U.S.-China Tariff Rollback: Impact On The American Economy

Table of Contents

Impact on Consumer Prices

A significant aspect of any U.S.-China tariff rollback is its effect on consumer prices.

Reduced Inflationary Pressure

Lower tariffs directly translate to lower prices for imported goods from China. This could provide much-needed relief from inflationary pressures, boosting consumers' purchasing power. Specific product categories likely to see price reductions include:

- Electronics (smartphones, laptops, televisions)

- Clothing and apparel

- Furniture and home goods

- Toys and sporting goods

However, it's important to consider mitigating factors. Supply chain disruptions, lingering logistical issues, and potential increases in other input costs could partially offset the benefits of reduced tariffs.

Shifting Consumer Spending

Lower prices on imported goods could significantly influence consumer spending patterns. Increased disposable income due to lower prices might lead to:

- Increased discretionary spending on entertainment, travel, and other services.

- A shift in consumer preference towards imported goods, potentially impacting domestic industries.

- Varying impacts across different income brackets; lower-income households might benefit disproportionately from lower prices on essential goods.

Effect on Businesses and Industries

The impact of a U.S.-China tariff rollback extends beyond consumer prices, significantly affecting businesses and various industries.

Increased Profitability for Importing Businesses

Businesses importing goods from China stand to gain significantly from reduced tariffs. This increased profitability could translate into:

- Higher profit margins for retailers and importers.

- Increased investment in expansion and job creation.

- Greater competitiveness in the market for businesses dealing in imported goods. Examples include major retailers and manufacturers relying on Chinese supply chains.

Challenges for Domestic Industries

Conversely, domestic industries competing with cheaper Chinese imports face significant challenges. They might need to:

- Adopt innovative strategies to remain competitive, such as focusing on higher-value products or niche markets.

- Invest in technological upgrades to enhance efficiency and reduce costs.

- Seek government support programs aimed at bolstering domestic industries.

Supply Chain Restructuring

A U.S.-China tariff rollback could trigger a restructuring of supply chains. Businesses might:

- Shift sourcing strategies, potentially re-evaluating the balance between Chinese and other international suppliers.

- Re-negotiate contracts with existing suppliers.

- Experience both decreased transportation costs (due to less reliance on alternative, more expensive sourcing) and potential fluctuations due to the changing dynamics of global supply chains.

Macroeconomic Consequences

The macroeconomic implications of a U.S.-China tariff rollback are far-reaching.

GDP Growth and Economic Output

Reduced tariffs could stimulate economic growth through increased consumer spending and business investment. This could lead to a positive multiplier effect, boosting overall GDP. However, potential job losses in certain domestic industries could offset some of these positive effects. A thorough cost-benefit analysis is crucial.

Impact on the U.S. Trade Deficit

The relationship between tariffs and trade balances is complex. While tariff rollbacks might lead to increased imports from China, the overall impact on the U.S. trade deficit is not straightforward and depends on numerous other factors, including exchange rates and global demand.

Implications for U.S. Foreign Policy

A significant U.S.-China tariff rollback would have considerable geopolitical ramifications, potentially impacting broader U.S. foreign policy strategies toward China and the overall global trade landscape. It requires careful consideration of the interplay between economic and geopolitical objectives.

Conclusion: Navigating the Future of U.S.-China Trade Relations After Tariff Rollbacks

The potential impact of a U.S.-China tariff rollback on the American economy is multifaceted. While it could offer relief from inflation, boost consumer spending, and enhance the profitability of importing businesses, it also presents challenges for domestic industries and requires careful navigation of complex macroeconomic and geopolitical considerations. Further research and open discussion on U.S.-China trade policy, tariff negotiations, and the long-term effects of adjustments in trade relations with China are crucial for policymakers and businesses alike to effectively navigate this evolving landscape. Understanding the complexities involved is vital for informed decision-making and building a resilient and prosperous American economy.

