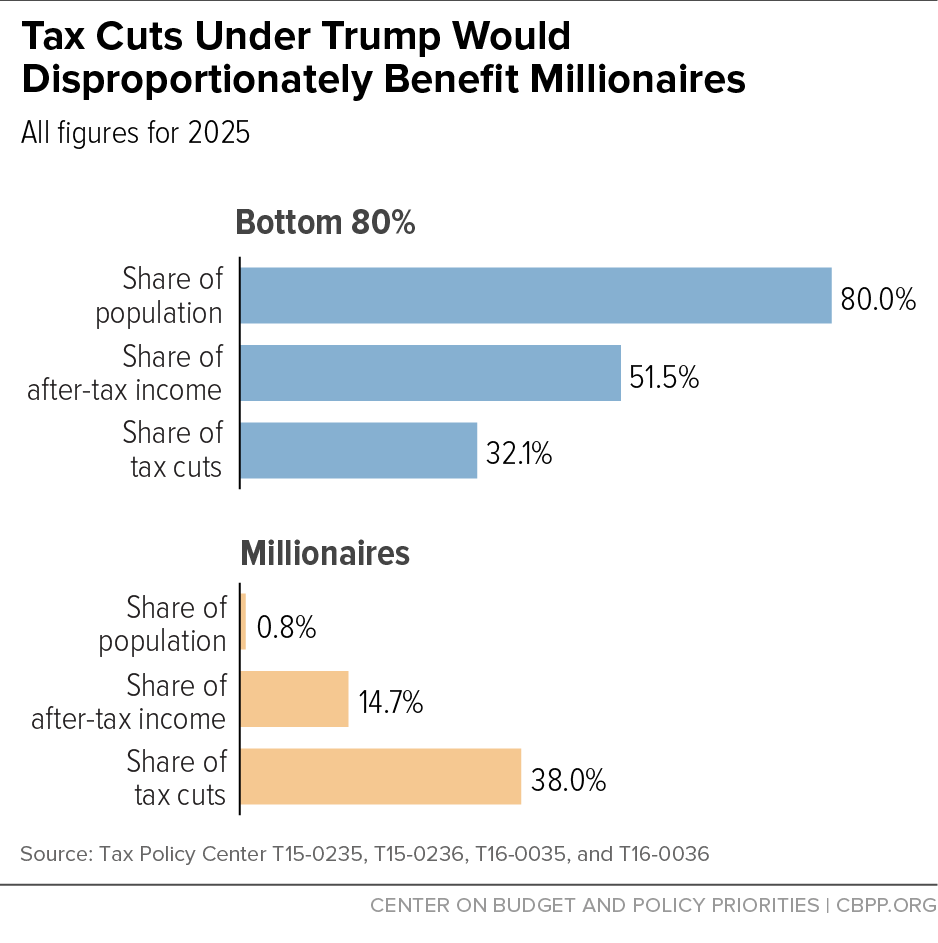

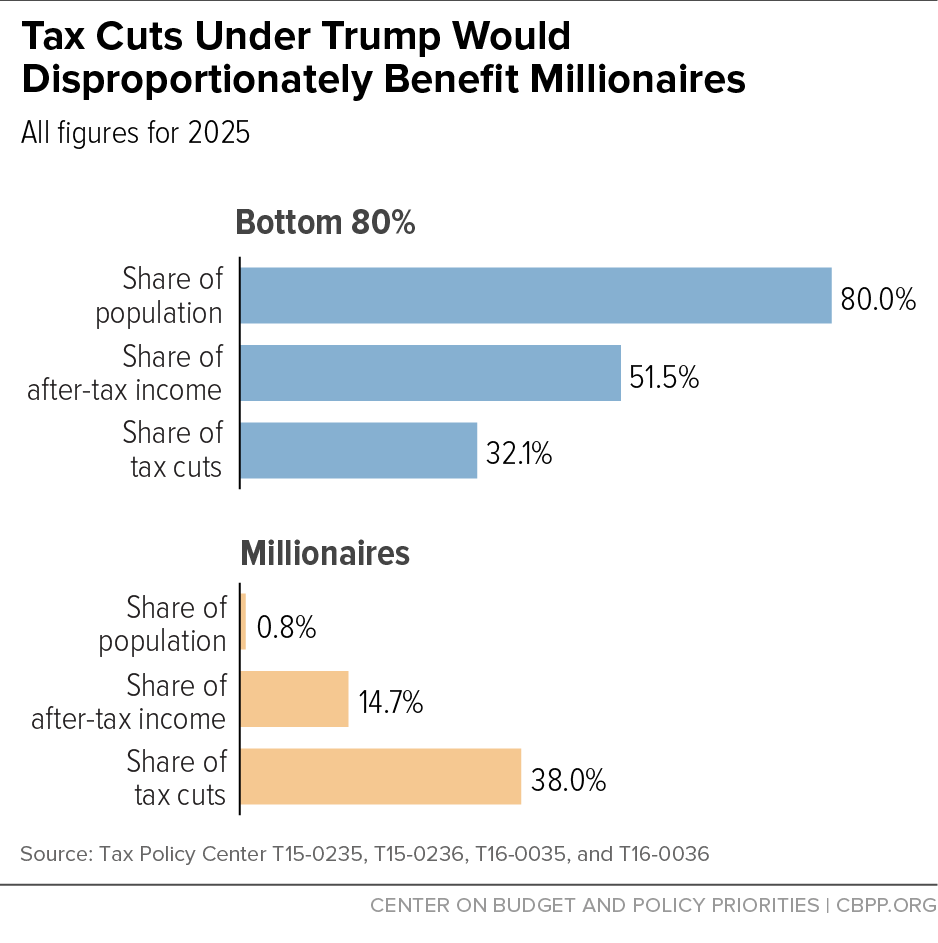

Income Inequality

The distributional effects of the Trump Tax Cuts, particularly their impact on income inequality, sparked considerable debate.

