Trump's Decision: Impact Of Nippon-U.S. Steel Deal Approval

Table of Contents

Economic Impact of Trump's Approval on the U.S. Steel Industry

The approval of the Nippon-U.S. Steel deal had a multifaceted impact on the American steel industry's economic landscape.

Job Creation and Market Share

The merger's effect on job creation and market share remains a subject of ongoing debate. While proponents argued that the deal would lead to increased domestic steel production and potentially create jobs, critics raised concerns about potential job losses in certain sectors.

- Increased Domestic Steel Production: The combined entity's larger scale could theoretically lead to increased domestic steel production, potentially reducing reliance on foreign imports.

- Potential Job Losses: Consolidation within the industry could lead to job losses in overlapping areas like administration and management, though proponents countered this by highlighting potential for new roles in expanded operations.

- Impact on Small Steel Producers: The increased market share of the merged entity might create challenges for smaller U.S. steel producers, increasing competition and potentially squeezing them out of the market. This could lead to further job losses in the sector.

Keywords: U.S. Steel jobs, domestic steel production, market competition, steel industry consolidation

Pricing and Competition

The merger's influence on steel pricing and competition within the U.S. market is another crucial aspect.

- Potential Price Increases: Some analysts predicted potential price increases due to reduced competition, potentially impacting downstream industries that rely on steel.

- Impact on Consumers: Higher steel prices could translate into increased costs for consumers in various sectors, from construction and automobiles to appliances.

- Competitiveness Against Foreign Steel Producers: The merger could impact the competitiveness of U.S. steel producers against foreign rivals, depending on the efficiency gains realized by the merged entity and any subsequent adjustments to trade policies.

Keywords: Steel prices, consumer prices, steel imports, international competition

Geopolitical Implications of the Nippon-U.S. Steel Deal

The Nippon-U.S. Steel deal carries significant geopolitical implications, impacting trade relations and the global steel market.

U.S.-Japan Trade Relations

The deal's approval occurred during a period of fluctuating U.S.-Japan trade relations.

- Trump Administration's Trade Policy: The Trump administration's protectionist trade policies significantly influenced the context of this merger, raising questions about potential trade tensions or collaborations.

- Potential Trade Tensions or Collaborations: While some saw it as a sign of potential collaboration between the two countries, others perceived it as highlighting ongoing trade tensions and the complexities of navigating global trade dynamics.

- Implications for Future Trade Negotiations: The deal's impact on future trade negotiations between the U.S. and Japan remained uncertain, potentially influencing discussions around tariffs and other trade barriers.

Keywords: US-Japan trade, trade agreements, trade negotiations, trade tariffs

Global Steel Market Dynamics

The merger significantly altered the global steel market's dynamics.

- Increased Market Power of NSSMC: The combined entity gained considerable market power, influencing global steel prices and potentially impacting smaller global steel producers.

- Impact on Other Global Steel Producers: Other global steel producers faced increased competition from the enlarged NSSMC, leading to potential adjustments in their own strategies and market positions.

- Shifts in Global Steel Production and Trade Patterns: The merger might have led to shifts in global steel production and trade patterns, with implications for different countries and regions.

Keywords: Global steel market, international steel trade, global steel production, competitive landscape

Long-Term Consequences and Future of Steel Mergers and Acquisitions

The long-term implications of Trump's decision extend to future mergers and acquisitions (M&A) activity within the steel industry.

Regulatory Scrutiny of Future Deals

Trump's decision set a precedent for future mergers and acquisitions in the steel sector.

- Increased or Decreased Regulatory Scrutiny: The level of regulatory scrutiny for future M&A deals in the steel industry remained uncertain, potentially depending on the specific circumstances of each case and evolving antitrust policies.

- Impact on Future Investment Decisions: The regulatory landscape influenced investment decisions within the steel sector, creating uncertainty for both domestic and international players.

- Changes in Antitrust Policies: The approval of the Nippon-U.S. Steel deal could impact future antitrust policies and how regulators approach similar mergers in the future.

Keywords: Antitrust laws, regulatory compliance, mergers and acquisitions, investment in steel

Impact on Innovation and Technological Advancement

The merger could influence innovation and technological advancement in the steel sector.

