Trump's Shift In Tone Triggers Gold Price Increase

Table of Contents

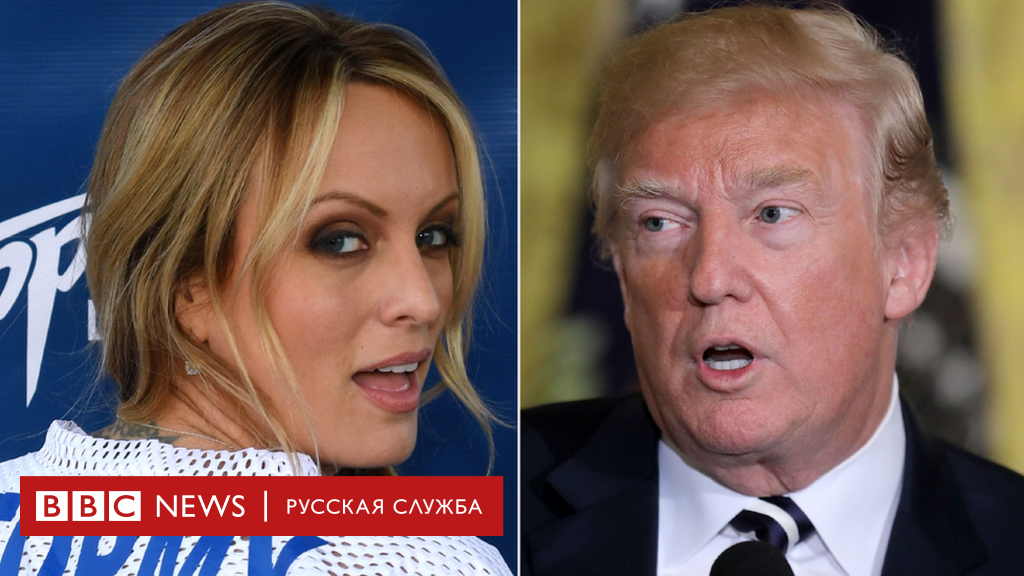

Trump's Rhetorical Shift and Market Reaction

The specific shift in Trump's public pronouncements involved a return to more aggressive and confrontational statements, coupled with renewed legal challenges. This marked a departure from a period of relative calm, immediately impacting investor sentiment.

- Increased market uncertainty: The change in rhetoric injected considerable uncertainty into the already volatile market environment. Investors, unsure of the potential consequences of Trump's actions, became apprehensive.

- Investor anxieties leading to a flight to safety: This uncertainty fueled a classic "flight to safety," with investors seeking refuge in assets perceived as less risky. Gold, a traditional safe haven, immediately benefited.

- Impact on stock markets and other asset classes: Stock markets experienced a degree of correction, while other asset classes also saw fluctuations as investors reassessed risk profiles. The impact varied, with some sectors more affected than others.

- Specific examples: For instance, (insert specific example here, citing a reputable news source like the Wall Street Journal or Bloomberg). Such statements immediately triggered market reactions, demonstrating the direct link between Trump's pronouncements and investor behavior.

Gold as a Safe Haven Asset During Political Uncertainty

Gold's status as a safe haven asset is deeply rooted in its history. It's a tangible asset, relatively unaffected by the whims of individual governments or economic policies, making it a valuable hedge against various uncertainties.

- Gold's historical performance: Throughout history, gold has consistently demonstrated its ability to hold its value, and even appreciate, during periods of political instability and economic downturns.

- Lack of correlation: Unlike stocks or bonds, gold often exhibits a low correlation with other asset classes. This lack of correlation makes it an attractive diversification tool for investors seeking to reduce overall portfolio risk.

- Inflation hedging: Gold is often considered a hedge against inflation. When the purchasing power of fiat currencies declines, the value of gold tends to rise, preserving investors' wealth.

- Historical examples: The gold price increases during the 2008 financial crisis and other periods of geopolitical tension serve as strong examples of its safe haven appeal. These historical events underscore the importance of gold within a diversified investment portfolio.

Analyzing the Gold Price Increase: Factors Beyond Trump's Statements

While Trump's rhetoric played a role, other factors contributed to the gold price increase. It's important to consider a holistic perspective to understand the market dynamics.

