Uber Stock: A Recession-Resistant Investment?

Table of Contents

Uber's Business Model and its Resilience During Economic Downturns

Uber's diverse business model contributes significantly to its potential resilience. Unlike companies reliant on a single product or service, Uber boasts multiple revenue streams, including rideshare, Uber Eats (food delivery), Uber Freight (logistics), and more. This diversification mitigates risk; even if one sector experiences a downturn, others may compensate.

The essential nature of some Uber services further enhances its recession-resistance. Ride-sharing remains crucial during emergencies, regardless of the economic climate. Similarly, food delivery services like Uber Eats saw a surge in demand during lockdowns, highlighting their importance even during economic hardship.

Historically, Uber has demonstrated some resilience during past economic downturns, although a complete analysis requires more time to assess its long-term performance through multiple economic cycles. However, some points are noteworthy:

- Increased demand for food delivery during lockdowns: The COVID-19 pandemic illustrated the resilience of Uber Eats, with demand soaring as people stayed home.

- Potential for increased usage of ride-sharing during periods of reduced public transport: Economic downturns can sometimes lead to reduced public transportation options, potentially increasing reliance on ride-sharing services.

- Cost-cutting measures Uber has implemented in the past: Uber has proven adept at adapting to changing economic conditions through efficient cost management strategies.

Analyzing Uber's Financials and Future Growth Potential

Understanding Uber's financial performance is crucial for evaluating its investment potential. Examining key metrics like revenue per trip, driver acquisition costs, and customer acquisition costs reveals insights into its operational efficiency and growth prospects. While Uber has experienced periods of profitability, consistent profitability remains a goal. Revenue growth is a key indicator, and its debt levels need careful consideration.

Uber's future growth strategy also plays a significant role. The company's expansion into new markets, coupled with ongoing technological advancements, holds considerable promise. This includes exploring:

- Projected revenue growth for the next few years: Analysts' predictions regarding Uber's future revenue offer a glimpse into its growth trajectory.

- Analysis of market share in different geographic regions: Understanding Uber's market dominance or potential for expansion in specific regions is critical.

- Potential for new revenue streams through partnerships or acquisitions: Strategic partnerships and acquisitions can unlock new opportunities for revenue generation.

Risks and Considerations for Investing in Uber Stock

Despite its potential, investing in Uber stock carries inherent risks. Regulatory hurdles in various countries, intense competition from other ride-sharing and food delivery services, and ongoing challenges related to driver relations are significant concerns.

Inflation and rising fuel costs directly impact Uber's profitability, squeezing margins and potentially affecting its financial performance. The gig economy itself is vulnerable to technological disruption and evolving consumer preferences.

Potential risks to consider include:

- Potential impact of self-driving car technology: Automation could significantly alter the dynamics of the ride-sharing industry.

- Risks related to driver compensation and labor regulations: Ongoing debates about driver classification and compensation pose significant challenges.

- Competition from other ride-sharing and food delivery services: The market is highly competitive, with established players and new entrants constantly vying for market share.

Comparing Uber Stock to Other Recession-Resistant Investments

To provide context, it's helpful to compare Uber stock to other traditionally recession-resistant investments such as gold, government bonds, and consumer staples. While these assets generally offer greater stability during economic downturns, they often come with lower growth potential.

Uber stock presents a higher-risk, higher-reward profile compared to these more conservative alternatives. The potential for significant growth is a key differentiator.

Key differences in risk and return profiles include:

- Growth Potential: Uber offers higher potential growth compared to traditional, more stable investments.

- Volatility: Uber stock tends to be more volatile than conservative investments.

- Liquidity: Uber stock is generally highly liquid, facilitating easier buying and selling.

Conclusion: Is Uber Stock a Recession-Resistant Investment?

Uber's diversified business model, essential services, and growth potential suggest some resilience during economic downturns. However, significant risks related to regulation, competition, and operational costs must be considered. While Uber might not fit the traditional definition of a "recession-proof" investment, its adaptability and diverse revenue streams offer some level of protection compared to more vulnerable companies.

Ultimately, the decision to invest in Uber stock is a personal one. It requires a careful assessment of your risk tolerance and investment goals. Therefore, we strongly encourage you to conduct thorough research before investing in Uber Stock and consult with a qualified financial advisor before making any investment decisions. Further research into "recession-proof stocks" or "recession-resistant investments" will enhance your understanding and help you make informed choices.