Featured Posts

-

Ali Larter Returns In Landman Season 2 New Bts Photos Surface

May 13, 2025

Ali Larter Returns In Landman Season 2 New Bts Photos Surface

May 13, 2025 -

Yamamotos Strong Start Edmans Blast Lead Dodgers To 3 0 Victory Over Cubs

May 13, 2025

Yamamotos Strong Start Edmans Blast Lead Dodgers To 3 0 Victory Over Cubs

May 13, 2025 -

Etf Investors Dumped Leveraged Semiconductor Funds Before Surge What Happened

May 13, 2025

Etf Investors Dumped Leveraged Semiconductor Funds Before Surge What Happened

May 13, 2025 -

10 Aktori Koito Sa Spasili Khora Geroichni Istorii I Snimki

May 13, 2025

10 Aktori Koito Sa Spasili Khora Geroichni Istorii I Snimki

May 13, 2025 -

Rediscover Scarlett Johansson And Chris Evans In This Hilarious Netflix Addition

May 13, 2025

Rediscover Scarlett Johansson And Chris Evans In This Hilarious Netflix Addition

May 13, 2025

Latest Posts

-

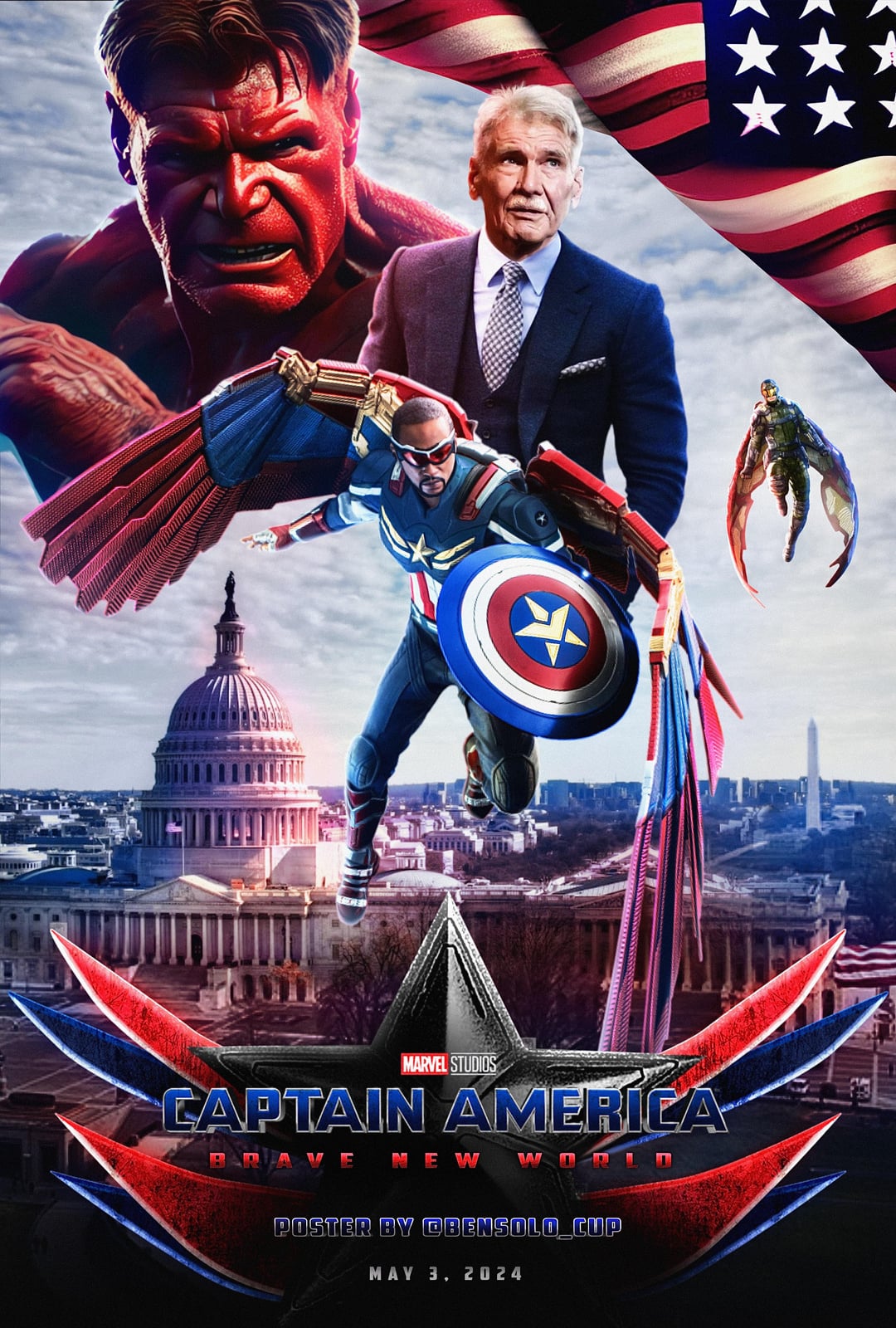

Watch Captain America Brave New World Online Streaming Options And Release Date

May 14, 2025

Watch Captain America Brave New World Online Streaming Options And Release Date

May 14, 2025 -

Captain America Brave New World 4 K Blu Ray Steelbook Pre Order Details

May 14, 2025

Captain America Brave New World 4 K Blu Ray Steelbook Pre Order Details

May 14, 2025 -

Captain America Brave New World Streaming Guide Where To Watch Online

May 14, 2025

Captain America Brave New World Streaming Guide Where To Watch Online

May 14, 2025 -

How To Watch Captain America Brave New World Online Stream Marvels Latest

May 14, 2025

How To Watch Captain America Brave New World Online Stream Marvels Latest

May 14, 2025 -

Watch Captain America Brave New World A Pvod Streaming Guide

May 14, 2025

Watch Captain America Brave New World A Pvod Streaming Guide

May 14, 2025