- Increased Research and Development: The merged entity’s increased resources might lead to a greater investment in research and development, potentially yielding innovative steel manufacturing technologies.

- Improved Steel Manufacturing Technologies: Consolidation could potentially lead to the development and implementation of improved steel manufacturing technologies, increasing efficiency and reducing costs.

- Impact on Environmental Sustainability Initiatives: The merger’s impact on environmental sustainability initiatives within the steel industry remains uncertain, potentially leading to either increased or decreased efforts depending on the company's priorities.

Keywords: Steel innovation, technology in steel manufacturing, sustainable steel production

Conclusion

President Trump's approval of the Nippon-U.S. Steel deal presents a complex interplay of economic, geopolitical, and regulatory consequences. While the deal holds the potential for increased domestic steel production and job creation, it also raises concerns about market dominance, pricing, and international trade relations. The long-term impact will depend on various factors, including regulatory oversight and the overall health of the global steel market.

Call to Action: Stay informed on the unfolding consequences of Trump's Nippon-U.S. Steel Deal and its impact on the future of the steel industry. Continue to follow developments surrounding this significant event in the global steel market to better understand the long-term implications of this pivotal decision regarding Trump's Nippon-U.S. Steel deal.

Featured Posts

-

Top Rated Office Chairs 2025 Our Tried And Tested Picks

May 26, 2025

Top Rated Office Chairs 2025 Our Tried And Tested Picks

May 26, 2025 -

The Jenson Fw 22 Extended Range Whats New

May 26, 2025

The Jenson Fw 22 Extended Range Whats New

May 26, 2025 -

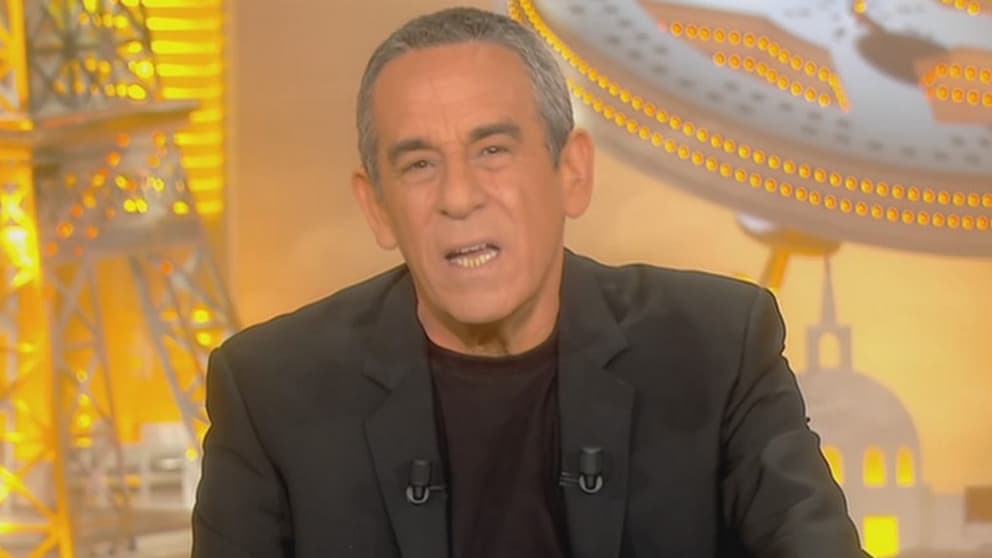

L Animateur Dezingue Son Ancien Sniper Ardisson Repond A Baffie

May 26, 2025

L Animateur Dezingue Son Ancien Sniper Ardisson Repond A Baffie

May 26, 2025 -

Paris Roubaix 2023 Van Der Poel Hit By Bottle Seeks Legal Recourse

May 26, 2025

Paris Roubaix 2023 Van Der Poel Hit By Bottle Seeks Legal Recourse

May 26, 2025 -

Addressing Oem Supply Chain And Country Of Origin Concerns Sg Wirelesss Strategic Partnerships

May 26, 2025

Addressing Oem Supply Chain And Country Of Origin Concerns Sg Wirelesss Strategic Partnerships

May 26, 2025