Featured Posts

-

Ukraina I Trump Sondaz Pokazuje Co Mysla Polacy

May 18, 2025

Ukraina I Trump Sondaz Pokazuje Co Mysla Polacy

May 18, 2025 -

Best No Kyc Casinos 2025 7 Bit Casino Review And Instant Withdrawal Guide

May 18, 2025

Best No Kyc Casinos 2025 7 Bit Casino Review And Instant Withdrawal Guide

May 18, 2025 -

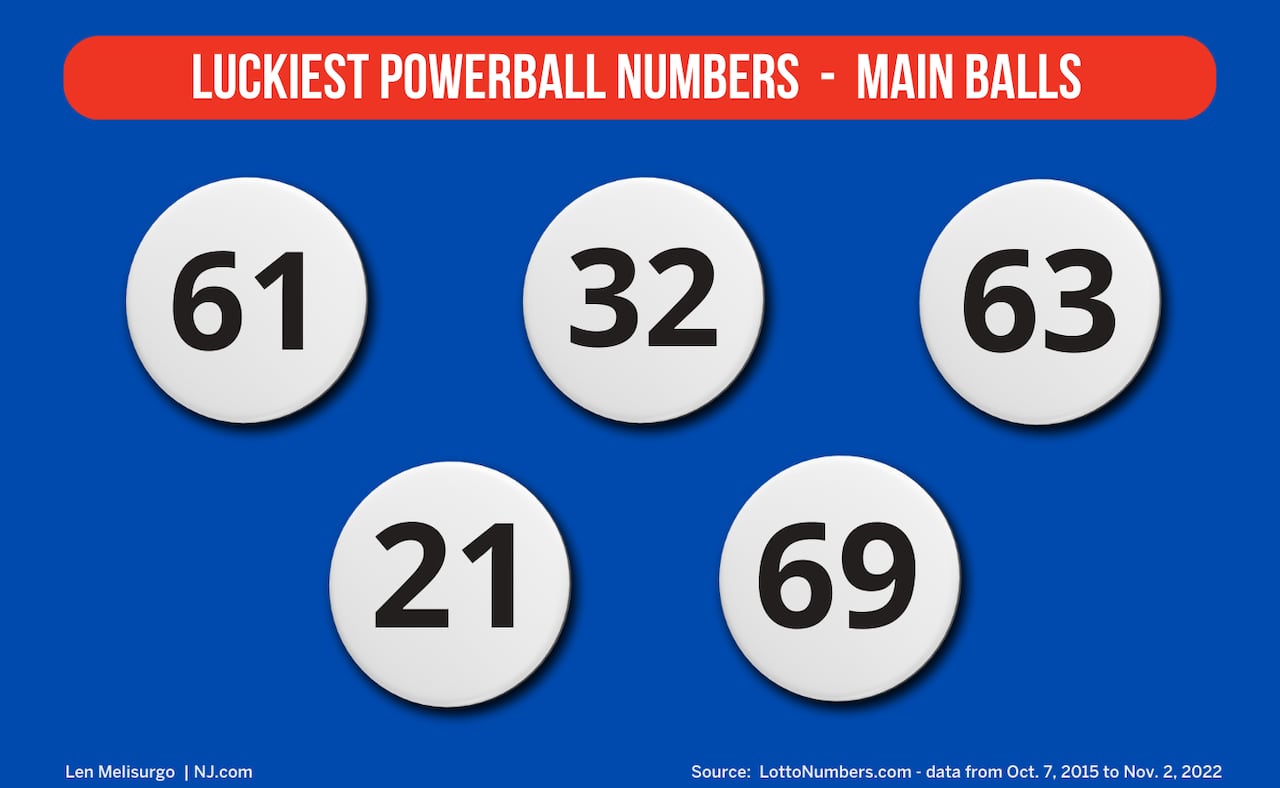

April 25 2025 Daily Lotto Winning Numbers

May 18, 2025

April 25 2025 Daily Lotto Winning Numbers

May 18, 2025 -

Honoring Emily Warren Roebling Her Crucial Role In Building The Brooklyn Bridge

May 18, 2025

Honoring Emily Warren Roebling Her Crucial Role In Building The Brooklyn Bridge

May 18, 2025 -

From Vegas World To The Strat A History Of Casino Promotion

May 18, 2025

From Vegas World To The Strat A History Of Casino Promotion

May 18, 2025

Latest Posts

-

I Tzenifer Aniston Kai O Pentro Paskal Mia Aprosmeni Synantisi

May 19, 2025

I Tzenifer Aniston Kai O Pentro Paskal Mia Aprosmeni Synantisi

May 19, 2025 -

Jennifer Aniston And Pedro Pascal Eksodos Poy Prokalese Thyella Sxolion

May 19, 2025

Jennifer Aniston And Pedro Pascal Eksodos Poy Prokalese Thyella Sxolion

May 19, 2025 -

Nyt Mini Crossword Answers March 13 Solve The Puzzle With Expert Tips

May 19, 2025

Nyt Mini Crossword Answers March 13 Solve The Puzzle With Expert Tips

May 19, 2025 -

Nyt Mini Crossword Answers For March 13 Complete Solutions And Hints

May 19, 2025

Nyt Mini Crossword Answers For March 13 Complete Solutions And Hints

May 19, 2025