- Global inflation: Persistent global inflation continues to erode the value of fiat currencies, increasing the relative attractiveness of gold as a store of value. This is a significant, ongoing factor impacting gold prices.

- Interest rates: Changes in interest rates influence the opportunity cost of holding non-interest-bearing assets like gold. Lower interest rates tend to support higher gold prices.

- Geopolitical tensions: Ongoing geopolitical tensions worldwide contribute to uncertainty and increase the demand for safe haven assets, further boosting gold prices.

- Supply and demand: The fundamental supply and demand dynamics within the gold market also impact price fluctuations. Increased demand coupled with relatively stable supply naturally pushes prices higher.

Technical Analysis of Gold Price Charts

(Optional: Include a relevant chart here if available, showing key support and resistance levels. Analyze recent price movements, correlating them with specific news events and mentioning any supporting technical indicators.)

For example, a clear upward trend in gold prices correlated with Trump's recent statements could be highlighted. Mentioning technical indicators such as moving averages or RSI could further support the analysis.

Conclusion

The recent rise in gold prices is attributable to a confluence of factors, including former President Trump's shift in tone, which amplified existing market uncertainties. This uncertainty fueled a flight to safety, benefiting gold's position as a time-tested safe haven asset. However, it's crucial to remember that other significant macroeconomic forces, like inflation and geopolitical instability, also play crucial roles in shaping gold's price. Understanding the interplay between these political and economic events is paramount for investors.

Call to Action: Understanding the interplay between political events and precious metal markets is crucial for investors. Stay informed about future developments and other geopolitical factors that could impact gold prices. Consider diversifying your investment portfolio with gold to mitigate risk and protect your wealth. Learn more about investing in gold and developing a robust investment strategy that includes gold as a safe haven asset. Consider consulting a financial advisor to determine if gold fits your personal investment goals and to discuss a strategy for investing in gold and other precious metals.

Featured Posts

-

Eurovision 2025 When And Where To Watch Live In Australia

Apr 25, 2025

Eurovision 2025 When And Where To Watch Live In Australia

Apr 25, 2025 -

Us Citizenship Interview Leads To Palestinian Students Continued Detention

Apr 25, 2025

Us Citizenship Interview Leads To Palestinian Students Continued Detention

Apr 25, 2025 -

Tramp I Voyna V Ukraine Evolyutsiya Ritoriki

Apr 25, 2025

Tramp I Voyna V Ukraine Evolyutsiya Ritoriki

Apr 25, 2025 -

Renaults Us Sports Car Plans A Victim Of Trumps Protectionist Trade Policy

Apr 25, 2025

Renaults Us Sports Car Plans A Victim Of Trumps Protectionist Trade Policy

Apr 25, 2025 -

Sane Inspires Bayern Munich To Hard Fought Win Against St Pauli

Apr 25, 2025

Sane Inspires Bayern Munich To Hard Fought Win Against St Pauli

Apr 25, 2025

Latest Posts

-

Tyran Alerbyt Abwzby Rhlat Mbashrt Jdydt Ila Kazakhstan

Apr 28, 2025

Tyran Alerbyt Abwzby Rhlat Mbashrt Jdydt Ila Kazakhstan

Apr 28, 2025 -

Wrsh Eml Wkhbrae Mntda Abwzby Llabtkar Fy Tb Alhyat Alshyt Almdydt

Apr 28, 2025

Wrsh Eml Wkhbrae Mntda Abwzby Llabtkar Fy Tb Alhyat Alshyt Almdydt

Apr 28, 2025 -

Abwzby Mntda Alabtkar Fy Tb Alhyat Alshyt Almdydt Yunaqsh Ahdth Alttwrat

Apr 28, 2025

Abwzby Mntda Alabtkar Fy Tb Alhyat Alshyt Almdydt Yunaqsh Ahdth Alttwrat

Apr 28, 2025 -

Unlocking Growth A Canadian Trade Missions Impact On Southeast Asian Energy

Apr 28, 2025

Unlocking Growth A Canadian Trade Missions Impact On Southeast Asian Energy

Apr 28, 2025 -

Alabtkar Fy Mjal Tb Alhyat Alshyt Almdydt Abwzby Thtdn Mntda Ealmya

Apr 28, 2025

Alabtkar Fy Mjal Tb Alhyat Alshyt Almdydt Abwzby Thtdn Mntda Ealmya

Apr 28, 2025