- Benefit Distribution: The benefits of the cuts were not evenly distributed across income groups.

- Exacerbation or Reduction of Inequality: Some argued that the cuts exacerbated income inequality, while others maintained that the overall economic growth stimulated by the cuts would benefit all income levels.

Conclusion

The Trump Tax Cuts involved substantial changes to both individual and corporate tax rates, deductions, and credits. These changes generated significant debate regarding their economic and social consequences. The impacts on GDP growth, the national debt, and income inequality remained subjects of ongoing analysis and discussion. For a deeper understanding of how these Trump Tax Cuts might affect your personal finances or business, consult a tax professional or explore further resources on tax reform. Understanding the intricacies of the Trump Tax Cuts is crucial for making informed financial decisions.

Featured Posts

-

Is Devon Sawa Returning For The Final Destination 25th Anniversary

May 13, 2025

Is Devon Sawa Returning For The Final Destination 25th Anniversary

May 13, 2025 -

Atalanta Vs Lazio Guia Completa Serie A 2025 Fecha Hora Y Transmision

May 13, 2025

Atalanta Vs Lazio Guia Completa Serie A 2025 Fecha Hora Y Transmision

May 13, 2025 -

Gymnos Panigyrismos Gia Ton Tzortz Mpalntok Meta Ti Niki Tis Sefilnt

May 13, 2025

Gymnos Panigyrismos Gia Ton Tzortz Mpalntok Meta Ti Niki Tis Sefilnt

May 13, 2025 -

How To Watch Texas Rangers Vs Boston Red Sox Mlb Game Free Live Stream

May 13, 2025

How To Watch Texas Rangers Vs Boston Red Sox Mlb Game Free Live Stream

May 13, 2025 -

Reliving The History Memorable Moments From Efls Greatest Games

May 13, 2025

Reliving The History Memorable Moments From Efls Greatest Games

May 13, 2025

Latest Posts

-

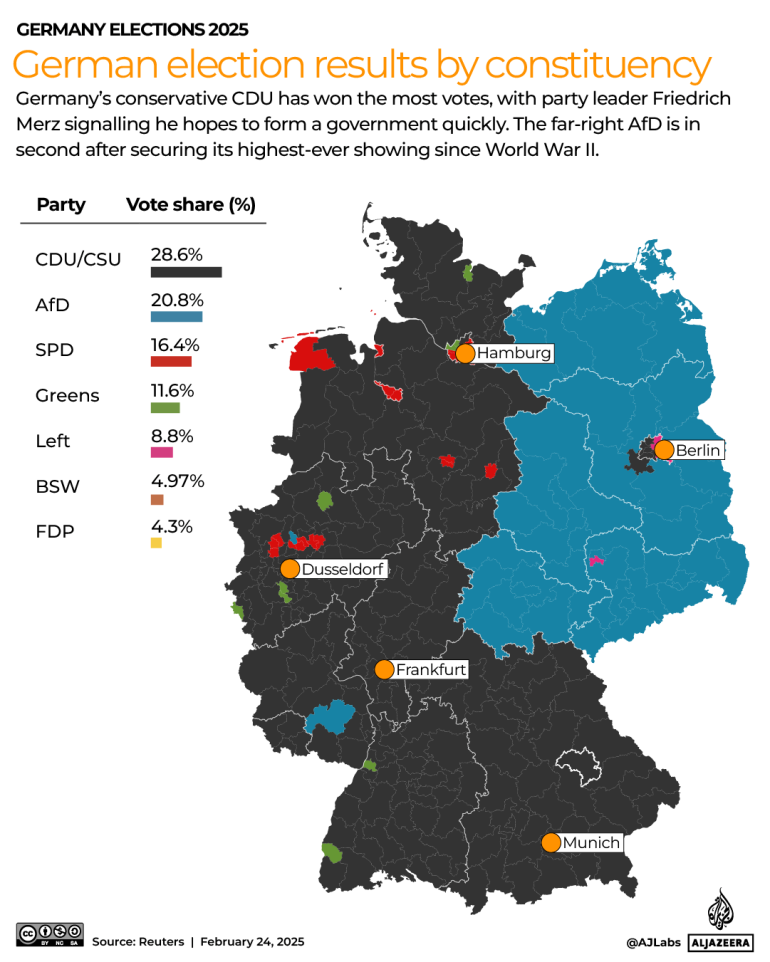

Deciding Germanys Future The Impact Of The Upcoming Election

May 14, 2025

Deciding Germanys Future The Impact Of The Upcoming Election

May 14, 2025 -

The German Election Key Issues And Potential Outcomes

May 14, 2025

The German Election Key Issues And Potential Outcomes

May 14, 2025 -

German Election Is This The Tide Turner

May 14, 2025

German Election Is This The Tide Turner

May 14, 2025 -

German Election 2023 A Crucial Turning Point

May 14, 2025

German Election 2023 A Crucial Turning Point

May 14, 2025 -

Stream Every Mission Impossible Movie A Complete Guide For Dead Reckoning

May 14, 2025

Stream Every Mission Impossible Movie A Complete Guide For Dead Reckoning

May 14, 2025